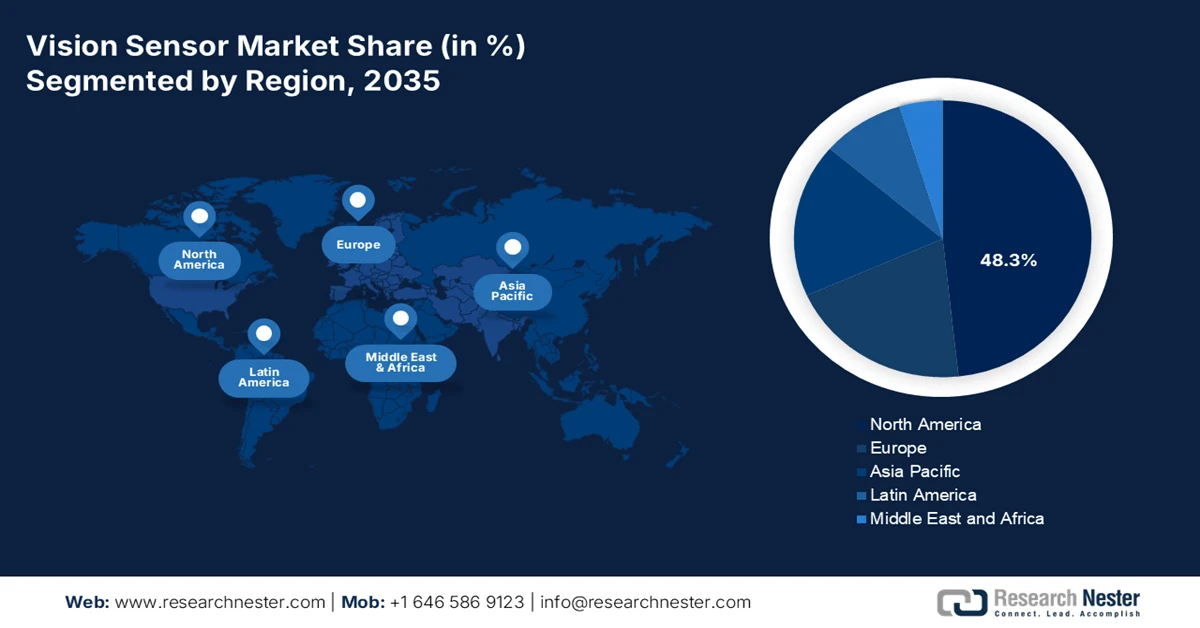

Vision Sensor Market - Regional Analysis

North America Market Insights

The North America vision sensor market is expected to dominate and hold a 48.3% share value by 2035. The market is driven by the advanced manufacturing upgrades, stringent regulatory compliance, and defense modernization. The U.S. CHIPS and Science Act fuels semiconductor fab construction, which requires precision metrology. The region’s high labor costs increase the ROI for robotic vision in logistics and automotive. A key trend is the integration of AI at the sensor edge for complex defect detection, moving beyond traditional rule-based inspection. The U.S. DoD’s investments in autonomous systems and ISR technologies for R&D further drive the demand for high-performance EO/IR sensors. The market is defined by a shift from hardware-centric sales to integrated solution offerings that include analytics and connectivity for Industry 4.0 data strategies.

U.S. vision sensor market is shaped by the rapid innovation and diversification beyond the traditional optical systems. The recent advancements, such as Teradar’s November 2025 launch of commercial terahertz vision technology and Cognex’s expansion into vision sensing. Teradar’s high-resolution all-weather THz imaging addresses the critical limitations of camera radar ad lidar based perception, aligning with the U.S. automotive defense and manufacturing requirements for robust sensing under adverse conditions. Similarly, Cognex’s September 2023 launch of the In Sight SnAPP vision sensor highlights the growing demand for simplified, high-accuracy industrial vision solutions and expands its addressable market by an estimated USD 1 billion. These developments underscore strong U.S. momentum in vision sensor adoption across autonomous systems, industrial automation, and safety-critical applications supported by the domestic R&D leadership and OEM collaboration.

