Vulvar and Vaginal Atrophy (VVA) Therapy Market Outlook:

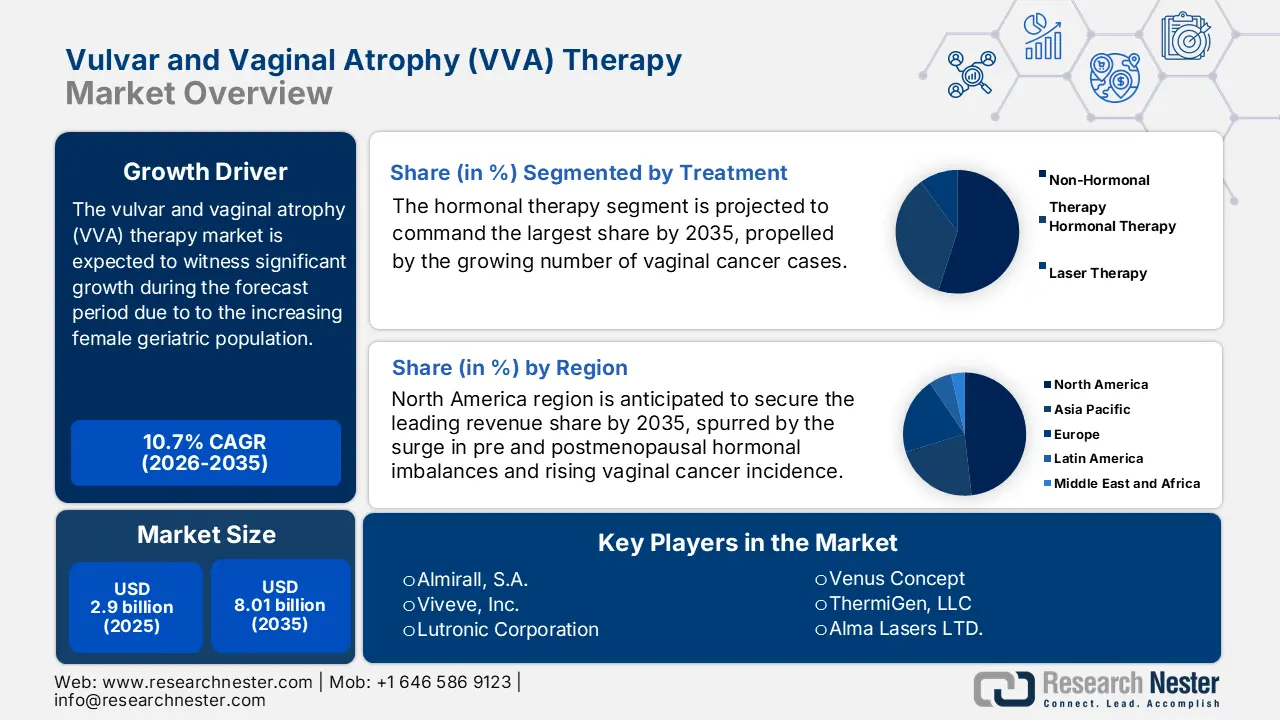

Vulvar and Vaginal Atrophy (VVA) Therapy Market size was valued at USD 2.9 billion in 2025 and is likely to cross USD 8.01 billion by 2035, registering more than 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vulvar and vaginal atrophy therapy is assessed at USD 3.18 billion.

The growth of the market can be attributed to the rising number of cases related to the hypoestrogenism condition, known as genitourinary syndrome of menopause (also known as vulvovaginal atrophy or urogenital trophy), among women. For instance, the menopausal genitourinary syndrome affects approximately 30% to 75% of postmenopausal women and can significantly impair health, sexual function, and quality of life.

