Trichloroisocyanuric Acid Market Outlook:

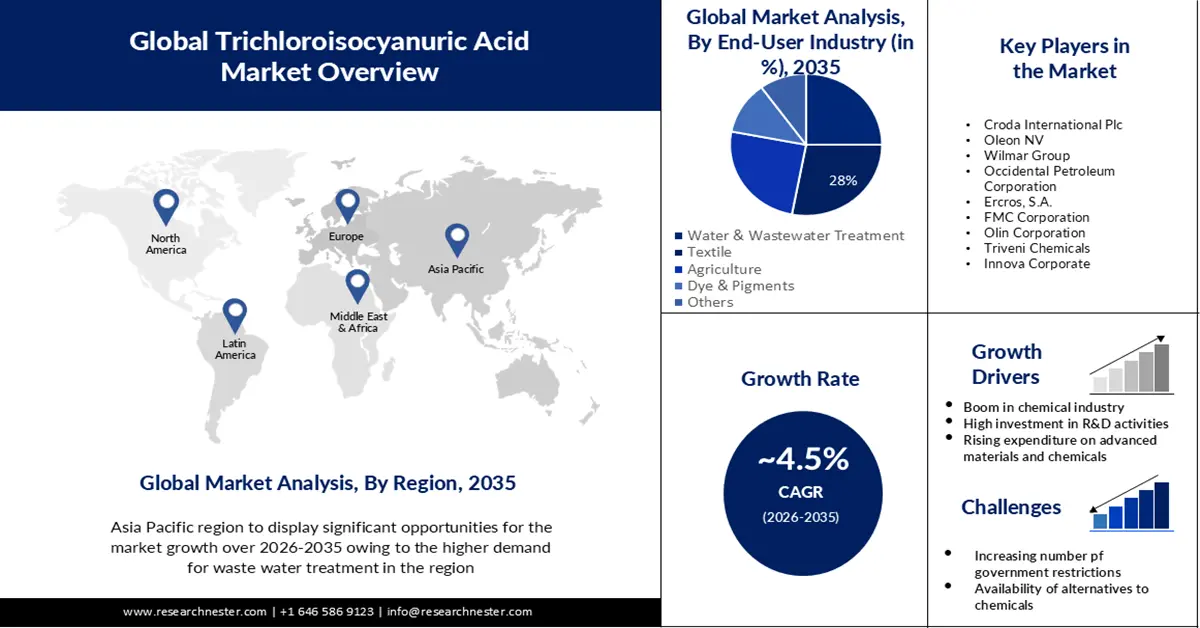

Trichloroisocyanuric Acid Market size was valued at USD 1.35 billion in 2025 and is set to exceed USD 2.1 billion by 2035, registering over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of trichloroisocyanuric acid is estimated at USD 1.4 billion.

The increasing sales of trichloroisocyanuric acid are to be stimulated by a recent boom in the textile industry, which will lead to market growth over the forecast period. The global production of textile fibers was estimated at around 24 million tonnes in 1975. The number is already nearly quadrupling, reaching 113 million tonnes by 2021. The production volumes of natural fibres such as cotton or wool amounted to 25.4 million metric tons while chemicals accounted for the remaining 88.2 million.

Furthermore, it is a regular practice in the farming industry to use trichloroisocyanurate for treating seeds and shielding crops from germs. According to an estimate by the U.S. Department of Agriculture, in 2020 about USD 1.055 trillion is expected to contribute to America's gross domestic product GDP contribution from food, agriculture, and associated sectors.

Key Trichloroisocyanuric Acid Market Insights Summary:

Regional Highlights:

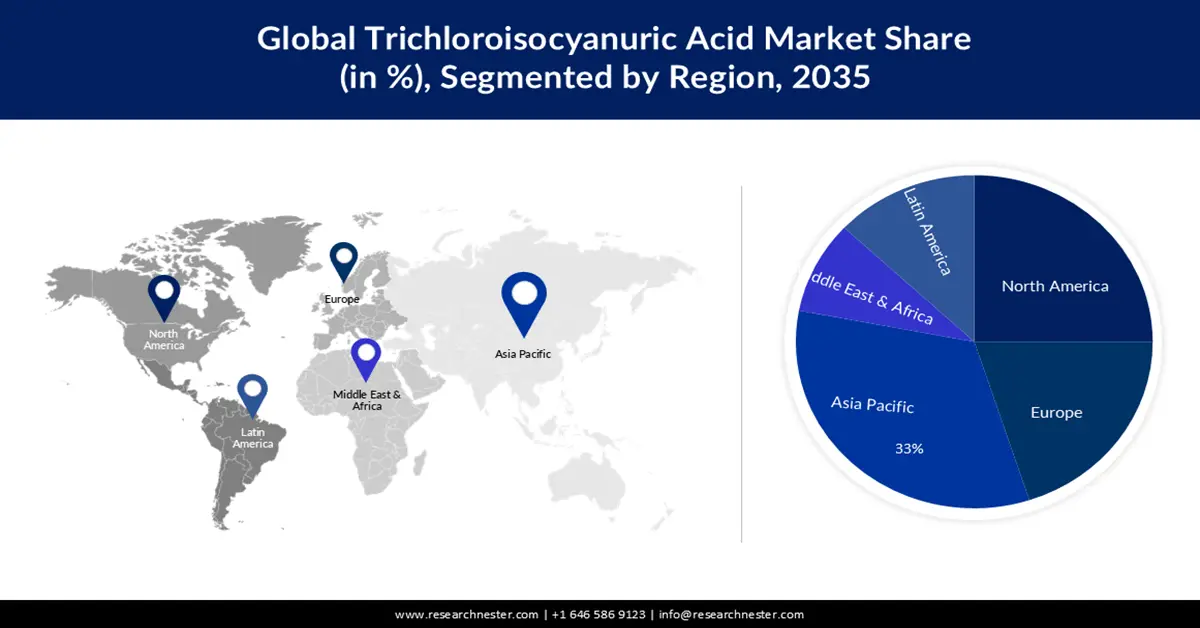

- Asia Pacific trichloroisocyanuric acid market achieves a 33% share by 2035, driven by increased use of trichloroisocyanuric acid in wastewater treatment and sanitation efforts.

- North America market will attain a 25% share by 2035, driven by rising demand for disinfectants in aquatic facilities and preference over chlorine.

Segment Insights:

- The bleaching agent segment in the trichloroisocyanuric acid market is expected to capture a 35% share by 2035, attributed to the frequent use of trichloroisocyanuric acid in textile bleaching and treatment processes.

- The textile segment in the trichloroisocyanuric acid market is forecasted to hold a 28% share by 2035, driven by the expansion of the textile industry and rising textile demand due to global population growth.

Key Growth Trends:

- Boom in the Chemical Industry

- High Investment in Research and Development Activities

Major Challenges:

- Increasing Number of Government Restrictions

- A Simple availability of alternatives to chemicals.

Key Players: Croda International Plc, Oleon NV, Wilmar Group, Occidental Petroleum Corporation, Ercros, S.A., FMC Corporation, Olin Corporation, Tokyo Chemical Industry Co., Ltd., Nissan Chemical corporation.

Global Trichloroisocyanuric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.35 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 2.1 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Trichloroisocyanuric Acid Market Growth Drivers and Challenges:

Growth Drivers

- Boom in the Chemical Industry- The white crystalline powder with a chlorine-like odor is used in the chemical industry in the tablet or granular form used as a reagent in organic chemical synthesis. According to current industry estimates, in 2021 the chemical sector is expected to generate an annual revenue of USD 4.7 trillion.

- High Investment in Research and Development Activities- The growth in sales of the market is driven by growing investments in research and development activities related to trichloroisocyanuric acid. The World Bank has published figures showing that research and development expenditure worldwide increased from 2.1 % of GDP in 2017 to 2.63% by 2020.

- Soaring Expenditure on Advanced Materials and Chemicals- According to estimates, the world's expenditure on advanced materials and chemicals will reach USD 41 billion in 2019.

Challenges

- Increasing Number of Government Restrictions- Trichloroisocyanuric acid is a strong chemical compound that cannot easily be used, but some strict government rules and regulations have been connected with it, which has led to an issue in the growth of this market.

- A Simple availability of alternatives to chemicals.

- The market for trichloroisocyanuric acid may be limited due to its small consumption because of its toxic nature.

Trichloroisocyanuric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.35 billion |

|

Forecast Year Market Size (2035) |

USD 2.1 billion |

|

Regional Scope |

|

Trichloroisocyanuric Acid Market Segmentation:

End-User Segment Analysis

The textile segment is anticipated to hold 28% share of the global trichloroisocyanuric acid market during the forecast period. One of the most important factors expected to drive market growth over the coming years is the expansion of textile industries worldwide, together with increasing demand for textiles as a result of an ever-growing population. According to the latest statistics, in 2020 there were about 87 million tons of textiles consumed worldwide with an annual growth rate of 4%.

Application Segment Analysis

Trichloroisocyanuric acid market from the bleaching agent is anticipated to have the highest share of about 35% during the forecast period. The textile industry uses trichloroisocyanuric acid very often as a bleaching agent, which is one of the most common and significant uses for it. It is also used for anti-shrink and dyestuff treatment in wool, other than the use as a bleaching agent.

Our in-depth analysis of the global market includes the following segments:

|

Form |

|

|

Application |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trichloroisocyanuric Acid Market Regional Analysis:

APAC Market Insights

The trichloroisocyanuric acid market in Asia Pacific is projected to hold the largest revenue share of about 33% by the end of 2035. In wastewater treatment chemicals, trichloroisocyanuric acid has been increasingly used to provide a region with safe drinking water and good sanitization. For instance, urban India generates 72,368 million liters (MLD) of sewage every day. India has the potential to treat and reuse 80% of the wastewater generated, which can be used for non-potable purposes.

North American Market Insights

The North America region is anticipated to account a significant revenue share of about 25% by the end of 2035. For a variety of water bodies such as swimming pools, whirlpools, fountains and other aquatic facilities in the region tricchloroisocyanuric acid acts as a disinfectant. Demand for trichloroisocyanuric acid is expected to increase during the forecast period because of its higher quality than chlorine which has been widely used in swimming pools.

Trichloroisocyanuric Acid Market Players:

- Kraton Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Croda International Plc

- Oleon NV

- Wilmar Group

- Occidental Petroleum Corporation

- Ercros, S.A.

- FMC Corporation

- Olin Corporation

- Triveni Chemicals

- B & V Chemicals

Recent Developments

-

Karton Corporation has successfully joined hands with DL Chemical Co., Ltd. This merger is expected to boost the company’s presence by leveraging DL Chemical’s manufacturing capabilities and footprint in the Asian market, along with its financial power, allowing it to invest in industry-leading sustainable innovation.

-

FMC Corporation has finally acquired BioPhero ApS, a Denmark-based pheromone research and production company. FMC Corporation (NYSE: FMC), an agricultural sciences company, today announced that it has completed the closing of its acquisition of BioPhero ApS, a Denmark-based pheromone research and production company. The companies announced the signing of a definitive acquisition agreement on June 29, 2022, and have now satisfied all necessary conditions and regulatory approvals.

- Report ID: 4202

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trichloroisocyanuric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.