Vehicle-to-Infrastructure (V2I) Communication Market Outlook:

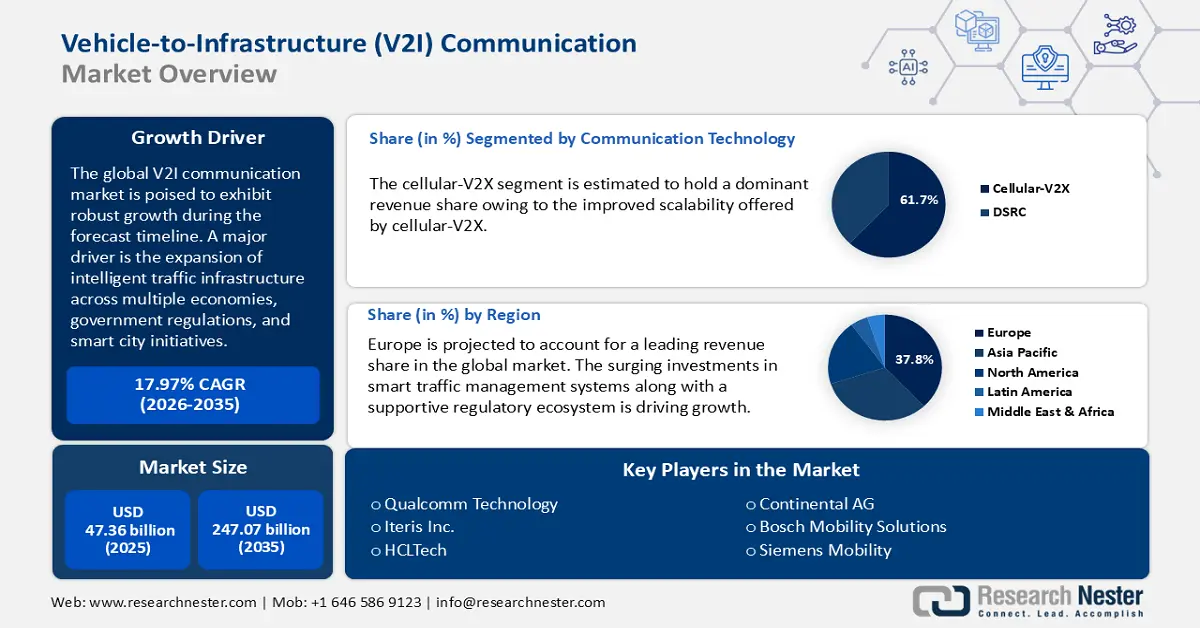

Vehicle-to-Infrastructure (V2I) Communication Market size was valued at USD 47.36 billion in 2025 and is projected to reach USD 247.07 billion by the end of 2035, rising at a CAGR of 17.97% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the V2I communication is assessed at USD 55.81 billion.

The vehicle-to-infrastructure (V2I) communication market is expanding rapidly, driven by urbanization and traffic congestion concerns, and by pressure to improve road safety. Smart city projects are a key driver of this expansion, bringing together automotive manufacturers, infrastructure developers, municipalities, and telecom service providers to partner for the deployment of Roadside Units (RSUs), sensors, and communication nodes. Regions, including Asia Pacific, are leading the charge in deployments in scale and in dollars. There are clear indicators of a shift to greater adoption of advanced communications technologies, particularly Cellular V2X (C V2X) and ultimately 5G services which, in many cases, can be deployed in combination with or instead of traditional Dedicated Short-Range Communications (DSRC), due in part to advances in latency, scalability, and support for other advanced (e.g., real time) transport applications.

Furthermore, there is increasing integration with edge computing, AI/ML for predictive analytics, faster response times, risk detection, adaptive signal control, and real-time traffic management. This integration enhances infrastructure use and supports real-time and adaptive traffic management options, especially in highly congested areas in the urban environment. While the opportunities are enormous, so are the challenges. Cybersecurity and data privacy issues are a challenge because many information exchanges are required as part of V2I. Even so, entering the new world of V2I is complicated by existing legacy infrastructure and protocols, as many jurisdictions maintain a relatively older traffic system not easily compatible with established near-field connectivity standards. This further complicates entry into V2I since the local governments must determine which legacy traffic signals and associated traffic infrastructure should also be upgraded at additional costs to achieve V2I.

