Transportation Management System Market Outlook:

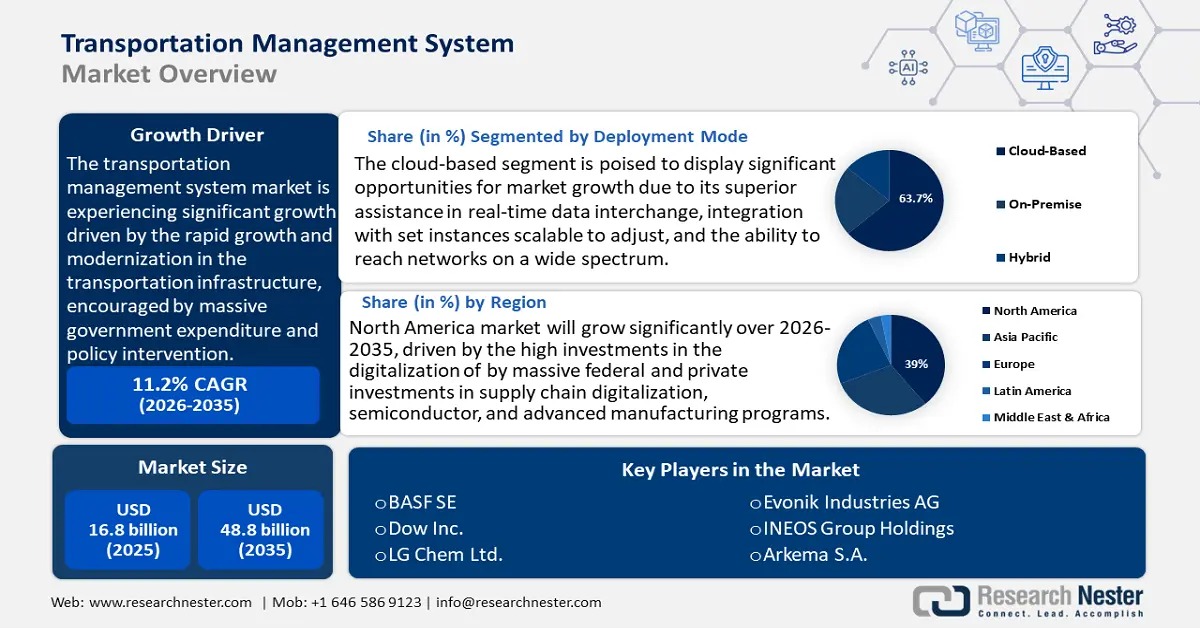

Transportation Management System Market size was valued at USD 16.8 billion in 2025 and is projected to reach USD 48.8 billion by the end of 2035, rising at a CAGR of 11.2% during the forecast period, from 2026 to 2035. In 2026, the industry size of transportation management system is estimated at USD18.7 billion.

The transportation management system market is anticipated to witness an upward trend, primarily attributed to the rapid growth and modernization in the transportation infrastructure, encouraged by massive government expenditure and policy intervention. For example, government investments in the logistics corridors, ports, railways, and overall infrastructure development have been gaining momentum, with the Indian infrastructure and logistics development budget currently being reported at 91.38 billion in fiscal year 2023 alone. Such projects as dedicated freight corridors and multi-modal connectivity zones, which aim to minimize logistics prices and intensify efficient transferring of goods, are enforced by this budget. The share of transportation within GDP in India has increased to 9.3% in FY13 as compared to 6.8% in FY01, and employment in the sector increased to 4.2% in FY10, which means a high demand and resilience of the sector.