Global vulvar and vaginal atrophy (VVA) therapy market trends such as rising awareness about VVA therapies among the female population, the vulvar and vaginal atrophy therapy market size is expected to expand notably during the forecast year. According to the National Institute of Health, approximately 1.3 million women in the United States enter menopause each year. The age of menopause begins mostly between 51 and 52 years of age. However, approximately 5% of women worldwide experience early menopause between the ages of 40 and 45, and 1% experience premature menopause, i.e., before the age of 40, due to sex chromosomal abnormalities, resulting in permanent ovarian failure. Hence, all these factors are expected to hike the market growth over the forecast period.

Key Vulvar and Vaginal Atrophy (VVA) Therapy Market Insights Summary:

Regional Insights:

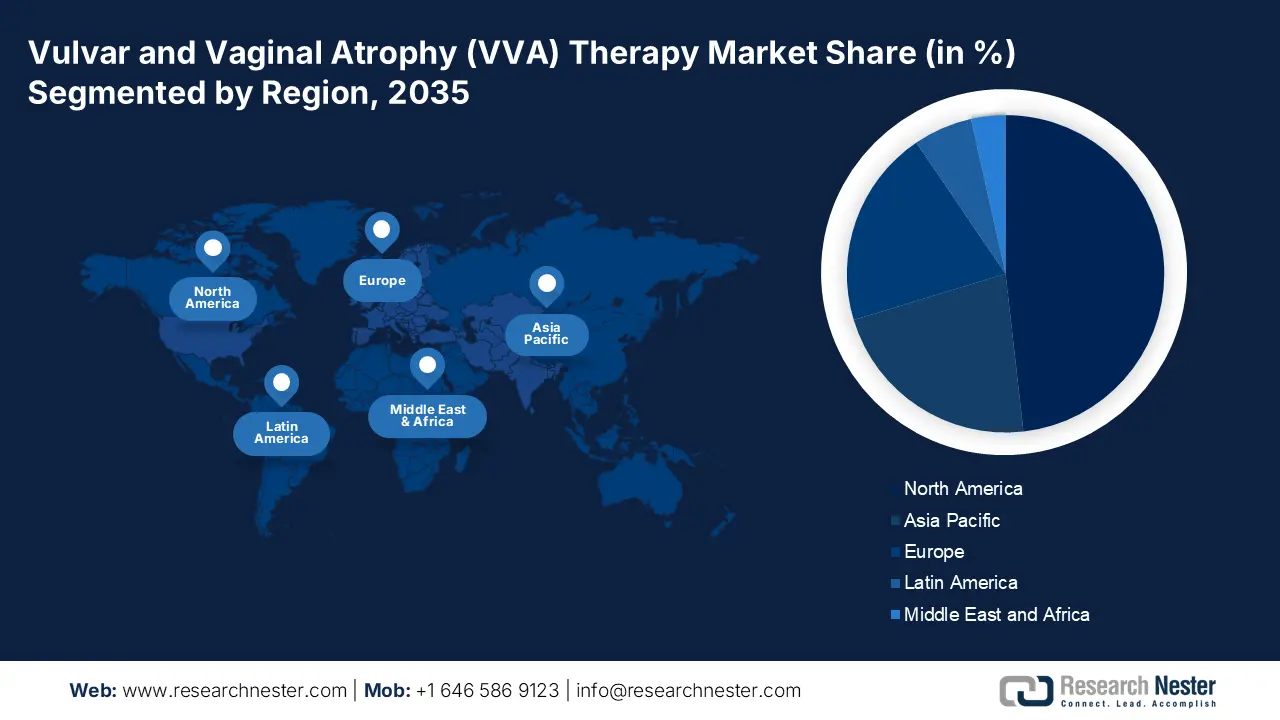

- North America is set to command the largest share by 2035 in the vulvar and vaginal atrophy (VVA) therapy market, owing to rising cases of hormonal imbalance, vaginal cancers, and growing UTI incidence.

- The Asia Pacific region is anticipated to secure the second-largest share by 2035, supported by increasing VVA awareness, expanding access to medication, and a growing geriatric female population.

