Vision Sensor Market Outlook:

Vision Sensor Market size was valued at USD 6.7 billion in 2025 and is projected to reach USD 26.4 billion by the end of 2035, rising at a CAGR of 14.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of vision sensor is estimated at USD 7.7 billion.

The vision sensor market is closely tied to industrial automation investment, semiconductor manufacturing activity, and advanced manufacturing output across automotive electronics, logistics, and aerospace sectors. According to the National Institute of Standards and Technology in its October 2024 report, the U.S. private manufacturing fixed investment exceeded USD 2.3 trillion in 2023, with the durable goods and high-value equipment accounting for a major share, directly supporting the demand for the automated inspection and quality control systems. The report also states that the manufacturing of computer, electronic, and optical products/equipment reached USD 384 billion in the U.S., reinforcing the sustained requirements for inline inspection defect detection and process monitoring enabled by vision-based sensing. This capital investment drives the adoption of precision, sensor-based automation systems.

Computer, Electronic, and Optical Products/Equipment Manufacturing

|

Country |

Value (USD billion) |

|

U.S. |

384 |

|

Germany |

100 |

|

Europe |

220 |

|

China |

610 |

|

Japan |

125 |

Source: National Institute of Standards and Technology October 2024

The growth is further propelled by the need for stringent quality assurance and traceability across regulated sectors such as pharmaceuticals and automotive. Robust regulation in the U.S. focuses on the supply chain integrity and manufacturing quality via initiatives such as Quality 4.0, which implicitly supports the integration of automated inspection systems. The data from the International Federation of Robotics in June 2025 underscores this trend, reporting that the global stock of over 542,000 industrial robots was installed in 2024, with the vision-guided robots constituting a significant and growing portion. This expansion directly correlates with the deployment of vision sensors for tasks such as guidance and verification. Further, the International Society of Automation identifies the convergence of operational technology and information technology as a key driver where vision sensors act as critical data acquisition nodes for real-time process analytics and control, moving beyond simple inspection to enable predictive maintenance and adaptive manufacturing workflows.

Key Vision Sensor Market Insights Summary:

Regional Highlights:

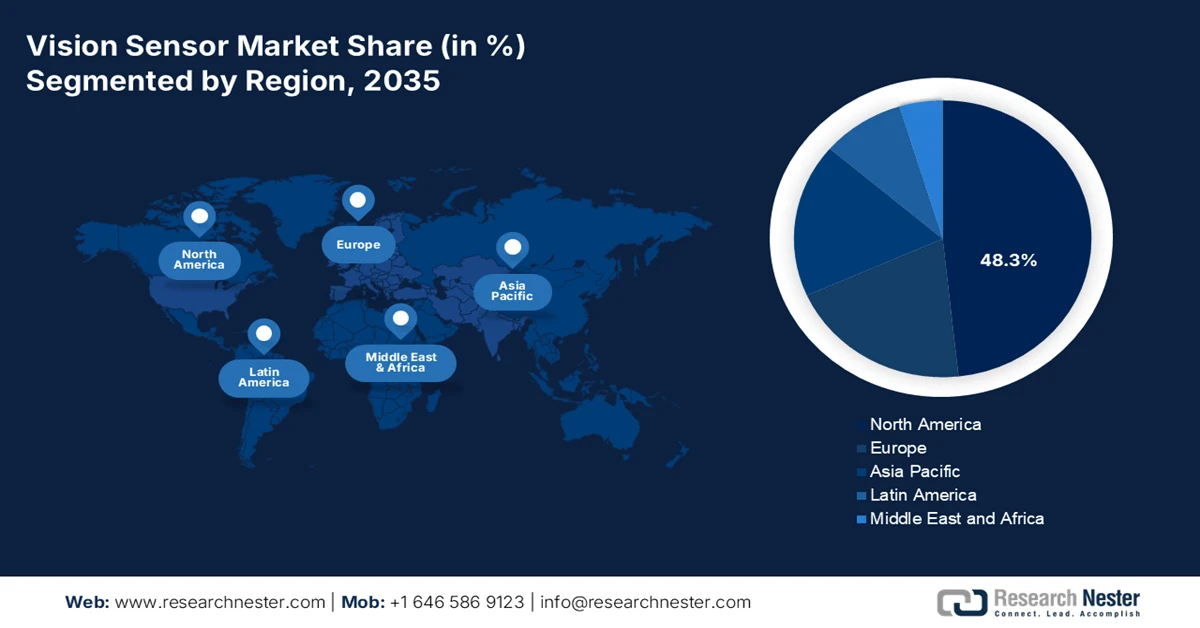

- North America in the vision sensor market is forecast to command a leading 48.3% share by 2035, reflecting strong uptake across advanced manufacturing, defense modernization, and regulated industries, reinforced by semiconductor capacity expansion and rising returns on robotic vision adoption

