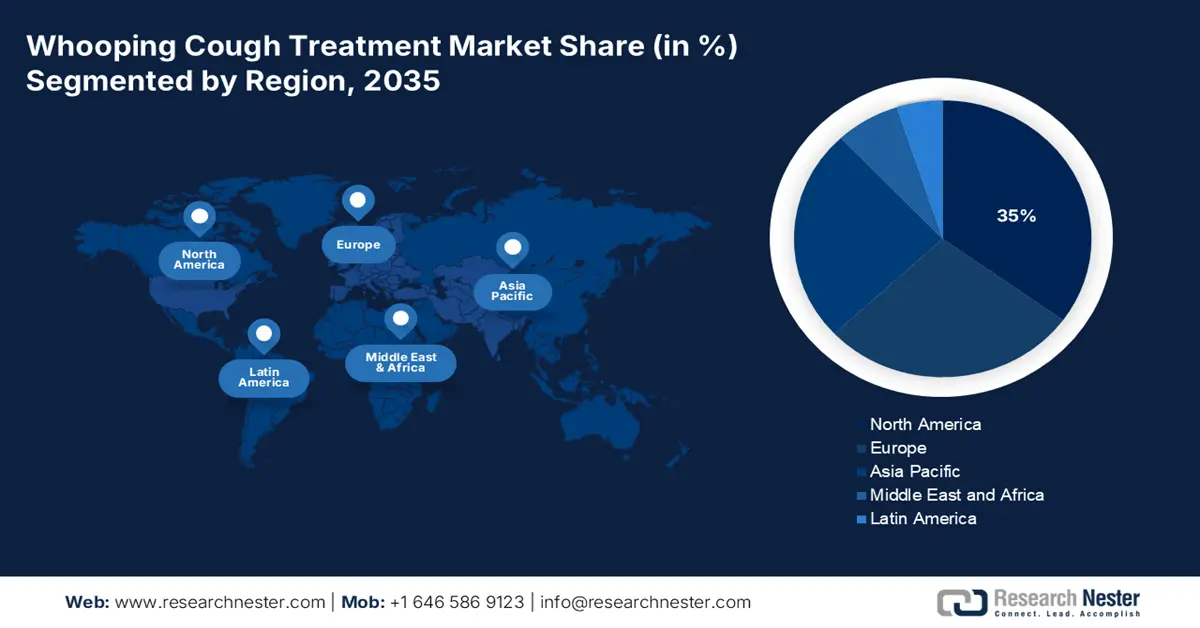

Whooping Cough Treatment Market - Regional Analysis

North America Market Insights

North America is poised to lead the worldwide whooping cough treatment market with a 35% share by the year 2035. The region is influenced by the rising number of cases of pertussis and continuous federal government expenditure through the CDC. The funding for immunization by CDC in 2025 amounts to USD 919,291. This indicates the continued funding for vaccines and antibiotic treatment schemes. Moreover, growth in diagnostic technologies and heightened awareness regarding vaccination is further propelling demand for efficient pertussis therapeutics in the region. Continued efforts on modernization initiatives in public health focus on adult booster campaigns and efforts in telehealth.

As per the CDC report in June 2025, the U.S. has had over 10,000 cases of pertussis per year, with cases doubling in the upcoming years, hence highlighting the increasing demand. The recently passed Medicare coverage of adult vaccines through Medicare Part B, reimbursement for in-home antibiotics, and caps to out-of-pocket patients through Part D increases patient access. Further, this expands medicare reimbursements for treating pertussis. Further, the CDC has established quality improvement processes for patients who have specific interventions that would reduce hospitalizations and the chance of transmitting the disease to others. There is also an increasing number of telehealth reimbursements for prescript antibiotics through Medicare/Medicaid. In addition, the CDC´s new vaccine price list sets a standard for contracting for community immunization programs, making the use of vaccines simple and easy.

