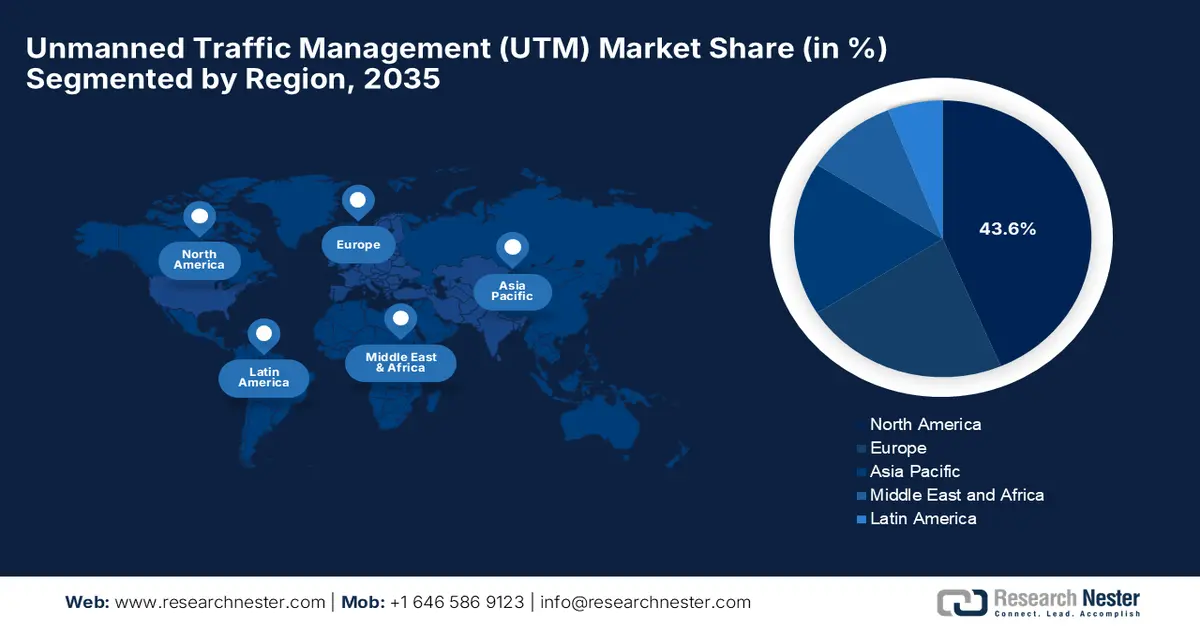

Unmanned Traffic Management Market - Regional Analysis

North America Market Insights

North America in the unmanned traffic management market will lead, capturing the largest revenue share of 43.6% over the forecasted years. The region’s dominance in this field is effectively attributable to advanced regulatory frameworks, high drone adoption, and robust ecosystem growth. In November 2025, uAvionix and OneSky announced that they had entered into a strategic partnership, integrating uAvionix’s FlightLine ADS-B traffic data into OneSky’s UTM platform, enabling real-time situational awareness for safer and scalable BVLOS operations. This integration fuses precise ADS-B data with OneSky’s decision-support tools, offering its support to rapid UTM deployment, low-altitude traffic detection, and compliance with FAA and global frameworks. Hence, such collaborations empower airspace operators, drone service providers, and UAM stakeholders with enhanced safety and improved operational efficiency.

The U.S. is the key growth engine for the progression of the regional unmanned traffic management (UTM) market, backed by the FAA’s progressive regulations and UTM pilot programs that have created a strong ecosystem for commercial and industrial drone operations. The country’s UTM market also benefits from several test sites for BVLOS operations, package delivery, and emergency response are being actively utilized, thereby enabling real-world data collection for system optimization. In May 2024, the FAA approved Amazon Prime Air to operate drones BVLOS by enabling the company to expand deliveries to more customers in the U.S. It utilizes advanced onboard detect-and-avoid technology, in which Amazon demonstrated safe navigation around aircraft and obstacles during FAA-observed flight tests. Furthermore, this authorization allows Prime Air to scale operations, integrate drones into its delivery network, and provide faster service with an expanded range of items.

U.S. Drone Registration and Pilot Certification Statistics (as of November 2025)

|

Metric |

Count |

|

Total Drones Registered |

837,513 |

|

Commercial Drone Registrations |

453,635 |

|

Recreational Flyer Registrations |

371,334 |

|

Paper Registrations |

12,544 |

|

Certificated Remote Pilots |

481,760 |

|

TRUST Certificates Issued |

1,226,168 |

Source: FAA

In Canada, the unmanned traffic management market is efficiently growing, which focuses heavily on enabling long-range and remote drone operations, particularly in terms of critical infrastructure monitoring and resource management. Simultaneously, Transport Canada has been working on regulatory frameworks that support both urban and rural UTM deployment, emphasizing environmental compliance and integration with existing air traffic control systems. In September 2025, Volatus Aerospace announced that it had received Transport Canada approval to expand its BVLOS operations by integrating MatrixSpace’s compact radar with Kongsberg Geospatial’s IRIS Terminal platform. This authorization enables scalable automated drone-in-a-box services for logistics, industrial monitoring, and wide-area surveillance, enhancing safety with advanced detect-and-avoid technology. In addition, the move positions Volatus as a leader in Canada’s industry by unlocking recurring revenue opportunities through autonomous, high-value missions.

APAC Market Insights

Asia Pacific is predicted to showcase the fastest growth in the unmanned traffic management market owing to the high drone usage in logistics, agriculture, and industrial inspections. Governments across the region are making investments in smart air traffic solutions and digital platforms to manage low-altitude airspace more efficiently. In this context, the NEDO, NEC, NTT DATA, and Hitachi reported that they have developed the international standard ISO 23629-5 for UAS traffic management in April 2023, which standardizes functional structures for safe and efficient drone operations in Japan. Besides, this framework enables global stakeholders to communicate using common terminology by improving coordination in system architecture, operation control, as well as data sharing. In addition, by defining crucial UTM functions such as registration, flight information management, and position data management, this standard supports safer, scalable drone integration across industries such as logistics, surveying, and inspection.

China is growing exponentially in the unmanned traffic management market, owing to the large-scale UTM deployments, which are leveraging drones for smart city applications, commercial deliveries, as well as industrial monitoring. Simultaneously, the government’s centralized air traffic initiatives, coupled with AI and 5G integration, are readily enhancing situational awareness and airspace coordination in the country. In December 2025, the Civil Aviation Administration of China (CAAC) released two mandatory national standards for UAVs, which are focused on real-name registration, activation, and operational identification. It also states that these regulations aim to enhance safety, ensure lawful operations, and support the orderly growth of China’s low-altitude economy, thereby providing a regulatory foundation for UTM systems. This also creates new, encouraging opportunities for UTM providers to integrate compliant traffic management solutions.

India has a strong scope to capitalize on the regional unmanned traffic management (UTM) market due to the growing use of drones in agriculture, e-commerce, and disaster management. Regulatory bodies in the country are introducing frameworks to facilitate BVLOS operations and real-time tracking. Simultaneously, the collaborative efforts with tech companies aim to create scalable airspace management platforms to ensure safe integration of drones into urban and rural areas is also propelling the continued growth of the country. In July 2024, Thales and Garuda Aerospace announced that they had signed an MoU to advance the drone ecosystem in India by combining Thales’ expertise in UTM solutions, UAV detection, and system integration with Garuda’s UAV manufacturing and UTM market knowledge. This collaboration aims to enable safe, secure, and scalable drone operations in the country, thereby supporting flight authorizations, airspace management, and long-term integration of advanced UTM technologies.

Europe Market Insights

Europe has gained a prominent position in the unmanned traffic management market is characterized by harmonized regulatory efforts under the European Union Aviation Safety Agency (EASA). Cross-border drone operations, urban air mobility trials, and industrial inspection projects are also efficiently driving adoption in this region. In addition, the regional UTM systems emphasize interoperability, data sharing, and automated conflict resolution to manage complex airspace safely. In this regard, Thales in December 2024 announced that it has partnered with Avinor to deploy Norway’s nationwide next-generation UTM system by integrating its Topsky-UAS platform powered by AstraUTM. It also mentioned that this system provides automated, real-time traffic management, compliance monitoring, along safe integration of unmanned and manned aircraft. Furthermore, this deployment supports proper drone operations, enhances situational awareness, and ensures regulatory compliance, thereby laying the foundation for advanced air mobility in the airspace.

Germany is the dominating player in the regional unmanned traffic management market, which is deploying UTM solutions to support industrial drones and urban air mobility programs. Smart infrastructure projects and research collaborations in this country are focused on airspace digitization, real-time flight planning, and emergency services integration. In February 2025, MyDefence announced that it is contributing to the BLU-Space project in Hamburg, which is a pioneering U-Space initiative aimed at enabling safe, automated, and efficient drone operations in complex urban airspace. It integrates advanced drone tracking sensor technology, which provides real-time air traffic data, and practical field testing, and the project sets operational standards for UTM, ensuring secure and coordinated integration of unmanned aircraft along with manned aviation. Furthermore, this collaboration positions MyDefence as a key player in shaping Europe’s urban airspace management and UTM infrastructure.

The U.K. also maintains a strong position in the unmanned traffic management (UTM) market owing to the implementation of UTM systems to enable commercial drone operations in logistics, healthcare, and public services. The Civil Aviation Authority in the country is proactively promoting trials for automated traffic management, BVLOS flights, and shared airspace utilization. In September 2025, Dronecloud announced that, in collaboration with RUAS and Velos Rotors, it had secured landmark UK Civil Aviation Authority approval to conduct 70 km of beyond visual line of sight drone flights across nine Network Rail routes. It utilizes Dronecloud’s UTM platform, wherein these flights ensure safe separation of aircraft and scalable, real-time monitoring for critical national infrastructure, reducing risk and operational disruption. Hence, this milestone marks the first large-scale deployment of UTM-enabled BVLOS operations in the UK, thereby paving the way for nationwide expansion and safer, more efficient rail services.

UK RPAS Statistics and Operational Data June 2024

|

Category |

Details |

|

Active Registered Drone Flyers & Operators (June 2024) |

601,980 |

|

Active Operators |

236,709 |

|

Active Flyers |

365,271 |

|

Active Remote Pilot Competency Qualification Holders |

18,500 approximately |

|

Active Specific Category Operational Authorisation Holders |

29,477 |

|

Active Recognised Assessment Entities |

26 |

|

Independent Flying Associations |

4 |

|

RPAS Accidents / Serious Incidents (2023) |

80 |

|

% Loss of Control Incidents |

70% (56 incidents) |

|

% System / Component Failure Incidents |

21.3% |

Source: CAA