Virtual Reality in Gaming Market Outlook:

Virtual Reality in Gaming Market size was over USD 36.08 Billion in 2025 and is poised to exceed USD 232.88 Billion by 2035, growing at over 20.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of virtual reality in gaming is estimated at USD 42.74 Billion.

The growth of the market can primarily be attributed to the growing number of gamers worldwide. For instance, there were more than 2.5 billion gamers in the world in 2020.

VR gaming is used to describe a new generation of computer games with virtual reality (VR) technology that gives players a truly immersive, first-person perspective of game action. Participants both experience and influence the game environment through a variety of VR gaming devices and accessories, including VR headsets, sensor-equipped gloves, hand controllers, and more. At its simplest, a VR game might involve a 3-D image that can be explored interactively on a computing device by manipulating keys, mouse or touchscreen. With the recent advancements in gaming devices as well as VR systems the demand for VR systems is on the rise amongst the gamers, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global virtual reality in gaming market during the forecast period. It is estimated that around 29% gamers in the United States owned a VR system in 2020.

Key Virtual Reality in Gaming Market Insights Summary:

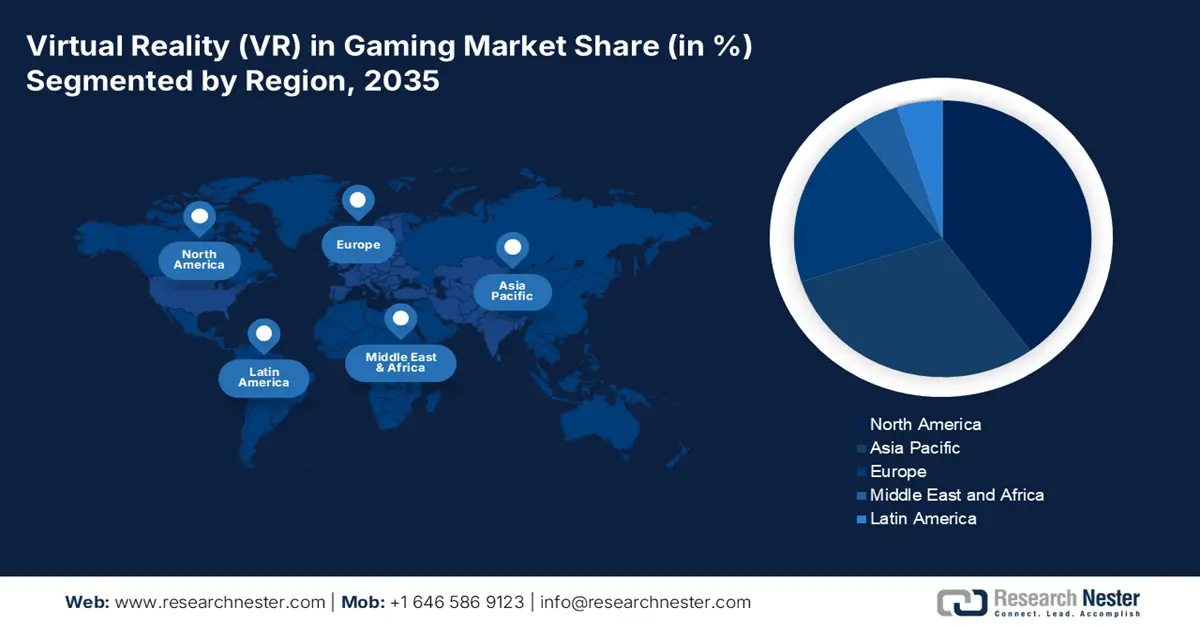

Regional Highlights:

- The Asia Pacific virtual reality (VR) in gaming market holds the largest share by 2035, driven by increasing game revenue and the largest gamers population in the region.

Segment Insights:

- The console/pc segment in the virtual reality in gaming market is projected to achieve the largest share by 2035, fueled by rising VR gaming adoption and preference for console-based gameplay.

Key Growth Trends:

- Upsurge in the Demand for VR Headsets

- Growing Use of Virtual Reality (VR)

Major Challenges:

- Creation of VR Games and Devices is Expensive and Labor-intensive

- Available VR Devices are Incompetent in Providing Full-fledged Experiences

Key Players: HTC Corporation, Nintendo Co., Ltd., Google Inc., Samsung Electronics Co. Ltd., Fove Inc., Sony Interactive Entertainment LLC, Razer Inc., Microsoft Corporation, Sega Corporation, Electronic Arts Inc., VR World Limited.

