Whooping Cough Treatment Market Outlook:

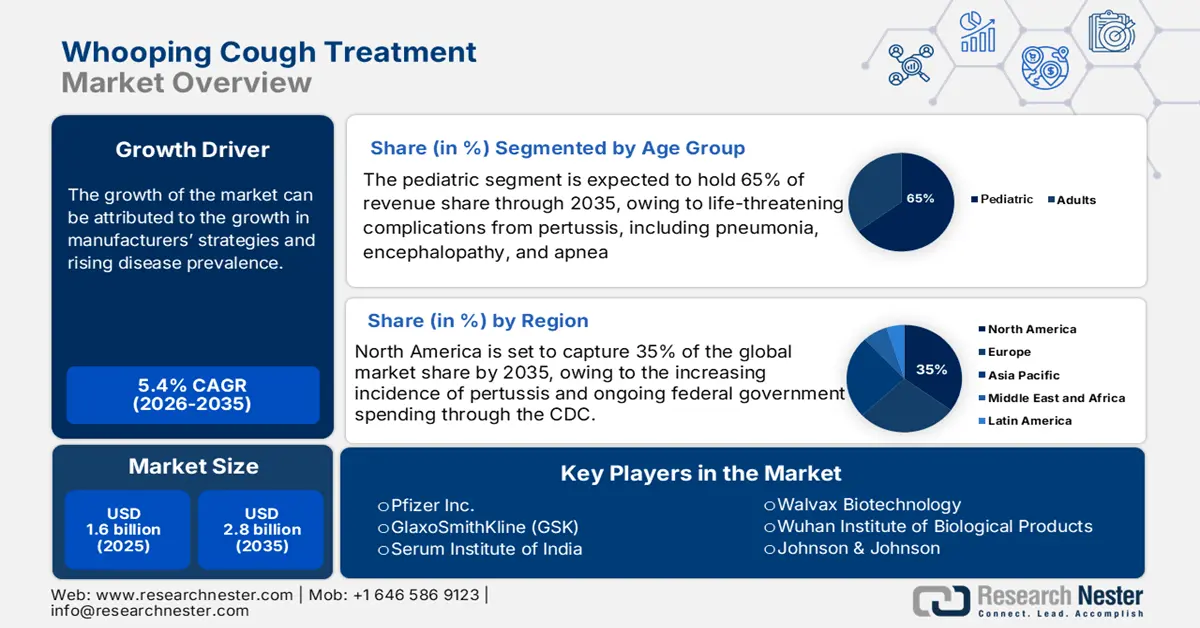

Whooping Cough Treatment Market size was valued at USD 1.6 billion in 2025 and is projected to reach approximately USD 2.8 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, 2026-2035. In 2026, the industry size of whooping cough treatment is assessed at USD 1.7 billion.

The whooping cough treatment market is driven by a steadily rising patient population with high annual incidence rates driving continuous pharmaceutical and medical device distribution. The CDC report in March 2024, the reported pertussis cases in 2023 is more than 5,611, putting a regular demand on antibiotics such as azithromycin and macrolides and supportive care devices like oxygen concentrators and pulse oximeters. The API supply chain of first-line medicines is global, and a portion of the manufacturing is currently centered in Asia. This generates dependencies and vulnerabilities and has been evidenced in API supply interruptions.

International trade is a critical component of the market's supply chain. The U.S. is a net importer of both finished antibiotic formulations and their underlying APIs. On the other hand, the OEC data in 2023 states that China is the leading exporter of antibiotics worth USD 4.84 billion. For instance, U.S. Food and Drug Administration documentation indicates a heavy reliance on foreign sources for essential medicine manufacturing, including drugs critical for treating respiratory infections. The assembly and packaging of final drug products are often conducted domestically or in partner nations with stringent regulatory oversight.

