Veterinary Artificial Reproduction Market Outlook:

Veterinary Artificial Reproduction Market size was over USD 1.67 billion in 2025 and is projected to reach USD 2.77 billion by 2035, witnessing around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of veterinary artificial reproduction is evaluated at USD 1.75 billion.

The market effectively attends to a growing and substantial patient pool internationally. According to the OIE and FAO data reports, the market caters to more than 1.6 billion livestock animals, including sheep, swine, and cattle, and 471 million companion animals, such as cats and dogs, all of which require yearly reproductive interventions. Besides this, the presence of a standard supply chain pathway for medical devices and associated drugs is also consolidated, with almost 80.5% of hormone production hubs in China, Germany, and the U.S. Meanwhile, the consumer price index for artificial insemination services has surged by 4.9%, whereas the producer price index for the overall market has increased by 6.3%.

Furthermore, the market constitutes research, development, and deployment-based investments, which have reached USD 1.3 billion in 2023. In addition, this accounts for 70.5% allocation to portable IVF systems and livestock genomics, which has been led by EU Horizon Europe and USDA grants funding. Besides, the reproductive devices and biologics global trade is highly dominated by the U.S., with an import valuation of USD 290 million, and Germany, with an export valuation of USD 320 million. Meanwhile, China is responsible for initiating a 45% supply of disposed AI/ET equipment. Moreover, the existence of assistance lines for embryo production and frozen semen has been increased, with a 30.7% reduction in the price structure.

Key Veterinary Artificial Reproduction Market Insights Summary:

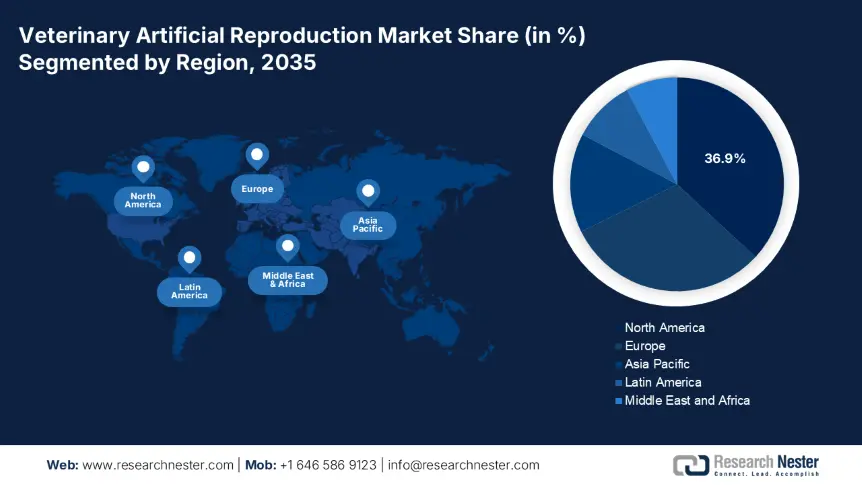

Regional Highlights:

- North America leads the veterinary artificial reproduction market with a 36.9% share, driven by government support and innovative reproductive technologies, supporting robust growth prospects through 2035.

- The Veterinary Artificial Reproduction Market in Europe is set for substantial growth through 2026–2035, driven by the availability of genomics programs and strict breeding regulations.

Segment Insights:

- The Companion Animals segment is forecasted to grow steadily through 2026-2035, driven by increased demand for breeding services and the trend of pet humanization in developed countries.

- Hormones segment are projected to hold a 22.70% share by 2035, driven by their crucial role in controlling breeding programs for companion and livestock animals.

Key Growth Trends:

- Rise in livestock genetics demand

- Animal fertility services humanization

Major Challenges:

- Barriers in reimbursement and government pricing

- Poor patient affordability

Key Players: Zoetis, Genus PLC, Merck Animal Health, CRV.

Global Veterinary Artificial Reproduction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.67 billion

- 2026 Market Size: USD 1.75 billion

- Projected Market Size: USD 2.77 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.9% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Veterinary Artificial Reproduction Market Growth Drivers and Challenges:

Growth Drivers

- Rise in livestock genetics demand: There is an international upliftment for disease-resistant and high-yield livestock, which has successfully escalated the need for innovative reproduction-based technologies. As per the 2024 FAO report, an estimated 60.8% of dairy farms utilized artificial intelligence in the U.S. and the EU, denoting an increase from 45.5%, which has highly fueled the requirement for superior genetics. For instance, the export of beef in Brazil has resulted in generating USD 9.9 billion in 2023 by making a 15.5% contribution to carcass yields, thereby denoting a suitable growth for the market.

