- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Robert Bosch GmbH

- Magna International Inc

- ZF Friedrichshafen AG

- Valeo

- Cogent Embedded, Inc.

- Westfalia-Automotive GmbH

- Ford Motor Company

- Continental AG

- Volkswagen Group

- Mercedes-Benz Group AG

- Jaguar Land Rover Automotive PLC

- BMW AG

- Recent Development Analysis

- Industry Risk Assessment

- SWOT Analysis

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million) Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2025-2037, By

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Regional Synopsis, Value (USD Million) 2025-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Density Component Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Country Level Analysis Value (USD Million), 2025-2037

- U.S.

- Canada

- Density Component Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Country Level Analysis Value (USD Million), 2025-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Density Component Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Country Level Analysis Value (USD Million), 2025-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Density Component Type, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Country Level Analysis Value (USD Million) 2025-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Density Component Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Density Component Type, Value (USD Million)

- Camera/Sensor

- Software Module

- Technology Type, Value (USD Million)

- Semi-Autonomous (L3)

- Autonomous (L4,L5)

- Vehicle Type, Value (USD Million)

- Passenger Cars

- LCV

- Trucks

- User Type, Value (USD Million)

- OEM Fitted

- Aftermarket

- Functional Systems, Value (USD Million)

- Steering Control

- Brake Control

- Country Level Analysis Value (USD Million), 2025-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Density Component Type, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic and Risk Outlook for 2024

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

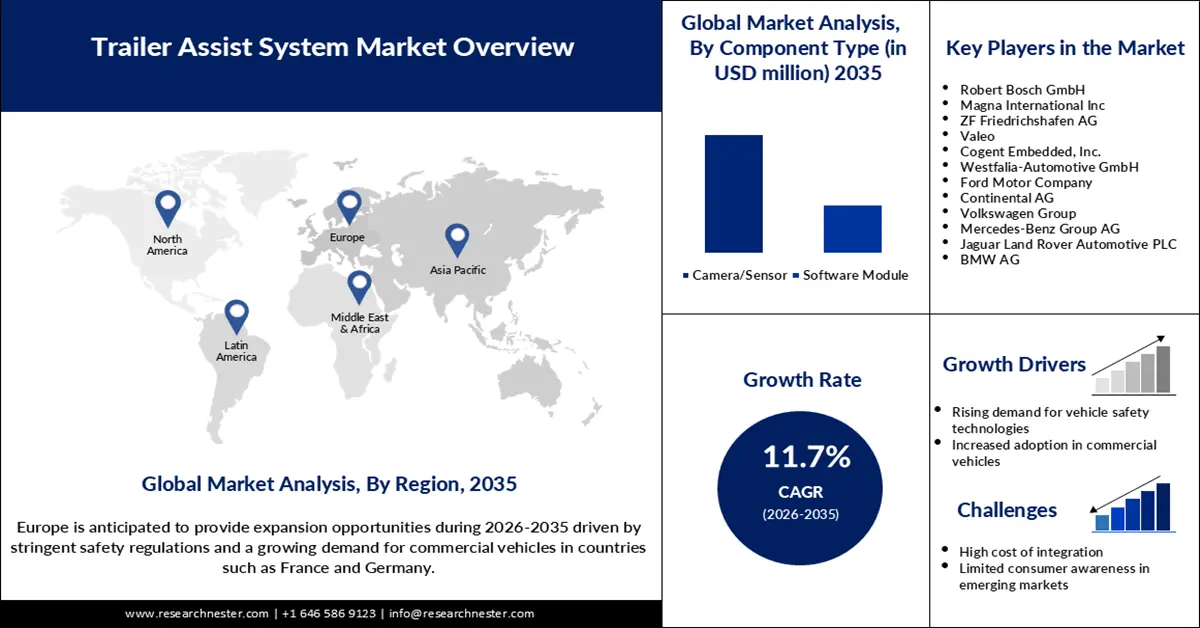

Trailer Assist System Market Outlook:

Trailer Assist System Market size was valued at USD 134.41 million in 2025 and is likely to cross USD 406.41 million by 2035, registering more than 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of trailer assist system is assessed at USD 148.56 million.

The trailer assist system market is expected to see substantial growth during the forecast period owing to the increasing adoption of advanced driver assistance systems (ADAS) and the growing demand for towing safety in commercial and personal vehicles. Many manufacturers are integrating trailer assist technology to enhance the maneuverability and convenience of towing vehicles. For example, Hyundai Mobis introduced the Trailer Reverse Assistance technology in September 2023, which upgrades towing safety by easily enabling reverse operations, reducing risks in parking, and offering better control to the driver.

