Global Turbo Compressor Market

- An Outline of the Global Turbo Compressor Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Atlas Copco AB

- DANFOSS A/S

- EBARA CORPORATION

- Hitachi Industrial Products, Ltd.

- IHI ASIA PACIFIC PTE. LTD.

- KOBE STEEL, LTD.

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Sulzer Ltd.

- TMTV Industries Pvt. Ltd.

- Turbo-Tech Compressor Wuxi Co., Ltd

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Analysis

- Product Type Scenario

- Power Output Analysis

- Turbo Compressor Capacity Analysis

- Patent Evaluation

- Key Application

- Recent Developments

- Root Cause Analysis

- Industry Risk Assessment

- Global Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

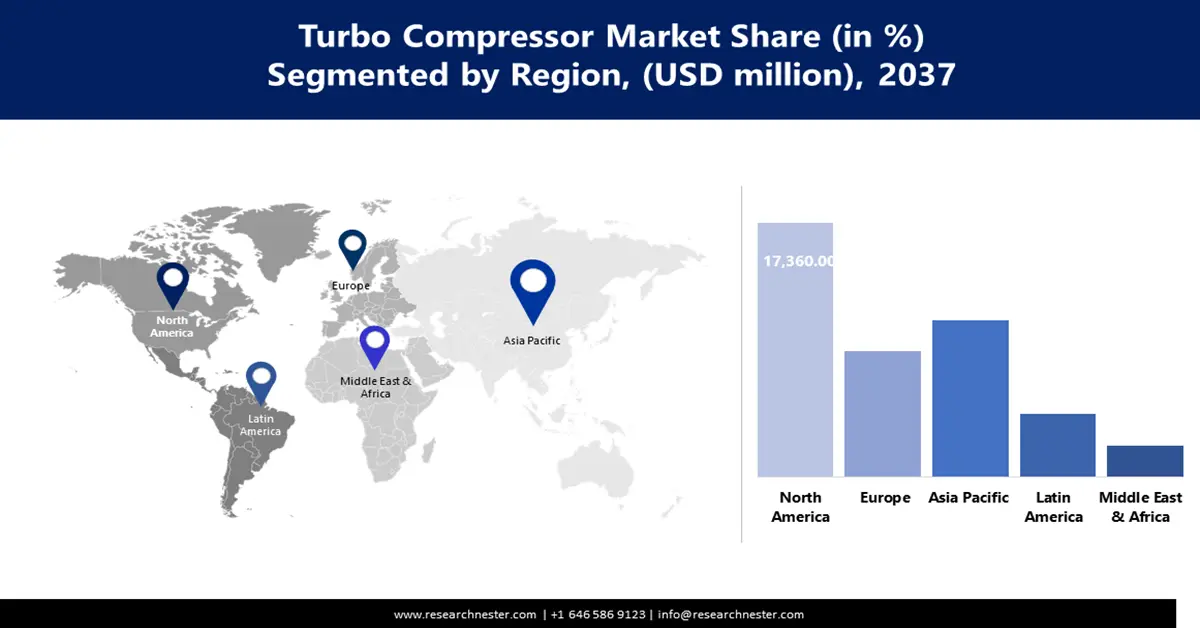

- By Region

- North America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Middle East and Africa, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Type, Value (USD Million)

- North America Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- North America Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- By Country

- U.S., Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Canada, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Type, Value (USD Million)

- Europe Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- By Country

- UK, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Germany, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- France, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Italy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Spain, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Russia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- BENELUX, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Poland, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Type, Value (USD Million)

- Asia Pacific Excluding Japan Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- By Country

- China, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- India, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- South Korea, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Australia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Indonesia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Malaysia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Vietnam, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Thailand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Singapore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- New Zealand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of APEJ, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Type, Value (USD Million)

- Japan Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- Type, Value (USD Million)

- Latin America Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Latin America Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- By Country

- Brazil, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Argentina, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Mexico, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Type, Value (USD Million)

- Middle East & Africa Turbo Compressor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Turbo Compressor Market Segmentation Analysis (2024-2037)

- Type, Value (USD Million)

- Centrifugal Turbo Compressor

- Axial Turbo Compressor

- Stage, Value (USD Million)

- Single-Stage

- Multi-Stage

- Capacity, Value (USD Million)

- Medium-Capacity Turbo Compressor (500 - 5000 m³/hour)