Segment Insights:

- The urine test segment is projected to secure a significant share in the vulvar and vaginal atrophy (VVA) therapy market, propelled by its broad diagnostic capability across conditions such as UTIs, diabetes, kidney disorders, and vaginal cancers.

- The hormonal therapy segment is anticipated to command the largest share by 2035, supported by rising utilization in managing menopausal symptoms and reducing cancer recurrence.

Key Growth Trends:

- Increasing Female Geriatric Population

- Increasing Incidences of Breast Cancer and Uterine Cancer in Women

Major Challenges:

- Unreported Cases of Genitourinary Syndrome of Menopause Owing to a Lack of Awareness

- Concerns about Vulvar and Vaginal Atrophy from Cancer Combination Treatments

Key Players: Daré Bioscience, Inc., Almirall, S.A., Viveve, Inc., Lutronic Corporation, Venus Concept, ThermiGen, LLC, Alma Lasers LTD., BTL, Fotona d.o.o., TherapeuticsMD, Inc, .

Global Vulvar and Vaginal Atrophy (VVA) Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.18 billion

- Projected Market Size: USD 8.01 billion by 2035

- Growth Forecasts: 10.7%

Key Regional Dynamics:

- Largest Region: North America (Largest Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 21 November, 2025

Vulvar and Vaginal Atrophy (VVA) Therapy Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Female Geriatric Population - According to the United Nations Department of Economic and Social Affairs, World Population Ageing 2020 Highlights report, there is a rapid growth of the aging population. An estimated 727 million people are aged 65 or more in 2020. The number is forecasted to reach over 1.5 billion people, almost more than double from 9.3% in 2020 to 16% in 2050. According to the data, on average, women live longer than men. The total aging population comprises 55% of the female population aged 65 years and above.

-

Increasing Incidences of Breast Cancer and Uterine Cancer in Women - Breast cancer has been found to affect the body’s hormones. In women, about 67%-80% of breast cancer cases are estrogen receptor (ER) positive, while in men, around 90% and 80% are estrogen receptor (ER) and progesterone receptor (PR) positive, respectively. According to the World Health Organization (WHO), in 2020, 2.3 million women were diagnosed with breast cancer worldwide. On the other hand, according to the National Cancer Institute, as of 2022, uterine cancer represents 3.4% of all new cancer cases in the United States.

-

Growing Healthcare Expenditure - According to the Centers for Medicare & Medicaid Services, national health spending in the United States is expected to grow at a 5.5 percent annual rate, reaching approximately USD 6.0 trillion by the end of 2027.

-

Increasing Lifestyle-Related Diseases in Women- Lifestyle diseases, associated with physical inactivity and poor diet quality, pose a significant health burden. Gestational diabetes mellitus (GDM), type 2 diabetes (DM2), and polycystic ovary syndrome (PCOS) are a few of the lifestyle-related diseases that affect women. According to the Centers for Disease Control and Prevention, PCOS is one of the most common causes of female infertility, affecting 6% to 12% (up to 5 million) of US women of reproductive age as of 2020. Certain lifestyle disorders, such as depression, insomnia, and weight gain, are also common among women.

-

Growing Prevalence of UTI – The prevalence of UTI is very higher and a considerable number of women across the globe aren’t aware of it. It is estimated that, in every 25 women, 10 of them suffer from urinary tract infections.

Challenges

- Unreported Cases of Genitourinary Syndrome of Menopause Owing to a Lack of Awareness - A significant number of women aren’t aware of this therapy. In the rural areas of most developing countries, women have no awareness of even UTI, and the burning sensation is very high. Women give no particular attention to these diseases since many of them hesitate to elaborate on the symptoms. Hence, such hesitance and lack of awareness are estimated to limit the market growth over the forecast period.