Key Whooping Cough Treatment Market Insights Summary:

Regional Highlights:

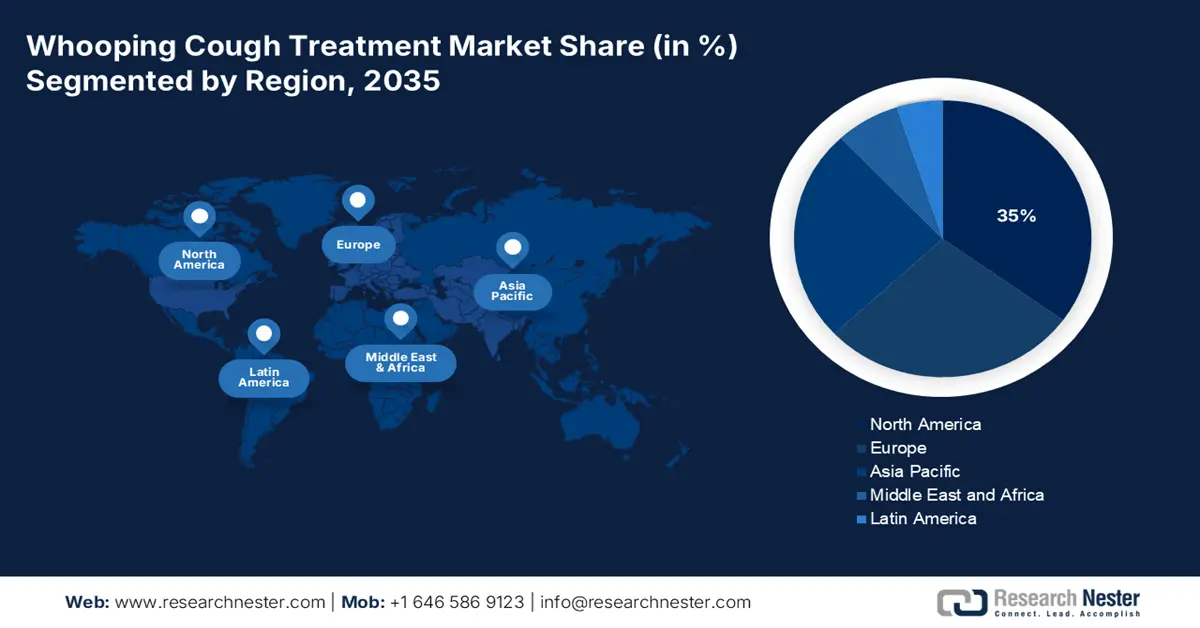

- North America is projected to hold a 35% share of the whooping cough treatment market by 2035, attributed to rising pertussis incidence, robust CDC immunization funding, and advancing diagnostic technologies.

- Asia Pacific is anticipated to witness the fastest growth through 2035, fueled by increasing pertussis cases, extensive government immunization initiatives, and improved access to antibiotic treatments.

Segment Insights:

- The pediatric segment is projected to account for 65% share of the whooping cough treatment market by 2035, propelled by the heightened susceptibility of infants under one year to severe pertussis-related complications such as pneumonia, encephalopathy, and apnea.

- The hospitals and clinics segment is anticipated to maintain a dominant position through 2035, owing to the increasing number of pertussis cases among infants necessitating inpatient care, continuous monitoring, and intensive therapeutic management.

Key Growth Trends:

- Growth in manufacturer strategies

- Rising disease prevalence

Major Challenges:

- Stringent price controls & reimbursement hurdles

Key Players: GlaxoSmithKline (GSK), Sanofi (Sanofi Pasteur), Pfizer, Merck & Co. (MSD), Johnson & Johnson (Janssen), Serum Institute of India, Sinopharm / China National Biotech, CSL Seqirus, Bharat Biotech, Biological E, Novavax, Walvax, GC Pharma (Green Cross), Samsung Biologics, Duopharma / Pharmaniaga, Takeda Pharmaceutical, Daiichi Sankyo, KM Biologics, KAKETSUKEN (Chemo-Sero-Therapeutic Institute), Meiji Seika Pharma

Global Whooping Cough Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: India, China, South Korea, Malaysia, Brazil

Last updated on : 29 September, 2025

Whooping Cough Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Growth in manufacturer strategies: Major pharmaceutical companies are in the process of developing better vaccines. Combination vaccines (DTaP, Tdap) are being introduced to cover multiple vaccine-preventable diseases. Manufacturers are looking to obtain public health reimbursement and plan campaigns to increase uptake and education about pertussis. Direct-to-consumer marketing is actively encouraging uptake of adult and booster vaccination in areas where recent adult pertussis increases have been seen. Companies are pursuing ways to establish themselves in the developing areas of the world where the burden of the disease is high.