- Large-Capacity Turbo Compressor (Above 5000 m³/hour)

- Power Output, Value (USD Million)

- 150 kW - 300 kW

- 300 kW - 2 MW

- Above 2 MW

- Speed, Value (USD Million)

- Below 3000 RPM

- 3000 - 6000 RPM

- 6000 - 10000 RPM

- Above 10000 RPM

- Application, Value (USD Million)

- Oil & Gas

- Steel Plant

- LNG Terminal

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Others

- By Country

- GCC, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- Israel, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- Type, Value (USD Million)

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Turbo Compressor Market Outlook:

Turbo Compressor Market size was valued at USD 20.3 billion in 2024 and is projected to reach a valuation of USD 43.4 billion by the end of 2037, rising at a CAGR of 6% during the forecast period, i.e., 2025-2037. In 2025, the industry size of turbo compressor is estimated USD 21.5 billion.

The turbo compressor market is anticipated to expand due to technological improvements and greater demand from several industries. In May 2024, Atlas Copco acquired Tecturbo in Brazil, which helped build up its Compressor Technique division and grow its operations in South America. The move supports Atlas Copco’s service capability strategy in growing markets, as it boosts regional growth through better technical assistance and aftermarket services. The trend toward more energy-efficient and sustainable operations is urging industries to use advanced turbo compressors, which helps the market grow.

Government policies are significantly influencing the turbo compressor market. The U.S. Department of Energy presented its Hydrogen Program Plan in March 2024, which describes ways to produce, store, and use hydrogen. The plan features programs to create and put into use turbo compressor technologies needed for hydrogen infrastructure, supporting the country’s clean energy efforts. These policies are expected to boost the introduction and development of turbo compressors in new energy areas.

Key Turbo Compressor Market Insights Summary:

Regional Highlights:

- North America is set to account for 40% of the turbo compressor market by 2037, attributed to its emphasis on energy efficiency and expanding infrastructure development.

- The Asia Pacific region is projected to grow at a 5.8% CAGR from 2025-2037, supported by rapid industrialization and large-scale infrastructure expansion across key economies.

Segment Insights:

- The centrifugal turbo compressor segment is anticipated to represent 68% share by 2037 in the turbo compressor market, underpinned by rising adoption across oil & gas, chemical processing, and wastewater treatment operations.

- The multi-stage turbo compressor segment is projected to capture a 70% share by 2037, supported by increasing demand for high pressure ratios and energy-efficient heavy-duty applications.

Key Growth Trends:

- Advancements in clean energy technologies

- Infrastructure development in wastewater treatment

Major Challenges:

- Regulatory compliance and environmental standards

- Market volatility and economic uncertainty

Key Players: Atlas Copco AB, DANFOSS A/S, EBARA CORPORATION, Hitachi Industrial Products, Ltd., IHI ASIA PACIFIC PTE. LTD., KOBE STEEL, LTD., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Sulzer Ltd., TMTV Industries Pvt. Ltd., Turbo-Tech Compressor Wuxi Co., Ltd.

Global Turbo Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 20.3 billion

- 2025 Market Size: USD 21.5 billion

- Projected Market Size: USD 43.4 billion by 2035

- Growth Forecasts: 6% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, United Arab Emirates

Last updated on : 8 September, 2025

Turbo Compressor Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in clean energy technologies: Clean energy trends are a major factor driving the turbo compressor market. In June 2023, IHI Corporation introduced a compact electric turbo compressor for high-altitude hydrogen fuel cell aircraft, able to produce 100 kW owing to proprietary air-bearing technology. The advancement supports the advancement of new aviation and propulsion technologies, in line with global plans to reduce carbon emissions. These technological developments are widening the use of turbo compressors in clean energy fields.

- Infrastructure development in wastewater treatment: Improving wastewater treatment efficiency is increasing the demand for turbo compressors. In May 2024, Sulzer introduced the HST 10 turbo compressor for wastewater treatment facilities that process up to 10,000 m³/day. By using magnetic bearings and permanent magnet motors, the system is highly energy efficient and needs less maintenance. The solution is designed to fulfill the need for affordable and dependable aeration in industries.