- Asia Pacific is projected to expand at a robust CAGR of 9.8% during 2026–2035, supported by its dominance as a global manufacturing base and proactive government-led industrial policies accelerating smart factory and logistics automation

Segment Insights:

- The stationary/robotic cell segment in the vision sensor market is expected to secure a dominant 70.5% share by 2035, highlighting its entrenched role in fixed automation environments and inspection-intensive workflows, stimulated by sustained industrial automation investments

- The hardware segment is anticipated to maintain the largest share by 2035, as market scaling remains closely tied to the widespread deployment of core physical vision components across production floors, strengthened by public funding for advanced manufacturing infrastructure

Key Growth Trends:

- Rising industrial robot installations

- Defense, aerospace, and national security manufacturing budgets

Major Challenges:

- High R&D and technological complexity

- Requirement for industry-specific application knowledge

Key Players: Cognex Corporation (U.S.), Keyence Corporation (Japan), Omron Corporation (Japan), Sick AG (Germany), Basler AG (Germany), Teledyne Technologies (U.S.), National Instruments (U.S.), Balluff GmbH (Germany), Datalogic S.p.A. (Italy), IDS Imaging Development Systems GmbH (Germany), Toshiba Teli Corporation (Japan), Panasonic Corporation (Japan), FLIR Systems (U.S.), Sony Corporation (Japan), Intel Corporation (U.S.), Samsung Electro-Mechanics (South Korea), Qualcomm (U.S.), ifm electronic (Germany), JAI A/S (Denmark), ESPROS Photonics AG (Switzerland).

Global Vision Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.7 billion

- 2026 Market Size: USD 7.7 billion

- Projected Market Size: USD 26.4 billion by 2035

- Growth Forecasts: 14.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Thailand

Last updated on : 27 January, 2026

Vision Sensor Market - Growth Drivers and Challenges

Growth Drivers

- Rising industrial robot installations: Government-backed robotics adoption is expanding the installed base for vision-guided systems. The International Federation of Robotics, in its June 2025 data reports that 553,000 industrial robots were installed globally in 2022, with Asia and Europe leading the deployments. Further, the U.S. installed robots in 2024 were 50,100 units. Many national automation roadmaps explicitly promote the sensor enabled robotics to improve the yield and flexibility. For example, Japan’s Ministry of Economy, Trade, and Industry prioritizes robotics and sensing technologies for industrial resilience, while Germany’s Industry 4.0 framework emphasizes machine vision for autonomous production cells. Vision sensors are increasingly selected over traditional cameras due to the compact design and easier PLC integration, indicating a sustained demand for the vision sensor market.

Annual Installation of Industrial Robots

|

Year |

Units (1000 units) |

|

2021 |

526 |

|

2022 |

553 |

|

2023 |

541 |

|

2024 |

542 |

Source: IFR June 2025

- Defense, aerospace, and national security manufacturing budgets: Defense manufacturing remains a stable demand driver for the high-reliability vision sensors used in the inspection, assembly, verification, and traceability. The U.S. Department of Defense report in March indicates that nearly USD 842 billion is allocated for the Department of defense with the funding mainly for advanced manufacturing electronics and quality assurance modernization. The vision sensors market solutions support defect detection in aerospace components, electronics, and munitions manufacturing. The NATO and EU defense programs similarly emphasize production efficiency and quality control amid rising geopolitical tensions. Further, the defense department has increased the investments in engineering and industrial base modernization, which is surging the adoption of automated inspection and machine vision systems across defense and aerospace supply chains.

- Stringent quality and traceability regulations: Regulatory mandates in the pharmaceutical, food, and automotive sectors enforce strict quality control, propelling the vision sensor market adoption. The U.S. regulatory standards push for advanced manufacturing and serialization requires top quality result for inspection and tracking, which is impossible without automated vision systems. This regulatory compulsion transforms the vision technology from an efficiency tool into a compliance necessity, creating resilient non-discretionary demand within these regulated industries. This creates a captive, highly compliant market with low price elasticity. For instance, the regulatory mandate for the unit-level traceability directly spurred investment in the serialization and aggregation lines reliant on vision for verification.

Challenges

- High R&D and technological complexity: Developing competitive vision sensors requires intense R&D in optics, image processing, and AI. This creates a steep barrier in the vision sensor market for new entrants who must match the performance of incumbents' decades of IP. For example, the leading companies invest a significant part of their revenue in R&D to maintain their edge in algorithms. A new player needs similar sustained investment to compete. Market growth attracts investment but also raises the technological bar.

- Requirement for industry-specific application knowledge: Success requires a deep domain knowledge to solve the specific problems, such as semiconductor wafer inspection vs. food packaging. Generic hardware fails without customized software and lighting. The dominating player addresses this by partnering with the specialist software companies and integrators across different verticals. A new manufacturer in the vision sensor market must either focus narrowly on one industry or build a costly, diverse knowledge and partner network from scratch.

Vision Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.6% |

|

Base Year Market Size (2025) |

USD 6.7 billion |

|

Forecast Year Market Size (2035) |

USD 26.4 billion |

|

Regional Scope |

|

Vision Sensor Market Segmentation:

Deployment Segment Analysis

In the vision sensor market, the stationary/robotic cell is leading the deployment segment and is expected to capture the vast majority of the share value of 70.5% by 2035. This dominance is driven by its critical role in automated production lines and quality control stations, where sensors are permanently integrated for high-speed repeatable tasks like assembly verification and inspection. The growth of this segment is directly fueled by the industrial automation investments. The key indicator is the record adoption of industrial robots according to the International Federation of Robotics in September 2023. A record of 553,052 industrial robots was installed globally in 2022, a number that underscores the scale of demand for stationary vision systems that enable these robots to see and operate precisely. This trend solidifies the stationary deployment’s market lead.

Component Segment Analysis

In the component segment, the hardware is holding the largest share value in the vision sensor market, encompassing the physical cameras, sensors, lenses, lighting, and processors. While the software and AI are becoming increasingly valuable, the market’s expansion is fundamentally tied to the volume and advancement of these core physical units deployed across factories. A key driver for this hardware demand is federal investment in advanced manufacturing and automation. The U.S. National Institute of Standards and Technology December 2025 announced funding of USD 50 billion to strengthen the U.S. position in semiconductor research, development, and manufacturing. These initiatives directly fund the capital equipment, including advanced sensor hardware that modernizes the production floors, ensuring sustained hardware dominance.

CHIPS and Science Act Overview

|

Component |

Funding Amount |

Purpose |

|

Total Department of Commerce Allocation |

USD 50 billion |

Strengthen U.S. position in semiconductor research, development, manufacturing, and workforce investment. |

|

CHIPS Research and Development Office |

USD 11 billion |

Develop a robust domestic R&D ecosystem. |

|

CHIPS Program Office |

USD 39 billion |

Provide incentives for investment in U.S. facilities and equipment. |

Source: NIST December 2025

Vision Type Segment Analysis

The 2D vision sensors continue to be the leading segment in the vision type segment in the vision sensor market, valued for their cost-effectiveness, speed, and maturity in solving a vast array of industrial tasks like barcode reading, label verification, and basic presence detection. Their deep-rooted position in high-volume manufacturing ensures ongoing dominance even as 3D vision grows for complex metrology. The demand for 2D systems is closely linked to the automation in major sectors such as electronics. Government data from the SWP in March 2023 shows the U.S. exports 42% of the semiconductor manufacturing equipment, a category including the vision systems, reflecting a significant demand for integrated 2D and 3D vision sensor technology.

Our in-depth analysis of the global vision sensor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Component |

|

|

Application |

|

|

Vision Type |

|

|

End user Industry |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vision Sensor Market - Regional Analysis

North America Market Insights

The North America vision sensor market is expected to dominate and hold a 48.3% share value by 2035. The market is driven by the advanced manufacturing upgrades, stringent regulatory compliance, and defense modernization. The U.S. CHIPS and Science Act fuels semiconductor fab construction, which requires precision metrology. The region’s high labor costs increase the ROI for robotic vision in logistics and automotive. A key trend is the integration of AI at the sensor edge for complex defect detection, moving beyond traditional rule-based inspection. The U.S. DoD’s investments in autonomous systems and ISR technologies for R&D further drive the demand for high-performance EO/IR sensors. The market is defined by a shift from hardware-centric sales to integrated solution offerings that include analytics and connectivity for Industry 4.0 data strategies.

