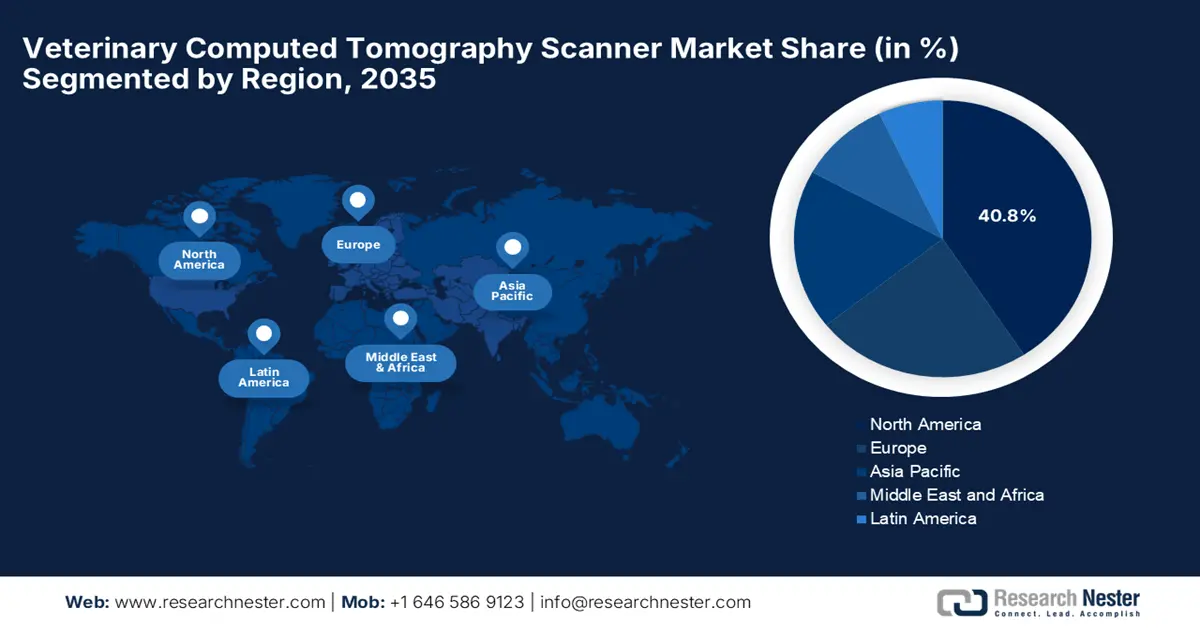

Veterinary Computed Tomography Scanner Market - Regional Analysis

North America Market Insights

North America market is anticipated to account for the largest share of 40.8% by the end of the forecast timeline. Factors such as increased benefits from pet care and cutting-edge healthcare infrastructure are readily driving the market in the region. As evidence, the 2021 HABRI Survey reported a significant majority of pet owners report improved mental and physical health due to pet ownership, with 87% experiencing mental health benefits and 76% noting overall health improvements, wherein veterinarians play a pivotal role, with many pet owners valuing discussions on the human-animal bond and its health impacts.

The market in the U.S. is gaining increased traction due to the infusion of advancements in CT scanner systems, increasing pet care expenditures, and the corporate veterinary chain. In June 2025, WFO reported that in 2023, U.S. citizens spent a total of USD 147 billion on their pets, wherein the number of insured pets in the U.S. rose by 17.1%, showing increased investment in pet health. The report also stated that on average, dog owners spend about USD 912 annually, while cat owners spend around USD 653, denoting a positive market outlook.

The veterinary computed tomography scanner market in Canada is significantly growing due to the increasing investments from the administrative bodies. Testifying this in October 2024, Agriculture and Agri-Food Canada announced a funding commitment of up to USD 13,343,409 over five years to Animal Health Canada through the AgriAssurance Program. Besides the investment, the program supports three key projects aimed at improving disease surveillance, emergency management, and animal care standards across the country’s vast geography.