- Collaborations for high-efficiency solutions: In the turbo compressor market, partnerships are playing a major role in sparking innovation, especially in clean energy and precision manufacturing. In February 2025, VMAC and Stealth Power formed a partnership to release the VMAC e30, a zero-emission rotary screw compressor powered by batteries for heavy vehicles. The collaboration is an example of the industry moving towards compact and sustainable air compression systems that comply with new regulations. Such partnerships help introduce new technologies quickly and make sure they work in real-world situations for various industries. With electrical efficiency and strong mobility, these partnerships solve for both environmental goals and practical use in the field. Partnerships such as this one indicate a wider industry move toward designing products that are conscious of emissions.

Challenges

- Regulatory compliance and environmental standards: Meeting the rising standards of environmental rules is a major challenge for the turbo compressor sector. For example, the U.S. EPA set new performance standards for greenhouse gas emissions from fossil fuel-fired power plants in April 2024. These standards require companies to upgrade turbo compressors for power generation to be more efficient and environmentally friendly. Turbo compressor companies also need to pay careful attention to regulations dealing with noise and the management of hazardous substances in manufacturing and maintenance.

- Market volatility and economic uncertainty: The turbo compressor market is often affected by changes and uncertainties in the economy. Global economic changes can shift the way industries produce, invest, and buy equipment such as turbo compressors. Businesses are likely to reduce or delay investments in new equipment and infrastructure in economic downturns, affecting the growth and sales of the turbo compressor market. On the other hand, when the economy grows, industrial activity and investment increase, leading to more demand for efficient compression technology. Such economic influences make the environment for turbo compressor makers and suppliers dynamic and uncertain, so they have to update their strategies to deal with these changes.

Turbo Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

6% |

|

Base Year Market Size (2024) |

USD 20.3 billion |

|

Forecast Year Market Size (2037) |

USD 43.4 billion |

|

Regional Scope |

|

Turbo Compressor Market Segmentation:

Type Segment Analysis

The centrifugal turbo compressor segment is anticipated to represent 68% of the market during the forecast period, owing to its usefulness in industries such as oil & gas, chemical processing, and wastewater treatment. Due to their small size, high efficiency, and low maintenance needs, these compressors are suited for long-term running operations. In April 2024, FS-Elliott launched the P650 centrifugal air compressor, equipping it with advanced aerodynamic parts for industrial operations looking for efficiency and reliability. The global demand for energy-efficient equipment with little downtime has made the centrifugal design the primary choice in project specifications. This move supports the industry’s switch to sustainable and environmentally friendly systems.

Stage Segment Analysis

Multi-stage turbo compressor segment is projected to capture 70% share of the market by 2037, driven by its high pressure ratio and low energy requirements. Multi-stage systems are chosen for heavy-duty applications such as LNG processing, power generation, and hydrogen compression because they provide better flow control and operational stability. In March 2024, Siemens Energy and GE Oil & Gas formed a partnership to jointly create advanced multi-stage turbo compressors for the oil and gas sector. They are created to meet high environmental demands and improve how much and how efficiently they operate. As reliability becomes a key factor, multi-stage systems are now the preferred option for industrial scale-up.

Our in-depth analysis of the turbo compressor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Stage |

|

|

Capacity |

|

|

Power Output |

|

|

Speed |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Turbo Compressor Market - Regional Analysis

North America Market Insights

North America is set to account for 40% of the turbo compressor market during the forecast period, due to a focus on energy efficiency and major infrastructure development. In March 2024, Baker Hughes supplied Bechtel Energy Inc. with gas technology equipment for two Louisiana LNG plants, including LM6000PF+ gas turbine-powered main refrigeration compressors, which indicates the region’s LNG growth ambitions. This investment in gas technology shows North America's readiness to address energy needs.

Turbo compressors are gaining popularity across many sectors in the U.S. due to a growing interest in sustainable energy. In February 2025, GE Vernova revealed that its LM6000 aeroderivative gas turbine will be able to run entirely on renewable hydrogen, set for commissioning in early 2026. This progress helps the country work towards net-zero emissions and encourages the use of hydrogen in electricity generation. These actions clearly show a shift toward using energy in ways that protect the environment in the U.S.

The turbo compressor market in Canada is expanding, owing to major investments in green technologies. In January 2025, Canada announced a CAD 310 million funding plan to help clean energy innovations, with a focus on high-efficiency turbomachinery. Some of the funds are allocated to research and development of low-emission turbo compressors for hydrogen and LNG applications. This funding contributes to Canada’s goal of being a leader in green industrial technologies. Businesses are moving forward quickly on projects to meet stronger environmental requirements. Turbo compressor firms in Canada are cooperating with the government's plan to lower emissions in the oil, gas, and power sectors.