- Animal fertility services humanization: There is a rise in pet demand and ownership, especially for pedigree animals, which is increasingly fueling the need for the veterinary artificial reproduction market globally. As stated in the 2024 AVMA report, approximately 40.7% of pet owners in the U.S. are seeking fertility-based treatment solutions, thereby denoting an increase from 28.5% since 2020. Besides, the pet IVF market in Germany has developed by 22.7% in 2023, highly attributed to the demand for rare breeds. Therefore, all these components are deliberately and positively impacting the market growth and expansion.

Challenges

- Barriers in reimbursement and government pricing: Manufacturers of the veterinary artificial reproduction market are facing strict price caps, which have resulted in limiting their profitability. For instance, the reference pricing strategies in the EU for veterinary hormones have suppressed GnRH and FSH drug expenses by 31% since 2020. Likewise, the Medicaid system in the U.S. covers only 15.7% of artificial intelligence-based livestock procedures, leading small-scale farmers to bear 210 to 510 per insemination out of their pockets. Thus, all these factors are deliberately causing a hindrance in the market expansion and upliftment across different nations.

- Poor patient affordability: This is another challenge that negatively impacts the market internationally. For instance, in India, an estimated 62% of the overall dairy farmers are unable to afford artificial intelligence, which creates a challenge for the market in the country. Meanwhile, the cost of pet IVF in the U.S. usually ranges between USD 3,200 to USD 5,200, which further excludes 85.5% of breeders. On the other hand, organizations are also increasing the valuation of their products and services. For instance, the lease-to-own semen straw program in ABS Global has enhanced the adoption of smallholders by 35.7%, thus posing a challenge to the market growth.

Veterinary Artificial Reproduction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.67 billion |

|

Forecast Year Market Size (2035) |

USD 2.77 billion |

|

Regional Scope |

|

Veterinary Artificial Reproduction Market Segmentation:

Technology (In-Vitro Fertilization, Artificial Insemination, Embryo Transfer)

Based on technology, the in-vitro fertilization segment in the veterinary artificial reproduction market is expected to hold the highest share of 33.8% during the forecast timeline, owing to the enhanced need for precision breeding and high genetic preservation. Besides, the USDA, through its funded dairy genomics programs, is efficiently promoting IVF to augment disease resistance and milk yield, with an estimated 33% of the overall elite dairy herds in the U.S. utilizing IVF. Also, the CRISPR integration is further bolstering the IVF’s appeal, especially in the China-based swine IVF projects, which in turn, have reduced production costs by 25.8%.

Animal Type (Companion Animals, Livestock)

Based on animal type, the companion animal segment is projected to hold the second-highest share of 29.5% in the veterinary artificial reproduction market by the end of 2035, due to factors such as an increase in the need for breeding services and a rise in pet humanization. In developed countries, including Japan and the U.S., the feline IVF and pedigree preservation are rapidly expanding, with almost 40.8% of the U.S. breeders implementing fertility treatment options. Besides, the IVF market in Japan has grown by 22% on a yearly basis, effectively attributed to a decline in the pet population and high disposable income.

Product (Hormones, Semen Straws, Cryopreservation Media)

Based on the product, the hormones segment is anticipated to hold the third-largest share of 22.7% in the veterinary artificial reproduction market during the forecast period, since it is crucial to keep control of breeding programs for both companion as well as livestock animals. Moreover, in this segment, the follicle-stimulating hormone (FSH) accounts for an estimated 76% of the overall dairy farms in the U.S. and the EU, depending on the aspect of superovulation protocols for cattle. Besides, the gonadotropin-releasing hormone (GnRH) is also essential, especially for estrus synchronization in China, wherein the country has almost achieved 40.5% of the total adoption growth rate since 2022.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Animal Type |

|

|

Product |

|

|

End User |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Artificial Reproduction Market Regional Analysis:

North America Market Analysis

North America is poised to account for the largest share of 36.9% in the veterinary artificial reproduction market by the end of the forecast timeline, highly driven by the presence and existence of strong government and administrative support, along with innovative reproductive technologies. Other factors, such as the provision of funding by the AAFC and the USDA, have increased pet humanization, especially accounting for 40.8% of the U.S. households that comprise pets, and the availability of approved CRISPR-specific gene editing are also positively driving the market expansion in the region.