Key Vehicle-to-Infrastructure (V2I) Communication Market Insights Summary:

Regional Highlights:

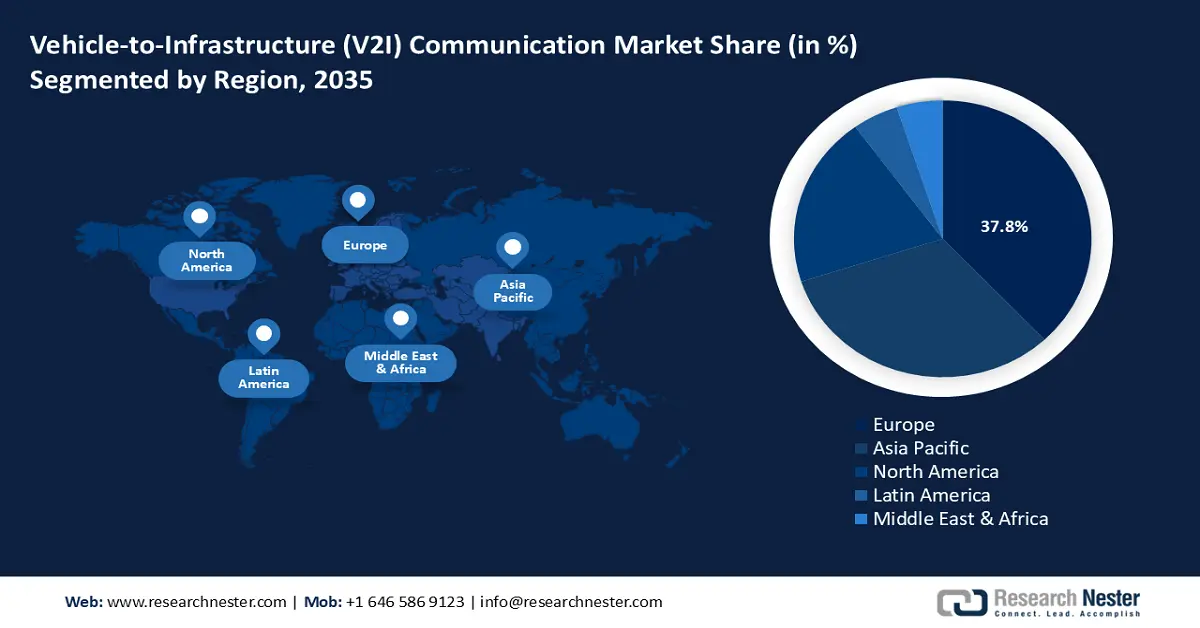

- Europe is projected to command a 37.8% share by 2035 in the vehicle-to-infrastructure (V2I) communication market, supported by a conducive regulatory landscape impelled by the EU’s interoperable ITS mandates.

- Asia Pacific is anticipated to witness the fastest expansion at a 40.4% CAGR from 2026-2035, underpinned by expanding smart-infrastructure investments across interconnected regional ecosystems.

Segment Insights:

- The cellular-V2X (C-V2X) segment is expected to capture a dominant 61.7% share throughout 2026-2035 in the vehicle-to-infrastructure (V2I) communication market, augmented by its scalable integration across 4G and 5G networks.

- The traffic management segment is projected to hold a 46.0% share by 2035, strengthened by the evolution of static road systems into intelligent, real-time V2I-enabled infrastructures.

Key Growth Trends:

- Government regulations and smart city initiatives

- Rising demand for road safety and traffic efficiency

Major Challenges:

- Infrastructure-protocol mismatch dilemma

- High infrastructure costs and retrofit challenges

Key Players: Qualcomm Technologies, Iteris, Inc., HCLTech, Continental AG, Bosch Mobility Solutions, Siemens Mobility, Kapsch TrafficCom, Cohda Wireless, Savari Inc., Autotalks Ltd., Denso Corporation, Huawei Technologies, Ericsson, Panasonic Corporation, NXP Semiconductors.