Global Virtual Reality in Gaming Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.08 Billion

- 2026 Market Size: USD 42.74 Billion

- Projected Market Size: USD 232.88 Billion by 2035

- Growth Forecasts: 20.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Singapore, India

Last updated on : 9 September, 2025

Virtual Reality in Gaming Market Growth Drivers and Challenges:

Growth Drivers

- Upsurge in the Demand for VR Headsets –VR headsets is the only thing needed for playing VR games. The surge in the demand for VR headsets is expected to drive the demand for virtual reality in gaming. For instance, it is forecasted that the global annual unit sales of VR headsets in 2022 to reach more than 8 million units.

- Growing Use of Virtual Reality (VR)– According to reports, in 2021, it was observed that over 58 million people in United States had used VR at least once in a month.

- Rising Number of Mobile Game Players – As per the statistics, in 2020, 43% of all the time spent on smartphones went to gaming and there were over 2.5 billion people are mobile game players.

- Surge in the VR Game Spending – VR game spending accounted for 0.4 % of the total revenue generated by gaming hardware and software developers in 2020.

- Increasing Number of Female Gamers – According to reports, in the United States, female to male ratio of hyper-casual players was estimated to be 55% to 45%, while 43% female owing VR devices in 2021.

Challenges

- Creation of VR Games and Devices is Expensive and Labor-intensive

- Available VR Devices are Incompetent in Providing Full-fledged Experiences

- VR Devices are Expensive for Modern Users

Virtual Reality in Gaming Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.5% |

|

Base Year Market Size (2025) |

USD 36.08 Billion |

|

Forecast Year Market Size (2035) |

USD 232.88 Billion |

|

Regional Scope |

|

Virtual Reality in Gaming Market Segmentation:

Device Segment Analysis

The global virtual reality in gaming market is segmented and analyzed for demand and supply by devices segment into console/PC, mobile, and standalone. Amongst these segments, the console/PC segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing number of gamers playing VR games along with the surge in the players using console/PC for gaming worldwide. For instance, more than 70% of gamers in the United States who played video games were owning a console in 2020.

Major Macro-Economic Indicators Impacting the Market Growth

The never-ending growth in internet accessibility around the world along with numerous technological advancements comprising 5G, blockchain, cloud services, Internet of Things (IoT), and Artificial Intelligence (AI) among others have significantly boosted the economic growth in the last two decades. As of April 2021, there were more than 4.5 billion users that were actively using the internet globally. Moreover, the growth in ICT sector has significantly contributed towards GDP growth, labor productivity, and R&D spending among other transformations of economies in different nations of the globe. Furthermore, the production of goods and services in the ICT sector is also contributing to the economic growth and development. As per the statistics in the United Nations Conference on Trade and Development’s database, the ICT good exports (% of total good exports) globally grew from 10.816 in 2015 to 11.536 in 2019. In 2019, these exports in Hong Kong SAR, China amounted to 56.65%, 25.23% in East Asia & Pacific, 26.50% in China, 25.77% in Korea, Rep., 8.74% in the United States, and 35.01% in Vietnam. These are some of the important factors that are boosting the growth of the market.

Our in-depth analysis of the global market includes the following segments:

|

By Device |

|

|

By Component |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Reality in Gaming Market Regional Analysis:

Regionally, the global virtual reality in gaming market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in Asia Pacific is projected to hold the largest market share by the end of 2035, backed by the increasing game revenue in the region, along with largest gamers population. For instance, there were approximately 1.5 billion gamers in the Asia Pacific region with China having over 665 million gamers in 2020, the biggest number of gamers in the region and the world.

Virtual Reality in Gaming Market Players:

- HTC Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nintendo Co., Ltd.

- Google Inc.

- Samsung Electronics Co. Ltd.

- Fove Inc.

- Sony Interactive Entertainment LLC

- Razer Inc.

- Microsoft Corporation

- Sega Corporation

- Electronic Arts Inc.

- VR World Limited

Recent Developments

-

HTC Corporation - HTC VIVE has announced that its VIVE Pro Eye will be available for sale in North America on vive.com and at select retail stores. The VIVE Pro Eye, features the latest in eye tracking technology and sets a new standard for enterprise VR. VIVE Pro Eye will be used by various industries for numerous benefits including gaming, and simulation, among others.

-

Nintendo Co., Ltd., - NintendoLife has launched its latest creation, a Labo VR interpretation of the stellar mechanics and movement of first-person shooter DOOM Eternal. It is a charming toolset that will enable Switch owners to create their own rudimentary games using easy-to-learn node-based tools that originally debuted as part of the Nintendo Labo series.

- Report ID: 4405

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Reality in Gaming Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.