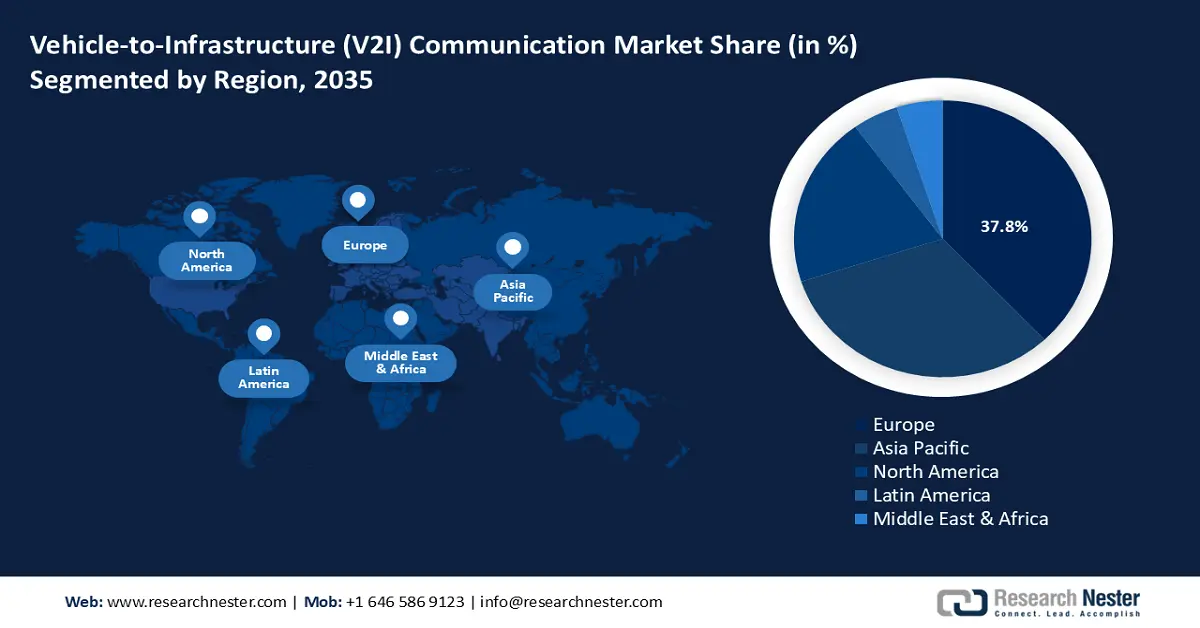

Vehicle-to-Infrastructure (V2I) Communication Market - Regional Analysis

Europe Market Insights

The vehicle-to-infrastructure communication market in Europe is poised to hold a leading revenue share of 37.8% by the end of 2035. A major driver of the market in Europe is a favorable regulatory ecosystem, facilitating vendors. For instance, the European Commission’s Intelligent Transport Systems Directive, revised in 2023, requires all the member states to support interoperable V2I communication by 2027, creating a supportive stakeholder environment. The market growth is additionally supported by proactive investments, to bolster smart mobility infrastructure under the Connective Europe Facility. Moreover, the future of the regional market remains lucrative due to a sustained push for autonomy, which is bound to create steady opportunities to provide regional alternatives to non-EU V2I platforms.

The German vehicle-to-infrastructure communication market is projected to expand its revenue share during the forecast period. The launch of C-ITS corridors and digital test beds, spearheaded by regions such as Bavaria and Baden-Württemberg, has driven the application of V2I communication infrastructure. Moreover, Tier 1 automotive suppliers have invested in V2I sensor platforms to ensure compatibility with regional traffic management systems. The V2I market reflects a federated push and pull system, where regional industrial champions and labor stakeholders have defined the competitive map. With greater investments expected to be funneled to smart city infrastructure, the German market is poised to maintain its growth by the end of 2035.

France is home to considerable government interest and initiatives in intelligent transportation systems (ITS) and smart infrastructure in urban and rural environments. The roads are the predominant means of transportation in France, and a large part of the travel/transportation occurs over the road network, making V2I space very large. The ex-tech market in France is exploding, especially in ITE-related sectors, which is a sign of an increased likelihood of use cases, more traffic, and therefore greater distance for V2I monetization.

Asia Pacific Market Insights

The APAC vehicle-to-infrastructure communication market is projected to exhibit the fastest expansion during the forecast period, rising at a 40.4% CAGR during the anticipated timeline from 2026 to 2035. The improving intra-Asian trade facilitated by agreements, including the Indonesia-Singapore Comprehensive Economic Partnership Agreement, has enabled the rapid deployment of smart infrastructure. Additionally, nuanced capital flows, from sovereign wealth funds such as Singapore’s GIC funneling resources into pan-ASEAN V21 pilots, bolster the regional markets. The culturally embedded trust networks have driven an interconnected market that balances local adaptability with regional coherence.

The China vehicle-to-infrastructure communication market is poised to account for a leading revenue share in APAC. The market’s growth is intricately linked with the dual circulation strategy, which experienced a surge in smart city investments in 2023. The market is also stratified by the vast behavioral differences between first-tier hubs such as Shanghai, with mature V2I ecosystems supported by SOE-led infrastructure reforms, and in the fourth-tier cities in the Western provinces of China, local governments have heavily incentivized private tech incubators to pilot scaled V2I models. Additionally, the heightened rollout of 5G in second and third-tier cities has fueled consumer adoption of connected car services, bolstering the V2I communication sector.

There are several synergistic factors that lead to extensive demand for India's vehicle-to-infrastructure communication market to capture a large revenue share. First, there is a rapid expansion of 5G throughout India as evidenced by base stations being deployed in nearly all districts and the availability of more 5 G-capable devices. This is creating a solid telecom backbone that supports the low-latency, high-communication reliability that V2I demand requires. The demand for safer, more efficient driving is increasing for both consumers and Original Equipment Manufacturers (OEMs).

North America Market Insights

North America is poised to take a leading revenue share in the vehicle-to-infrastructure communication market due to a broad explanation at the regional level, and subsequently for the USA and Canada, North America has several advantageous conditions: high levels of car ownership, significant investments in communication infrastructure, and strong government investment for reducing the risk of traffic collisions, congestion, and emissions. Federal and state/provincial governments are committing significant amounts of money through smart transportation and V2X initiatives, with funding for evaluations and pilot programs and spectrum allocation.

In the U.S., there are several specific factors that strengthen dominance in V2I revenue share. The U.S. Department of Transportation and related entities have developed roadmaps to expedite V2X adoption including V2I elements; The regulatory environment is changing (e.g., agreements about spectrum rules (i.e. C V2X) as examples showing clarification of rules is enabling infrastructure deployment; Pilot deployments in highways, urban intersections, toll systems etc. are helping to empirically prove out use cases and lessen risk. The high level of traffic fatalities and congestion provide heavy motivation from policy makers and safety advocates, facilitating and pushing adoption; Additionally, OEMs in the U.S. are increasingly incorporating V2X/V2I capabilities into new vehicles.

Canada vehicle-to-infrastructure communication market is also advancing robustly in the V2I space, updating its regulatory foundations to reflect connected and automated vehicle technologies - for example, Transport Canada has issued "Safety Framework for Connected and Automated Vehicles 2.0" to have oversight and ensure safe deployment. The U.S. has been a partner working with Canada on V2I issues, such as the Canada-U.S. Regulatory Cooperation Council, which is working together to harmonize ITS/V2I standards and architecture. It has also provided funding for smart city and mobility pilot projects, such as funding to establish live piloting environments for vehicle innovations (e.g., in Ontario) for both cross-border and multimodal scenarios.