Global Unmanned Traffic Management (UTM) Market

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Variables (Dependent and independent)

2.2. Multi Factor Based Sensitivity Model

3. Executive Summary - Global Unmanned Traffic Management (UTM) Market

4. Assessment of The Trends of Unmanned Traffic Management (UTM) Market

5. Regulatory and Standards Landscape

6. Analysis of Stages of Unmanned Traffic Management (UTM)

6.1. Research

6.2. Development

6.3. Testing

6.4. Implementation

7. Analysis of Competitive Landscape in Unmanned Traffic Management (UTM) Market

7.1. New Product Development

7.2. Partnerships, Agreements & Collaborations

7.3. Expansions

7.4. Others

8. Opportunity Mapping in Unmanned Traffic Management (UTM) Market

9. Analysis of Technological Adoption in Unmanned Traffic Management (UTM) Market

9.1.Blockchain Technology

o Study on Blockchain Vendors

o Application Analysis for End User Verticals

o Logistics & Transportation

o Energy & Utilities

o Medical Logistics

o Public Security

o Agriculture & forestry

o Surveillance & Monitoring

o Trend Analysis in Unmanned Traffic Management (UTM)

o Assessment on The Applicability in North America, Europe, Asia Pacific, Latin America & Middle East and Africa

9.2. Cloud Computing

o Study on Cloud Computing Vendors

o Application Analysis for End User Verticals

o Trend Analysis in Unmanned Traffic Management (UTM)

o Assessment on The Applicability in North America, Europe, Asia Pacific, Latin America & Middle East and Africa

9.3.Augmented Reality

o Study on Augmented Reality Vendors

o Application Analysis for End User Verticals

o Trend Analysis in Unmanned Traffic Management (UTM)

o Assessment on The Applicability in North America, Europe, Asia Pacific, Latin America & Middle East and Africa

9.4. Internet of Things (IoT)

o Study on IoT Vendors

o Application Analysis for End User Verticals

o Trend Analysis in Unmanned Traffic Management (UTM)

o Assessment on The Applicability in North America, Europe, Asia Pacific, Latin America & Middle East and Africa

9.5. Automation

o Study on IoT Vendors

o Application Analysis for End User Verticals

o Trend Analysis in Unmanned Traffic Management (UTM)

o Assessment on The Applicability in North America, Europe, Asia Pacific, Latin America & Middle East and Africa

10. Market Dynamics

10.1. Drivers

10.2. Restraints

11. Unmanned Traffic Management (UTM) Market – Value Chain Analysis

12. Global Unmanned Traffic Management (UTM) Market Outlook

12.1. Market Size and forecast, 2018-2027

o By Value (USD Million)

12.2. Global Unmanned Traffic Management (UTM) Market Segmentation, 2018-2027

o By Regions, 2018-2028f

· North America (U.S. and Canada)

· Latin America (Brazil, Mexico, Argentina, Rest of Latin America)

· Europe (Germany, UK, France, Italy, Spain, Hungary, Poland, Turkey, Russia, Rest of Europe)

· Asia-Pacific (China, India, Japan, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia Pacific)

· Middle East and Africa (Israel, GCC, North Africa, South Africa, Rest of Middle East and Africa)

o By Component

· Hardware, 2018-2028f (USD Million)

· Software, 2018-2028f (USD Million)

· Services, 2018-2028f (USD Million)

· Flight Services, 2018-2028f (USD Million)

· Information Services, 2018-2028f (USD Million)

· Security Services, 2018-2028f (USD Million)

o By Type

· Persistent UTM, 2018-2028f (USD Million)

· Non-Persistent UTM, 2018-2028f (USD Million)

o By Solution

· Navigation Infrastructure, 2018-2028f (USD Million)

· Surveillance Infrastructure, 2018-2028f (USD Million)

· Communication infrastructure, 2018-2028f (USD Million)

· Others, 2018-2028f (USD Million)

o By End-Use

· Logistics & Transportation, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

· Medical Logistics, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

· Surveillance and Monitoring, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

· Agriculture and Forestry, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

· Public and Security, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

· Energy and Utility, 2018-2028f (USD Million)

· Assessment of Unmanned Traffic Management (UTM) Providers

· Evaluation of Cost Trends

· Study on UTM Users

· Technological Analysis

12.3. North America Unmanned Traffic Management (UTM) Market, 2018-2027 (USD Million)

o By Component

o By Type

o By Solution

o By End-Use

o By Country

· US, 2018-2028f (USD Million)