U.S. vision sensor market is shaped by the rapid innovation and diversification beyond the traditional optical systems. The recent advancements, such as Teradar’s November 2025 launch of commercial terahertz vision technology and Cognex’s expansion into vision sensing. Teradar’s high-resolution all-weather THz imaging addresses the critical limitations of camera radar ad lidar based perception, aligning with the U.S. automotive defense and manufacturing requirements for robust sensing under adverse conditions. Similarly, Cognex’s September 2023 launch of the In Sight SnAPP vision sensor highlights the growing demand for simplified, high-accuracy industrial vision solutions and expands its addressable market by an estimated USD 1 billion. These developments underscore strong U.S. momentum in vision sensor adoption across autonomous systems, industrial automation, and safety-critical applications supported by the domestic R&D leadership and OEM collaboration.

Recent News in Sensor and Imaging Technologies

|

Year |

Company |

News |

|

December 2025 |

Wabtec Corporation |

Finalized the acquisition of Frauscher Sensor Technology Group GmbH (“Frauscher”), a global market leader in train detection, wayside object control solutions, and axle counting systems |

|

July 2024 |

onsemi |

Completed acquisition of SWIR Vision Systems, integrating CQD short wavelength infrared technology into CMOS sensors to enhance intelligent sensing for industrial, automotive, and defense markets |

|

January 2024 |

ABB |

Acquired Canadian company Real Tech to expand smart water management offerings with optical sensor technology, strengthening presence in the water segment |

Source: ABB, Wabtec Corporation, onsemi

The Canada vision sensor market is closely linked to the country’s automotive and electric vehicle manufacturing ecosystem, which remains one of Canada's largest sectors. According to the Government of Canada report in May 2025, the automotive manufacturing contributed USD 16.8 billion to GDP in 2024, employed over 125,000 workers, and supported more than 427,000 indirect jobs, creating a sustained demand for automated inspection and quality assurance solutions. Federal and provincial governments have actively supported the EV and battery investments via Investment Tax Credits, the strategic innovation funds, and special contribution agreements, reinforcing the long term automation adoption. Further, the government has announced USD 2.5 billion for Honda’s EV supply chain projects. As EV and battery projects are surging, vision sensors will remain critical for battery inspection, assembly verification, and traceability across Canada’s automotive supply chain.

APAC Market Insights

The Asia Pacific vision sensor market is the fastest growing and is expected to grow at a CAGR of 9.8% during the forecast period 2026 to 2035. The market is driven by its position as the global manufacturing hub and government industrial policies. China's target for high-tech manufacturing sovereignty is a primary catalyst, creating a massive demand for automated quality inspection in electronics and EVs. Similarly, Japan and India's PLI schemes boost the smart manufacturing adoption. A key trend is the rapid integration of affordable AI-enabled vision solutions by small and medium enterprises to compete on quality. The region also leads in deploying vision sensors for new logistics automation infrastructure fueled by the e-commerce growth.

Rapid advances in domestic innovation and expanding industrial automation requirements are shaping the China vision sensor market. Product launches such as AlpsenTek’s ALPIX-Pizol hybrid vision sensor in March 2025 demonstrate China’s growing capability to develop advanced sensing architectures that integrate global shutter image with the event-based vision for edge AI robotics, drones, and smart city applications. At the same time, China remains a key commercialization hub, as evidenced by the international suppliers such as LUCID showcasing high-resolution SWIR machine vision cameras at Vision China Shanghai 2024, reflecting strong local demand for advanced inspection and non-visible spectrum imaging. These developments align with China’s focus on smart manufacturing, low-power AI perception, and autonomous systems, reinforcing the sustained demand for the high-performance vision sensors across electronics manufacturing, robotics, and urban infrastructure projects.

Japan vision sensor market is defined by the high precision demand and an aging workforce, driving the investment in automation to maintain quality and productivity. The government’s Society 5.0 vision promotes the integration of cyber-physical systems, with the vision sensors acting as the critical eyes for collaborative robots and IoT platforms in electronics and automotive sectors. A dominant trend is the development of the ultra-compact high-speed sensors for intricate assembly and semiconductor inspection. The report from the Semiconductor Equipment Association of Japan in July 2023 indicates that the semiconductor manufacturing equipment sales in 2023 reached 3.2 trillion yen, highlighting the sustained capital deployment into sectors that are intensive users of advanced vision technology.

