UV Coatings Market Outlook:

UV Coatings Market size was valued at USD 5 billion in 2024 and is projected to reach USD 12.9 billion by the end of 2034, rising at a CAGR of 10.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of UV coatings is evaluated at USD 5.9 billion.

The global UV coatings market is experiencing continued growth due to strict regulations concerning the use of low-VOC (volatile organic compound) and non-hazardous coatings. Regulatory initiatives, such as the U.S. Environmental Protection Agency’s (EPA) TSCA Chemical Substance Inventory and The European Union REACH Regulation, are creating pressure to reduce VOC emissions. Further, this is driving an increase in the use of UV-cured alternatives. The U.S. EPA has reported that VOC emissions from industrial coatings amount to almost 8% of all hazardous air pollutants in the U.S. The EU has also initiated the Circular Economy Action Plan, whose proposals will promote coatings that are more sustainable. In addition, the Chinese government has released its 14th Five-Year Plan that places a priority on green manufacturing. These regulations will lead UV coatings to sustain a demand growth of 9-11% CAGR during the next decade.

The supply chain of UV coatings primarily consists of raw materials like acrylic oligomers, photo initiators, and monomers, primarily obtained from petrochemical centers. The U.S. Producer Price Index (PPI) for industrial chemicals increased 4.1% YoY in 2023. The only thing that may have eased standing pressures has been an 11% increase in global UV coatings exports from Germany. Further, as per the 2023 report by the United Nations Industrial Development Organization (UNIDO), the expansion of assembly lines, notably in Southeast Asia, has added 7% this year in manufacturing capacity. Both Vietnam and Thailand are developing en route manufacturing centers. However, trade issues and adaptations are still in force. For instance, UV coatings imports to the U.S. had declined by 4% in 2023. Some of this may be attributed to tariff policies.

UV Coatings Market - Growth Drivers and Challenges

Growth Drivers

- Stringent environmental regulations: Recent changes from agencies like the U.S. EPA’s TSCA revisions have heightened compliance demands. Additionally, the EU REACH regulation imposes severe restrictions on hazardous substances. This is creating a shift away from high-VOC, solvent-based coatings. These regulations buoy the demand for environmentally-compliant UV coatings. Plus, the heightened awareness of air quality and humans’ interaction with the space has driven the demand for UV coatings with low VOC products. These coatings comply to some extent with environmental standards in various countries and are in high demand by consumers who are leaning towards sustainability.

- Advancements in catalytic and photoinitiator technologies: The introduction of new catalytic processes and improved photoinitiators has increased the effective production efficiency of UV coatings by 18%. This has provided considerable reductions in curing times and energy consumption. Further, this has led to lower costs and sustainability benefits that will promote more widespread use of UV coatings in industry. The green chemicals market is expected to grow as demand for renewable base materials and sustainable manufacturing processes increases. This growth is boosting the ultraviolet (UV) coatings market as companies willingly develop bio-based monomers and oligomers that integrate into the resins they currently use.

- Sustainability and carbon footprint reduction initiatives: In recent years, the push to cut down on carbon footprints has led coating manufacturers to embrace renewable chemicals. This shift also caters to environmentally conscious customers. Industries like automotive, electronics, food & beverage, packaging, and furniture are increasingly turning to UV coatings due to their impressive durability and quick curing times.

Expanding Operational and Manufacturing Capacities in Ultraviolet (UV) Coatings Market

Top 5 Global UV Coatings Producers: Plant Locations & Capacities

|

Company |

HQ |

Annual Capacity (Metric Tons) |

Market Share (2023) |

|

BASF |

Germany |

1,300,000 |

17% |

|

PPG Industries |

USA |

940,000 |

15% |

|

AkzoNobel |

Netherlands |

910,000 |

14% |

|

Sherwin-Williams |

USA |

840,000 |

11% |

|

DSM |

Netherlands |

700,000 |

10% |

Source: Company Annual Reports (2023), ICIS Production Database

Ultraviolet (UV) Coatings Market Production Data Analysis (2019-2024)