Moreover, government initiatives towards road safety enhancements and the reduction of accident rates are encouraging the development of trailer assist systems. Accordingly, the EU General Safety Regulation starting from July 2022, all new vehicle types are fitted with advanced safety systems, including trailer assist. This legislation was formed to improve the safety of occupants in vehicles, pedestrians, and cyclists by making it necessary to use life-saving technologies across the different states of the European Union. Consequently, these initiatives provide great opportunities for market expansion, especially in areas that have high safety requirements.

Key Trailer Assist System Market Insights Summary:

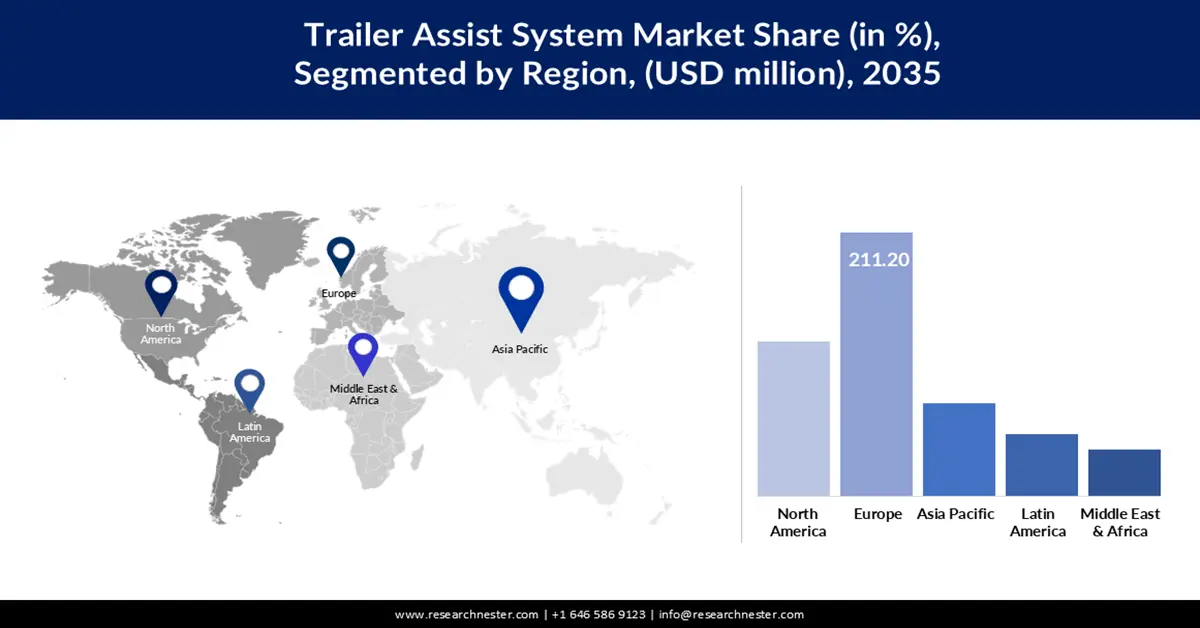

Regional Highlights:

- Europe is projected to command a 40% share of the trailer assist system market by 2035, supported by stringent EU safety mandates and accelerating innovation aimed at achieving Vision Zero.

- North America is estimated to secure around a 25% share by 2035, propelled by rising demand for towed vehicles across the U.S. and Canada.

Segment Insights:

- The camera/sensor segment is expected to capture over 71% share by 2035 in the trailer assist system market, impelled by the escalating need for high-precision sensing technologies that enhance towing safety.

- By 2035, the passenger segment is anticipated to exceed a 55% share, fueled by increasing recreational towing requirements and broader adoption of advanced driver-assistance features.

Key Growth Trends:

- Growing demand for safety inclusions

- Growing commercial applications

Major Challenges:

- Regulatory compliance and standardization

- Installation and maintenance by skilled workforce

Key Players: Magna International Inc., Daimler Truck Holding AG, Robert Bosh Gmbh, Carit Automotive Gmbh & Co. KG, Borg Warner Inc., Ford Motor Company, Hitachi, Ltd., Jaguar Land Rover Automotive plc., General Motors, Dorner Works, Ltd.

Global Trailer Assist System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 134.41 million

- 2026 Market Size: USD 148.56 million

- Projected Market Size: USD 406.41 million by 2035

- Growth Forecasts: 11.7%

Key Regional Dynamics:

- Largest Region: Europe (40% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 24 November, 2025

Trailer Assist System Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for safety inclusions: Safety has become one of the prime concerns for vehicle manufacturers to decrease the chances of accidents occurring with or involving trailers. The use of active trailer assist systems grants more control over maneuverability, boosting towing safety by a great margin. One example is the launch of Magna's next-generation cameras and electronic control units that supply surround and 3D views for enhanced trailer safety on the 2022 Toyota Tundra in May 2022. This kind of emphasis on safety will top the charts in driving trailer assist system market as consumers and businesses begin to pay close attention to technologies that can minimize human error.

- Growing commercial applications: The adoption of the trailer assist system is growing in commercial vehicles due to the adoption of fleets with telematics and trailer connectivity technologies for more operational efficiency and safety. For instance, Phillips Connect estimated during the American Transportation Association Fall Meeting in 2022 that 70% of new trailers would be penetrated by some form of telematics in 2025 and over 80% in the following five years. The integration of the trailer assist system with telematics gives fleet operators more diagnostic and close monitoring of trailers, hence pushing up the rate of adoption in the commercial segment.

- Automating Solutions with AI: Automakers are incorporating sophisticated AI into trailer assist systems to accommodate seamless automation and driver burden minimization. In May 2021, Ford, in agreement with its vision, launched the Pro Trailer Hitch Assist modular AI-powered system that automatically aligns the hitch ball on trailers for seamless towing by users of the F-150 Lightning. These developments are anticipated to drive trailer assist system market growth, as AI-driven trailer assist systems guarantee the convenience and accuracy that is required by various consumers and commercial users.

Challenges

- Regulatory compliance and standardization: One of the major challenges in the trailer assist system market is the adoption of different regulatory standards in different regions. The U.S. Federal Motor Carrier Safety Administration enforces standards that include but are not limited to, the ELD mandate, further complicating the regulatory landscape of compliance. Such standards require manufacturers to be on their toes regarding updates and adaptability, which raises the entry barrier for small players.

- Installation and maintenance by skilled workforce: Another significant challenge is the shortage of skilled personnel that could install and maintain such advanced systems. A great extent of specialized training is also required in integrating trailer assist systems with in-vehicle technologies, such as AI-based solutions. According to industry reports, by 2023, there will be greater demand for ADAS installation technicians, with a majority of automotive firms lacking the capacity to keep pace with the ongoing development of trailer assist technology. This may lead to delays in the wide-scale adoption of such systems, especially in regions where skilled labor is at a premium.

Trailer Assist System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 134.41 million |

|

Forecast Year Market Size (2035) |

USD 406.41 million |

|

Regional Scope |

|

Trailer Assist System Market Segmentation:

Component Type Segment Analysis

The camera/sensor segment is set to account for more than 71% trailer assist system market share by the end of 2035. This segment growth is owing to the surging demand for extremely high-precision sensors and cameras that offer far greater safety while performing towing operations. Sensors and cameras provide real-time feedback to the drivers, thereby enabling them to make effective decisions while reversing or maneuvering trailers. In May 2022, Magna introduced advanced camera and control units supporting 3D displays and surround view, which granted this component type stronger market dominance. The trailer assist system technology has become increasingly important for both commercial and passenger vehicles since it greatly reduces the chances of accidents during towing.

Vehicle Type Segment Analysis

By 2035, passenger segment is anticipated to dominate over 55% trailer assist system market share, as their sales are foreseen to include augmented towing capabilities. Rising recreational activities such as camping and boating is driving demand for greater towing capacity in SUVs and pickup trucks. These, together with the inclusion of trailer assist systems in those vehicles, will further contribute to the segment growth. Additionally, development in safety and driver assistance systems will make the trailer assist feature more affordable and acceptable for a wide range of vehicle owners. This is further supported by a trend where automakers are leaning toward convenience and ease of use, especially in long-distance travel and outdoor adventure vehicles.

Our in-depth analysis of the trailer assist system market includes the following segments

|

Component Type |

|

|

Technology Type |

|

|

Vehicle Type |

|

|

User Type |

|

|

Functional Systems |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trailer Assist System Market - Regional Analysis

Europe Market Insights

Europe industry is poised to dominate majority revenue share of 40% by 2035, owing to stringent EU safety regulations and rapid advancements in trailer assist systems. Companies are coming up with innovative ideas that will help fulfill Vision Zero, which is a future without traffic accidents. Growing demand for automotive automation further fuels trailer assist system market expansion.

With significant attention to sustainability, smart mobility solutions, and strict safety standards, Germany subsequently secures a leading position in vehicle innovation. The addition of trailer assist systems falls in line with wider efforts across Germany focused on improving automotive safety and efficiency to maintain the country's competitive advantage within the global automotive industry. Besides, cooperation with tech companies and ongoing investments in R&D help carmakers develop these systems further to be more sophisticated and reliable.

Government support for ADAS, coupled with increased stringency in safety regulations in France, has accelerated the traction for trailer assist systems across various segments of vehicles. With growing consumer awareness and demand for smarter and safer driving technologies, car manufacturers in France remain equally concerned not only with fulfilling regulatory requirements but also with the positioning of such systems as one of the differentiators in their model offerings.

North America Market Insights

By the end of 2035, North America trailer assist system market is set to dominate around 25% revenue share, driven by the U.S. and Canada. A surge in the requirement for towed vehicles, particularly in the commercial industry is likely to boost the trailer assist system market growth.

The U.S. trailer assist system market is growing with increasing adoptions of safety regulations and advanced automotive technologies. As per the National Highway Traffic Safety Administration (NHTSA) has provided a preliminary estimate indicating that 40,990 people died in motor vehicle crashes in 2023. This represents a 3.6% decline compared to 2022, when 42,514 fatalities were reported. In 2023, the fatality rate was 1.26 deaths per 100 million vehicle miles traveled. These statistics indicate that the demand for towing assistance technologies is increasing and will further increase as these technologies can significantly improve the safety of towing operations, which are generally associated with higher accident risks.

Canada also plays an important part in North America trailer assist system market, especially in the commercial vehicle segment, where efficiency and safety are key concerns. Strict safety standards and demands for improved trailer connectivity solutions in the country contribute significantly to this growth. Besides, the increasing stringency in regulations concerning driver safety and vehicle performance has made companies in Canada increasingly equip their fleets with improved telematics and trailer assist systems to ensure efficiency of operations as well as compliance with requirements.

Trailer Assist System Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Magna International Inc

- ZF Friedrichshafen AG

- Valeo

- Cogent Embedded, Inc.

- Westfalia-Automotive GmbH

- Ford Motor Company

- Continental AG

- Volkswagen Group

- Mercedes-Benz Group AG

- Jaguar Land Rover Automotive PLC

- BMW AG

The trailer assist system market is highly competitive due to the presence of traditional players like Magna, Bosch, Ford, and Hyundai Mobis. These companies continuously introduce new solutions to make passenger and commercial vehicles safer and more convenient. Other key players such as Phillips Connect and Plus promote the market expansion with telematics solutions for trailers and automation. Such moves drive competitive dynamics, while the demand for advanced towing technologies is on the rise, and regulatory compliance is pushing the pace in Europe and North America.

In April 2023, Bosch collaborated with Plus on the development of software-defined trailer assist systems for commercial vehicles, providing 360-degree surround perception technology. The collaboration was one of the major steps towards offering automated towing assistance and making it much safer and more efficient. Companies also introduce partial automation with continuous driver assistance to shift toward the demand rise for advanced trailer systems and gain a leading position in the competition outlook.

Here are some leading companies in the trailer assist system market:

Recent Developments

- In July 2024, Thermo introduced Trailer Assist Premium, the latest feature in its Thermo King Connected Solutions TracKing offering. This new feature allows customers to access comprehensive insights into refrigerated trailers, providing vehicle-related data such as EBS, odometer readings, axle load, and tire pressure monitoring system (TPMS) information. All this data is easily accessible through the TracKing platform, empowering fleet operators with real-time visibility and better control over their trailer operations, improving both efficiency and safety.

- In June 2024, Continental entered into a partnership with Samsara, a global leader in telematics solutions to offer advanced, data-driven fleet management focused on truck trailers. This collaboration enables the sharing of critical data points, giving customers enhanced access to trailer-related information. Through this partnership, fleets can benefit from Continental’s in-tire sensor data, which includes essential metrics like tire pressure and mileage, leading to more informed maintenance decisions and improved fleet performance.

- In September 2023, Mobileye and Valeo announced a strategic partnership to develop next-generation imaging radars for advanced driver assistance systems (ADAS) and automated driving features. This collaboration aims to deliver best-in-class, software-defined radar solutions that enhance the performance of driver-assist technologies. By combining their expertise, both companies are set to push the boundaries of autonomous driving and safety, offering superior radar capabilities for the evolving automotive landscape.

- Report ID: 4418

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trailer Assist System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.