- Rising disease prevalence: Since the social restrictions related to the pandemic were lifted, the incidence of pertussis cases has surged. For instance, according to the Centers for Disease Control and Prevention (CDC) in January 2025, the U.S. reported more than 35,435 cases of pertussis in 2024 in 2024. The spikes in pertussis cases are creating demand for pertussis therapeutics. This resurgence is driving governments and healthcare providers to strengthen vaccination campaigns and expand access to antibiotic therapies.

- Government spending and reimbursement policies: Substantial government healthcare expenditure is a primary demand driver. In the USA, Medicare and Medicaid coverage for antibiotic treatments and hospital care for pertussis ensures patient access. Spending on infectious disease management, including pertussis, is a significant part of the public health budget. CDC allocates funds for vaccines and therapeutics, directly influencing market volume. Stable government funding surges a predictable demand base for manufacturers and suppliers serving public health systems.

Number of Reported Pertussis Cases Per Year

|

Year |

No. of Cases |

|

2020 |

6,124 |

|

2021 |

2,116 |

|

2022 |

3,044 |

|

2023 |

7,063 |

|

2024 |

35,435 |

Source: CDC, April 2025, CDC, January 2025

Challenges

- Stringent price controls & reimbursement hurdles: Government health technology assessment (HTA) bodies, like NICE in the UK and IQWiG in Germany, demand extensive cost-effectiveness data for new treatments. For a disease largely managed by generic antibiotics, demonstrating superior value for a new product is exceptionally difficult. Payers are reluctant to reimburse premium-priced therapies when established, cheap alternatives exist. This creates a huge barrier to market access, as manufacturers cannot secure a price that justifies R&D investment, hence slowing down innovation in space.

Whooping Cough Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Whooping Cough Treatment Market Segmentation:

Age Group Segment Analysis

Under the age group, pediatric dominates the segment and is poised to hold the whooping cough treatment market share value of 65% by 2035. The segment is driven by the infants under one year mainly due to their extreme vulnerability to severe and life-threatening complications from pertussis including pneumonia, encephalopathy, and apnea. As per the CDC report in January 2025, 33.4% of infants under 6 months diagnosed with pertussis required hospitalization, and this age group had an incidence rate of 85.4 cases per 100,000 far surpassing all other pediatric and adult age groups.

End user Segment Analysis

Hospitals and clinics lead the end user segment and are driven by the rising cases of pertussis among infants requiring proper inpatient care for intensive supportive management that cannot be provided at home. This includes complete monitoring for apnea by providing oxygen therapy for respiratory distress, managing dehydration via intravenous fluids, and treating secondary complications such as pneumonia. The high acuity of these cases, combined with the need for rapid diagnostic testing and antibiotic administration in a controlled environment, ensures that the majority of associated costs and revenue are generated within inpatient and emergency clinical settings.

Treatment Approach Segment Analysis

Antibiotic therapy is the cornerstone of pertussis management and holds the highest revenue whooping cough treatment market share for two critical reasons such as treatment of active infection and post-exposure prophylaxis (PEP). While antibiotics may not drastically alter the disease course if given late, they are essential to eliminate the Bordetella pertussis bacterium from the nasopharynx, stopping its transmission. According to the CDC report in April 2024, household contacts of confirmed cases receive antibiotic PEP within 21 days. This widespread prophylactic use in entire families, daycare centers, and healthcare settings generates massive prescription volume, solidifying this sub-segment's dominance.