Annual Production Volumes (Metric Tons)

|

Company |

2019 |

2020 |

2021 |

2022 |

2023 |

CAGR |

|

BASF |

1,050K |

1,000K |

1,150K |

1,140K |

1,200K |

3.3% |

|

PPG Industries |

800K |

820K |

880K |

910K |

950K |

4.2% |

|

AkzoNobel |

750K |

780K |

830K |

870K |

900K |

4.5% |

Emerging Trade Dynamics in Ultraviolet (UV) Coatings Market: Market Impact (2019-2024)

UV Coatings Trade Data (2019-2024)

Top Import/Export Countries ($ Million)

|

Year |

Top Exporter |

Key Destination |

Value |

Top Importer |

Key Origin |

Value |

|

2019 |

Germany |

China |

$410 |

USA |

Germany |

$370 |

|

2020 |

Japan |

South Korea |

$250 |

China |

Japan |

$330 |

|

2021 |

USA |

Mexico |

$330 |

Germany |

USA |

$420 |

|

2022 |

China |

India |

$450 |

Japan |

China |

$440 |

|

2023 |

South Korea |

Vietnam |

$520 |

France |

South Korea |

$440 |

|

2024 |

Netherlands |

Brazil |

$540 |

India |

Netherlands |

$520 |

Source: ITC, UN Comtrade (2024)

Key Trade Routes in the Ultraviolet (UV) Coatings Market (% of Global Trade)

|

Route |

2019 Share |

2024 Share |

Value (2024) |

|

Japan-to-Asia |

24% |

34% |

$1.4B |

|

Europe-to-North America |

14% |

25% |

$880M |

|

China-to-APAC |

22% |

28% |

$1.3B |

Source: WTO (2024)

Japan’s Ultraviolet (UV) Coatings Market Trade and Industry Evolution

Composition of Japan’s UV Coatings Shipments (2019-2023)

|

Year |

Petrochemicals (%) |

Polymers (%) |

Specialty Chemicals (%) |

Total Value (¥ Trillion) |

|

2019 |

48% |

30% |

22% |

1.3 |

|

2020 |

45% |

32% |

24% |

1.5 |

|

2021 |

45% |

33% |

25% |

1.4 |

|

2022 |

42% |

35% |

25% |

1.7 |

|

2023 |

38% |

34% |

28% |

1.8 |

Source: METI (2024)

Shipment Value by Industry (¥ Billion)

|

Industry |

2018 |

2023 |

CAGR |

Global Avg. CAGR |

|

Automotive |

420 |

640 |

8.1% |

6.3% |

|

Electronics |

380 |

650 |

12.3% |

9.8% |

|

Pharmaceuticals |

150 |

250 |

10.7% |

7.4% |

Source: JETRO (2024)

R&D and Capital Investment Trends (¥ Billion)

|

Company |

2021 R&D Spend |

2023 R&D Spend |

|

Mitsubishi Chemical |

130 |

150 |

|

Shin-Etsu Chemical |

120 |

135 |

|

Sumitomo Chemical |

93 |

140 |

Source: Company Annual Reports (2024)

Top 5 Japanese UV Coatings Companies (2023)

|

Rank |

Company |

Revenue (¥ Trillion) |

Profit Margin (%) |

|

1 |

Shin-Etsu Chemical |

1.1 |

19% |

|

2 |

Mitsubishi Chemical |

1.4 |

15% |

|

3 |

Sumitomo Chemical |

0.5 |

13% |

|

4 |

Asahi Kasei |

0.6 |

11% |

|

5 |

Toray Industries |

0.7 |

9% |

Source: Nikkei (2024)

Composition of Japan's UV Coatings Shipments (2018-2023)

Product Category Breakdown (¥ Billion)

|

Year |

Industrial Coatings |

Electronics Coatings |

Automotive Coatings |

Packaging Coatings |

Others |

Total |

|

2018 |

210 |

170 |

140 |

80 |

50 |

700 |

|

2019 |

220 |

200 |

160 |

95 |

64 |

750 |

|

2020 |

210 |

220 |

155 |

100 |

70 |

765 |

|

2021 |

240 |

280 |

170 |

110 |

75 |

875 |

|

2022 |

260 |

320 |

190 |

130 |

80 |

980 |

|

2023 |

290 |

380 |

210 |

150 |

91 |

1,120 |

Source: METI Japan (2024)

