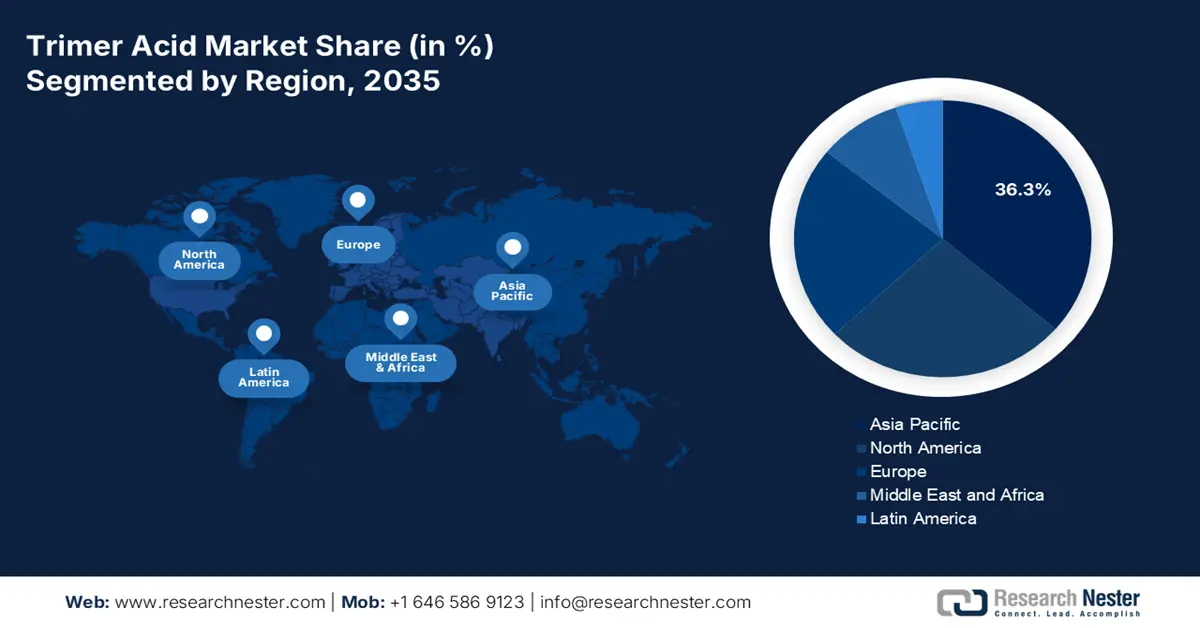

Trimer Acid Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 36.3% of the trimer acid market share. Demand is driven by infrastructure, adhesives/sealants, and coatings across regional economies. China is by far leading in consumption due to new and existing scale in construction and industrial growth. The region's growing acceptance of bio-based product offerings and related additive technologies is also enabling growth in APAC. It is expected that by 2035, the region will maintain that growth precipitated by sustained urbanization and continued investment in industrialization.

China’s trimer acid demand is expected to grow due to high use in construction and infrastructure projects, part of continued rapid urbanization, and associated use by coatings, sealants, adhesives, and polyamide resins, which are driving demand up sharply. Environmental regulation pushes the adoption of bio-based chemistries, too. The country’s urbanization rate is projected to rise, with temporary megaprojects providing short-term support for this trend through 2035.

North America Market Insights

The North American trimer acid market is expected to hold 26.6% of the market share by 2035, due to its increased demand for polyamide resins and adhesives for automotive and industrial coatings. The growing opportunities in oilfield chemicals, paints, and construction materials. There is also a strong push to increase trimer acid-based bio-based and bio-feedstock feedstocks from R&D efforts. The North America trimer acid market continues to gain momentum from increased adoption of lightweight automotive components and strong consumption of trimer acid-based adhesives in manufacturing clusters in the U.S. and Canada.

The U.S. expansion is expected to continue due to substantial consumption rates in existing adhesives and coatings manufacturing, construction, energy infrastructure, and transportation sectors. Growing trimer acid consumption for corrosion inhibitors, particularly in pipelines and offshore drilling, is increasing trimer acid demand and consumption levels. About 2% of all dry natural gas production and 15% of all crude oil production in the United States in 2022 came from the Federal Offshore Gulf of America. About 97% of all oil and gas production in the OCS occurs in the Gulf of Mexico, which is a hub to the great majority of federal offshore oil and gas wells. In addition, favorable regulatory activities at the U.S. federal level (EPA) continue to promote low-VOC chemicals to support PEP and business development. There is also an important expansion in domestic U.S. bio-based chemical production, specifically for trimer acid source points in Louisiana and Texas, which is providing a necessary domestic supply for cost-competitive and performance-based chemical expansion.

Europe Market Insights

The European trimer acid market is expected to hold 22.9% of the market share by 2035, due to the demand for trimer acid is set to increase due to increasing use in adhesives, coatings, and as a building block in the manufacture of polyamides. Germany and the UK are the largest consumers, given the strong specialty chemicals industry. Europe is set to see increased imports from Asia and regulatory requirements evolving with ECHA REACH amendments that will drive compliance costs. Additionally, stricter carbon reduction targets are reshaping industry practices, compelling manufacturers and importers to balance sustainability goals with growing demand, ultimately influencing competitiveness and operational strategies across the European market.

The built environment accounts for 25% of the UK’s total carbon footprint, and this sector will be crucial in meeting national emission reduction targets, according to a report by the UK Environmental Audit Committee. The UK Government aims to achieve net zero by 2050, positioning the UK among the most ambitious climate change efforts worldwide. This target will be legally binding and states that, by 2032, it will reduce Scope 1 emissions by 50%, with a 75% reduction expected by 2037. This means the UK will be over three-quarters of the way toward net zero by 2037. As the delivery organization for the UK Government's office and warehouse portfolio strategies, the Government is committed to reducing Scope 1 emissions by 50% by 2027 and 78% by 2035 for government buildings, exceeding the government’s targets.