The supply of materials and their production growth are closely connected with the analysis of regional and international trade conditions, in which the lines of assembly are becoming more dependent on agile transport systems and digital management systems. Producer Price Index (PPI) transportation-related output data has been steadily increasing, and the Producer Price Index (PPI) of Warehousing Services (General Warehousing and Storage) came in at 175.245 in July 2025 (Index Jun 1993=100), which has shown a marginal change every month in warehousing services prices. The PPI for Transportation Services in July 2025 exhibited both upward and downward trends relative to July 2024: the cost of providing Air transportation services rose by 3.6%, rail by 1.4%, respectively, and the costs of providing Freight and cargo arrangement services rose by 1.1%. Meanwhile, the Consumer Price Index (CPI) on Transportation Services and Goods indicated a stable change of 0.0% in the period between July 2024 and 2025, while transportation contributed 1.0% to the increase of 2.7% per the CPI in all goods and services prices. Reshoring and nearshoring trends, coupled with persistent investments in research, development, and deployment of TMS and related logistics technologies, underpin current expansion in manufacturing and assembly capabilities and further bolster production capacity and support transportation management system market growth.

Key Transportation Management System Market Insights Summary:

Regional Insights:

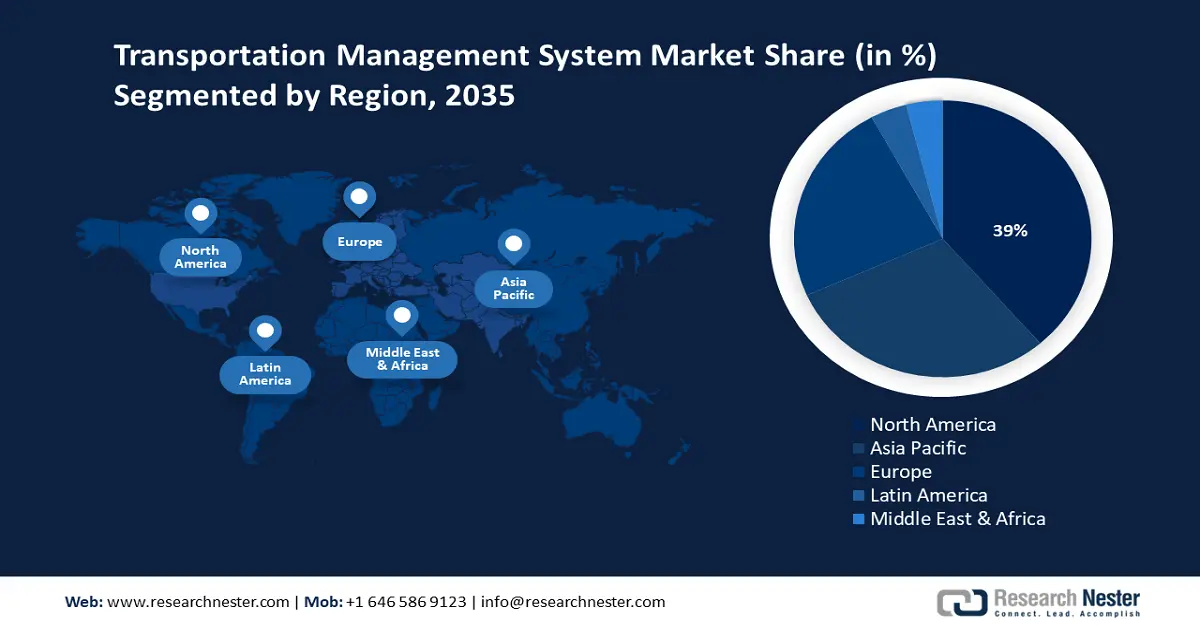

- By 2035, the north america region is anticipated to command a 39% share in the transportation management system market, anchored by intensifying investments in supply-chain digitalization, advanced manufacturing programs, and sustainability-focused logistics modernization.

- The asia pacific region is forecast to secure a 30% share by 2035, bolstered by rapid urban expansion, stronger economic activity in metropolitan areas, and rising commitments to sustainable transport infrastructure.

Segment Insights:

- Across 2026–2035, the cloud-based segment is projected to represent 63.7% of the transportation management system market share, propelled by its real-time data exchange capability, scalability, and cost-efficient SaaS-driven deployment models.

- The roadways segment is expected to account for a 54.4% share by 2035, supported by heightened reliance on truck freight for national shipments and the growing need for route optimization, tracking, and carrier management.