Our in-depth analysis of the whooping cough treatment market includes the following segments:

|

Segment |

Subsegment |

|

Drug Type |

|

|

Age Group |

|

|

Distribution Channel |

|

|

Treatment Approach |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Whooping Cough Treatment Market - Regional Analysis

North America Market Insights

North America is poised to lead the worldwide whooping cough treatment market with a 35% share by the year 2035. The region is influenced by the rising number of cases of pertussis and continuous federal government expenditure through the CDC. The funding for immunization by CDC in 2025 amounts to USD 919,291. This indicates the continued funding for vaccines and antibiotic treatment schemes. Moreover, growth in diagnostic technologies and heightened awareness regarding vaccination is further propelling demand for efficient pertussis therapeutics in the region. Continued efforts on modernization initiatives in public health focus on adult booster campaigns and efforts in telehealth.

As per the CDC report in June 2025, the U.S. has had over 10,000 cases of pertussis per year, with cases doubling in the upcoming years, hence highlighting the increasing demand. The recently passed Medicare coverage of adult vaccines through Medicare Part B, reimbursement for in-home antibiotics, and caps to out-of-pocket patients through Part D increases patient access. Further, this expands medicare reimbursements for treating pertussis. Further, the CDC has established quality improvement processes for patients who have specific interventions that would reduce hospitalizations and the chance of transmitting the disease to others. There is also an increasing number of telehealth reimbursements for prescript antibiotics through Medicare/Medicaid. In addition, the CDC´s new vaccine price list sets a standard for contracting for community immunization programs, making the use of vaccines simple and easy.

Pertussis Incidence by Age Group and Year

|

Year |

<1 yr |

1-6 yrs |

7-10 yrs |

11-19 yrs |

20+ yrs |

|

2010 |

100.90 |

23.27 |

31.78 |

13.30 |

3.15 |

|

2011 |

70.89 |

15.02 |

20.05 |

10.26 |

2.15 |

|

2012 |

126.65 |

34.09 |

58.52 |

38.02 |

4.51 |

|

2013 |

102.77 |

22.09 |

30.61 |

21.27 |

2.61 |

|

2014 |

106.68 |

25.14 |

34.04 |

29.57 |

2.50 |

|

2015 |

68.10 |

15.60 |

17.45 |

17.90 |

1.90 |

|

2016 |

51.41 |

13.65 |

14.84 |

16.31 |

1.68 |

|

2017 |

57.78 |

15.16 |

15.79 |

16.83 |

1.68 |

|

2018 |

52.8 |

13.5 |

11.6 |

13.0 |

1.4 |

|

2019 |

59.00 |

16.31 |

15.05 |

15.01 |

1.78 |

|

2020 |

19.25 |

5.39 |

4.70 |

4.46 |

0.68 |

|

2021 |

5.22 |

1.94 |

0.46 |

0.45 |

0.49 |

|

2022 |

9.07 |

3.65 |

1.30 |

0.79 |

0.54 |

Source: CDC April 2025

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global whooping cough treatment market by the end of 2035. The growth is driven by the rising incidence of pertussis, bolstered government immunization efforts, and improved access to antibiotics. Several nations are implementing national immunization programs for pertussis prevention. For instance, India’s universal immunization programme (UIP) administers vaccination for pertussis for millions of infants a year. Moreover, there have been increases in adult booster uptake in Malaysia and South Korea. Other common trends across these nations are digital surveillance efforts in place as part of India’s Ayushman Bharat, telehealth provision of antibiotics, and public-private partnerships for outreach into remote rural areas.

Japan dominates the whooping cough treatment market in the Asia Pacific and is driven by a sophisticated healthcare system and an ageing population growing rapidly, representing a special demand driver for adult pertussis boosters to immunize susceptible newborns. According to the JIHS report in May 2025, the total number of reported cases of pertussis diagnosed was 22,351, a record number for the same time period since the disease has been under surveillance. These increasing numbers have resulted in different national immunization programs, such as the Tdap booster for adults and pregnant women, and funding research with the Japan Agency for Medical Research and Development (AMED) on next-generation vaccines.