· Canada, 2018-2028f (USD Million)

12.3. Europe Unmanned Traffic Management (UTM) Market, 2018-2027 (USD Million)

o By Component

o By Type

o By Solution

o By End-Use

o By Country

· Germany, 2018-2028f (USD Million)

· UK, 2018-2028f (USD Million)

· Germany, 2018-2028f (USD Million)

· UK, 2018-2028f (USD Million)

· France, 2018-2028f (USD Million)

· Italy, 2018-2028f (USD Million)

· Spain, 2018-2028f (USD Million)

· Poland, 2018-2028f (USD Million)

· Hungary, 2018-2028f (USD Million)

· Turkey, 2018-2028f (USD Million)

· Russia, 2018-2028f (USD Million)

· Rest of Europe, 2018-2028f (USD Million)

12.3. Asia-Pacific Unmanned Traffic Management (UTM) Market, 2018-2027 (USD Million)

o By Component

o By Type

o By Solution

o By End-Use

o By Country

· China, 2018-2028f (USD Million)

· India, 2018-2028f (USD Million)

· Japan, 2018-2028f (USD Million)

· South Korea, 2018-2028f (USD Million)

· Indonesia, 2018-2028f (USD Million)

· Malaysia, 2018-2028f (USD Million)

· Australia, 2018-2028f (USD Million)

· Rest of Asia-Pacific, 2018-2028f (USD Million)

12.3. Latin America Unmanned Traffic Management (UTM) Market, 2018-2027 (USD Million)

o By Component

o By Type

o By Solution

o By End-Use

o By Country

· Brazil, 2018-2028f (USD Million)

· Mexico, 2018-2028f (USD Million)

· Argentina, 2018-2028f (USD Million)

· Rest of Latin America, 2018-2028f (USD Million)

12.3. Middle East and Africa (MEA) Unmanned Traffic Management (UTM) Market, 2018-2027 (USD Million)

o By Component

o By Type

o By Solution

o By End-Use

o By Country

· Israel, 2018-2028f (USD Million)

· GCC, 2018-2028f (USD Million)

· North Africa, 2018-2028f (USD Million)

· South Africa, 2018-2028f (USD Million)

· Rest of MEA, 2018-2028f (USD Million)

13. Competitive Landscape

13.1. Frequentis AG

13.2. Lockheed Martin

13.3. Leonardo

13.4. Thales Group

13.5. Harris

13.6. GE Aviation (GE Co.)

13.7. Airmap, Inc.

13.8. Altitude Angel

13.9. Nokia

13.10. Rockwell Collins

13.11. Unifly NV

13.12. Precision Hawk

Unmanned Traffic Management Market Outlook:

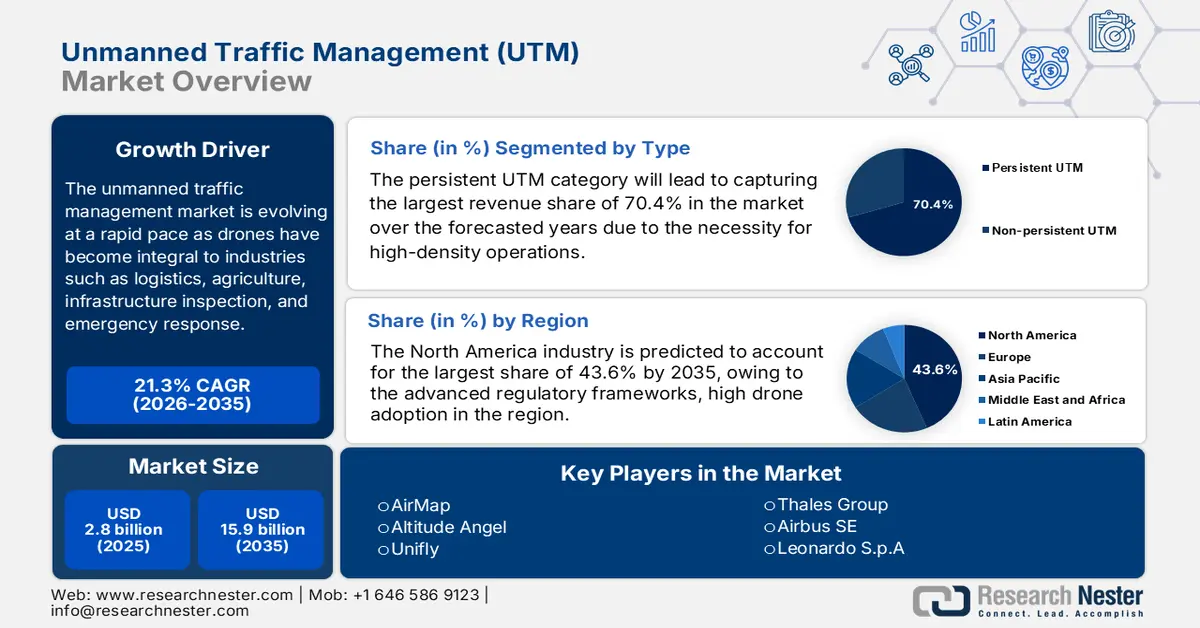

Unmanned Traffic Management Market size was valued at USD 2.8 billion in 2025 and is projected to reach USD 15.9 billion by the end of 2035, rising at a CAGR of 21.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of unmanned traffic management is evaluated at USD 3.4 billion.

The UTM market is evolving at a rapid pace as drones have become integral to industries such as logistics, agriculture, infrastructure inspection, and emergency response. In this regard, the FAA, in collaboration with NASA and industry, in November 2022, reported that it is developing and validating UAS traffic management concepts, systems engineering requirements, and operational capabilities to manage diverse beyond visual line of sight operations below 400 feet. It also mentioned the key drivers, which include the growing variety of UAS operations, the need for efficient management in complex airspace, and integrated information governance. Moreover, the outcomes are focused on creating an interoperable ecosystem with secure data exchange, enterprise services that support a unified information environment, and systems engineering designs that inform future policies, regulations, and standards.

Furthermore, there has been an increased adoption of beyond-visual-line-of-sight operations, the push for standardization, and integration with traditional air traffic management. The unmanned traffic management (UTM) market is poised for extensive growth in the upcoming years as UTM becomes essential for managing complex airspace, encouraging the pioneers to expand commercial drone operations. In September 2025, ANRA Technologies announced that it had expanded into Dubai after winning the Dubai UTM competition by establishing a regional hub to manage the Emirate’s next-generation UTM platform and support safe, scalable drone operations within the Dubai control traffic area. In addition, this expansion builds on ANRA’s FAA-approved UTM deployments in the U.S. and EASA-certified U-space services in Europe, reinforcing its global footprint. The Dubai office will facilitate collaboration with government, commercial, and defense partners by also advancing digital airspace solutions, advanced air mobility services, and vertiport management systems, hence positively impacting UTM market growth.

Key Unmanned Traffic Management Market Insights Summary:

Regional Highlights:

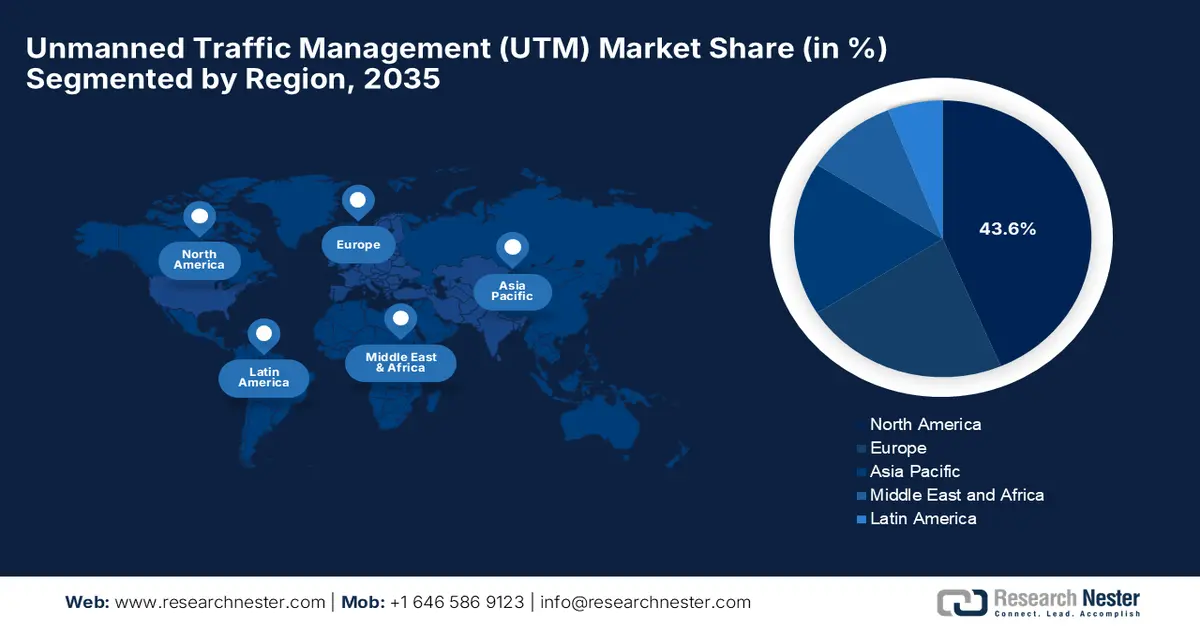

- North America is forecast to secure a 43.6% revenue share by 2035 in the unmanned traffic management market, supported by mature regulatory frameworks, high drone adoption, and a strong ecosystem reinforced through strategic UTM platform collaborations.

- Asia Pacific is projected to witness the fastest expansion through 2035, stimulated by extensive drone usage across logistics, agriculture, and industrial inspections alongside rising government investments in smart low-altitude airspace management systems.

Segment Insights:

- The persistent UTM category is expected to command a 70.4% revenue share by 2035 in the unmanned traffic management market, strengthened by the requirement for continuous monitoring and coordinated control to manage high-density drone operations and routine BVLOS missions.

- By 2035, the software platforms segment is anticipated to grow at a notable rate, accelerated by the rising need for real-time data exchange, automated flight planning, and conflict management to safely orchestrate complex low-altitude drone traffic.

Key Growth Trends:

- Increasing adoption of drones across industries

- Technological advancements

Major Challenges:

- Regulatory and standardization challenges

- Technical integration and interoperability restraints

Key Players: Altitude Angel (UK), Unifly (Belgium), Thales Group (France), Airbus SE (Netherlands/Europe), Leonardo S.p.A. (Italy), Lockheed Martin Corporation (U.S.), Frequentis AG (Austria), L3Harris Technologies (U.S.), Raytheon Technologies (U.S.), OneSky Systems (U.S.), Droniq (Germany), Skyward IO (U.S.), ANRA Technologies (U.S.), Terra Drone Corporation (Japan).

Global Unmanned Traffic Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 3.4 billion

- Projected Market Size: USD 15.9 billion by 2035

- Growth Forecasts: 21.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 5 January, 2026

Unmanned Traffic Management Market - Growth Drivers and Challenges

Growth Drivers

- Increasing adoption of drones across industries: The rise in commercial and industrial drone use for delivery, agriculture, surveillance, infrastructure inspection, and emergency services is a primary progressing factor for the unmanned traffic management (UTM) market. In this regard, the FAA in July 2024 announced that it had authorized multiple commercial drone operators, which include Zipline and Wing Aviation, to operate in the same airspace in Dallas using unmanned aircraft system traffic management technology. It also mentioned that this allowed safe coordination of beyond visual line of sight flights below 400 feet, wherein operators are sharing flight data and routes to prevent any type of conflicts. Hence, such initiatives represent a key step toward routine, large-scale drone operations by also maintaining FAA safety oversight.

- Technological advancements: The improvements in terms of AI, machine learning, 5G, and real-time data analytics are key enablers that enhance UTM capabilities, driving consistent business in the unmanned traffic management market. In November 2025, Terra Drone’s group company Unifly demonstrated the results of the spatio project in Romania, showcasing its technologies for collision avoidance during flight planning and safe flight separation management during drone operations. Besides, the project involved multiple companies and research institutions from Europe, validating UTM solutions for safe, efficient airspace use, and by also supporting future regulatory frameworks. In addition, Unifly’s platform integrates advanced UTM capabilities, enabling real-world deployment and addressing the growing complexity of autonomous drone and urban air mobility operations.