Europe Market Insights

The Europe vision sensor market is propelled by a strong regulatory framework and strong industrial foundations in automotive and pharmaceuticals. The key drivers include the EU’s stringent Good Manufacturing Practice guidelines, which mandate meticulous quality control in the life sciences, and the European Chips Act to boost the semiconductor sector, necessitating advanced inspection systems. A significant trend is the integration of vision sensors with collaborative robots for flexible small batch production in industries such as aerospace and specialty machinery. Sustainability initiatives also drive the demand for vision systems in circular economy applications such as automated waste sorting and remanufacturing. The region's growth is tempered by higher energy costs and complex adoption cycles but remains innovation-focused, with strong demand for high-precision, compliant solutions.

The leadership in industrial robotics and factory automation are driving the Germany vision sensor market. As Europe’s largest robot market and the world’s fifth largest, Germany has installed more than 26,982 industrial robots in 2024, accounting for 32% of the total Europe installation despite a modest 5% YoY decline from 2023, based on the International Federation of Robotics in June 2025. This sustained installation base underpins the steady demand for the vision sensor used in robot guidance, inspection, bin picking, and quality assurance across the automotive machinery and electronics manufacturing. Even with the short term fluctuations in robot deployments, Germany manufacturers continue to prioritize productivity, flexibility, and defect reduction, driving the integration of smart and embedded vision sensors into production lines. The scale and maturity of Germany’s automation ecosystems ensure the ongoing replacement, upgrade, and retrofit demand, positioning the country as a core market for advanced vision sensor solutions.

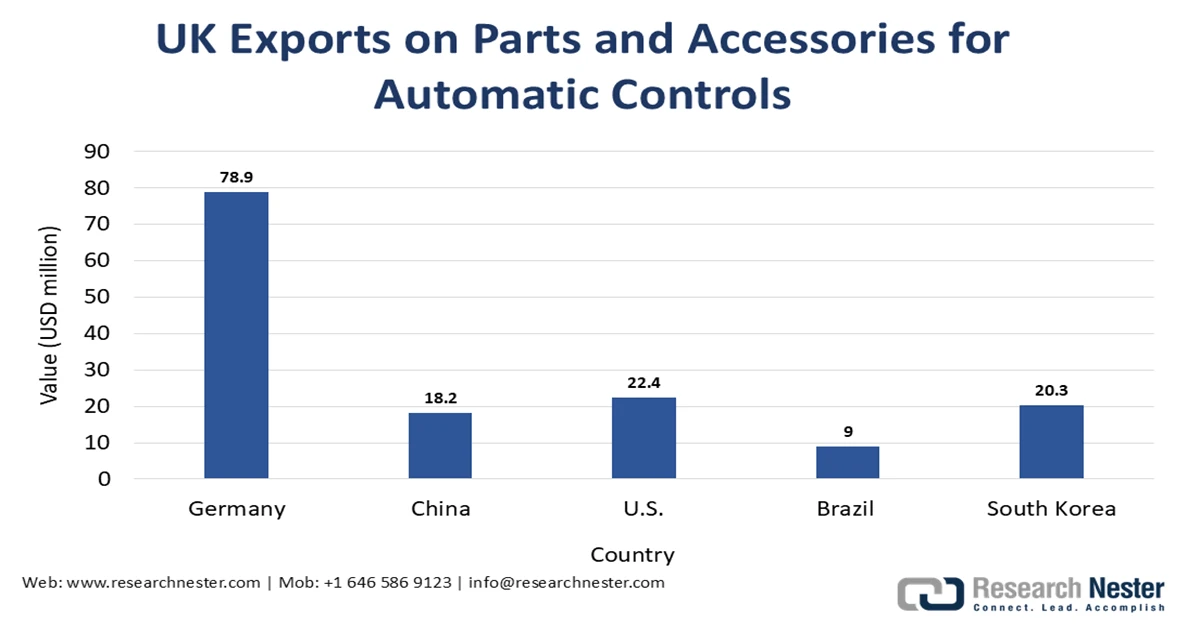

Source: OEC 2023

The UK vision sensor market is supported by the sustained demand for automated control systems across manufacturing, logistics, and process industries, where vision sensors function as critical feedback and inspection components. The OEC 2023 report covering parts of accessories for automated regulating or controlling instruments, including the vision sensor modules, indicates that the UK exported USD 280 million of these in 2023. As UK manufacturers continue to modernize the production lines to improve efficiency, traceability, and quality compliance, demand for the compact and integrated vision sensors remains steady. This trend is reinforced by the automation investments in food processing, pharmaceuticals, and advanced manufacturing. The UK’s emphasis on productivity improvement and industrial digitalization supports ongoing imports and upgrades of vision-enabled control systems, positioning the country as a consistent though mature vision sensor market within the broader vision sensor landscape.