Global Vehicle-to-Infrastructure (V2I) Communication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 47.36 billion

- 2026 Market Size: USD 55.81 billion

- Projected Market Size: USD 247.07 billion by 2035

- Growth Forecasts: 17.97% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (37.8% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, United Arab Emirates, Brazil

Last updated on : 1 October, 2025

Vehicle-to-Infrastructure (V2I) Communication Market - Growth Drivers and Challenges

Growth Drivers

- Government regulations and smart city initiatives: Around the world, governments are proactively encouraging smart transportation systems under a larger smart city umbrella. Regulatory pressure—such as the European Union’s Intelligent Transport Systems (ITS) directive, or the U.S. Department of Transportation’s V2X initiatives—encourages cities to adopt connected infrastructure. Such directives look to decrease road fatalities, improve urban mobility, and decrease emissions. Increasingly, public-sector investments are going toward roadside units (RSUs), adaptive traffic signals, and communications platforms that enable V2I systems.

- Rising demand for road safety and traffic efficiency: As city traffic increases and automobile accidents continuously become more common, there is greater interest in technology to assist with safety and flow. V2I warns drivers in real-time about traffic signals, road hazards, pedestrian crossings, and much more. This type of active communication between drivers and the roadway through V2I could lead to faster response times and, therefore, a reduced number of accidents. Smart intersections that also rely on V2I can factually reduce signal phases based on traffic volume, enhancing traffic flow and reducing fuel consumption. The ability to combine safety and improved automotive flow represents a significant gain for both legislators and automakers and drives advancements in technology.

- Advancements in 5G and cellular V2X (C-V2X) technologies: The implementation of 5G networks is considerably advancing the use and performance of V2I communication systems. C-V2X and 5G afford much lower latencies and larger data throughput capabilities than traditional DSRC-based systems, along with the larger coverage areas, making them more suited for mission-critical applications such as autonomous driving and emergency vehicle notifications. With technological advancements in supporting vehicle-to-infrastructure data exchange, real-time decision-making will yield improved data accuracy. As telecommunications providers continue to provide 5G infrastructure around the globe, the efficiencies of V2I systems and their scalability will increase drastically.

Road Safety Financing as a Percentage of Total World Bank Road and Urban Transport Funding (FY19-FY23)

|

Fiscal Year |

Road Safety Financing as % of Total World Bank Road and Urban Transport Financing |

|

FY19 |

6.2% |

|

FY20 |

5.8% |

|

FY21 |

7.3% |

|

FY22 |

14.5% |

|

FY23 |

14.4% |

Source: World Bank Group

Challenges

- Infrastructure-protocol mismatch dilemma: The global V2I market has faced a major challenge in the mismatch of infrastructure and protocols. The incompatibility between legacy transportation infrastructure and V2I communication protocols causes an impediment in the market. The mismatch is evident in regions marred with aging public infrastructure, slowing the deployment of V2I systems with lower latencies, causing fragmentation.

- High infrastructure costs and retrofit challenges: V2I systems necessitate high budget commitment for roadside infrastructure (RSUs), sensors, communication modules, and cloud support structures. Many cities operate traffic systems that were built years ago and cannot be added on to V2I systems, thus leading to very costly solutions. Budget and financial restraints, particularly relevant in developing countries, present a significant barrier to widespread implementations of V2I systems. Determining a viable financial mechanism originating from a public sector vs. private sector is also incredibly complex, and lengthens the timelines to implement V2I technology.

Vehicle-to-Infrastructure (V2I) Communication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.97% |

|

Base Year Market Size (2025) |

USD 47.36 billion |

|

Forecast Year Market Size (2035) |

USD 247.07 billion |

|

Regional Scope |

|

Vehicle-to-Infrastructure (V2I) Communication Market Segmentation:

Communication Technology Segment Analysis

The cellular-V2X (C-V2X) segment in the vehicle-to-infrastructure communication market is poised to hold a leading revenue share of 61.7% during the anticipated timeline. C-V2X offers greater scalability in comparison to its predecessor, DSRC, by leveraging 4G LTE and 5G networks. The segment’s growth has eliminated the requirement for dedicated short-range roadside infrastructure. This has ensured that C-V2X is lucrative for private stakeholders as well as for governments seeking cost-effective deployments across rural and urban regions. Moreover, the transition has been accelerated by the strong backing of telecom giants such as Qualcomm and Ericsson, and OEMs such as Audi and Ford.