- Supportive regulatory frameworks: This, coupled with the suitable government initiatives, is developing regulations that promote safe drone integration into national airspaces, propelling the unmanned traffic management market growth. As of the May 2022 report from the FAA, the UTM pilot program was established under the FAA Extension, Safety, and Security Act to develop and demonstrate capabilities for safely integrating small unmanned aircraft systems into the national airspace system. Phase 1 was focused on flight intent sharing, notifications, and UAS Volume Reservations with FAA UAS Test Sites, whereas Phase 2 tested remote identification technologies and higher-density operations. Furthermore, UPP provides a proof of concept for a cloud-based UTM ecosystem, supporting enterprise services, situational awareness, and cooperative separation, laying the groundwork for broader BVLOS operations and future UTM deployment.

Challenges

- Regulatory and standardization challenges: One of the biggest challenges in the unmanned traffic management market is the absence of proper global regulations and standards. Drone operations are mostly governed by country-specific aviation authorities, which results in fragmented rules for airspace access, data sharing, certification, and BVLOS approvals. Therefore, this makes it difficult for the UTM providers to scale solutions across regions and results in burgeoning costs for operators. To address these concerns, progress is being made through frameworks such as FAA BVLOS rules and EASA’s U-space, whereas alignment between jurisdictions is still limited. Furthermore, this slow pace of regulatory approvals can cause a delay in commercial deployments and create uncertainty for technology developers who are looking for long-term adoption of UTM platforms.

- Technical integration and interoperability restraints: This is yet another major restraint in the unmanned traffic management (UTM) market since the UTM systems must integrate with existing air traffic management, telecom networks, surveillance systems, and diverse drone hardware. In this context, achieving data exchange across multiple stakeholders, air navigation service providers, operators, law enforcement, and emergency services, is technically very complex. Simultaneously, the differences in terms of communication protocols, data formats, and system architectures can lead to interoperability gaps in this field. In addition, reliable performance in dense urban environments, which have limited connectivity, is also a major burden in this field. Since the drone traffic is continuously increasing, UTM platforms must scale without latency or system failures. Hence, the existence of these technical hurdles requires continuous investment in software architecture, making it challenging for pioneers from price-sensitive regions.

Unmanned Traffic Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

21.3% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 15.9 billion |

|

Regional Scope |

|

Unmanned Traffic Management Market Segmentation:

Type Segment Analysis

The persistent UTM category will lead to capturing the largest revenue share of 70.4% in the unmanned traffic management market over the forecasted years. The subtype provides continuous, long-term monitoring and coordination of drone flights, which is especially necessary for high-density operations such as logistics and BVLOS missions. These capabilities are essential for handling increasingly complex airspace, which is a core goal of UTM. According to the article published by NASA in December 2024, it highlighted its work with the FAA to enable beyond visual line of sight commercial drone flights in shared airspace using UTM technology. In addition, UTM allows multiple operators to share flight plans, coordinate strategically, and maintain situational awareness for safe operations below 400 feet. Furthermore, this research is advancing the safe deployment of drone package deliveries and other small UAS operations across the U.S., laying the groundwork for routine commercial BVLOS flights.

Component Segment Analysis

By the conclusion of 2035 software platforms segment is anticipated to grow at a considerable rate in the unmanned traffic management market. The growth of the subsegment is highly attributable to its capability in enabling real-time data exchange, flight planning, conflict avoidance, and automation of core UTM functions, which are highly essential to safely managing low-altitude drone traffic. Besides, there has been an increasing adoption of BVLOS operations and integration with Remote ID technologies, which require robust software solutions for tracking and situational awareness. In addition, the rising deployment of drones across logistics, infrastructure inspection, and public safety applications is efficiently driving demand for scalable, automated traffic management platforms. Furthermore, the continuous advancements in AI, machine learning, and cloud-based analytics enhance the efficiency and reliability of software platforms, solidifying their role in the UTM ecosystem.

Application Segment Analysis

In the unmanned traffic management (UTM) market, the logistics & transportation segment will capture a significant revenue share during the forecasted years. The subtype represents one of the fastest real uses of drones, whereas most of the governing bodies are focused on safe coordination of drone operations. In December 2025, the U.S. Transportation Secretary introduced the nation’s first-ever advanced air mobility national strategy, outlining 40 recommendations to safely integrate highly automated aircraft for passenger and cargo transport. The strategy emphasizes modern infrastructure, airspace management, workforce development, and automation to enhance logistics, medical, and emergency operations. This initiative positions the U.S. to lead in next-generation aviation by also enabling efficient and safe deployment of drones and eVTOLs across urban and rural areas, hence denoting a wider segment scope.