National Institute of Food and Agriculture Funded Veterinary Training and Workforce Development Projects

|

Project Title |

Recipient Organization |

Project Start Date |

Project End Date |

|

Partnering with communities to enhance rural veterinary experiences in a DVM training program |

LOUISIANA STATE UNIVERSITY |

09/15/2025 |

09/14/2028 |

|

Enhancement of Livestock Veterinary Education and Livestock Extension |

UNIVERSITY OF ALASKA FAIRBANKS |

09/01/2025 |

08/31/2028 |

|

Developing a veterinary workforce to be successful in rural food animal practice |

MISSISSIPPI STATE UNIVERSITY |

08/01/2024 |

07/31/2027 |

|

Texas A&M Agrilife Extension Veterinary Science Certificate Program |

TEXAS A&M AGRILIFE EXTENSION SERVICE |

08/01/2024 |

07/31/2027 |

|

Business Fundamentals for Veterinary Practice Startup and Ownership in Rural Communities |

UNIVERSITY OF MISSOURI SYSTEM |

09/01/2023 |

08/31/2026 |

Source: USDA

APAC Market Insights

Asia Pacific is likely to showcase the fastest growth in the veterinary computed tomography scanner market during the analyzed timeframe. The growth in the region is effectively attributable to the increasing pet ownership and advancements in veterinary care. On the other hand, prominent countries such as Japan, Australia, and South Korea are leading in adopting advanced diagnostic technologies, allowing a steady cash influx in this field. Furthermore, a rising demand for non-invasive imaging techniques is also contributing to the expansion of veterinary imaging services across the region.

China is the prominent player in the market, primarily fueled by a growing pet population and heightened awareness of animal health. Besides, the market is witnessing increased investments in veterinary infrastructure and a shift towards advanced diagnostic tools. In February 2023, ITA reported that in 2021, the country’s 58 million pet cats and 54 million pet dogs benefited from USD 38.5 billion in spending, which is a 20.6% increase from the previous year, hence suitable for standard market growth.

India is gaining enhanced traction in the veterinary computed tomography scanner market on account of rising demand for quality animal healthcare and advancements in veterinary diagnostics. In April 2025, IBEF reported that the country has the third-largest pet population globally, which has 32 million pets and is expected to rise to 51 million by the end of 2028. Besides the U.S., Godrej Pet Care, a subsidiary of Godrej Consumer Products, plans to invest Rs. 500 crore (USD 59 million) over the next five years to capture this emerging opportunity.

Europe Market Insights

Europe in the veterinary computed tomography scanner market is projected to grow at a notable pace during the forecast period. This growth is fueled by components, including robust health and medical facilities, as well as strict animal welfare regulations. Additionally, the region’s progression rate is attributed to the existence of all accredited veterinary hospital centers, along with the dispersion of pet insurance. Other trends, such as artificial intelligence adoption, portable CT implementation, and administrative funding, also positively impact the market development in the region.

The veterinary computed tomography scanner market in Germany is gaining more exposure since it is anticipated to maintain the region’s largest revenue share by the end of 2035, due to the world’s most suitable and standard animal health regulatory strategies. In June 2025, Siemens Healthineers reported that it received the U.S. FDA Clearance for Magnetom Flow.Ace, which is the first helium-free 1.5 T MRI scanner for human and veterinary use and reduces helium dependency and eliminates the need for a quench pipe.

There is a huge growth opportunity for the market in the UK since it accounts for most of the region’s veterinary CT scanner requirements, which is attributed to the largest per capita pet insurance coverage policies. For instance, in December 2024, the Royal Veterinary College reported that it launched a large-bore CT scanner, which revolutionizes equine imaging by enabling scans of previously inaccessible body regions in standing, sedated horses. The system allows veterinarians to better diagnose conditions affecting the head, neck, limbs, and joints, improving early detection of diseases.