- Concerns about Vulvar and Vaginal Atrophy from Cancer Combination Treatments

- Adverse Effect on the Quality of Life

Vulvar and Vaginal Atrophy (VVA) Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 8.01 billion |

|

Regional Scope |

|

Vulvar and Vaginal Atrophy (VVA) Therapy Market Segmentation:

Treatment Segment Analysis

The global vulvar and vaginal atrophy (VVA) therapy market is segmented and analyzed for demand and supply by treatment into non-hormonal therapy, hormonal therapy, and laser therapy. Out of these types of treatment, the hormonal therapy segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the growing number of vaginal cancer cases as the therapy lessens the chances of cancer recurrence. For instance, according to the Centers for Disease Control and Prevention, in 2019, around 1,368 women were diagnosed with vaginal cancer in the United States. On the other hand, most women have menopausal hormone therapy (MHT) also known as hormone replacement therapy (HRT) if they experience symptoms associated with menopause. Additionally, hormonal therapy is also used to treat breast cancer using hormones to grow. Hence, such a higher utilization is anticipated to spike the segment growth over the forecast period.

Diagnosis Segment Analysis

The global vulvar and vaginal atrophy (VVA) therapy market is also segmented and analyzed for demand and supply by diagnosis into pelvic examination, urine test, and acid balance test. Amongst these three segments, the urine test segment is expected to garner a significant share in the year 2035. Urine test is done since they can diagnose almost every type of disorder including UTI, Diabetes, kidney diseases, vaginal cancer, and others. To check for UTI, urine is examined via a microscope to look for bacteria or white blood cells, major signs of infection.

Our in-depth analysis of the global market includes the following segments:

|

By Symptoms |

|

|

By Diagnosis |

|

|

By Treatment |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vulvar and Vaginal Atrophy (VVA) Therapy Market - Regional Analysis

North American Market Insights

North America industry is poised to hold largest revenue share by 2035. The growth of the market can be attributed majorly to the surge in the number of women suffering from pre and postmenopausal hormonal imbalances along with the growing number of vaginal cancer cases in the region. For instance, according to the Centers for Disease Control and Prevention, in 2019, around 5,579 women (2.6 per 100,000) were diagnosed with vulvar cancer in the United States. Additionally, the boom in the instance of urinary tract infection cases in women owing to hypersexuality and unhealthy lifestyle and growing awareness of the infection is further anticipated to expand the regional market size during the forecast period. For instance, in 2022, it was estimated that around 45% of the women living in the USA are prone to get UTIs. Meanwhile, the doctor visits owing to UTIs are observed to be approximately 8 million every year.

APAC Market Insights

The Asia Pacific vulvar and vaginal atrophy (VVA) therapy market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the growing awareness of vulvar and vaginal atrophy basked by the escalating provision of required medication and the boom in the number of female geriatrics in the region. For instance, it was projected that in 2020, there were nearly 50% of geriatric females in the Asia Pacific. Women above 60 or 65 are considered to be geriatrics and highly prone to vaginal infection on account of the lack of estrogen. On the other hand, the increasing prevalence of UTI and vaginal cancers has also led to a higher demand for VVA therapy which results in a major growth driver to boost the market growth over the forecast period.

Vulvar and Vaginal Atrophy (VVA) Therapy Market Players:

- Daré Bioscience, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Almirall, S.A.

- Viveve, Inc.

- Lutronic Corporation

- Venus Concept

- ThermiGen, LLC

- Alma Lasers LTD.

- BTL

- Fotona d.o.o.

- TherapeuticsMD, Inc.

Recent Developments

-

Dare Bioscience, Inc. has announced the initiation of the DARE-VVA1’s Phase I/II trial to evaluate a proprietary investigational formulation for the non-hormonal treatment of moderate to severe vulvar and vaginal atrophy (VVA). DARE-VVA1 is a new intravaginal tamoxifen product developed to treat vulvar and vaginal atrophy.

-

TherapeuticsMD, Inc. announced the approval by the U.S. Food and Drug Administration for Imvexxy 4 mcg dose. Imvexxy 4 mcg is now a commercially available drug in the United States for the treatment of dyspareunia, which is a symptom of vulvar and vaginal atrophy.

- Report ID: 4178

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vulvar and Vaginal Atrophy (VVA) Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.