Our in-depth analysis of the unmanned traffic management market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Component |

|

|

Application |

|

|

Solution |

|

|

End user |

|

|

Technology |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Unmanned Traffic Management Market - Regional Analysis

North America Market Insights

North America in the unmanned traffic management market will lead, capturing the largest revenue share of 43.6% over the forecasted years. The region’s dominance in this field is effectively attributable to advanced regulatory frameworks, high drone adoption, and robust ecosystem growth. In November 2025, uAvionix and OneSky announced that they had entered into a strategic partnership, integrating uAvionix’s FlightLine ADS-B traffic data into OneSky’s UTM platform, enabling real-time situational awareness for safer and scalable BVLOS operations. This integration fuses precise ADS-B data with OneSky’s decision-support tools, offering its support to rapid UTM deployment, low-altitude traffic detection, and compliance with FAA and global frameworks. Hence, such collaborations empower airspace operators, drone service providers, and UAM stakeholders with enhanced safety and improved operational efficiency.

The U.S. is the key growth engine for the progression of the regional unmanned traffic management (UTM) market, backed by the FAA’s progressive regulations and UTM pilot programs that have created a strong ecosystem for commercial and industrial drone operations. The country’s UTM market also benefits from several test sites for BVLOS operations, package delivery, and emergency response are being actively utilized, thereby enabling real-world data collection for system optimization. In May 2024, the FAA approved Amazon Prime Air to operate drones BVLOS by enabling the company to expand deliveries to more customers in the U.S. It utilizes advanced onboard detect-and-avoid technology, in which Amazon demonstrated safe navigation around aircraft and obstacles during FAA-observed flight tests. Furthermore, this authorization allows Prime Air to scale operations, integrate drones into its delivery network, and provide faster service with an expanded range of items.

U.S. Drone Registration and Pilot Certification Statistics (as of November 2025)

|

Metric |

Count |

|

Total Drones Registered |

837,513 |

|

Commercial Drone Registrations |

453,635 |

|

Recreational Flyer Registrations |

371,334 |

|

Paper Registrations |

12,544 |

|

Certificated Remote Pilots |

481,760 |

|

TRUST Certificates Issued |

1,226,168 |

Source: FAA

In Canada, the unmanned traffic management market is efficiently growing, which focuses heavily on enabling long-range and remote drone operations, particularly in terms of critical infrastructure monitoring and resource management. Simultaneously, Transport Canada has been working on regulatory frameworks that support both urban and rural UTM deployment, emphasizing environmental compliance and integration with existing air traffic control systems. In September 2025, Volatus Aerospace announced that it had received Transport Canada approval to expand its BVLOS operations by integrating MatrixSpace’s compact radar with Kongsberg Geospatial’s IRIS Terminal platform. This authorization enables scalable automated drone-in-a-box services for logistics, industrial monitoring, and wide-area surveillance, enhancing safety with advanced detect-and-avoid technology. In addition, the move positions Volatus as a leader in Canada’s industry by unlocking recurring revenue opportunities through autonomous, high-value missions.

APAC Market Insights

Asia Pacific is predicted to showcase the fastest growth in the unmanned traffic management market owing to the high drone usage in logistics, agriculture, and industrial inspections. Governments across the region are making investments in smart air traffic solutions and digital platforms to manage low-altitude airspace more efficiently. In this context, the NEDO, NEC, NTT DATA, and Hitachi reported that they have developed the international standard ISO 23629-5 for UAS traffic management in April 2023, which standardizes functional structures for safe and efficient drone operations in Japan. Besides, this framework enables global stakeholders to communicate using common terminology by improving coordination in system architecture, operation control, as well as data sharing. In addition, by defining crucial UTM functions such as registration, flight information management, and position data management, this standard supports safer, scalable drone integration across industries such as logistics, surveying, and inspection.

China is growing exponentially in the unmanned traffic management market, owing to the large-scale UTM deployments, which are leveraging drones for smart city applications, commercial deliveries, as well as industrial monitoring. Simultaneously, the government’s centralized air traffic initiatives, coupled with AI and 5G integration, are readily enhancing situational awareness and airspace coordination in the country. In December 2025, the Civil Aviation Administration of China (CAAC) released two mandatory national standards for UAVs, which are focused on real-name registration, activation, and operational identification. It also states that these regulations aim to enhance safety, ensure lawful operations, and support the orderly growth of China’s low-altitude economy, thereby providing a regulatory foundation for UTM systems. This also creates new, encouraging opportunities for UTM providers to integrate compliant traffic management solutions.

India has a strong scope to capitalize on the regional unmanned traffic management (UTM) market due to the growing use of drones in agriculture, e-commerce, and disaster management. Regulatory bodies in the country are introducing frameworks to facilitate BVLOS operations and real-time tracking. Simultaneously, the collaborative efforts with tech companies aim to create scalable airspace management platforms to ensure safe integration of drones into urban and rural areas is also propelling the continued growth of the country. In July 2024, Thales and Garuda Aerospace announced that they had signed an MoU to advance the drone ecosystem in India by combining Thales’ expertise in UTM solutions, UAV detection, and system integration with Garuda’s UAV manufacturing and UTM market knowledge. This collaboration aims to enable safe, secure, and scalable drone operations in the country, thereby supporting flight authorizations, airspace management, and long-term integration of advanced UTM technologies.

Europe Market Insights

Europe has gained a prominent position in the unmanned traffic management market is characterized by harmonized regulatory efforts under the European Union Aviation Safety Agency (EASA). Cross-border drone operations, urban air mobility trials, and industrial inspection projects are also efficiently driving adoption in this region. In addition, the regional UTM systems emphasize interoperability, data sharing, and automated conflict resolution to manage complex airspace safely. In this regard, Thales in December 2024 announced that it has partnered with Avinor to deploy Norway’s nationwide next-generation UTM system by integrating its Topsky-UAS platform powered by AstraUTM. It also mentioned that this system provides automated, real-time traffic management, compliance monitoring, along safe integration of unmanned and manned aircraft. Furthermore, this deployment supports proper drone operations, enhances situational awareness, and ensures regulatory compliance, thereby laying the foundation for advanced air mobility in the airspace.

Germany is the dominating player in the regional unmanned traffic management market, which is deploying UTM solutions to support industrial drones and urban air mobility programs. Smart infrastructure projects and research collaborations in this country are focused on airspace digitization, real-time flight planning, and emergency services integration. In February 2025, MyDefence announced that it is contributing to the BLU-Space project in Hamburg, which is a pioneering U-Space initiative aimed at enabling safe, automated, and efficient drone operations in complex urban airspace. It integrates advanced drone tracking sensor technology, which provides real-time air traffic data, and practical field testing, and the project sets operational standards for UTM, ensuring secure and coordinated integration of unmanned aircraft along with manned aviation. Furthermore, this collaboration positions MyDefence as a key player in shaping Europe’s urban airspace management and UTM infrastructure.

The U.K. also maintains a strong position in the unmanned traffic management (UTM) market owing to the implementation of UTM systems to enable commercial drone operations in logistics, healthcare, and public services. The Civil Aviation Authority in the country is proactively promoting trials for automated traffic management, BVLOS flights, and shared airspace utilization. In September 2025, Dronecloud announced that, in collaboration with RUAS and Velos Rotors, it had secured landmark UK Civil Aviation Authority approval to conduct 70 km of beyond visual line of sight drone flights across nine Network Rail routes. It utilizes Dronecloud’s UTM platform, wherein these flights ensure safe separation of aircraft and scalable, real-time monitoring for critical national infrastructure, reducing risk and operational disruption. Hence, this milestone marks the first large-scale deployment of UTM-enabled BVLOS operations in the UK, thereby paving the way for nationwide expansion and safer, more efficient rail services.

UK RPAS Statistics and Operational Data June 2024

|

Category |

Details |

|

Active Registered Drone Flyers & Operators (June 2024) |

601,980 |

|

Active Operators |

236,709 |

|

Active Flyers |

365,271 |

|

Active Remote Pilot Competency Qualification Holders |

18,500 approximately |

|

Active Specific Category Operational Authorisation Holders |

29,477 |

|

Active Recognised Assessment Entities |

26 |

|

Independent Flying Associations |

4 |

|

RPAS Accidents / Serious Incidents (2023) |

80 |

|

% Loss of Control Incidents |

70% (56 incidents) |

|

% System / Component Failure Incidents |

21.3% |

Source: CAA

Key Unmanned Traffic Management Market Players:

- AirMap (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altitude Angel (UK)

- Unifly (Belgium)

- Thales Group (France)

- Airbus SE (Netherlands/Europe)

- Leonardo S.p.A. (Italy)

- Lockheed Martin Corporation (U.S.)

- Frequentis AG (Austria)

- L3Harris Technologies (U.S.)

- Raytheon Technologies (U.S.)

- OneSky Systems (U.S.)

- Droniq (Germany)

- Skyward IO (U.S.)

- ANRA Technologies (U.S.)

- Terra Drone Corporation (Japan)

- AirMap, based in the U.S. and is a leader in UTM platforms, which is offering scalable cloud-native solutions for real-time airspace intelligence, automated flight authorization, geofencing, and regulatory compliance. This, in turn that supports commercial drone operators, governments, and ANSPs across the globe. The firm is mainly focused on partnerships with airports, regulators, and drone manufacturers, acquisitions, and investment in AI and cybersecurity to enhance platform capabilities.

- Altitude Angel provides the GuardianUTM platform, which is a cloud-based traffic management system having dynamic conflict detection, automated airspace services, and integration with existing ATM systems. The company’s growth strategy is mainly focused on interoperability, international expansion through collaborations with telecoms and air navigation service providers, and ongoing R&D in AI and data analytics.

- Unifly is a frontrunner in this field, which specializes in modular, cloud-based UTM and drone telematics services that facilitate real-time airspace awareness, flight planning, and compliance monitoring. In addition, the firm’s open architecture supports integration with third-party applications and regulatory frameworks across Europe, Asia, and the Middle East, supported by extensive support from a strong R&D focus and partnerships with mapping and tech providers.

- Thales Group leverages both aerospace and defense expertise in the UTM market by offering end-to-end, secure, and interoperable traffic management solutions for civil, government, and defense customers. Integrating UTM with traditional ATM systems, investing in cybersecurity and analytics, and securing long-term contracts with ANSPSs are a few strategies opted for by the firm to secure its global UTM market position.

- Airbus SE is a Europe-based aerospace giant that has major operations across Europe and delivers advanced UTM systems integrating real-time flight tracking, risk assessment, and compliance features. Airbus is mainly focused on strategic investments, pilot projects, and partnerships with regulators to enable safe integration of UTM with broader aviation and urban air mobility ecosystems, hence attracting a wider customer base.

Below is the list of some prominent players operating in the global UTM market:

The unmanned traffic management market hosts both aerospace pioneers and technology firms that are competing in terms of continued innovations, partnerships, and platform integrations. Established defense and aviation companies such as Thales, Airbus, and Leonardo leverage their deep air traffic management expertise to develop safety-centric UTM systems, whereas technology-focused players such as AirMap, Altitude Angel, and Unifly drive software innovations. In this regard, High Lander and Starling Inc. in November 2025 announced that they entered into a partnership to integrate Starling’s long-range eVTOL Pathfinder-X and autonomous dock with High Lander’s FAA-compliant BVLOS operations, fleet management, and UTM platforms. This collaboration enables scalable, end-to-end BVLOS missions for commercial, public safety, and homeland security use cases, thereby combining hardware with real-time airspace management and regulatory support.

Corporate Landscape of the Unmanned Traffic Management Market:

Recent Developments

- In November 2025, NAV CANADA announced a significant update to its NAV Drone app, expanding support for advanced drone operations in line with Transport Canada’s 2025 regulations and strengthening the integration of drones into enterprise.

- In September 2025, ANRA Technologies announced that it had been appointed by Dubai Aviation Engineering Projects and Dubai Air Navigation Services to develop a next-generation UTM platform for safe and scalable drone operations across Dubai’s airspace, which will enable real-time monitoring, flight authorization, and conflict management.

- In May 2025, Flytrex and Wing notified that they became the first commercial drone delivery companies in the U.S. to implement daily strategic flight coordination in shared airspace. By exchanging flight intent data and automatically deconflicting routes, both companies safely operate overlapping delivery services without manual coordination.

- In January 2025, Aloft announced the launch of its new UTM SDK, which enables drone hardware manufacturers and software providers to integrate FAA-approved airspace services, real-time telemetry, and compliance tools directly into their platforms.

- Report ID: 2539

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Unmanned Traffic Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.