Retail Clinics Market Outlook:

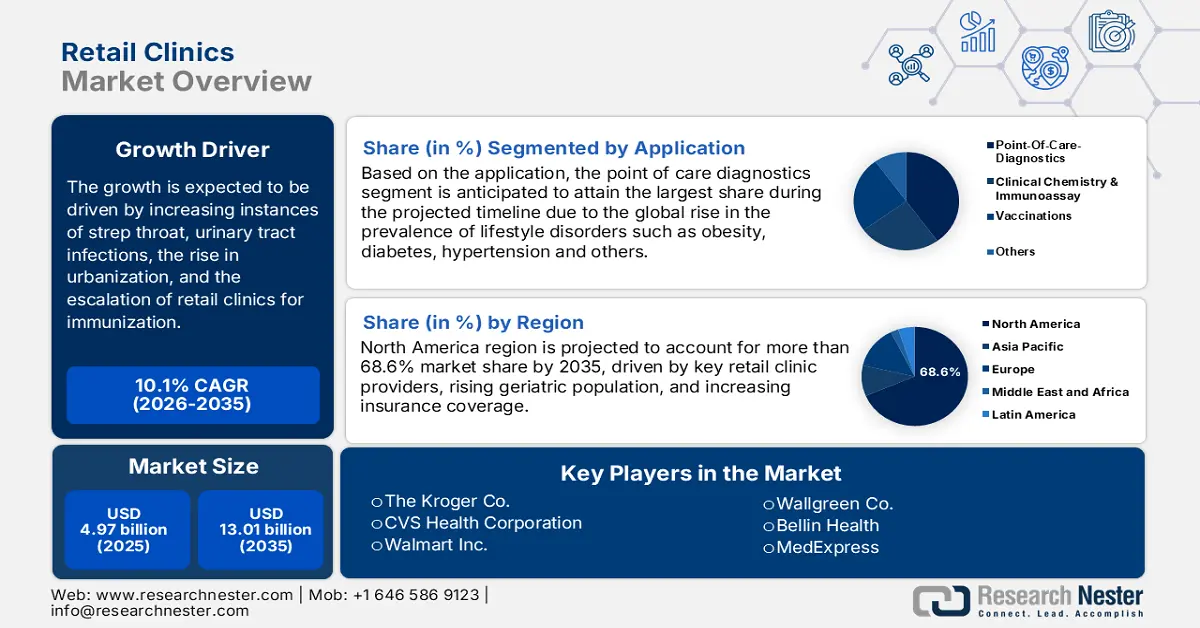

Retail Clinics Market size was over USD 4.97 Billion in 2025 and is poised to exceed USD 13.01 Billion by 2035, witnessing over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of retail clinics is estimated at USD 5.42 Billion.

The growth of the market is primarily ascribed to the increasing role of retail clinics by providing convenience in treating minor illness, preventive health screenings, and a good alternative for expensive emergency care for minor health conditions. For instance, up to 21% of visits to emergency rooms for non-emergencies are estimated to be preventable if they were made at retail clinics or urgent care centers, that result in yearly cost savings of up to USD 4 billion.

Since the start of pandemic to the post pandemic period, the burden on other conventional healthcare institutions has increased a lot. In such scenario, the role of retail clinics has emerged as a boon and more advantageous to deal with those health issues which are easy to diagnose and treat. According to the World Health Organization (WHO), In Africa region, there are only about two medical doctors for every 10,000 people, while there are only ten nurses and midwives for every 10,000 people. Furthermore, nearly 18 million more healthcare workers are required in low and lower-middle income nations.

Key Retail Clinics Market Insights Summary:

Regional Highlights:

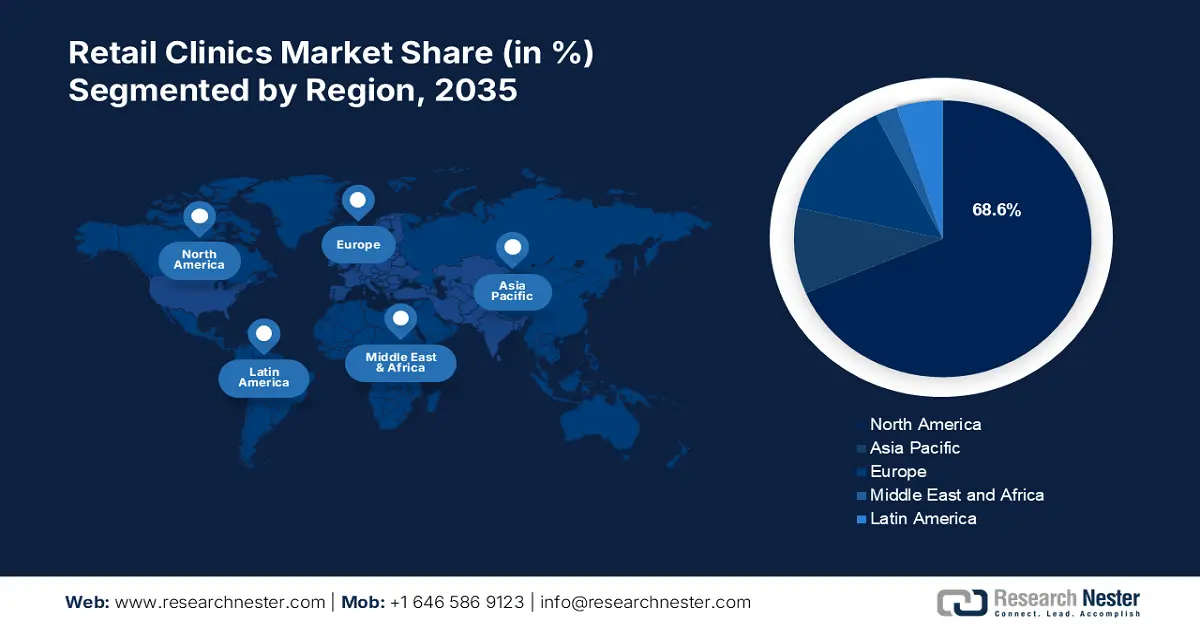

- The North America Retail Clinics Market will hold around 68.6% share by 2035, driven by key retail clinic providers, rising geriatric population, and increasing insurance coverage.

Segment Insights:

- The point-of-care diagnostics segment in the Retail Clinics Market is anticipated to achieve the largest share by 2035, driven by rising lifestyle disorders such as obesity, diabetes, and hypertension worldwide.

Key Growth Trends:

- Rise in Urbanization

- Escalation of Retail Clinics for Immunization

Major Challenges:

- Insufficient Infrastructure for Retail Clinics

- Inadequacy of Provision for Treating Complex Diseases

Key Players: The Kroger Co,CVS Health Corporation, Walmart Inc., Walgreen Co., Bellin Health, Concentra, Inc., MedExpress, Advocate Health Care, Kaiser Foundation Health Plan, Inc., Nextcare Claims Management LLC.

Global Retail Clinics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.97 Billion

- 2026 Market Size: USD 5.42 Billion

- Projected Market Size: USD 13.01 Billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (68.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Australia

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 9 September, 2025

Retail Clinics Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in Strep Throat Cases - Strep throat is a bacterial infection that leads to throat swelling and pain. The bacteria in group A Streptococcus end up causing this common condition. Children and adults of all ages get strep throat. However, it is especially common among children aged 5 to 15. Therefore, increasing cases of strep throat is one of the leading factors for the growth of retail clinics market. For instance, every year, approximately 610 million people globally contract strep throat, with many of them are children.

-

Global Upsurge in Urinary Tract Infection - Globally, there are anticipated to be 152 million UTI infection cases annually, costing more than USD 6.5 billion in direct medical expenses.

- Staggering Increase in COVID-19 Detection Tests - Austria had conducted the most COVID-19 tests per 1 million population among the countries which are most seriously affected by the pandemic as of September 12, 2022. Whereas, the United States has administered nearly over 1 billion COVID-19 tests in total.

- Rise in Urbanization – As per the World Bank, currently, more than 50% of the world's population resides in cities. The number of people living in urban areas is estimated to rise more than double to 6 billion by 2045.

- Escalation of Retail Clinics for Immunization – According to the Centers for Disease Control and Prevention, more than 266.5 million doses of the COVID-19 vaccine had been given and recorded by Federal Retail Pharmacy Program participants in the US as of September 15, 2022. This comprises are the 8 million doses given on-site to long-term care facilities. With more than 41,000 sites nationwide, the program has a total of 21 retail pharmacy partners.

Challenges

-

Insufficient Infrastructure for Retail Clinics – In the developing nations, owing to the slow rate of development and less GDP growth, insufficient amount of expense is spent on infrastructure for retail clinics. This trend is expected to pose as a challenge to market growth.

-

Inadequacy of Provision for Treating Complex Diseases

- Stringent Governmental Regulations

Retail Clinics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 4.97 Billion |

|

Forecast Year Market Size (2035) |

USD 13.01 Billion |

|

Regional Scope |

|

Retail Clinics Market Segmentation:

Application Segment Analysis

The global retail clinics market is segmented and analyzed for demand and supply by application into clinical chemistry & immunoassay, point-of-care diagnostics, vaccinations, and others. Out of these, the point-of-care diagnostics segment is estimated to garner the largest market size over the forecast period owing to the worldwide growing prevalence of various lifestyle disorders such as obesity, diabetes, hypertension, and other disorders. For instance, as per research, the total number of diabetes patients is estimated to upsurge to 641 million by 2030 and 786 million by 2045.

Our in-depth analysis of the global market includes the following segments:

|

By Location |

|

|

By Ownership |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Retail Clinics Market Regional Analysis:

North America region is projected to account for more than 68.6% market share by 2035, backed by the existence of key retail clinic providers, growing geriatric population, increasing prevalence of sinusitis infections, and sufficient insurance coverage provided by these retail clinics in the region. According to the Centers for Disease Control and Prevention, till 2022, the number of adults diagnosed with sinusitis in the United States have risen to 28.9 million.

Retail Clinics Market Players:

- The Kroger Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CVS Health Corporation

- Walmart Inc.

- Walgreen Co.

- Bellin Health

- Concentra, Inc.

- MedExpress

- Advocate Health Care

- Kaiser Foundation Health Plan, Inc.

- Nextcare Claims Management LLC

Recent Developments

-

CVS Health Corporation is ready to acquire Signify Health for USD 30.50 per share in cash, denoting a total transaction value of nearly USD 8 billion.

-

Walmart Inc. expands across North and Central Florida with the opening of its five new health centers, with a variety of health services including primary care, labs, X-ray and EKG, behavioral health and counseling, dental, optical, and hearing services.

- Report ID: 4411

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Retail Clinics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.