Application Segment Analysis

The traffic management segment in the vehicle-to-infrastructure communication market is slated to hold a leading revenue share of 46.0% throughout the forecast timeline. A key driver is the advantage offered by the V2I-enabled traffic management systems in transforming static road infrastructure into intelligent, responsive systems. In major metro regions, such as Toronto and Tokyo, the application has reportedly decreased average travel time reductions during peak hours. The economic incentive of applications remains compelling, with the time lost in traffic improving productivity. With a greater number of cities implementing smart systems, V2I-based traffic management is poised to experience greater application opportunities throughout the forecast period across multiple regional markets.

Component Segment Analysis

In the foreseeable future, hardware will likely be the primary element in the V2I communication Market. Hardware is fundamental: without hardware, there is no physical infrastructure to facilitate communication. Hardware is an obvious and heavy capital commitment. Governments and municipalities often must make substantial upfront investments to develop or enhance infrastructure. This immediately raises the hardware cost baseline. There simply is a greater degree of hardware investment than there is software or services in the initial investment, and especially in the early phases of deployment, regarding outfitting vehicles and road infrastructure.

Our in-depth analysis of the vehicle-to-infrastructure (V2I) communication market includes the following segments:

|

Segments |

Subsegments |

|

Communication Technology |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vehicle-to-Infrastructure (V2I) Communication Market - Regional Analysis

Europe Market Insights

The vehicle-to-infrastructure communication market in Europe is poised to hold a leading revenue share of 37.8% by the end of 2035. A major driver of the market in Europe is a favorable regulatory ecosystem, facilitating vendors. For instance, the European Commission’s Intelligent Transport Systems Directive, revised in 2023, requires all the member states to support interoperable V2I communication by 2027, creating a supportive stakeholder environment. The market growth is additionally supported by proactive investments, to bolster smart mobility infrastructure under the Connective Europe Facility. Moreover, the future of the regional market remains lucrative due to a sustained push for autonomy, which is bound to create steady opportunities to provide regional alternatives to non-EU V2I platforms.

The German vehicle-to-infrastructure communication market is projected to expand its revenue share during the forecast period. The launch of C-ITS corridors and digital test beds, spearheaded by regions such as Bavaria and Baden-Württemberg, has driven the application of V2I communication infrastructure. Moreover, Tier 1 automotive suppliers have invested in V2I sensor platforms to ensure compatibility with regional traffic management systems. The V2I market reflects a federated push and pull system, where regional industrial champions and labor stakeholders have defined the competitive map. With greater investments expected to be funneled to smart city infrastructure, the German market is poised to maintain its growth by the end of 2035.

France is home to considerable government interest and initiatives in intelligent transportation systems (ITS) and smart infrastructure in urban and rural environments. The roads are the predominant means of transportation in France, and a large part of the travel/transportation occurs over the road network, making V2I space very large. The ex-tech market in France is exploding, especially in ITE-related sectors, which is a sign of an increased likelihood of use cases, more traffic, and therefore greater distance for V2I monetization.

Asia Pacific Market Insights

The APAC vehicle-to-infrastructure communication market is projected to exhibit the fastest expansion during the forecast period, rising at a 40.4% CAGR during the anticipated timeline from 2026 to 2035. The improving intra-Asian trade facilitated by agreements, including the Indonesia-Singapore Comprehensive Economic Partnership Agreement, has enabled the rapid deployment of smart infrastructure. Additionally, nuanced capital flows, from sovereign wealth funds such as Singapore’s GIC funneling resources into pan-ASEAN V21 pilots, bolster the regional markets. The culturally embedded trust networks have driven an interconnected market that balances local adaptability with regional coherence.

