Gaming PC Market Outlook:

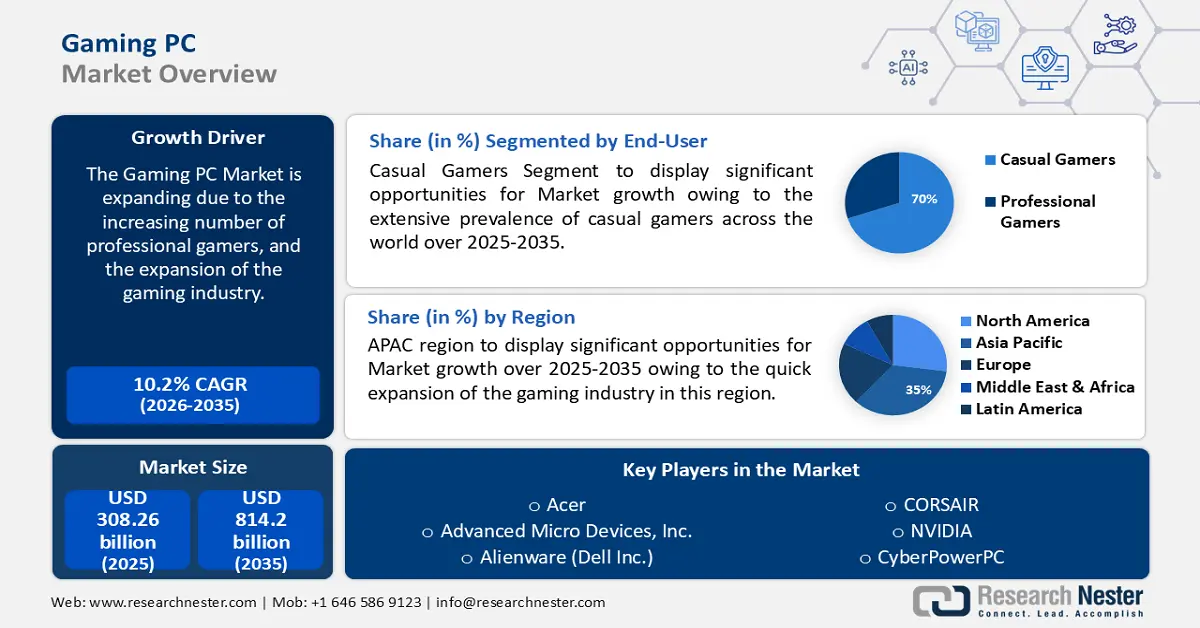

Gaming PC Market size was valued at USD 65.52 billion in 2025 and is likely to cross USD 194.59 billion by 2035, registering more than 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gaming PC is assessed at USD 72.3 billion.

The expansion of the gaming sector globally will exponentially help the gaming PC market to grow. As described by the International Trade Association, sales have increased as a result of the epidemic; in the United States, consumer spending on video games and subscription services has increased by a record 31%. The income generated by mobile gaming increased by 13.3% in 2020 to USD 77.2 billion.

Key Gaming PC Market Insights Summary:

Regional Highlights:

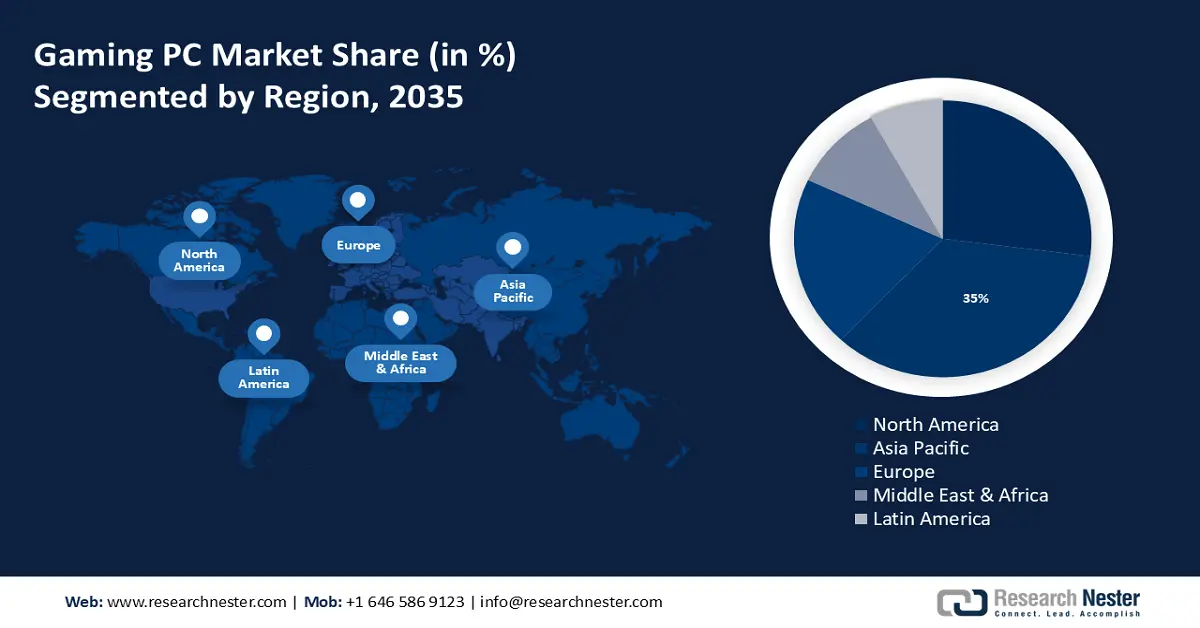

- Asia Pacific gaming pc market will hold more than 35% share by 2035, fueled by rapid growth in the gaming industry and high average gaming hours.

- North America market will achieve a 25% share by 2035, driven by adoption of next-gen computing and global expansion strategies.

Segment Insights:

- The casual gamers segment in the gaming pc market is projected to see significant growth till 2035, driven by the global prevalence and growth of casual gamers.

- The high-end & extreme high-end price range segment in the gaming pc market is expected to capture a 55% share by 2035, driven by increasing demand for top-tier gaming hardware.

Key Growth Trends:

- Radical increase in the number of gamers globally

- Recent advancement in the internet infrastructure

Major Challenges:

- Casual gamers interested in mobile and tablets

- Rising competition on the appeal of gaming PCs

Key Players: Acer Inc., Advanced Micro Devices, Inc., Alienware (Dell Inc.), CORSAIR, NVIDIA, CyberPowerPC, Lenovo Group Ltd., Razer Inc., Digital Storm, Micro-Star International (MSI), DeNA, Sega Corporation, Gumi, SQUARE ENIX.

Global Gaming PC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 65.52 billion

- 2026 Market Size: USD 72.3 billion

- Projected Market Size: USD 194.59 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 17 September, 2025

Gaming PC Market Growth Drivers and Challenges:

Growth Drivers

- Radical increase in the number of gamers globally - Every year, more people play video games because more people of all ages and genders are discovering titles they like, and the industry itself is expanding and becoming more valuable. 3.11 billion people play video games worldwide, and the number is growing yearly, according to current data.

A new content ecosystem has also emerged, mostly driven by live streams, esports competitors, and game content providers. Fantasy sports and real-money gambling continue to lead the way in terms of income generation. To put it mildly, 2022 was an incredible year for the gaming sector and will further raise its business in the coming future. - Recent advancement in the internet infrastructure - High-speed internet connectivity and the presence of the Internet of Things (IoTs) is one of the numerous motivating reasons that have been propelling the expansion of esports as well as gaming PCs. In line with Word Bank research, over the past 20 years, there has been a 1,000-fold growth in global data traffic.

Digital data may theoretically circle the world five times in a second as it travels thousands of kilometers at the amazing speed of 200,000 km/s over this seamless global data infrastructure supply chain. Thus, the need for data infrastructure is rising at an exponential rate due to the data explosion.

The whole gaming experience has been affected by having access to broadband and 3G/4G spectrum for high-speed Internet connections. In the past, lags occurred during gameplay when using a regular internet connection because it was insufficient. - Increasing demand in female gamers for games on PC - The gaming PC market survey predicts that 37% of gamers in Asia are female and that the percentage of female gamers is expanding at a rate of 11% per year, which is nearly twice as fast as that of male gamers.

Apart from this, 53% of gamers in Southeast Asia are female, with the Philippines having the highest number at 63%. Robust increases throughout Asia and the MENA area are still observed, despite the less balanced economies in South Asia, China, and MENA.

Challenges

- Casual gamers interested in mobile and tablets - Because smartphones and tablets are so accessible, the customer base for mobile gaming is far wider and more varied. The industry has grown significantly as a result of the ease of mobile gaming and the rising power of mobile devices. Advertisements for mobile games can be found on TV, billboards, digital platforms, newspapers, magazines, and even transit media.

- Rising competition on the appeal of gaming PCs - Recently, the appeal of having a gaming PC has increased dramatically, escaping the confines of specialized markets and permeating popular culture. However, building a computer from scratch seems like a daunting endeavor to many.

Gaming PC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 65.52 billion |

|

Forecast Year Market Size (2035) |

USD 194.59 billion |

|

Regional Scope |

|

Gaming PC Market Segmentation:

Product Segment Analysis

Desktop segment is estimated to dominate gaming PC market share of over 50% by 2035 because of their high demand driven by the extensive use and export of desktops for gaming. With USD 357 billion in overall commerce, computers ranked as the tenth most traded product worldwide in 2022. Computer exports increased by 0.084% from USD 357 billion to USD 357 billion in 2022. Computer commerce makes up 1.51% of global trade.

Additionally, desktop processors have more cores and run at higher rates than their laptop counterparts because of improved thermal conditions, and PC memory is frequently quicker.

Price Range Segment Analysis

In gaming PC market, high-end & extreme high-end-range segment is poised to hold revenue share of more than 55% by 2035 due to the increasing prevalence of this price range to have a perfect gaming PC for the long run. As found in the research of the International Trade Association, the gaming industry will benefit greatly from the release of next-generation consoles in terms of both software and hardware which will be priced in high-end & extremely high-end ranges.

One benefit of newer motherboards is that they support the newest, most advanced standards and technology, although they are categorized in the high-end and extremely high-end price range. For instance, some Intel 600-Series Chipsets feature strong next-generation components including integrated Intel KillerTM Wi-Fi 6E, PCIe 5.0 GPUs and SSDs, and DDR5 RAM but they are expensive.

End-User Segment Analysis

By 2035, casual gamers segment is estimated to account for gaming PC market share of around 70% on account of the extensive prevalence of casual gamers across the world.

In 2023, there were 3.38 billion gamers globally, an increase of 6% annually. Global player count is still rising due to player growth in developing nations. Moreover, the number of payers has grown by 7% and reached 1.47 billion by 2023, since local payment methods are crucial to enabling the market's potential growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Price Range |

|

|

Distribution Channel |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gaming PC Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 35% by 2035. The region will grow at a gain of 11.7% and it will get a revenue size of 37.5 Billion. This progress will be noticed on account of the quick expansion of the gaming industry in this region. According to our research, gamers in Asian markets report playing the most hours on average each week. With 11.3 hours, China tops the leaderboard and is more than two hours ahead of the world average of 8.9. The average amount of gaming hours in other APAC markets is higher than or equal to the worldwide average: Singapore (9.8 hours), Hong Kong (9.7 hours), Australia (9.3 hours), and Indonesia (8.7 hours).

The current partnerships of giant companies to modify the cloud operation will increase the market advancement of gaming PCs in China. To illustrate, Huawei and Changhong IT said on March 2, 2020, that they had achieved the goal of working together as the general distributor in China. The two parties have signed the contract online thanks to the cooperation of the Huawei cloud WeLink platform and CloudLink Board.

Increasing supplies of gaming PCs in Japan by famous companies will drive the market in this region. For instance, Haier Japan provides supplies in southern Kumamoto-ken in Kyushu, Japan.

Korea will encounter a huge growth again because of the rising interest of people in online gaming. 71% of people in South Korea played video games in 2021, indicating a high level of gamer penetration there. This indicates that there are more than 35 million gamers in South Korea.

North American Market Insights

By the end of 2035, North American region gaming PC market is poised to account for more than 25% revenue share and will hold the second position driven by the increasing use of next-generation computing in gaming PCs and the growing adoption of new strategies in the gaming industry of North America across the world. Moreover, according to the International Trade Association, to increase sales, 80% of North American gaming businesses are going overseas. Due to job growth and the need to replace individuals who leave the sector permanently, an average of 377,500 vacancies per year are expected for these occupations.

The U.S. will have a superior expansion during the forecast time period because of the presence of some prominent companies of gaming PCs. Recently, NVIDIA unveiled its next-generation cloud gaming platform, GeForce NOWTM, which offered GeForce RTXTM 3080-class gaming and is only accessible through a new, high-performance membership tier. With the lowest latency, the highest resolutions, and the quickest frame rates for cloud gaming, the GeForce NOW RTX 3080 subscription tier gave gamers access to the biggest generational jump in GeForce history.

The gaming PC industry in the Canadian region will rise immensely because of the rising technology in the gaming industry in this region. 70% of Canadian gamers say they prefer to play games online, a statistic that highlights the nation's move to a digital economy in terms of entertainment consumption and enjoyment.

Gaming PC Market Players:

- Acer Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advanced Micro Devices, Inc.

- Alienware (Dell Inc.)

- CORSAIR

- NVIDIA Corporation

- CyberPowerPC

- Lenovo Group Ltd.

- Razer Inc.

- Digital Storm

- Micro-Star International (MSI)

Most businesses are concentrating on recent technologies and many companies are making partnership to develop innovative gaming PCs. Most of the famous companies are mentioned below:

Recent Developments

- Acer Inc. declared the newest addition to its schedule of influential gaming desktops, the Predator Orion X. The compressed gaming PC packs an enormous punch as it blends up to the special edition 13th Gen Intel Core i9-13900KS processor and equal to a liquid-cooled NVIDIA GeForce RTX 4090 GPU, custom-engineered to appropriate all this power in a small, portable chassis.

- Acer Inc. declared the fresh Acer Swift X 16 (SFX16-61G), planned to bring out one’s inventiveness through a suite of execution-packed components for graphic planning, 3D rendering, and video editing.

- Report ID: 6035

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gaming PC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.