Endocrinology Drugs Market Outlook:

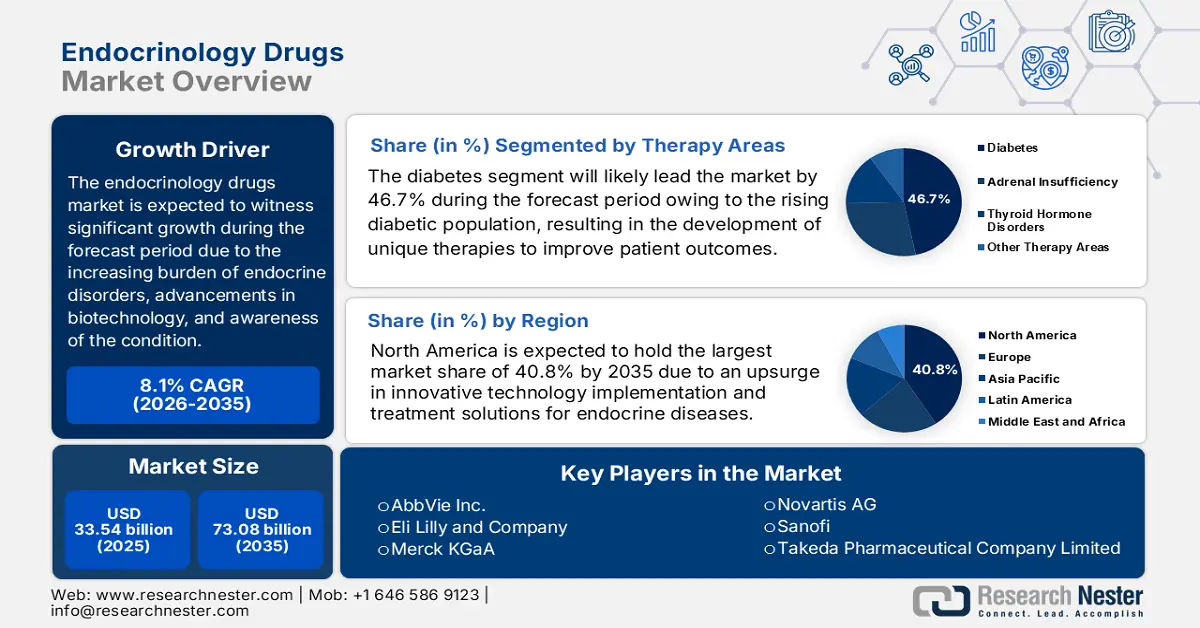

Endocrinology Drugs Market size was over USD 33.54 billion in 2025 and is poised to exceed USD 73.08 billion by 2035, growing at over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endocrinology drugs is estimated at USD 35.99 billion.

The growth of the endocrinology drugs market is majorly driven by the rising prevalence of endocrine disorders in the aging population, awareness of proactive screening for hormonal disorders, and focus on personalized medicine along with targeted therapeutics. There is a rising incidence of disorders associated with the endocrine system which has been linked with disruptions in hormonal balance further leading to conditions such as thyroid, adrenal, and hyperglycemia. For instance, in May 2023 according to an analysis published in NLM by Frontiers in Endocrinology, approximately 13 million people in the U.S. suffer from undiagnosed endocrine issues with thyroid diseases accounting for 30% and 48.8% of metabolic disorders.

In addition, the adoption of targeted therapeutics with approval from the regulatory authorities further encourages pharmaceutical companies to invest in the drugs sector. In October 2024, the FDA approved inavolisib with palbociclib and fulvestrant for treating endocrine-resistant, PIK3CA-mutated, HR-positive, and HER2-negative advanced breast cancer. The approval was based on the INAVO120 trial, a randomized placebo-controlled, multicancer study involving 325 patients. Such approvals not only enhance treatment procedures but also contribute to market growth by encouraging pharmaceutical companies to invest further in the industry contributing to better patient outcomes.

Key Endocrinology Drugs Market Insights Summary:

Regional Highlights:

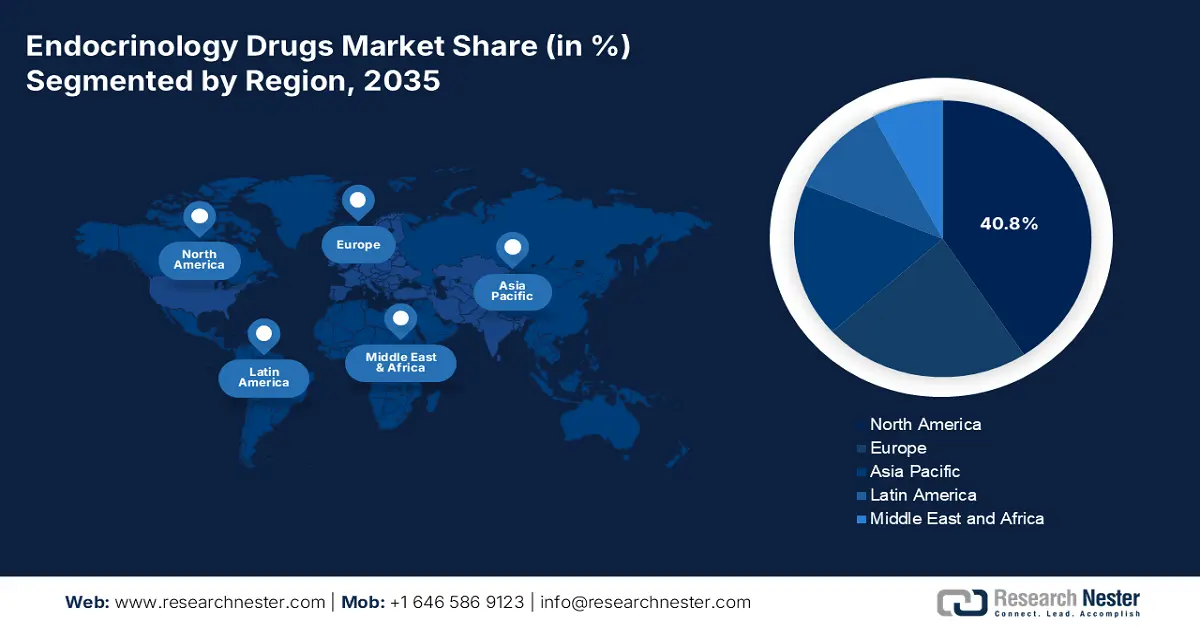

- North America commands a 40.8% share in the endocrinology drugs market, driven by advancements in biopharma and early disease diagnosis, ensuring robust growth through 2035.

- Asia Pacific’s endocrinology drugs market is forecasted to experience lucrative growth by 2035, driven by R&D focus and use of precision medicine.

Segment Insights:

- The Diabetes segment is anticipated to achieve 46.7% market share by 2035, propelled by rising obesity, sedentary lifestyles, and an aging population.

Key Growth Trends:

- Increasing prevalence of hormonal disorders

- Pharmaceutical and drug development advancements

Major Challenges:

- High research and development costs

- Strict regulatory frameworks

- Key Players: AstraZeneca, Eli Lilly, Merck, Novo Nordisk A/S, Novartis AG, Bayer AG, and more.

Global Endocrinology Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33.54 billion

- 2026 Market Size: USD 35.99 billion

- Projected Market Size: USD 73.08 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Endocrinology Drugs Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing prevalence of hormonal disorders: The major driver of the endocrinology drugs market is the rising burden of hormonal and endocrine disorders, particularly thyroid diseases with an extensive requirement for targeted drugs. According to a study by NLM in May 2022, hypothyroidism affects approximately 4.6% of the U.S. population, with 0.3% being clinical type and 4.3% as subclinical. Furthermore, the study underscores that women aged 85 years and older are more likely to receive hormone treatment compared to other demographic groups. Thus, the demographic patterns highlight the growing demand for endocrinology drugs and access to thyroid disorder treatments to address the medical need.

-

Pharmaceutical and drug development advancements: The principal driver for the endocrinology drugs market is advancements in the pharmaceutical and drug development process. Additionally, innovations in drug formulations and delivery systems with the use of biologics and biosimilars are improving treatment outcomes for endocrine disorders. For instance, in August 2024, Ascendis Pharma A/S announced the FDA approval for YORVIPATH which is the first and only treatment of hypoparathyroidism in adults addressing a critical unmet medical need. Such approvals reflect ongoing pharmaceutical advancements, thus expanding treatment options in the market.

Challenges

-

High research and development costs: The key restraint for the endocrinology drugs market is the unaffordable investments in research and clinical trials. Since endocrine disorders involve complex hormonal interactions, drug discovery demands advanced biotechnology and precision medicine approaches making it an even more cost-intensive process. Furthermore, preclinical and clinical trials take years to complete for testing safety and efficacy resulting in a substantial number of trials remaining failed. These cost factors impact patient accessibility, especially in underdeveloped countries limiting market expansion.

-

Strict regulatory frameworks: The major limiting factor in the endocrinology drugs market is the presence of stringent guidelines from regulatory authorities, primarily ensuring safety and efficacy. Most drug approval processes involve multiple phases of testing as the drugs directly affect hormonal balance to avoid any sort of side effects. Additionally, updates in regulatory requirements and labeling changes act as major restraints for pharmaceutical companies to maintain compliance. Therefore, the regulatory delays widen disparities in health in communities.

Endocrinology Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 33.54 billion |

|

Forecast Year Market Size (2035) |

USD 73.08 billion |

|

Regional Scope |

|

Endocrinology Drugs Market Segmentation:

Therapy Areas (Adrenal Insufficiency, Diabetes, Thyroid Hormone Disorders)

Based on therapy areas, the diabetes segment is set to account for endocrinology drugs market share of more than 46.7% by the end of 2035. The rising prevalence of the disease is due to sedentary lifestyles, obesity rates, and an aging population are contributing factors to the growing diabetic patient pool. In November 2024, WHO reported that hyperglycemia cases surged from 200 million in 1990 to 830 million in 2022 majorly in developing countries. In addition, over 2 million deaths in 2021 were linked to diabetes and kidney diseases. These statistics highlight the increasing demand for therapeutic drugs making it a crucial segment in the endocrine drugs industry.

Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)

Based on distribution channel, the hospital pharmacies segment is anticipated to dominate the endocrinology drugs market by 2035 attributable to the growing number of hospital visits for specialized treatments and strategic investments by companies. This is an area of growth as hospitals serve as the primary healthcare providers for complex endocrine disorders requiring specialist supervision. For instance, in July 2024 AstraZeneca announced its acquisition of Amolyt Pharma for USD 1.05 billion expanding its rare endocrine disease pipeline. The deal includes Eneboparatide a phase III therapy for hypoparathyroidism requiring hospital-based treatment reinforcing the market growth.

Our in-depth analysis of the global market includes the following segments:

|

Therapy Area |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endocrinology Drugs Market Regional Analysis:

North America Market Statistics

North America in endocrinology drugs market is likely to account for more than 40.8% revenue share by the end of 2035, driven by the advancements in biopharmaceuticals and personalized medicine. The region’s well-established healthcare infrastructure coupled with growing awareness and early diagnosis of conditions further contribute to market expansion. Moreover, rising obesity rates and sedentary lifestyles lead to a surge in hyperglycemia cases fueling the demand for endocrine drugs in the country.

The U.S. endocrinology drugs market is unfolding remarkable growth opportunities attributable to the increased healthcare expenditure and rising geriatric population susceptible to disorders. For instance, in February 2025, Eli Lilly and Company announced its launch of Zepbound single-dose vials in the U.S. to improve affordability. Additionally, the company reduced the prices of 2.5mg and 5mg vials making treatment more accessible. This move highlights the expanding accessibility of therapeutics in the country rising demand for effective obesity treatments.

The endocrinology drugs market in Canada is witnessing significant growth due to the growing instances of hormonal imbalances and demand for hormone replacement therapies. In addition, the government supports research and development through its funding. In March 2025 the Government of Canada signed a pharma care agreement with British Columbia to invest over USD 670 million over four years in universal access to contraceptive and diabetes medications reducing health risks and complications. This investment is anticipated to improve patient accessibility to essential medications by driving the market growth for endocrinology drug development.

Asia Pacific Market Analysis

The endocrinology drugs market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline. Health professionals are incorporating advanced diagnostic techniques and precision medicine resulting in efficient treatments. Consequently, pharmaceutical companies are focusing on research and development in endocrine pharmacology driving market expansion in the region.

The market in India is expecting substantial growth due to healthcare awareness and government initiatives aimed at improving treatment access as management has become highly intense. For instance, in December 2024 Government of India took significant steps under NHM by setting up 770 district NCD clinics and 372 day care centers and providing access to certain drugs including endocrinology drugs for diabetes and hormonal disorders strengthening affordability and accessibility.

The endocrinology drugs market in China is gaining traction due to growing collaborations between public and private companies, technological advancement in biotechnology, and increased investment in personalized medicine. In August 2024 VISEN Pharmaceuticals announced the successful completion of phase 3 PaTHway China trial for Palopegteriparatide in treating hypoparathyroidism strengthening the market in China by offering improved treatments. The completion of clinical trial is expected to accelerate market adoption further positioning China as a global leader in the industry.

Key Endocrinology Drugs Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca

- Eli Lilly

- Merck

- Novo Nordisk A/S

- Novartis AG

- Sanofi

- Biocon

- Bayer AG

- Hikma

- Glenmark Pharmaceuticals

The company's landscape in the endocrinology drugs market is rapidly expanding due to the awareness about health concerns among the population and advancements in targeted drugs for endocrine issues. In November 2024, Eton Pharmaceuticals, Inc. acquired the U.S. rights to Amglidia for treating neonatal hyperglycemia to expand treatment options addressing unmet needs of therapeutics. The strategic move is likely to strengthen the company’s presence in the market contributing to market expansion in endocrinology therapeutics.

Here's the list of some key players:

Recent Developments

- In March 2024, Novo Nordisk announced that the CHMP issued a positive recommendation for Awiqli for once-weekly basal insulin icodec that provides superior blood sugar control compared to daily basal insulin.

- In December 2022, Glenmark Pharmaceuticals Limited launched India’s first triple fixed dose combination of Teneligliptin, Pioglitazone, and Metformin for adults with type-2 diabetes and high insulin resistance ensuring adherence with a single pill.

- In December 2022, Hikma Pharmaceuticals PLC launched Levothyroxine Sodium injection in the U.S. in ready-to-use vials of 100 mcg/mL dose which is a crucial medication used in hospitals for the treatment of myxedema coma caused by hypothyroidism.

- Report ID: 7401

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endocrinology Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.