Recent News in Sensor and Imaging Technologies

|

Year |

Company |

News |

|

December 2025 |

Wabtec Corporation |

Finalized the acquisition of Frauscher Sensor Technology Group GmbH (“Frauscher”), a global market leader in train detection, wayside object control solutions, and axle counting systems |

|

July 2024 |

onsemi |

Completed acquisition of SWIR Vision Systems, integrating CQD short wavelength infrared technology into CMOS sensors to enhance intelligent sensing for industrial, automotive, and defense markets |

|

January 2024 |

ABB |

Acquired Canadian company Real Tech to expand smart water management offerings with optical sensor technology, strengthening presence in the water segment |

Source: ABB, Wabtec Corporation, onsemi

The Canada vision sensor market is closely linked to the country’s automotive and electric vehicle manufacturing ecosystem, which remains one of Canada's largest sectors. According to the Government of Canada report in May 2025, the automotive manufacturing contributed USD 16.8 billion to GDP in 2024, employed over 125,000 workers, and supported more than 427,000 indirect jobs, creating a sustained demand for automated inspection and quality assurance solutions. Federal and provincial governments have actively supported the EV and battery investments via Investment Tax Credits, the strategic innovation funds, and special contribution agreements, reinforcing the long term automation adoption. Further, the government has announced USD 2.5 billion for Honda’s EV supply chain projects. As EV and battery projects are surging, vision sensors will remain critical for battery inspection, assembly verification, and traceability across Canada’s automotive supply chain.

APAC Market Insights

The Asia Pacific vision sensor market is the fastest growing and is expected to grow at a CAGR of 9.8% during the forecast period 2026 to 2035. The market is driven by its position as the global manufacturing hub and government industrial policies. China's target for high-tech manufacturing sovereignty is a primary catalyst, creating a massive demand for automated quality inspection in electronics and EVs. Similarly, Japan and India's PLI schemes boost the smart manufacturing adoption. A key trend is the rapid integration of affordable AI-enabled vision solutions by small and medium enterprises to compete on quality. The region also leads in deploying vision sensors for new logistics automation infrastructure fueled by the e-commerce growth.

Rapid advances in domestic innovation and expanding industrial automation requirements are shaping the China vision sensor market. Product launches such as AlpsenTek’s ALPIX-Pizol hybrid vision sensor in March 2025 demonstrate China’s growing capability to develop advanced sensing architectures that integrate global shutter image with the event-based vision for edge AI robotics, drones, and smart city applications. At the same time, China remains a key commercialization hub, as evidenced by the international suppliers such as LUCID showcasing high-resolution SWIR machine vision cameras at Vision China Shanghai 2024, reflecting strong local demand for advanced inspection and non-visible spectrum imaging. These developments align with China’s focus on smart manufacturing, low-power AI perception, and autonomous systems, reinforcing the sustained demand for the high-performance vision sensors across electronics manufacturing, robotics, and urban infrastructure projects.

Japan vision sensor market is defined by the high precision demand and an aging workforce, driving the investment in automation to maintain quality and productivity. The government’s Society 5.0 vision promotes the integration of cyber-physical systems, with the vision sensors acting as the critical eyes for collaborative robots and IoT platforms in electronics and automotive sectors. A dominant trend is the development of the ultra-compact high-speed sensors for intricate assembly and semiconductor inspection. The report from the Semiconductor Equipment Association of Japan in July 2023 indicates that the semiconductor manufacturing equipment sales in 2023 reached 3.2 trillion yen, highlighting the sustained capital deployment into sectors that are intensive users of advanced vision technology.

Europe Market Insights

The Europe vision sensor market is propelled by a strong regulatory framework and strong industrial foundations in automotive and pharmaceuticals. The key drivers include the EU’s stringent Good Manufacturing Practice guidelines, which mandate meticulous quality control in the life sciences, and the European Chips Act to boost the semiconductor sector, necessitating advanced inspection systems. A significant trend is the integration of vision sensors with collaborative robots for flexible small batch production in industries such as aerospace and specialty machinery. Sustainability initiatives also drive the demand for vision systems in circular economy applications such as automated waste sorting and remanufacturing. The region's growth is tempered by higher energy costs and complex adoption cycles but remains innovation-focused, with strong demand for high-precision, compliant solutions.