Pertussis Incidence by Age Group and Year

|

Year |

<1 yr |

1-6 yrs |

7-10 yrs |

11-19 yrs |

20+ yrs |

|

2010 |

100.90 |

23.27 |

31.78 |

13.30 |

3.15 |

|

2011 |

70.89 |

15.02 |

20.05 |

10.26 |

2.15 |

|

2012 |

126.65 |

34.09 |

58.52 |

38.02 |

4.51 |

|

2013 |

102.77 |

22.09 |

30.61 |

21.27 |

2.61 |

|

2014 |

106.68 |

25.14 |

34.04 |

29.57 |

2.50 |

|

2015 |

68.10 |

15.60 |

17.45 |

17.90 |

1.90 |

|

2016 |

51.41 |

13.65 |

14.84 |

16.31 |

1.68 |

|

2017 |

57.78 |

15.16 |

15.79 |

16.83 |

1.68 |

|

2018 |

52.8 |

13.5 |

11.6 |

13.0 |

1.4 |

|

2019 |

59.00 |

16.31 |

15.05 |

15.01 |

1.78 |

|

2020 |

19.25 |

5.39 |

4.70 |

4.46 |

0.68 |

|

2021 |

5.22 |

1.94 |

0.46 |

0.45 |

0.49 |

|

2022 |

9.07 |

3.65 |

1.30 |

0.79 |

0.54 |

Source: CDC April 2025

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global whooping cough treatment market by the end of 2035. The growth is driven by the rising incidence of pertussis, bolstered government immunization efforts, and improved access to antibiotics. Several nations are implementing national immunization programs for pertussis prevention. For instance, India’s universal immunization programme (UIP) administers vaccination for pertussis for millions of infants a year. Moreover, there have been increases in adult booster uptake in Malaysia and South Korea. Other common trends across these nations are digital surveillance efforts in place as part of India’s Ayushman Bharat, telehealth provision of antibiotics, and public-private partnerships for outreach into remote rural areas.

Japan dominates the whooping cough treatment market in the Asia Pacific and is driven by a sophisticated healthcare system and an ageing population growing rapidly, representing a special demand driver for adult pertussis boosters to immunize susceptible newborns. According to the JIHS report in May 2025, the total number of reported cases of pertussis diagnosed was 22,351, a record number for the same time period since the disease has been under surveillance. These increasing numbers have resulted in different national immunization programs, such as the Tdap booster for adults and pregnant women, and funding research with the Japan Agency for Medical Research and Development (AMED) on next-generation vaccines.

Age distribution of cumulative number of reported cases of pertussis in weeks 1–21 (2018–2025)

|

Year |

Total cases (n) |

0 years (0–5 months) |

0 years (6–11 months) |

1–9 years |

10–19 years |

≥20 years |

|

2018 |

1,825 |

5.5% (100) |

1.0% (18) |

33.2% (605) |

29.2% (533) |

31.2% (569) |

|

2019 |

6,425 |

4.9% (315) |

0.5% (33) |

40.7% (2,612) |

32.4% (2,081) |

21.5% (1,384) |

|

2020 |

2,360 |

6.0% (141) |

0.5% (12) |

36.8% (868) |

27.2% (643) |

29.5% (696) |

|

2021 |

221 |

0.5% (1) |

1.8% (4) |

21.7% (48) |

14.5% (32) |

61.5% (136) |

|

2022 |

226 |

2.2% (5) |

4.4% (10) |

44.2% (100) |

12.4% (28) |

36.7% (83) |

|

2023 |

282 |

4.3% (12) |

1.1% (3) |

35.8% (101) |

16.0% (45) |

42.9% (121) |

|

2024 |

342 |

2.6% (9) |

0.0% (0) |

34.2% (117) |

20.5% (70) |

42.7% (146) |

|

2025* |

22,351 |

2.0% (456) |

0.4% (92) |

23.6% (5,268) |

58.7% (13,129) |

15.2% (3,406) |

Source: JIHS, May 2025

Europe Market Insights

The Europe whooping cough treatment market is estimated to garner a notable industry value from 2026 to 2035. The growth is propelled by the oscillating pertussis outbreaks, increased adult booster programs, and stronger EU-wide health funding initiatives. As per the ECDC report in May 2024, the prevalence of pertussis was 25,000 cases in 2023 and a projected total of 32,000 cases by early 2024 across the EU/EEA region. There is still a significant demand-pull driver from hospitals (inpatient care), outpatient clinics, and immunization clinics. Furthermore, even potential speed in the EMA and other national agencies' authorizations and launch of new macrolide formulations and maternal booster combinations.

Germany is Europe's largest and most stable whooping cough treatment market and is driven by robust government expenditure and high levels of vaccine uptake. According to the ISOPR report in November 2024, hospitalization expenditure for pertussis cases has been researched extensively, with expenditure per hospitalization ranging from around €2,524 to almost €4,953 based on age and severity. This investment aligns with the Standing Committee on Vaccination (STIKO) recommendations and allows for widespread access to treatment, making it a market increase in booster vaccine demand since 2021.