Asia Pacific Market Insights

The turbo compressor market in the Asia Pacific is set to rise at a significant CAGR of 5.8% between 2025 and 2037. A major cause for this growth is the rapid industrial growth and big infrastructure projects happening in major countries such as China and India. For instance, China's National Energy Administration announced in March 2024 an approximately USD 700 billion investment plan in green energy projects over the next five years, a strategy aimed at significantly lowering emissions. This commitment underscores the region's strong dedication to adopting clean energy technologies.

China is shifting toward adoption of clean energy and raise industrial efficiency, which is a major force driving the growth of its turbo compressor market. This is shown by Cummins’ launch in February 2024 of its first e-compressor for fuel cell engines in Wuxi, China. This model makes use of a 45kW high-speed motor that can reach speeds of 110,000 rpm. The technology, built for fuel cell engines from 150 to 260 kW, improves efficiency and performance, which furthers China's aims for clean energy development. These technological breakthroughs are necessary to keep up with the growing needs of an evolving industry.

The turbo compressor market in India is rising at a stable rate, driven by the country’s growing interest in green energy and industrial growth. In March 2024, Petrotech Inc. saw an upsurge in demand for high-tech turbomachinery and compressor control systems across the oil and gas sector, showing how automation and control help boost efficiency and cut down on downtime. Similar developments can be seen in India industrial sector, which is pushing the use of advanced turbo compressor technologies in many areas. Adoption of these technologies is likely to keep growing as India builds up its manufacturing base.

Key Turbo Compressor Market Players:

- Atlas Copco AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DANFOSS A/S

- EBARA CORPORATION

- Hitachi Industrial Products, Ltd.

- IHI ASIA PACIFIC PTE. LTD.

- KOBE STEEL, LTD.

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Sulzer Ltd.

- TMTV Industries Pvt. Ltd.

- Turbo-Tech Compressor Wuxi Co., Ltd

Companies in the turbo compressor market are competing fiercely to improve their technology and expand their market share. Key players in this sector are Atlas Copco AB, DANFOSS A/S, EBARA CORPORATION, Hitachi Industrial Products, Ltd., IHI ASIA PACIFIC PTE. LTD., KOBE STEEL, LTD., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Sulzer Ltd., TMTV Industries Pvt. Ltd., and Turbo-Tech Compressor Wuxi Co., Ltd. To stay ahead, these companies are working on innovation, forming partnerships, and growing globally.

Multiple companies are working on new product innovations aimed at supporting the infrastructure of next-generation energy. In November 2024, Voith and Mehrer Compression GmbH formed a partnership to design and bring to market compressors that are better for the environment in hydrogen use. The partnership is aimed at producing compressors for hydrogen that are sustainable, energy efficient, and emit fewer pollutants. Such a partnership helps both companies take advantage of the growing hydrogen market, which is key for meeting worldwide decarbonization aims. This partnership highlights how teamwork is important for developing new technology in the turbo compressor industry.

Here are some leading companies in the turbo compressor market:

Recent Developments

- In April 2025, MTU Maintenance announced a significant expansion of its footprint in North America. The company will add CFM LEAP and GEnx maintenance, repair, and overhaul (MRO) services to its portfolio in the United States. MTU's site in Fort Worth, Texas, will evolve from an on-site service center to a full disassembly, assembly, and test facility, enhancing its service capabilities in the region.

- In December 2024, Mitsubishi Heavy Industries delivered steam turbine-driven compressors to Chevron-QatarEnergy’s Texas ethane cracker. These include cracked gas and refrigerant compressors integrated with advanced turbine control. The project supports the 2.08-MMtpy Golden Triangle Polymers plant. It reflects MHI’s continued leadership in large-scale petrochemical compression projects.

- In February 2024, Hitachi Industrial Products secured a centrifugal compressor order for LG Chem’s Daesan HVO facility in South Korea. This project supports the processing of 312,000 tons of bio-feedstock annually. The compressor is central to LG Chem’s decarbonization plans. It enhances Hitachi’s strategic presence in the Korean industrial equipment market.

- Report ID: 405

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Turbo Compressor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.