The China vehicle-to-infrastructure communication market is poised to account for a leading revenue share in APAC. The market’s growth is intricately linked with the dual circulation strategy, which experienced a surge in smart city investments in 2023. The market is also stratified by the vast behavioral differences between first-tier hubs such as Shanghai, with mature V2I ecosystems supported by SOE-led infrastructure reforms, and in the fourth-tier cities in the Western provinces of China, local governments have heavily incentivized private tech incubators to pilot scaled V2I models. Additionally, the heightened rollout of 5G in second and third-tier cities has fueled consumer adoption of connected car services, bolstering the V2I communication sector.

There are several synergistic factors that lead to extensive demand for India's vehicle-to-infrastructure communication market to capture a large revenue share. First, there is a rapid expansion of 5G throughout India as evidenced by base stations being deployed in nearly all districts and the availability of more 5 G-capable devices. This is creating a solid telecom backbone that supports the low-latency, high-communication reliability that V2I demand requires. The demand for safer, more efficient driving is increasing for both consumers and Original Equipment Manufacturers (OEMs).

North America Market Insights

North America is poised to take a leading revenue share in the vehicle-to-infrastructure communication market due to a broad explanation at the regional level, and subsequently for the USA and Canada, North America has several advantageous conditions: high levels of car ownership, significant investments in communication infrastructure, and strong government investment for reducing the risk of traffic collisions, congestion, and emissions. Federal and state/provincial governments are committing significant amounts of money through smart transportation and V2X initiatives, with funding for evaluations and pilot programs and spectrum allocation.

In the U.S., there are several specific factors that strengthen dominance in V2I revenue share. The U.S. Department of Transportation and related entities have developed roadmaps to expedite V2X adoption including V2I elements; The regulatory environment is changing (e.g., agreements about spectrum rules (i.e. C V2X) as examples showing clarification of rules is enabling infrastructure deployment; Pilot deployments in highways, urban intersections, toll systems etc. are helping to empirically prove out use cases and lessen risk. The high level of traffic fatalities and congestion provide heavy motivation from policy makers and safety advocates, facilitating and pushing adoption; Additionally, OEMs in the U.S. are increasingly incorporating V2X/V2I capabilities into new vehicles.

Canada vehicle-to-infrastructure communication market is also advancing robustly in the V2I space, updating its regulatory foundations to reflect connected and automated vehicle technologies - for example, Transport Canada has issued "Safety Framework for Connected and Automated Vehicles 2.0" to have oversight and ensure safe deployment. The U.S. has been a partner working with Canada on V2I issues, such as the Canada-U.S. Regulatory Cooperation Council, which is working together to harmonize ITS/V2I standards and architecture. It has also provided funding for smart city and mobility pilot projects, such as funding to establish live piloting environments for vehicle innovations (e.g., in Ontario) for both cross-border and multimodal scenarios.

Key Vehicle-to-Infrastructure (V2I) Communication Market Players:

- Qualcomm Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Iteris, Inc.

- HCLTech

- Continental AG

- Bosch Mobility Solutions

- Siemens Mobility

- Kapsch TrafficCom

- Cohda Wireless

- Savari Inc.

- Autotalks Ltd.

- Denso Corporation

- Huawei Technologies

- Ericsson

- Panasonic Corporation

- NXP Semiconductors

The V2I communication market is consolidating around companies that have both vertical integration and domain-specific IP in 5 G-V2X, edge computing, and traffic management infrastructure. Within the market, the companies are leveraging supportive regulatory systems in regional markets and the expansion of smart traffic management infrastructure.

Here is a list of key players operating in the market:

Recent Developments

- In April 2025, Huawei introduced the Luxeed R7, in collaboration with Chery, which is an all-electric SUV set to compete with the Model Y of Tesla. The new vehicle features the Qiankun ADS 3.0 driver assistance systems, offering improved intelligent driving capabilities.

- In October 2024, Coredge IO Pvt Ltd. and Qualcomm Technologies announced a strategic partnership in launching an AI Inference-as-a-Service platform. The platform is powered by Qualcomm’s Cloud AI 100 Ultra in a bid to provide scalable AI solutions to large enterprises as well as SMEs.

- Report ID: 3189

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vehicle-to-Infrastructure (V2I) Communication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.