Vibrator Mesh Nebulizer Market Outlook:

Vibrator Mesh Nebulizer Market size was valued at USD 2.13 billion in 2025 and is projected to reach USD 9.1 billion by the end of 2035, rising at a CAGR of 17.2% during the forecast period (2026-2035). In 2026, the industry size of vibrator mesh nebulizer is assessed at USD 3 billion.

The patient pool of the vibrator mesh nebulizer market is increasing, highly attributed to the rise in the occurrence of chronic respiratory disorders. As per an article published by the World Health Organization (WHO) in 2024, with 3.5 million fatalities from chronic obstructive pulmonary disease (COPD) in 2021, roughly 5% of all deaths globally, COPD is the fourth most common cause of mortality worldwide.

Almost 90% of deaths from COPD in those under 70 years old happen in low- and middle-income (LMIC) nations. These projections are further indicated to increase owing to a surge in the aging population, along with environmental factors, including air pollution. Besides, administrative health and medical programs are effectively increasing in developed countries, resulting in respiratory therapy accessibility, which is further driving the overall market growth globally. Furthermore, the vibrator mesh nebulizer market development is attributed to the supply chain aspect that includes different stages, such as assembly, medical device manufacturing, and active pharmaceutical ingredient (API) procurement.

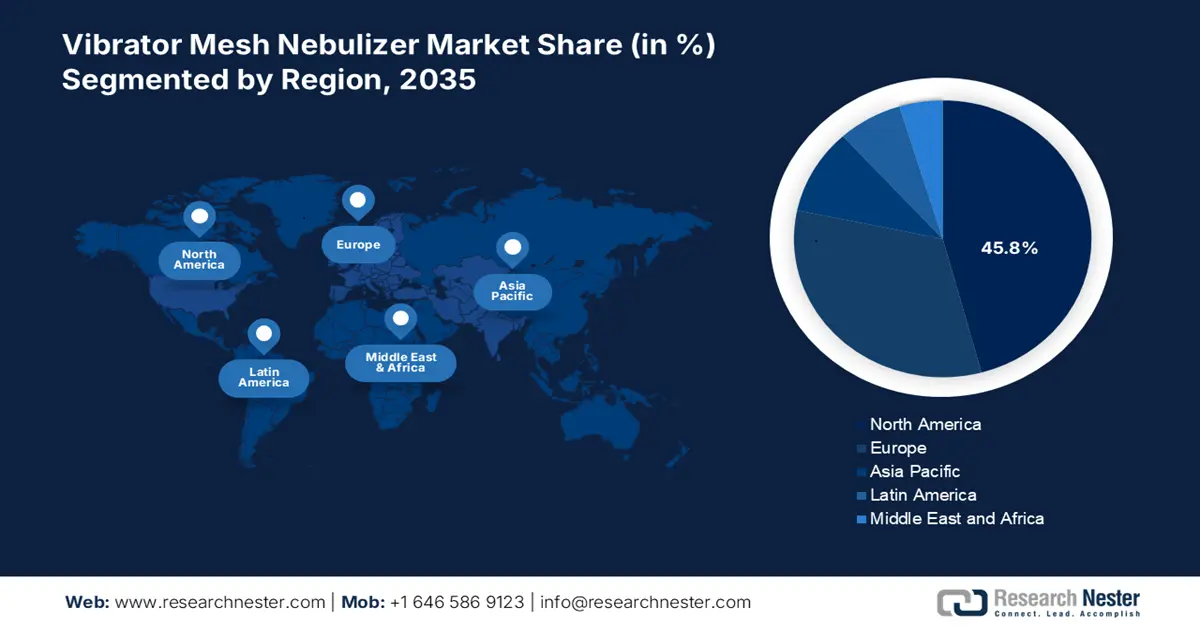

In terms of geography, North America continues to be the leading region in the vibrator mesh nebulizer market because of its good healthcare infrastructure and coverage through universal insurance. The Asia-Pacific region is identified as the fastest-growing area, with more healthcare investment, a growing middle class. Europe continues to grow steadily with universal access and regulations through the Medical Device Regulation (MDR) resources. Dominating entities in the vibrator mesh nebulizer market include Philips Respironics, PARI GmbH, OMRON Healthcare, Aerogen, and Yuwell. These companies are investing in R&D to develop smaller, smarter, and more devices that are efficient. Other trends in terms of strategy are combinations with drug/devices, smart connections for devices, and disposable nebulizer pods for clinics.

Key Vibrator Mesh Nebulizer Market Insights Summary:

Regional Highlights:

- By 2035, North America is set to capture a 45.8% share of the vibrator mesh nebulizer market, underpinned by the presence of medicaid and medicare coverage acceleration, as well as a surge in asthma and COPD occurrence.

- By 2035, Europe is anticipated to secure a 32.5% share of the market, sustained by a surge in the elderly population.

Segment Insights:

- By 2035, the active mesh nebulizers segment is projected to command a 68.5% share of the vibrator mesh nebulizer market, propelled by unparalleled drug delivery efficiency, along with precision in dosing capabilities.

- By 2035, the portable nebulizers segment is expected to hold a 61.2% share, supported by the escalated need for home-specific treatment models, along with a rise in the need for on-the-go and convenient respiratory care models.

Key Growth Trends:

- Reimbursement policies and medical expenditure

- Improvement in cost saving and medical quality

Major Challenges:

- Resistance to innovation

- High cost of devices and limited affordability

Key Players: Philips Respironics, PARI GmbH, Vectura Group, GE Healthcare, Medtronic, DeVilbiss Healthcare, Becton Dickinson (BD), Agilent Technologies, Rossmax International, Boehringer Ingelheim, Cipla, Lupin, GSK (GlaxoSmithKline), Aerogen, Löwenstein Medical.

Global Vibrator Mesh Nebulizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.13 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 9.1 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Mexico

Last updated on : 29 August, 2025

Vibrator Mesh Nebulizer Market - Growth Drivers and Challenges

Growth Drivers

- Reimbursement policies and medical expenditure: The presence of government healthcare programs such as Medicaid and Medicare is effectively influencing the vibrator mesh nebulizer market demand by ensuring respiratory treatment coverage for rare disorders. Besides, the accelerated approvals by the FDA have also increased the reimbursement eligibility criteria for innovative nebulizers, thereby driving the vibrator mesh nebulizer market penetration. Reimbursement policies decrease the out-of-pocket costs for patients. Because vibrating mesh nebulizers cost more to purchase than regular nebulizers, when insurance will reimburse a patient for a vibrating nebulizer, they are more likely to choose this device. This leads to higher adoption given chronic care patients, who require long-term respiratory therapies.

- Improvement in cost saving and medical quality: The vibrator mesh nebulizer market has initiated improved clinical results by effectively delivering drugs while maintaining the quality and affordability. Besides, hospitals usually prioritize value-specific care services that are increasingly implemented for mesh nebulizers. In medical quality terms, these nebulizers rank as a higher-end product because they are quiet, portable, and can accurately deliver medication. Nebulizer function and adherence are particularly useful in chronic respiratory conditions such as asthma and COPD, where it is important to develop a routine and deliver effective treatment. The fact that vibrating mesh nebulizers and inhalers are easy to use at home facilitates the current trend towards a value-based or home-based practice of healthcare, which can help mitigate the use of hospitals and clinics.

- Technological advancements and product innovation: Advancements in nebulizer technology have led to vibrating mesh nebulizers that are more portable, quieter, and user-friendly than previous generations, greatly improving patient experience. Incorporation of numerous smart features, such as Bluetooth connectivity for app-based tracking and dose monitoring, has made them attractive to both tech-savvy users and health care providers looking to enhance compliance. These devices also accommodate a wider array of medications, need less power and battery life. Continuous innovation in mesh materials and battery life serves to increase device usability and performance. This ongoing improvement will likely result in mesh nebulizers being the device of choice for both developed and developing health systems.

Challenges

- Resistance to innovation: The reimbursement system, at times, lags behind technological innovation, which causes a restraint on the vibrator mesh nebulizer market internationally. For instance, in 2024, Medicare decided to eliminate artificial intelligence-driven nebulizers from coverage policy. Likewise, vibrating mesh nebulizers need either diligent cleaning or careful handling in order to perform optimally. This may potentially be a barrier for some groups of users, such as older patients or young children.

- High cost of devices and limited affordability: Heavy upfront costs compared to traditional jet or ultrasonic nebulizers are one of the primary hindrances to the adoption of vibrating mesh nebulizers. The technology is more advanced and therefore costs more to produce and prices to the consumer. This presents challenges for low- and middle-income communities where cost-sensitive care decisions dominate. In high-income countries, limited budgets for hospitals and clinics may make volts purchases supplies unlikely in bulk. With inconsistent reimbursement policies for nebulizers, many patients will typically select cheaper alternatives to mesh nebulizers regardless of its better performance profile.

Vibrator Mesh Nebulizer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 2.13 billion |

|

Forecast Year Market Size (2035) |

USD 9.1 billion |

|

Regional Scope |

|

Vibrator Mesh Nebulizer Market Segmentation:

Technology Segment Analysis

Based on technology, the active mesh nebulizers segment is projected to hold the largest share of 68.5% in the vibrator mesh nebulizer market by the end of 2035. The segment’s upliftment is denoted by the aspect of unparalleled drug delivery efficiency, along with precision in dosing capabilities. These devices make use of electrified vibrated micro-mesh plates to produce ultra-fine aerosols, further making them suitable for ICU and biologic drugs applications. Besides, the majority of ICUs in the U.S. prefer active nebulizers for providing critical respiratory care support, thereby suitable for the overall market development internationally.

Product Type Segment Analysis

Based on product type, the portable nebulizers segment is poised to hold a considerable share of 61.2% in the vibrator mesh nebulizer market by the end of the forecast period. This growth is fueled by the escalated need for home-specific treatment models, along with a rise in the need for on-the-go and convenient respiratory care models. Besides, these are compact devices that deliberately leverage progressive battery technology as well as lightweight designs to ensure that active patients can effectively manage conditions such as asthma and COPD without making any form of interruption in daily routines, thus suitable for market development.

Application Segment Analysis

Chronic Obstructive Pulmonary Disease (COPD) accounted for the largest segment within the vibrator mesh nebulizer market because COPD is chronic and highly prevalent around the world. In addition, nebulizers are highlighted for their clinical benefits in the management of COPD. Inhalation therapies that use vibrating mesh nebulizers are ideal for patients with COPD because vibrating mesh nebulizers deliver a consistent, fine-particle aerosol containing the associated medication. This accuracy is especially important for patients with COPD during an acute exacerbation because rapid and effective drug delivery can prevent hospitalization.

Our in-depth analysis of the vibrator mesh nebulizer market includes the following segments:

|

Segments |

Subsegments |

|

Technology |

|

|

Product Type |

|

|

End User |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vibrator Mesh Nebulizer Market - Regional Analysis

North America Market Insights

North America in the vibrator mesh nebulizer market is projected to account for the highest share of 45.8% by the end of the forecast timeline. This regional growth is effectively driven by the presence of Medicaid and Medicare coverage acceleration, as well as a surge in asthma and COPD occurrence. According to the American Lung Association, asthma prevalence among adults in 2023 varied from 7.1% in Mississippi to 14.1% in Puerto Rico. The healthcare systems in the U.S. and Canada allow patients to access advanced treatment options, such as vibrating mesh nebulizers. In fact, favorable insurance reimbursement policies significantly reduce costs to patients and make things more affordable and accessible for them. North America also has a good level of awareness of lung disease management among patients and caregivers, and a strong presence of major players and manufacturers of nebulizers. In addition, the region has an identity of home care and portable medical devices, which supports the overall use of vibrating mesh nebulizers in the market.

The growth of the vibrator mesh nebulizer market in the U.S. has been supported by the adoption of telehealth and artificial intelligence-based devices on the rehabilitation continuum, due in part to advanced healthcare infrastructure, wider insurance coverage, and a large cohort of the population suffering from chronic respiratory diseases like COPD and asthma. This also includes rapidly increasing awareness of respiratory health, government support for home healthcare, and highly accepted innovative medical devices among patients and healthcare professionals alike. The presence of major manufacturers in the medical device sector, as well as sustained investment in R&D funds to advance provision and application of vibrating mesh nebulizers across multiple domains supports growth. Therefore, these factors represent just some of the issues leading to innovation 'hubs' better access to vibrating mesh nebulizers. Additionally, this added awareness about respiratory health, government oversight for home healthcare, and acceptance and adoption of innovative medical devices in general have the potential to drive demand for ventilators and nebulizers, vibrating mesh in particular.

The growth in the Canada vibrating mesh nebulizers market is consistently on the rise, with a growth rate of 8.3%, primarily driven by medical and healthcare funding initiatives from provinces. Furthermore, the growth is attributed to having a universal health care system to support funding sources. This is important as Canada has an aging population and an increasing number of people with respiratory issues, leading to increased need and usage. Canada focuses on home care models that prefer portable nebulizers of sufficient efficacy that are sometimes supported through government programs that can assist with the cost. Additionally, the presence of major companies in the medical device industry in Canada allows for better access and continued investment in R&D attains additional applications and experiences with vibrating mesh nebulizers.

Europe Market Insights

Europe in the vibrator mesh nebulizer market is projected to hold a share of 32.5% by the end of the forecast period. The region’s growth is highly fueled by a surge in the elderly population. Moreover, other key trends such as telemedicine integration, along with an expansion in homecare facilities, are also expected to boost the vibrator mesh nebulizer market development in the region. Also, the adoption of strict regulatory regimes guarantees patient access to safe and effective devices and fosters innovation and uptake. The region's emphasis on home-based healthcare and patient-centered treatment complements the portability and usability of vibrating mesh nebulizers. In addition, the significant investments from prominent manufacturers and increasing knowledge and awareness by healthcare professionals and patients support Europe’s strong market.

Germany is positioned intentionally ahead of the rest of the region when it comes to the vibrating mesh nebulizer market, showcasing an impressive 33% share of the revenue due to their incredible healthcare infrastructure and the prevalence of chronic respiratory diseases including: COPD and asthma. Furthermore, patients generally enjoy a universal healthcare system, meaning they can receive sophisticated medical devices without financial burden. Additionally, and not surprisingly, Germany is a leader in financing for medical research and innovation, and provides support and funding for more innovative therapies for respiratory diseases. Meanwhile, the elderly population (65 + years of age) is increasing in size and the portable, easier-to-use nebulizers are an emerging market that enhance compliance and may improve patient quality of life. In summary, each of these scenarios described offers the potential for growth of vibrating mesh nebulizer product utilization in the German market.

The UK vibrating mesh nebulizer market is projected to account for 28.7% of total regional revenue by the end of 2035 due to the National Health Service (NHS) and breadth of coverage. Respiratory disease has seen an upward trend in the UK, partly driven by an aging population along with increased environmental factors, subsequently increasing demands for innovative and more efficient delivery devices. The UK government has recently encouraged home care and the improving patient adherence aligned with the advances of benefits attached to vibrating mesh nebulizer as a form of drug delivery. Increased education amongst health care providers and patients of advances in nebulization technology gives confidence for future growth of the meshed nebulizer market in the UK.

APAC Market Insights

The vibrating mesh nebulizer market is going to dramatically grow in the Asia-Pacific region due to different drivers in the area. The rapid urbanization and industrialization effects on increased air pollution as well as the growing prevalence of respiratory diseases such as asthma and COPD result in a greater need for inhalational therapies and subsequently a larger patient cohort. The increasing investment in healthcare infrastructures across many Asia-Pacific countries, which ultimately facilitates access to medical devices, including more advanced nebulizers will expand the patient populations using these devices. The increase in disposable incomes for growing middle-class populations and a shift in perceptions of respiratory health will create demand for modern, portable, and improved nebulizers. The expansion of governmental initiatives, and healthcare reimbursement programs to support the better management of chronic diseases will assist in the penetration of the traditional patient populations.

India is expected to capture a sizeable share of the vibrating mesh nebulizer market due to its rapidly growing population and high prevalence of respiratory diseases. India has continued to experience considerable improvements in healthcare access, including increased access to new medical technologies, particularly in urban and semi-urban settings. National healthcare programmes such as Ayushman Bharat have driven individual healthcare coverage and treatment affordability in India. Moreover, growing awareness in respiratory matters, and the uptake of care/health solutions with the individual at home has solidified demand for portable and convenient nebulizers. This growing demand will provide momentum for India to become the largest growth market in the region.

China has a substantial share of the vibrating mesh nebulizer market because of its vast population and a high burden of chronic respiratory disease due to pollution and smoking. China is also making significant investments to build health infrastructure, as well as modernizing the current health system. As such, the availability of high-tech respiratory devices in rural and urban areas is favorable. Coupled with increasing disposable incomes and rising awareness of health issues, patients are turning to more efficient and convenient nebulizer technologies.

Key Vibrator Mesh Nebulizer Market Players:

- Philips Respironics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PARI GmbH

- Vectura Group

- GE Healthcare

- Medtronic

- DeVilbiss Healthcare

- Becton Dickinson (BD)

- Agilent Technologies

- Rossmax International

- Boehringer Ingelheim

- Cipla

- Lupin

- GSK (GlaxoSmithKline)

- Aerogen

- Löwenstein Medical

The international vibrator mesh nebulizer market comprises leading organizations, such as PARI, holding a revenue share of 13%, and Philips, with a share of 25% of the overall market. Both these organizations have implemented strategies behind this that include partnerships with hospitals and the effective integration of IoT. Additionally, in 2024, a collaboration was formed between Philips and the Mayo Clinic to develop artificial intelligence-based nebulizers that have received clearance from the FDA. Besides this, API-based drug combinations, launched by Vectura, successfully captured an estimated 9.5% of the COPD market, thus positively impacting the global market.

Here is a list of key players operating in the global vibrator mesh nebulizer market:

Recent Developments

- In February 2025, Inhalon Biopharma, Inc. announced the development of a first-in-class inhaled antibody platform for treating acute respiratory infections (ARI). The company intends to move its inhaled-antibody therapy into a human challenge study in 2026. The business also said that it has signed a deal to carry out the Phase 2a trial with hVIVO (AIM: HVO), a rapidly expanding specialized contract research company that leads the globe in human challenge trials.

- In October 2024, Liquidia Corporation, a US-based biopharmaceutical company developing innovative therapies, partnered with Taiwan-based Pharmosa Biopharm to announce the creation and marketing of L606, a sustained-release inhaled treprostinil formulation that is presently undergoing clinical trial evaluation for the treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension linked to interstitial lung disease (PH-ILD).

- Report ID: 2913

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vibrator Mesh Nebulizer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.