Urgent Care Centers Market Outlook:

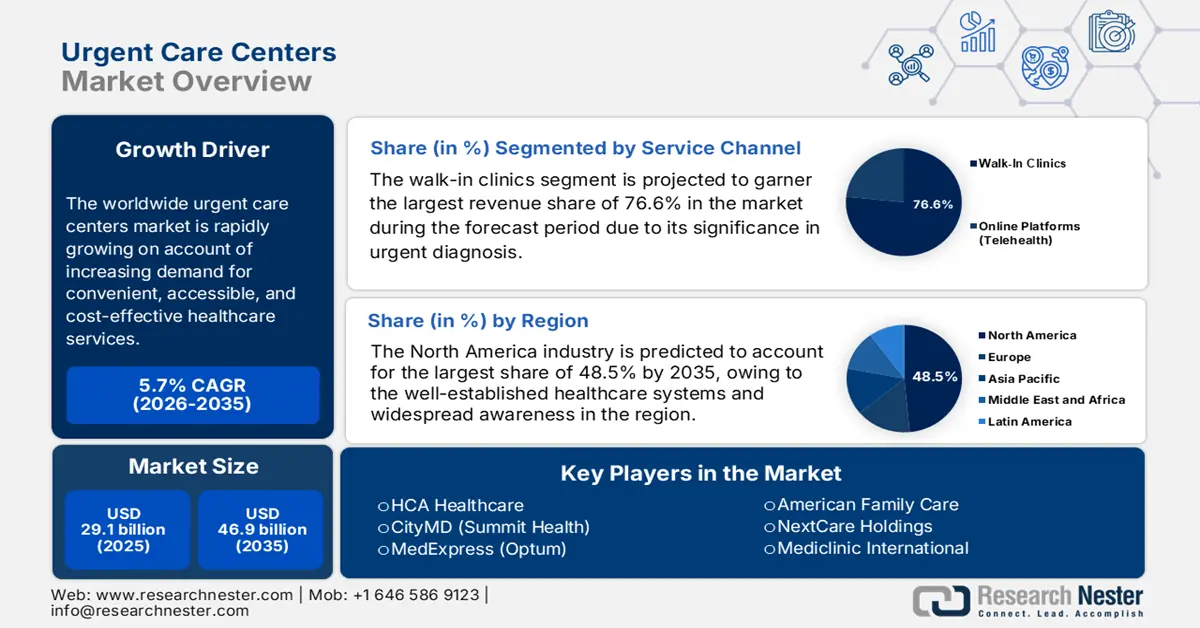

Urgent Care Centers Market size was valued at USD 29.1 billion in 2025 and is projected to reach USD 46.9 billion by 2035, growing at around CAGR of 5.7% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of urgent care centers is estimated at USD 30.2 billion.

The worldwide market is rapidly growing on account of increasing demand for convenient, accessible, and cost-effective healthcare services. In this regard, the study by the Journal of Health Economics in May 2023 found that the entry of UCCs in a zip code led to a rise in Medicare spending, with no improvement found in terms of mortality. Besides, six years after UCC entry, annual per-capita Medicare spending increased by a remarkable USD 268, marking a rise of $6,335 per new UCC use, highlighting their role as referral hubs within hospital networks.

In addition, technological advancements such as telehealth integration and electronic health records are enhancing efficiency and quality of care. This can be testified by the article published by NIH in April 2025 that found that between October 2021 and September 2024, there were 5,343,465 UCC index visits which users included 85.31% adults (18+), 17.17% seniors (65+), and 54.87% females, with 41.31% identifying as Hispanic. These figures reflect the strong demand and digital readiness for targeted online urgent care marketing.

Key Urgent Care Centers Market Insights Summary:

Regional Highlights:

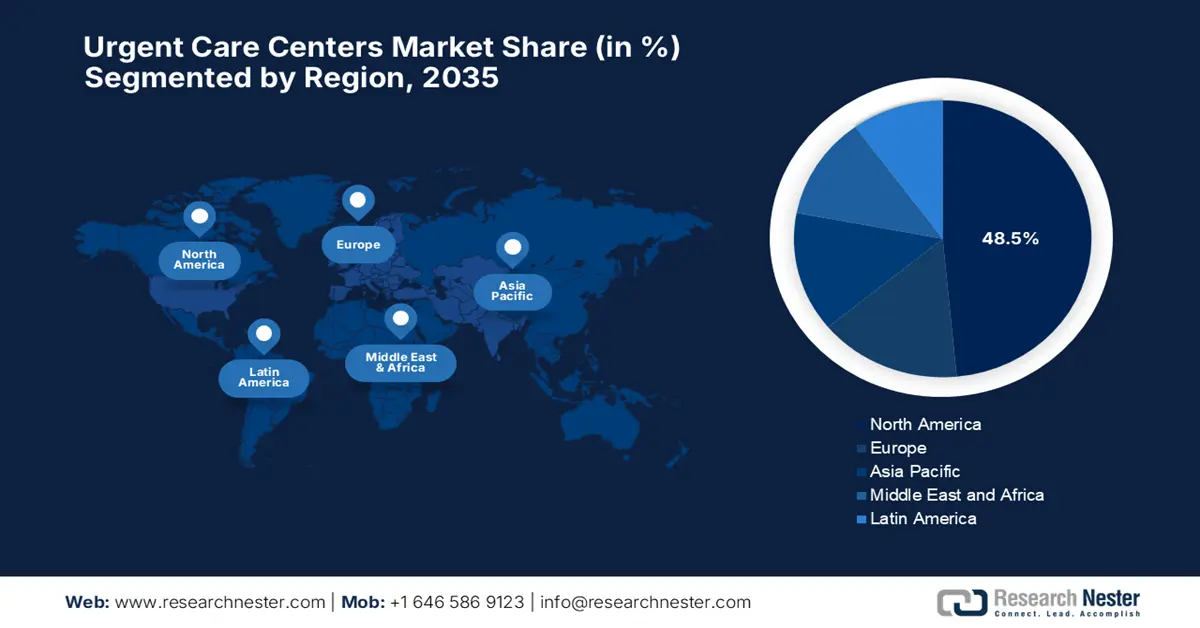

- By 2035, North America is poised to command a 48.5% share of the urgent care centers market, underpinned by well-established healthcare systems and growing awareness of urgent care accessibility.

- Across 2026-2035, Asia Pacific is projected to be the fastest-expanding region, supported by rising urban populations, increasing healthcare awareness, and demand for efficient, accessible care solutions.

Segment Insights:

- By 2035, the walk-in clinics segment in the urgent care centers market is anticipated to secure a 76.6% revenue share, sustained by its operational importance in urgent diagnosis and supportive insurance reimbursement structures.

- By 2035, the adult demographic segment is projected to capture a 41.3% share, reinforced by employer-sponsored care benefits and round-the-clock service availability.

Key Growth Trends:

- Convenience & cost-effectiveness

- Digital innovations

Major Challenges:

- Workforce Shortages

- Reimbursement complications

Key Players: HCA Healthcare, CityMD (Summit Health), MedExpress (Optum), American Family Care, NextCare Holdings, Mediclinic International, Fresenius Medical Care, Bupa, Apollo Hospitals, Narayana Health, Ramsay Health Care, Samsung Medical Center, KPJ Healthcare, IHH Healthcare, Eu Yan Sang.

Global Urgent Care Centers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.1 billion

- 2026 Market Size: USD 30.2 billion

- Projected Market Size: USD 46.9 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 25 August, 2025

Urgent Care Centers Market - Growth Drivers and Challenges

Growth Drivers

-

Convenience & cost-effectiveness: The urgent care centers are enabling walk-in care for non-emergency situations that readily caters to patients seeking alternatives to long wait tenures. A NIH study in July 2023 observed that the presence of a GP-led urgent care walk-in clinic near a hospital emergency department significantly reduced low-urgency emergency visits by 37.3%, especially in terms of dermatology, neurology, ophthalmology, and trauma cases. Also, most patients referred from the ED received care at the clinic, decreasing the length of stay.

-

Digital innovations: The aspect of technology and digitalization plays a vital role in healthcare that readily bolsters growth in the market expansion across all nations. For instance, in August 2025, UPMC and GoHealth Urgent Care launched 81 UPMC-GoHealth Urgent Care centers across Pennsylvania and West Virginia. This joint venture expands access to the most trusted, on-demand care with advanced technology and streamlined operations, thereby fostering a favourable business environment in this field.

- Mutually beneficial collaborations: The existence of alliances between the urgent care providers and retail chains, health systems, and hospital networks is amplifying the growth trajectory in this landscape. In July 2025, Community Health Network and GoHealth Urgent Care declared a joint venture with a key emphasis on enhancing urgent care services across Central Indiana. This partnership aims to expand access to high-quality, on-demand care throughout the region, hence suitable for standard market upliftment.

Key Injury and Fatality Data Driving Urgent Care Market Growth (2023)

|

Category |

Data |

|

Total recordable nonfatal injury/illness cases (private industry) |

2,569,000 |

|

Cases involving days away from work (DAFW) |

946,500 |

|

Fatal work-related injuries (all sectors) |

5,283 |

|

Fatal roadway incidents (all sectors) |

1,252 |

|

Fatal falls, slips, trips (all sectors) |

885 |

|

Fatal homicides (all sectors) |

458 |

Source: U.S. Bureau of Labor Statistics

International Interventions in Urgent Care Delivery Models 2023

|

Reference |

Population & Location |

Intervention Type |

|

Greene |

Service users & relatives, Australia |

Geriatric urgent care, in-person |

|

Lippi Bruni |

Type 2 diabetics, Italy |

GP in community centers, in-person |

|

Galloway |

Cancer patients, Canada |

Urgent care in hospital, in-person |

|

Wackers |

Acute care patients, Netherlands |

ED + after-hours care, in-person |

Source: NIH

Challenges

- Workforce Shortages: One of the considerable challenges in the market is the lack of a skilled workforce, which hinders adoption among a wider group of audience. Besides, the increasing patient volumes and intensifying competition from hospitals and specialty clinics make it difficult to recruit a skilled workforce. Therefore, the existence of these concerns can further lead to longer wait times, reduced patient satisfaction, and ultimately hinder upliftment.

- Reimbursement complications: The aspect of regulatory and reimbursement complications is a major obstacle for the urgent care centers market to grab the desired consumer pool. The insurance policies vary widely by state and payer, wherein reimbursement rates for urgent care services are often lower compared to hospitals or specialist visits. Therefore, navigating through this can negatively impact financial sustainability and growth opportunities in the market.

Urgent Care Centers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 29.1 billion |

|

Forecast Year Market Size (2035) |

USD 46.9 billion |

|

Regional Scope |

|

Urgent Care Centers Market Segmentation:

Service Channel Segment Analysis

Walk-in clinics segment is projected to garner the largest revenue share of 76.6% in the market during the forecast period. The dominance in the segment is attributed to its significance in urgent diagnosis and insurance reimbursement policies for on-site care. This can be testified by the report from CMS, which revealed that U.S. healthcare spending reached USD 4.9 trillion in 2023, accounting for 17.6% of GDP. Cost-efficient care alternatives such as urgent care centers continue to attract both patients and investors, hence a positive segment outlook.

Age Group Segment Analysis

Adult demographic segment is expected to gain a significant share of 41.3%in the urgent care centers market by the end of 2035. The growth in the segment originates from employer-sponsored care benefits and the service availability, regardless of the time. This can be testified by the report from HMCC in June 2024 that revealed that adults under the age of 43 are more likely to seek care in these centers or retail clinic settings compared to other age groups, thereby providing an encouraging revenue opportunity.

Application Segment Analysis

Acute illness treatment segment is anticipated to capture a considerable revenue share of 32.6% in the market during the discussed time frame. These settings are currently offering rapid PCR testing, and the reduced wait times are making it preferable to a wider audience group. The study by Cureus in March 2024 revealed that the patients who were unaware of urgent care centers visited a UCC recently, mainly for minor issues like colds, headaches, and abdominal pain, denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Service Channel |

|

|

Age Group |

|

|

Application |

|

|

Product Type |

|

|

Technology Integration |

|

|

Payment Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urgent Care Centers Market - Regional Analysis

North America Market Insights

North America is set to garner the largest revenue share of 48.5% in the market by the end of 2035. The well-established healthcare systems and widespread awareness of these centers are the primary fueling factors for this leadership. In July 2024, Virginia Mason Franciscan Health reported that it had partnered with Intuitive Health to expand access to care in the Puget Sound region, particularly in Kitsap County. It also stated that to meet rising demand and workforce shortages, VMFH will open a second hybrid Emergency Department or an Urgent Care clinic in Port Orchard, hence positively influencing market growth.

The U.S. is set to dominate the regional urgent care centers market owing to the rising burden of acute respiratory infections dominating service demands, cost advantages over primary care and emergency departments, and rapid telemedicine adoption. As evidence, UCA revealed that between January and March 2024, 5 million visits occurred after 5 p.m., highlighting strong after-hours demand, whereas 41% of medical groups benchmark their data externally at least quarterly, supporting continuous performance optimization in the urgent care sector.

Canada’s market of urgent care centers is rapidly growing due to the extreme necessity of timely care and persistent overcrowding in healthcare settings. NIH study in April 2023 revealed that a cross-sectional study in Ontario analyzed 1,148,151 visits by 562,781 patients to 72 walk-in clinics, revealing that 70% of users were already enrolled with a family physician. Besides, walk-in clinic patients were generally younger but had higher healthcare utilization and more comorbidities than the general population. Hence, this pattern underscores that convenience and accessibility as key drivers in this field.

U.S. Urgent Care Center Growth (2022-2024)

|

Year |

Number of Centers |

|

2022 |

12,000 |

|

2023 |

13,500 |

|

2024 |

15,000 |

Source: Urgent Care Association

APAC Market Insights

Asia Pacific’s urgent care centers market is likely to emerge as the fastest-growing region between the timeframe 2026 to 2035. The region’s development in this field is facilitated by the growing urban populations, increasing healthcare awareness, and rising demand for efficient and accessible care alternatives. In April 2023, TXP Medical Co. Ltd. stated that its NEXT Stage ER (NSER) data platform is making an entry into four Malaysia-based hospitals to improve emergency medicine operations. Also, the project, selected by JETRO as a key DX initiative, integrates prehospital and in-hospital patient data using tools like NSER mobile for ambulance paramedics and the TXP Self-Assessment System for patient interviews.

There is a huge opportunity for the market in India, driven by private-sector-led clinics and chains offering walk-in consultations, diagnostics, and minor procedures. The country also received huge support from the government of India, which implemented the Ayushman Bharat Digital Mission (ABDM). Besides, these centers can leverage telemedicine platforms such as e-Sanjeevani to provide accessible, timely care for non-emergency conditions, especially in underserved and rural areas. Integration with digital health IDs and electronic medical records enables proper patient management and improved health outcomes.

Australia in the market is rapidly growing, which is supported by government initiatives and enhanced healthcare access. In this regard, Medicare UCCs in Australia are offering bulk-billed urgent care for non-life-threatening conditions, wherein no appointments or referrals are needed, operating extended hours. Also, the country received a total fund of USD 1.4 billion in government investment, which also includes USD 644.3 million from 2025 to 2026. The network is expanding to 137 clinics nationwide by the end of 2028, hence suitable for standard market development.

DTP3 Immunization Coverage and Unvaccinated Children in Key APAC Markets (2024): Implications for Urgent Care Demand

|

Country |

Coverage (%) |

Vaccinated |

Unvaccinated |

|

Indonesia |

78 |

3.4 million |

969,000 |

|

Philippines |

71 |

5,000 |

525,000 |

|

China |

97 |

8.5 million |

263,000 |

|

Malaysia |

93 |

<1,000 |

31,000 |

|

Thailand |

92 |

25,000 |

46,000 |

Source: UNICEF

Europe Market Insights

Europe market is expected to grow at a considerable rate, with an increased demand for convenient, cost-effective, and timely medical care outside these hospital settings. Also, factors such as aging populations and chronic disease burden are also propelling the need for urgent care. In May 2021, ConvenientMD reported that it secured an investment from Bain Capital Double Impact to expand ConvenientMD’s affordable and flexible urgent care services by opening new locations in underserved areas and broadening service offerings.

Germany is augmenting its leadership in the regional urgent care centers market to reduce pressure on overcrowded hospital emergency departments and address the needs of an aging population. In March 2025, AMBOSS, and medical education platform, secured a substantial €240 million in funding from long-term investors, including KIRKBI, M&G Investments, and Lightrock. The company further stated that the investment supports AMBOSS's international expansion and broadens its offerings to include nurses and other healthcare professionals, hence a positive market outlook.

The U.K. in the urgent care centers market is projected for robust growth that operates under the National Health Service (NHS) and includes Urgent Treatment Centres (UTCs), Minor Injury Units (MIUs), and Walk-in Centres. In June 2025, the UK government announced a £450 million urgent care plan for the tenure 2025 to 2026, which will deliver 40 new same-day emergency care centers, 15 mental health crisis centers, and nearly 500 new ambulances. Besides, this initiative also aims to cut A&E wait times for 800,000 patients on a yearly basis.

Key Urgent Care Centers Market Players:

- HCA Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CityMD (Summit Health)

- MedExpress (Optum)

- American Family Care

- NextCare Holdings

- Mediclinic International

- Fresenius Medical Care

- Bupa

- Apollo Hospitals

- Narayana Health

- Ramsay Health Care

- Samsung Medical Center

- KPJ Healthcare

- IHH Healthcare

- Eu Yan Sang

The market is witnessing intensifying competition between the top five players, such as HCA, CityMD, MedExpress, AFC, and NextCare, who have taken control of the maximum revenue share. The U.S.-based pioneers are reinforcing their dominance with merger acquisitions and telehealth integration where whereas firms from Japan are leading in automation. Vertical integration, tech adoption, and public-private partnerships are a few assets of this landscape, fostering a favourable business environment.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2024, Yale New Haven Health (YNHHS) announced that it had opened its first newly branded urgent care center in Fairfield, CT, at 340 Grasmere Avenue. The center provides high-quality, professional urgent care services.

- In July 2024, the University of Maryland Medical System declared that it had inaugurated two new urgent care centers in Pasadena and Glen Burnie. Each center spans around 3,000 square feet and will operate on a daily basis from 8 a.m. to 8 p.m., serving both adults and children over 12 months old.

- Report ID: 4898

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urgent Care Centers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.