Key Vision Sensor Market Players:

- Cognex Corporation (U.S.)

- Keyence Corporation (Japan)

- Omron Corporation (Japan)

- Sick AG (Germany)

- Basler AG (Germany)

- Teledyne Technologies (U.S.)

- National Instruments (U.S.)

- Balluff GmbH (Germany)

- Datalogic S.p.A. (Italy)

- IDS Imaging Development Systems GmbH (Germany)

- Toshiba Teli Corporation (Japan)

- Panasonic Corporation (Japan)

- FLIR Systems (U.S.)

- Sony Corporation (Japan)

- Intel Corporation (U.S.)

- Samsung Electro-Mechanics (South Korea)

- Qualcomm (U.S.)

- ifm electronic (Germany)

- JAI A/S (Denmark)

- ESPROS Photonics AG (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cognex Corporation is a global leader in the vision sensor market, renowned for its comprehensive machine vision systems. The company has driven significant advancements by integrating advanced vision sensors with its proprietary machine learning software, PatMax. This strategic fusion enables unparalleled accuracy in complex industrial tasks such as robotic guidance and assembly verification, solidifying its dominance in high-precision manufacturing and logistics automation.

- Keyence Corporation is a dominant player in the vision sensor market, distinguished by its use centric all in one sensor solutions. The company has revolutionized accessibility by integrating high-performance vision sensors with intuitive built-in software and displays. This strategic initiative eliminates the need for separate processors and extensive programming, allowing a vast range of manufacturers to deploy reliable inspection and measurement systems rapidly, thereby expanding the market’s reach. In 2024, the company made a net sales of ¥967,288, based on the annual report.

- Omron Corporation is a key innovator in the vision sensor market, leveraging its deep expertise in industrial automation. The company has made significant advancements by seamlessly embedding its vision sensors into integrated IoT and robotic platforms such as its Sysmac ecosystem. This strategic approach ensures that vision data is a core component of the production control loop, enabling predictive maintenance and highly adaptive manufacturing lines for the smart factory. According to the 2024 annual report, the company’s operating income reached JPY 49.0 billion.

- SICK AG is a major player in the vision sensor market, specializing in sensor intelligence for factory and logistics automation. The company has advanced the market by developing robust vision sensors designed for harsh industrial environments. Its strategic focus on combining vision data with safety technology and LiDAR enables comprehensive solutions for tasks like code reading, collision avoidance, and volume measurement, critical for Industry 4.0 and automated material handling.

- Basler AG is a pivotal component provider in the vision sensor market, primarily as a leading manufacturer of high-quality industrial cameras and lenses. The company’s strategic advancement lies in offering a versatile modular portfolio that serves as the critical imaging foundation for system integrators and OEMs. By ensuring reliable high-speed image capture, Basler enables the development of advanced vision sensor applications across diverse sectors from medicine to mobility

Here is a list of key players operating in the global vision sensor market:

The global vision sensor market is highly competitive and is dominated by the established automation and industrial giants from the U.S., Europe, and Japan, which use deep expertise in machine vision and robotics. The key strategies include continuous investment in AI-driven smart sensors, 3D vision technology, and integrated software solutions to enhance the precision and ease of use. To expand reach, players are actively forming strategic partnerships, acquiring niche innovators, and strengthening distribution networks, mainly in high-growth Asia markets. For example, in September 2025, Baumer announced the acquisition of X-Sensors AG, an expert in force sensor technology. Price competition is intense, pushing the vendors to diversify offerings into cost-sensitive sectors while maintaining technological leadership in automotive electronics and logistics.

Corporate Landscape of the Vision Sensor Market:

Recent Developments

- In January 2026, Ambarella, an edge AI semiconductor company has announced the launch of the Powerful Edge AI 8K Vision SoC with industry-leading AI and multi-sensor perception performance.

- In November 2025, Nikon Corporation launched a new model of the robot vision system, which specializes in 2D vision tracking, enabling high-speed, flexible movement of robotic arms. By adopting Nikon's ultra-compact machine vision camera, the robot arm achieves a significant reduction in weight and size.

- In September 2025, OMNIVISION launched the new OV50R CMOS image sensor that features ultra-high dynamic range (HDR) of up to 110 decibels (dB) for video and preview with single exposure, excellent low-light performance, fast autofocus and high frame rates.

- Report ID: 3163

- Published Date: Jan 27, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vision Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.