The veterinary artificial reproduction market in the U.S. is thriving significantly since the country is expected to gain livestock productivity worth USD 603.8 billion by the end of 2030. Besides, the availability of federal strategies such as the USDA’s USD 205 million Dairy Genomics Program and accelerated CRISPR-based semen adoption is also positively impacting the market growth in the country. In addition, Medicaid has provided USD 3,500 to USD 5,500 coverage of per-pet IVF cycle, which also readily drives the market expansion in the country.

The veterinary artificial reproduction market in Canada is gaining increased traction and is propelled by the rise in the demand for pet cloning and the allocation of public-funded livestock programs, accounting for USD 3.3 billion since 2023. Besides, Ontario is leading the country with an almost 18.5% high ET adoption rate, especially for dairy herds, while British Columbia subsidizes the canine IVF for rare breeds in the country. Moreover, strategic partnerships between domestic and U.S. organizations effectively aim to uplift the technology transformation and ensure localized production, thus suitable for market amplification.

Europe Regional Market Size & Growth

Europe in the veterinary artificial reproduction market is anticipated to account for a share of 30.8% by the end of the forecast timeline. Factors such as the availability of EU-specified genomics programs, high demand for animal IVF, and stringent livestock breeding regulations are highly responsible for driving the market growth in the region. Germany and France are both leading the region with a combined regional revenue of 55.8%, attributed to the presence of government subsidies for dairy ET. Additionally, as of 2024, the UK’s £122 million Livestock Genetics Strategy also bolsters the artificial intelligence adoption, thus another factor for regional market expansion.

The veterinary artificial reproduction market in Germany is readily dominating the regional market with a revenue share of 23%, effectively facilitated by progressive livestock breeding programs and strong government backing. Additionally, the country was allocated an estimated €4.1 billion in 2024 to implement reproductive technologies, which included 81.5% of exclusive dairy herds, catering to embryo transfer adoption. Besides, the Common Agricultural Policy (CAP) of the EU invested €205 million yearly in subsidizing ET in cattle. Also, the country comprises CRISPR-based swine genetics, out of which 31% of pork producers utilize gene-edited semen, thereby driving the market demand.

The veterinary artificial reproduction market in France accounts for 19% of the region’s market, which is supported by €1.9 billion yearly as a fund provision by the government, especially for companion animal and livestock genomics services. On the other hand, the National Institute for Agricultural Research (INRAE) made an investment of €155 million for gene-edited cattle projects in the country, which further uplifted the EI implementation rate in at least 31% of the beef herd. Moreover, the country’s swine artificial intelligence exports generated €320 million, which in turn, is facilitated by Southeast Asia and China, thereby uplifting the market demand in the country.

Key Veterinary Artificial Reproduction Market Players:

- Zoetis (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Genus PLC (UK)

- Merck Animal Health (U.S.)

- CRV (Netherlands)

- URUS Group (U.S.)

- ABS Global (U.S.)

- Semex (Canada)

- Boehringer Ingelheim (Germany)

- Virbac (France)

- JSR Genetics (UK)

- HerdX (U.S.)

- Taurus (Brazil)

- Nandi Genetics (India)

- Geno (Norway)

- AgriBio (Australia)

The veterinary artificial reproduction market is effectively dominated by leading organizations such as Merck, Genus PLC, and Zoetis, all collectively holding a share of 47%. This is possible through strategic implementations, including government partnerships, IoT adoption, and CRISPR patents, all of which eventually contribute towards market development across different nations. Besides, emerging companies initiate competition in the market through low-cost artificial intelligence kits, while CRV’s blockchain traceability diminishes compliance price by an estimated 20.2%, thus denoting a positive outlook for the overall market.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Boehringer Ingelheim Animal Health accomplished the €205 million BioRepro Hub construction in Hannover for the mass production of innovative recombinant reproduction hormones.

- In November 2024, Genus ABS introduced the EcoBreed, which is a climate-adaptive bovine genetics platform, suitable for featuring semen from cattle through genetic selection which will reduce methane emissions by 21%.

- Report ID: 7686

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Veterinary Artificial Reproduction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.