Key Growth Trends:

- Strict safety and compliance obligations

- Regulatory evolution in the European Union

Major Challenges:

- High regulatory compliance costs

- Price volatility and competitive pressures

Key Players: Dow Inc., LG Chem Ltd., Evonik Industries AG, INEOS Group Holdings, Arkema S.A., Reliance Industries Ltd, Petronas Chemicals Group Berhad, Orica Limited, Solvay S.A.

Global Transportation Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.8 billion

- 2026 Market Size: USD 18.7 billion

- Projected Market Size: USD 48.8 billion by 2035

- Growth Forecasts: 11.2%

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 25 August, 2025

Transportation Management System Market - Growth Drivers and Challenges

Growth Drivers

- Strict safety and compliance obligations: December 2024 amendments to the Toxic Substances Control Act (TSCA) by the EPA set high standards on manufacturers and importers of new chemicals, particularly those that persist, are bioaccumulative, and toxic, e.g., PFAS. Such amendments will abolish any coverings and stipulate a full safety review, as well as force a public disclosure of the determination of chemical safety. Manufacturers need to provide more comprehensive reports and information on chemical risks, environmental exposures, and proposed uses to address the added workload of reporting. These regulations drive chemical firms to adopt Transportation Management Systems (TMS) as a way of managing compliance documentation effectively, aligning audit readiness, and conforming to the legal mandates. These modifications are meant to safeguard human life and the environment in a better condition, as they avoid the entry of noxious chemicals.

- Regulatory evolution in the European Union: The European Union REACH Regulation requires that any company that manufactures or imports chemical substances in quantities of greater than 1 ton per year should complete their registration with the European Chemicals Agency (ECHA). The regulation plans to adopt a precautionary approach as it requires safety data provision, risk analysis, and refinements to be done regularly to make sure that chemicals are not subject to a high risk of adverse effects on human health or the environment.

REACH also encourages safer chemical alternatives to substances of very high concern, and improves the regularity of the chemical hazards of a given substance by making available a mutual public database of chemical hazards. This rigorous framework of regulatory strategies imposes intensive regulatory compliance needs, which introduces demand for the value of digital TMS to regulate complicated regulatory data, guarantee flawless documentation, and expedite logistics of the supply chain in the chemical industry. - Digitalization of logistics and chemical transport: Digitalization of chemical logistics is a profound innovation in chemical shipment. As per the 2023 Cefic report, the use of high technologies, such as AI-based route optimization, IoT-based real-time tracking, or blockchain-based documentation systems, helps streamline operations and make them more compliant with the regulatory framework. They enable accurate shipment tracking, automate documentation routines, and make better decisions in a changing supply chain context. While specific quantitative benefits such as percentage reductions in planning times are not provided, the report underscores widespread stakeholder recognition of these digital technologies as critical enablers for sustainability and competitiveness in chemical transportation. The implementation of such technologies supports better environmental reporting, risk mitigation, and compliance with increasingly stringent regulations.

Freight Shipment Trends by Mode

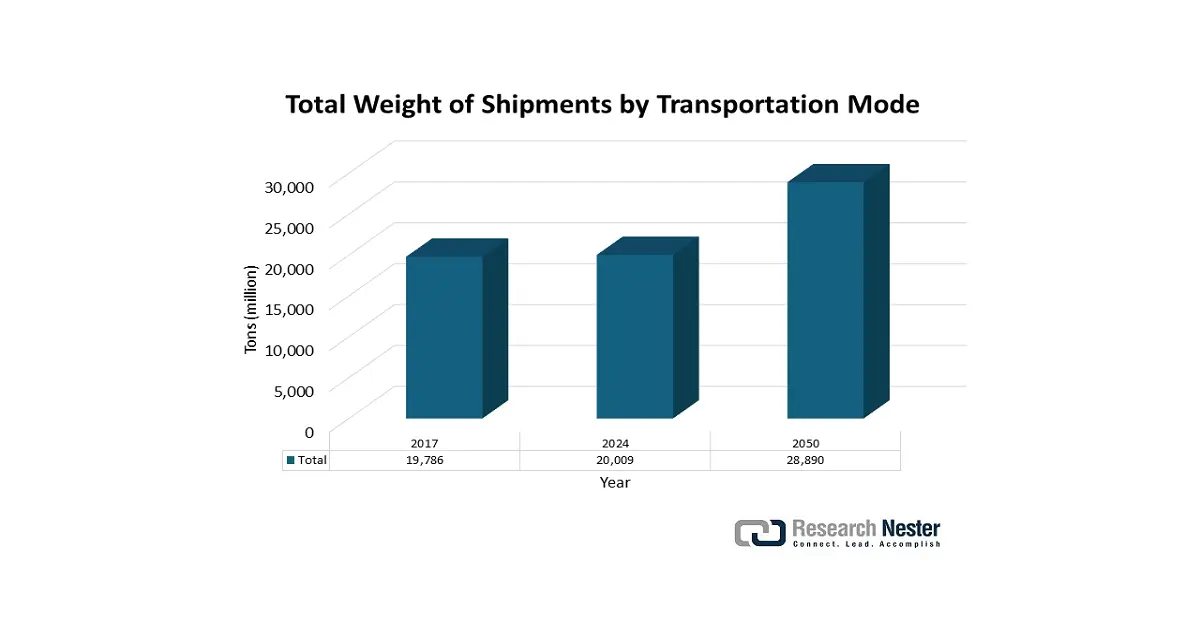

The evolving weight and volume of freight shipments across truck, rail, water, and air modes are primary drivers for the Transportation Management System (TMS) market. As shipment volumes grow and logistics networks become more complex, businesses face immense pressure to optimize costs, capacity, and visibility across multimodal supply chains. A modern TMS is critical for automating mode selection, negotiating carrier rates, and consolidating less-than-truckload (LTL) shipments into cost-effective full truckloads (FTL).

(Source: Bureau of Transportation Statistics)

Challenges

- High regulatory compliance costs: Increasing EPA compliance and safety regulations in 2023 posed significant challenges to chemical manufacturing with the use of transportation management systems. According to the U.S. Congressional hearings, 67% of chemical manufacturers reduced the level of investment in the new technologies, and 83% were forced to re-divert the operational funds to maintain the pressure of the regulations. This regulatory pressure led to the slow expansion of facilities and compelled some manufacturers to relocate pockets of their operations overseas to cut costs. The SMEs were particularly dominated by a lack of ability to absorb increasing paperwork and compliance costs, restraining their growth and innovation in the U.S. chemical industry.

- Price volatility and competitive pressures: Volatility in feedstock prices can have a severe adverse impact on pricing stability and profit margins, given that the suppliers of transportation management systems have to deal with major price fluctuations. According to the Indian Oil Chairman at the World Economic Forum Davos 2025, crude oil prices are expected to vary between $75 and $80 per barrel in 2025, due to geopolitical expansions causing volatility, and this can compel the chemical manufacturers to continuously change supply and pricing models. This aspect of volatility makes long-term contracts impossible and budget planning a nightmare, besides enhancing risks to suppliers who aim at supplying products to satisfy the sustainability urge of consumers. Firms are being forced to generate more dynamic and flexible pricing policies at the expense of margin and competitiveness.

Transportation Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 16.8 billion |

|

Forecast Year Market Size (2035) |

USD 48.8 billion |

|

Regional Scope |

|

Transportation Management System Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is expected to grow at the fastest transportation management system market share of 63.7% over the forecast period from 2026 to 2035, due to its superior assistance in real-time data interchange, integration with set instances scalable to adjust, and the ability to reach networks on a wide spectrum in comparison to on-premise deployments. According to OECD analysis, data points toward transport companies that offer logistic services accelerating investments in digital solutions, and that cloud-based systems work to facilitate cross-border trade, supply chain resilience, and business model adaptability. The increasing demand for Software-as-a-Service (SaaS) and multi-tenant cloud architectures, where seamless analytics, compliance management, and operational scalability are the requirements, though no particular market share number is disclosed. Cloud deployment holds value to an organization because it lowers the costs of IT maintenance and allows quick upgrading of IT systems to comply with regulations and the transportation management system market.

SaaS subscription models offer logistics and transportation companies scalable, pay-as-you-go access to sophisticated transportation management system (TMS) features, including real-time shipment visibility, automated carrier selection, and route optimization. Such a solution does not require substantial initial investments in IT infrastructure and, therefore, organizations, regardless of size and scope of operations, can easily implement and scale up superior logistics technology. The supplier oversees maintenance and updates, reducing disruptions in operations, and helps businesses concentrate on the operations that they particularly deal with.

Additionally, the multi-tenant platforms allow multiple independent service providers to run on shared cloud infrastructure, which is controlled by a central control center. This architecture enables competition in the transportation management system market because it enables operators to bid on transportation requests through combinatorial auctions, which enables efficient allocation of services based on price and availability. With a greater number of operators, the platform is more efficient, and commercially unprofitable requests decrease, and the platform incurs lower costs. The combination of SaaS and multi-tenant platforms allows greater flexibility in operations, cost, and service provision that contribute to innovation and competitiveness in the field of transportation management.

Transportation Mode Segment Analysis

The roadways segment is projected to grow at a transportation management system market share of 54.4% by 2035. As per the recent commodity flow survey results published by the Bureau of Transportation Statistics, trucks transported 50.5% of all freight tonnage and 55.0% of shipment value in the United States. This reaffirms the position of road transport as the mode of transport for the weight as well as the monetary value of goods shipped nationally. This shift in preference towards the use of trucks is because of the drive created by demand from e-commerce, retail, and manufacturing, where there is a need to have a flexible and door-to-door opportunity for services in freight. Truck logistics requires Transportation Management Systems (TMS) to achieve route optimization, real-time tracking of shipments, and effective management of carriers. With increasingly complex supply chains, and pressure on suppliers of transparency and reliability by customers, the critical situation of roadways and truck freight guarantees its high and further wide integration of the TMS solutions to facilitate the operations and fulfill the law regulations.

With over 9 million truckloads being transported on an annual basis, the trucking industry has the largest contribution of all freight modes in the United States, with USD 611.5 billion being the output of the industry as of the last reporting year. The for-hire trucking represents USD 244.0 billion of the total value, highlighting the industry in terms of both its economic value and the volume of cargo transported by truck, nationwide. This strength elucidates the fact that trucking plays a major role in supply chain logistics, enabling industries to transport short and long loads across the country. The parcel shipping market in the U.S. moved about 14.8 billion packages, and the major industry players, such as UPS, delivered 5.2 billion of them. The concentration in the parcel market between UPS and FedEx is high at more than 60% of market revenue, with both companies enjoying considerable duopoly in the industry as e-commerce becomes a volume driver. The economic contribution of parcel and courier services has grown due to the rise in the economic activity of the UK, and the economic contribution made by activities related to parcel and courier services has more than twofold during this period. In the decade, parcel services and courier services made up the couriers and messengers sector employed approximately 909,000 people in 2024.

Solution Segment Analysis

The execution segment is likely to grow at a steady pace by 2035, owing to increasing adoption of on-time shipment tracking, auto-freight, and dispatch optimization executives’ modules by logistics carriers and large fleet operators, as per BTS freight data. Such systems enable the firms to achieve strict customer service standards, regulatory and operational efficiency objectives. The executive solutions are deemed crucial to minimize errors, enhance traceability, and deliver on schedule, fact Apple factors of immense importance to just-in-time supply chains and global sourcing. With the development of digitization, the number of businesses that use TMS execution functions to get a competitive edge, counter disruptions, and optimize their logistics activities is increasing, but the BTS does not report on a dedicated market share among these operations.

Our in-depth analysis of the transportation management system market includes the following segments:

|

Segment |

Subsegment |

|

Solution |

|

|

Deployment Mode |

|

|

Transportation Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transportation Management System Market - Regional Analysis

North America Market Insights

By 2035, the North American transportation management system market is anticipated to grow at a revenue share of 39%, attributed to the high investments in the digitalization of the supply chain and technologies in logistics. Recent years (2023) saw a rigid commitment of more than USD 50 billion in allocated funding to semiconductor and advanced manufacturing programs that led to a rise in freight tracking and sustainability, as well as chemical logistics modernization. By 2033, the chemical transportation demand is projected to increase by 15% and would necessitate increased TMS-enabled freight capacity and greater controls in monitoring hazardous materials. Federal programs such as the EPA’s Green Chemistry Program led to the adoption of more than 50 sustainable chemical processes in 2021, reducing hazardous waste and safety risks in logistics. Ongoing public-private collaborations continuously drive innovation in TMS technologies across North America, emphasizing scalability, regulatory compliance, and safe transport of chemicals.

The U.S. transportation management system market is expected to dominate the region, owing to rapid innovation driven by a highly advanced logistics infrastructure and robust private sector adoption. The Office of Clean Energy Demonstrations (OCED) announced USD 6 billion for 33 projects in 20 states focused on industrial decarbonization, the largest investment in this sector in American history, specifically targeting energy-intensive industries and strengthening the U.S. manufacturing and logistics base. The OECD also announced USD 890 million for three projects in California, North Dakota, and Texas to demonstrate advanced carbon capture, transport, and storage technologies that are highly relevant to decarbonizing freight operations.

The U.S. is a leader in the chemical sector; its leading-edge manufacturing is concentrated in automation and real-time data integration that contributes to increased supply chain resiliency and responsiveness. As of 2022, the U.S. has an enormous transport system that consists of 3,425,519 miles of public roads and a National Bridge Inventory that manages hundreds of thousands of bridges, making it possible to transport large amounts of goods and chemicals. These aspects make the U.S. market ready to experience endless growth of TMS, which will revolve around digital transformation and sustainability.

Canada’s transportation management system market is expected to grow substantially over the forecast years from 2026 to 2035, attributed to the rising transportation sector in the country. The transportation sector's share in the national economy in 2024 is estimated to contribute 4.3% of Canada's GDP, which is estimated at $96.5 billion, with a growth rate of 2.6% as compared to the immediate previous year. The transport sector generates close to one million Canadian jobs yearly and is at the core of easing the Canadian merchandise trade, whereby it was estimated to be about $1.55 trillion in five major trade corridors. In terms of mode, 46% of this value of trade was transported by road, 21.1% by sea, 11.6% by air, and 10.5% by rail.

The Canadian government keeps investing in clean energy and infrastructure; i.e., it has invested 1.5 billion into to Clean Fuels Fund to develop clean fuels and technologies under the Federal Sustainable Development Strategy. In 2024, cargo volumes and passenger traffic have experienced significant growth, mirroring the broader expansion seen across the global economy and logistics sector. Federal initiatives have motivated digitalizing documentation, real-time tracking of freight, and secure transportation processes with chemicals. Ongoing developments in the business of merchandise and investments in the freight infrastructure are keeping Canada at the cutting edge of transport logistics and management.

Asia Pacific Market Insights

The Asia Pacific transportation management system market is predicted to grow at a steady pace, with a 30% share during the projected years by 2035, driven by the considerable growth of the urban population and rising economic activities within cities. The region has a population growth of about 44 million per year, adding to its urban population, which drives the demand for transportation, requiring more sustainable and efficient transportation solutions. It is projected that 80% of future gains in economic activity in the Asia Pacific until 2050, according to the Asian Development Bank, will be based in urban environments, and thus continue driving growth in sophisticated TMS capabilities to streamline logistics flows and lessen congestion. Accompanying this transition, by Q3 2024, China’s outstanding green loans reached 35.75 trillion yuan (approximately $4.9 trillion), a 19% increase from 2023, with significant portions directed to green infrastructure and clean energy projects, including public transportation modernization. Such initiatives are an indication of the region’s dedication to sustainability in the urban transport sector, contributing to market growth.

The China transportation management system market is expected to lead the Asia Pacific region, attributed to its being the largest producer and consumer of chemical products, where the chemical industry contributes 20% of the total national industrial emissions and 13% of the total CO2 emissions in China. Necessary decarbonization of this segment is deemed to be one of the key concerns in the sense of the achievement of carbon neutrality of the country. Areas of transformation that are of significance to the identified key segments are ammonia, methanol, and ethylene, since they are the primary chemicals and have a high capacity to influence the national carbon output.

Opening up the way to low-carbon development Chinese government and industry are actively pursuing low-carbon development, involving technical innovation, policy support, and strategic investment. Such trends make high-value chemicals generated in the downstream increasingly resurgent concerning zero-carbon transition initiatives. The geographical distribution of chemical manufacturing is shifting toward areas with a high supply of green hydrogen and carbon capture, as is the case with China and its pathway toward a carbon-neutral future. This strategy positions China to be among the world leaders in establishing a green, competitive, and clean technology-based chemicals industry.

By 2035, India’s transportation management system market is set to grow with a significant growth rate, owing to the rising urban population, which in India was recorded as 522.9, compared to year 2.27% increase in the same figure. It is projected that the population of India living in an urban setting will be over 40% by 2030. The chemical industry of India accounted for more than 9% of the manufacturing gross value added in the country and 7% of total exports in 2024. It is estimated that the industry will exceed USD 300 billion by the year 2028. Policies of the government are focused on the enhancement of innovation, sustainable development, and the promotion of the ideas of a circular economy. Measures to improve targeted reforms assume that by the year 2040, the chemical industry is predicted to reach USD 1 trillion. The national and industry programs are concentrated on safety, green chemicals, and advanced logistics as sector growth drivers and environmental compliance.

Europe Market Insights

The transportation management system market in Europe is projected to experience an upward trend in the growth trajectory during the forecast years by 2035, driven by the solid industrial logistical requirements, the climate action policies, and the investments in digital freight solutions influence the Europe transportation management system market. The chemical sector of Germany is the largest in Europe, with a turnover of €225.5 billion in the year 2023, and 80% of the firms carry out R&D. The Chemical sector in France generated a turnover of €108.5 billion and a record 21% rise in capital expenditure on sustainability and innovation. The turnover of the UK chemical sector was 60 billion pounds, and a significant portion of it was devoted to environmental and safety work.

With the assistance of the European Green Deal, member states saw €400 million of new investments in green TMS solutions that made it possible to increase the demand for green logistics with member states. Nordic countries and the Netherlands can be considered as promoting the digital supply chain since it is carried out at the national level and in the framework of the EU, taking responsibility at the EU level, along with CEFIC.

Key Transportation Management System Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc.

- LG Chem Ltd.

- Evonik Industries AG

- INEOS Group Holdings

- Arkema S.A.

- Reliance Industries Ltd

- Petronas Chemicals Group Berhad

- Orica Limited

- Solvay S.A.

The competitive landscape of the transportation management system market is identified by the diversified portfolio of multinational companies and their operations in the major regions, which identify. Germany, the USA, Japan, and South Korean industry leaders, as well as innovation and sustainability demands of regulations, rely on scale, research and development capital, and strategic relationships to encourage innovation. Such players are also more and more embracing digital logistics solutions, including IoT, testing green chemistry initiatives to improve supply chain visibility and eco performance. Increasing investment in new markets in Asia, as well as deploying specialty chemicals with high performance, supports long-term growth and recovery in the face of supply chain pressures.

Top Global Transportation Management System Manufacturers

Recent Developments

- In October 2024, C.H. Robinson, a major international logistics provider, reported accomplishing the complete automation of the freight shipment lifecycle by using generative artificial intelligence. This solution allows 100 percent seamless digital planning, booking, and following of a chemical cargo, eradicating the manual operations and decreasing processing duration. The platform enhances speed and accuracy in the management of chemical transportation, which makes scheduling a shipment fast and assigning real-time resolutions to issues. These innovations enhance trustworthiness, facilitate the compliance requirements of hazardous materials, and raise efficiency with regard to their global clients. The project is one of the early cargo transport example projects using generative AI in North America.

- Report ID: 4991

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.