The leadership in industrial robotics and factory automation are driving the Germany vision sensor market. As Europe’s largest robot market and the world’s fifth largest, Germany has installed more than 26,982 industrial robots in 2024, accounting for 32% of the total Europe installation despite a modest 5% YoY decline from 2023, based on the International Federation of Robotics in June 2025. This sustained installation base underpins the steady demand for the vision sensor used in robot guidance, inspection, bin picking, and quality assurance across the automotive machinery and electronics manufacturing. Even with the short term fluctuations in robot deployments, Germany manufacturers continue to prioritize productivity, flexibility, and defect reduction, driving the integration of smart and embedded vision sensors into production lines. The scale and maturity of Germany’s automation ecosystems ensure the ongoing replacement, upgrade, and retrofit demand, positioning the country as a core market for advanced vision sensor solutions.

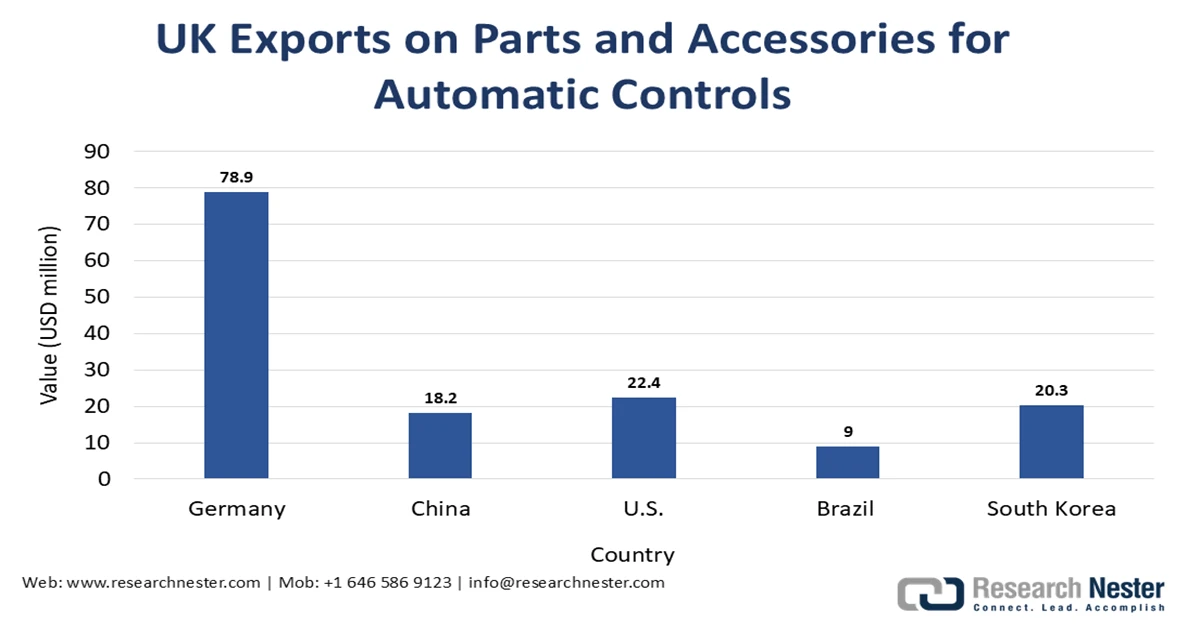

Source: OEC 2023

The UK vision sensor market is supported by the sustained demand for automated control systems across manufacturing, logistics, and process industries, where vision sensors function as critical feedback and inspection components. The OEC 2023 report covering parts of accessories for automated regulating or controlling instruments, including the vision sensor modules, indicates that the UK exported USD 280 million of these in 2023. As UK manufacturers continue to modernize the production lines to improve efficiency, traceability, and quality compliance, demand for the compact and integrated vision sensors remains steady. This trend is reinforced by the automation investments in food processing, pharmaceuticals, and advanced manufacturing. The UK’s emphasis on productivity improvement and industrial digitalization supports ongoing imports and upgrades of vision-enabled control systems, positioning the country as a consistent though mature vision sensor market within the broader vision sensor landscape.