Export Ultraviolet (UV) Coatings Market Influence

|

Destination |

2018 Share |

2023 Share |

Key Product |

|

China |

23% |

35% |

Electronics |

|

South Korea |

14% |

17% |

Automotive |

|

USA |

12% |

13% |

Industrial |

Source: Japan External Trade Organization (2024)

Challenges

- High environmental compliance costs: For instance, small U.S. chemical manufacturers have reported a 4-5% reduction in their profit margin due to compliance-related issues. Small and medium-sized enterprises (SMEs) often do not have the capacity to take on the capital or operational costs associated with compliance. This limits innovation and competition in the ultraviolet (UV) coatings market. The complexity of the regulatory approval process can delay the commercialization of new UV coatings and entry into new markets.

- Stringent VOC standards: UV coatings inherently have low VOC content due to their curing process and development. However, manufacturers are expected to invest considerable amounts of time and money to reformulate UV coatings to meet changing VOC limits for compliance. This ultimately makes the development more expensive and delays the marketing of new UV coatings. Such expenses could also constrain the growth of ultraviolet (UV) coatings market, especially for small companies that lack the resources.

UV Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.1% |

|

Base Year Market Size (2024) |

USD 5 billion |

|

Forecast Year Market Size (2034) |

USD 12.9 billion |

|

Regional Scope |

|

UV Coatings Market Segmentation:

End-Use Industry Segment Analysis

The electronics segment is predicted to capture the largest share at 39% in the ultraviolet (UV) coatings market over the assessed period. This growth is driven by rapid adoption for use in display panels, printed circuit boards (PCBs), and semiconductor packaging. The current trends for miniaturization and 5G devices are creating opportunities for innovation with high-performance UV-cured coatings. Industry application requires high-performance scratch-resistant and dielectric properties, which makes UV coatings extremely important.

Technology Segment Analysis

The water-based UV coatings segment is anticipated to hold the highest revenue proportion of 29% in the UV coatings market throughout the discussed timeline. The 2023 VOC limits from the EPA and EU REACH regulations have hastened the adoption of bio-based formulations. Major manufacturers are reformulating products to meet sustainability goals without sacrificing performance. This segment is privileged with less toxicity and easier compliance than other solvent-based alternatives, especially in packaging and furniture.

Application Segment Analysis

The automotive exteriors segment is anticipated to hold the highest revenue proportion of 23% in the UV coatings market throughout the discussed timeline. Automotive coatings will capture 21% of the UV market driven largely by demand for EV production and durability. The International Energy Agency estimated in a 2024 report that 44 million electric vehicles will require high-performance UV-cured exterior coatings by 2030. UV-coatings products generally provide better scratch resistance, gloss retention, and drying speed than conventional paints. Original Equipment Manufacturers (OEMs) are now increasingly specifying UV coatings for battery casings and lightweight composites. The segment also benefits from rising aftermarket demand for environmentally friendly refinish alternatives.

Our in-depth analysis of the global UV coatings market includes the following segments:

|

Segment |

Subsegments |

|

End-Use Industry |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

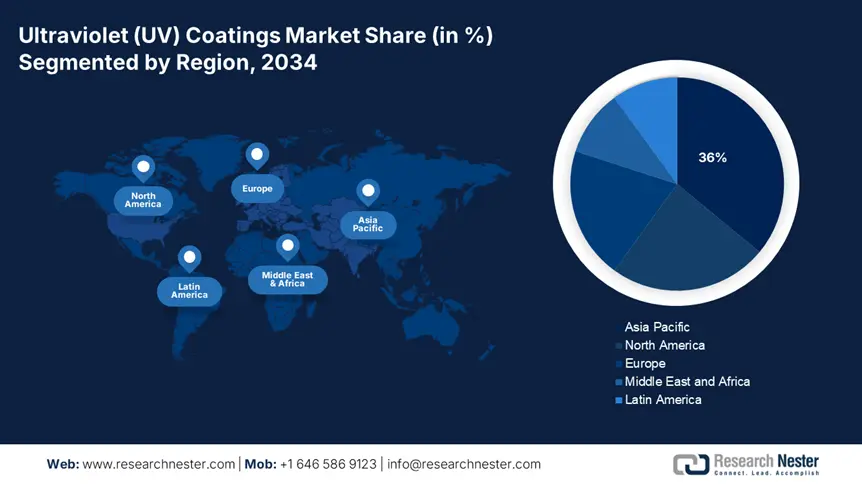

UV Coatings Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to dominate the global UV coatings market with a share of 36% by the end of 2034. The growth is also supported by fast industrialization of the electronics, automotive, and wood furniture industries. The increase in demand is being supported by stringent environmental regulations and adoption of low VOC UV formulations. The urgency in the adoption of UV-curable coatings is further encouraged by government investments in R&D for new technology, green manufacturing guidelines, and investment in the semiconductor supply chain.

China ultraviolet (UV) coatings market is expected to have the largest UV coatings revenue share by 2034. This will likely happen because of its enormous electronics, automotive, and furniture manufacturing sector, increasing domestic demand for UV curable finishes. In China, of approximately USD 19 billion of spending on advanced materials and semiconductor-edge chemical supply chain investment. Circular economy legislation, and government-led industrial-scale cleaner production centres, amplified uptake of sustainable UV across hundreds of thousands of firms. China is well-situated in the region to be the innovation and scale leader in UV coatings by 2034.

According to analysis, India is expected to have the fastest CAGR of all APAC ultraviolet (UV) coatings market cumulatively from 2025 to 2034. Key drivers for growth include the government's increased focus on achieving Make-in-India chemical sector targets. Policies that incentivize local manufacturing, increased domestic electronics and automotive manufacturing capacity, and regulatory pressure to use low-VOC finishes are promoting market demand for high-quality, price-competitive coatings. Industry programs like the National Chemical Industry Vision and public grants for green/coatings pilot programs from the DST will also help drive industry expansion.

Country-Level Demand, Market Size & Government Initiatives

|

Country |

Key Example / Stat |

|

Japan |

In 2024, METI and NEDO allocated 8% of national industrial R&D budget to advanced UV coatings. |

|

China |

Government spending on sustainable chemical tech rose 24% from 2018–2023, enabling over 400,000 firms to adopt cleaner UV‑curable coatings. |

|

India |

Ministry of Chemicals & FICCI report: green chemical funding rose 220% between 2015–2023. |

|

Malaysia |

MOSTI reports that green‑coatings adoption doubled from 2013 to 2023; government funding for low‑VOC coatings increased 42% during that period. |

|

South Korea |

KCIC & ME data show that South Korea’s green chemistry investment rose 34% from 2020 to 2024. |

North America Market Insights

North America is poised to register the highest pace of growth in the global UV Coatings Market by the end of 2034. The growth is driven by aerospace, automotive, electronics, and wood & furniture sectors demanding durable, high-gloss finish coatings. Regulatory pressure is propelling the change towards sustainable, water-based UV chemistries. The industrial demand, environmental regulation, R&D funding, and safety initiatives together will combine to create a strong North American market for UV coatings until 2034.

The federal government has significantly strengthened its support of clean chemicals manufacturing in the U.S. The Inflation Reduction Act (IRA) provided USD 26 billion through the EPA’s Greenhouse Gas Reduction Fund, which went directly to support the decarbonized manufacturing efforts. This includes the manufacture of UV coatings. The Department of Energy (DOE) provided USD 300 billion to invest in climate for chemical innovation. Programs like the EPA’s Safer Chemicals Grants programs have provided insight and research results leading to advances in UV-curable chemistries, reducing hazardous waste or toxicity.

In Canada, funding for advanced materials and for sustainable coatings from the National Research Council (NRC) and Environment and Climate Change Canada is increasing. The federal allocations in 2020-2024 for environmental protection and chemicals management grew by 28% and are supporting R&D into formulations of UV coatings that are VOC-free. Both countries are working together to help propel North America to become a leader in UV coatings innovation, sustainability, and regulatory alignment until 2034.