Age distribution of cumulative number of reported cases of pertussis in weeks 1–21 (2018–2025)

|

Year |

Total cases (n) |

0 years (0–5 months) |

0 years (6–11 months) |

1–9 years |

10–19 years |

≥20 years |

|

2018 |

1,825 |

5.5% (100) |

1.0% (18) |

33.2% (605) |

29.2% (533) |

31.2% (569) |

|

2019 |

6,425 |

4.9% (315) |

0.5% (33) |

40.7% (2,612) |

32.4% (2,081) |

21.5% (1,384) |

|

2020 |

2,360 |

6.0% (141) |

0.5% (12) |

36.8% (868) |

27.2% (643) |

29.5% (696) |

|

2021 |

221 |

0.5% (1) |

1.8% (4) |

21.7% (48) |

14.5% (32) |

61.5% (136) |

|

2022 |

226 |

2.2% (5) |

4.4% (10) |

44.2% (100) |

12.4% (28) |

36.7% (83) |

|

2023 |

282 |

4.3% (12) |

1.1% (3) |

35.8% (101) |

16.0% (45) |

42.9% (121) |

|

2024 |

342 |

2.6% (9) |

0.0% (0) |

34.2% (117) |

20.5% (70) |

42.7% (146) |

|

2025* |

22,351 |

2.0% (456) |

0.4% (92) |

23.6% (5,268) |

58.7% (13,129) |

15.2% (3,406) |

Source: JIHS, May 2025

Europe Market Insights

The Europe whooping cough treatment market is estimated to garner a notable industry value from 2026 to 2035. The growth is propelled by the oscillating pertussis outbreaks, increased adult booster programs, and stronger EU-wide health funding initiatives. As per the ECDC report in May 2024, the prevalence of pertussis was 25,000 cases in 2023 and a projected total of 32,000 cases by early 2024 across the EU/EEA region. There is still a significant demand-pull driver from hospitals (inpatient care), outpatient clinics, and immunization clinics. Furthermore, even potential speed in the EMA and other national agencies' authorizations and launch of new macrolide formulations and maternal booster combinations.

Germany is Europe's largest and most stable whooping cough treatment market and is driven by robust government expenditure and high levels of vaccine uptake. According to the ISOPR report in November 2024, hospitalization expenditure for pertussis cases has been researched extensively, with expenditure per hospitalization ranging from around €2,524 to almost €4,953 based on age and severity. This investment aligns with the Standing Committee on Vaccination (STIKO) recommendations and allows for widespread access to treatment, making it a market increase in booster vaccine demand since 2021.

Key Whooping Cough Treatment Market Players:

- GlaxoSmithKline (GSK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi (Sanofi Pasteur)

- Pfizer

- Merck & Co. (MSD)

- Johnson & Johnson (Janssen)

- Serum Institute of India

- Sinopharm / China National Biotech

- CSL Seqirus

- Bharat Biotech

- Biological E

- Novavax

- Walvax

- GC Pharma (Green Cross)

- Samsung Biologics

- Duopharma / Pharmaniaga

- Takeda Pharmaceutical

- Daiichi Sankyo

- KM Biologics

- KAKETSUKEN (Chemo-Sero-Therapeutic Institute)

- Meiji Seika Pharma

The whooping cough treatment market is dominated by crapulated by international vaccine producers, Sanofi, GSK, Pfizer, and Merck. Other new entrants like Serum Institute, Bharat Biotech, CanSino, and Walvax are established lower income markets with competitively priced vaccines. Regional players such as Mitsubishi Tanabe, KM Biologics, and Pharmaniaga want to implore governments to benefit from domestic charm and collaborate on the issue of booster rollout programs. HT's life cycle reveals Chief the prioritized market will be estimated.

Below is the list of some prominent players operating in the global whooping cough treatment market:

Recent Developments

- In July 2025, Sanofi has announced that it has agreed to acquire Vicebio Ltd. The acquisition brings the early combination vaccine for respiratory virus. Sanofi would acquire all of Vicebio’s share capital for USD 1.15 billion, with potential milestone payments of up to USD 450 million based on development and regulatory achievements.

- In January 2025, hVIVO has announced that it has signed a letter of intent with ILiAD Biotechnologies, LLC, to conduct a pivotal Phase 3 human challenge trial for its lead Bordetella pertussis vaccine candidate, BPZE1, which is used for the prevention of whooping cough.

- Report ID: 3980

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Whooping Cough Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.