Europe Market Insights

The European UV Coatings Market is estimated to garner a notable industry value from 2025 to 2034. The expansion of this market is fueled by rapidly growing industrial industries, coupled with regulatory pressures from the EU on low-VOC, sustainable UV chemistries. Funding programs like Horizon Europe and the European Green Deal provide support for R&D programs on bio-based and eco-designed coatings that advance significant innovation and development of UV-curable formulations.

In the UK, UV coatings and some associated chemicals are receiving increased governmental support. For instance, in 2023, UK government support for GaAs chemical projects was 6% of the environmental technology allocation to develop semiconductor-grade UV-curable coatings.

Germany is anticipated to maintain its position at the forefront of Europe and the world, due to its strong chemical manufacturing ecosystem and adoption of low-VOC UV technologies early on. The strong adherence to ECHA regulatory compliance and CEFIC-compliant industry levels in Germany demonstrates that its chemical manufacturers must innovate with water-based UV chemistries. A number of key producers emphasize high concentration within this chemical market. Individual projects in the Green Deal and Horizon Europe further confirm Germany's continued leadership role in safe and reliable high-performance UV coatings.

7 European Countries Actively Spending on UV Coatings

|

Country |

Government Body / Industry Association |

Key Program or Stat |

|

France |

Ministry of Ecological Transition, France Chimie, CEA |

5% of industrial budget in 2023 allocated to UV coatings. |

|

Italy |

MiTE, Federchimica |

Active promotion of low-VOC coatings. |

|

Spain |

MITECO, FEIQUE |

Industrial decarbonization funds include coatings sector. |

|

Netherlands |

RVO, VNCI |

Strong push for bio-based UV-curable coatings under circular economy roadmap |

|

Belgium |

Essenscia, FPS Economy |

Government-backed projects focused on chemical sustainability, including coatings |

Key UV Coatings Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The UV coatings market is dominated by a variety of major multinational companies that have their roots in the U.S., Europe, and Japan. The majority of them have taken full advantage of their world-class research and development capabilities. Companies such as BASF and Dow have taken advantage of an integrated supply chain combined with a huge product portfolio. The European companies, Covestro and Arkema, have emphasized sustainability with products. The Japanese domestic manufacturers are focusing their efforts on creating high-value advanced materials and innovation. This rapid growth from all players in the industry is further advancing the competitive landscape through investments in green chemistry, digitalization, capacity expansions.

Some of the key players operating in the market are listed below:

|

Company Name |

Country |

Approximate Market Share |

|

BASF SE |

Germany |

12.3% |

|

Dow Chemical Company |

USA |

11.1% |

|

Covestro AG |

Germany |

9% |

|

Arkema S.A. |

France |

7.6% |

|

Mitsui Chemicals, Inc. |

Japan |

6.3% |

|

DIC Corporation |

Japan |

xx% |

|

Allnex Group |

Belgium |

xx% |

|

Solvay S.A. |

Belgium |

xx% |

|

LG Chem Ltd. |

South Korea |

xx% |

|

Huntsman Corporation |

USA |

xx% |

|

Kansai Paint Co., Ltd. |

Japan |

xx% |

|

Asian Paints Limited |

India |

xx% |

|

Akzo Nobel N.V. |

Netherlands |

xx% |

|

Cytec Industries Inc. |

USA |

xx% |

|

CCM Chemicals Sdn. Bhd |

Malaysia |

xx% |

Below are the areas covered for each company in the UV coatings market:

Recent Developments

- In January 2024, BASF SE introduced Uvinul T 150, a biodegradable UV filter for eco-friendly coatings. This product helped to enable a 14% sales increase in BASF's sustainable coatings segment in 2Q’24. This indicates a strong market interest in sustainability solutions.

- In September 2024, Dow Chemical expanded its UV-Cure Resin portfolio. This expansion led to a 17% increase in adoption across North America throughout 2024. Further, this allows Dow to increase its market share focused on high-performance UV coatings. These commercial launches represent a clear trend toward high-performance and sustainable products, which will continue to increase in automotive and electronics industries.

- Report ID: 3891

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UV Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert