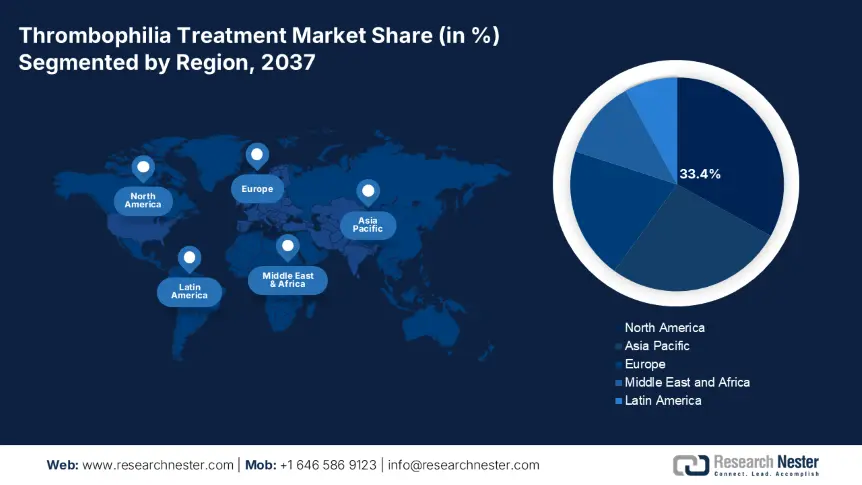

Thrombophilia Treatment Market - Regional Analysis

North America Market Insights

The North America market is anticipated to maintain its dominance, registering 33.4% revenue share by the year 2037. The growth of the thrombophilia treatment market in the region can be attributed to the presence of a strong payer system and early intervention of the DOACs. The region is witnessing wide Medicaid coverage and Medicare reimbursements and a surge in the adoption of molecular diagnostics. In 2023, the U.S. allocated 9.1% of the federal health budget, that is USD 5.2 billion, for the treatment of thrombophilia. Also, in 2024, the Medicaid support reached USD 1.21 billion to allow the treatment coverage.

Moreover, Canada allocated 8.1% of the federal health budget for the treatment of thrombophilia. The Canadian Institute for Health Information has given preference to thrombophilia care under the VTE prevention guidelines. Ontario has also raised the funding by almost 17% over the last 5 years. Under the national pharmacare strategy, there will be an improvement in the DOAC affordability and access in the country. Latest programs such as Ontario’s eConsult have enhanced specialist access, lowering the time-to-treatment for the patients of thrombophilia.

Asia-Pacific Market Insights

The Asia Pacific thrombophilia treatment market is the maximum growth acquiring region with 7.3% of the CAGR during 2025-2037. The growth in the region is driven by rising disease awareness and expanding public health coverage. Also, there is a growing healthcare investment and rising efforts for policy-driven initiatives. For instance, in China, there is a 15.4% increase in the thrombophilia-related spending during 2020-2025, and the National VTE Prevention Guidelines impose the screening in 51+ prominent hospitals. Also, the telemedicine platforms are enhancing rural access to improve patient care.

Additionally, in India, the Ayushman Bharat program covers screening of 500,000 beneficiaries for thrombophilia. The National Health Mission has infused USD 24.4 million for the prevention programs for VTE in 2024. According to the National Accreditation Board for Testing and Calibration Laboratories in India, almost 1510 labs are now offering thrombophilia tests. Moreover, the eSanjeevani platform allows remote anticoagulation monitoring for 100,000 patients. Also, AI-enabled VTE risk prediction pilots are in operated in Tata hospitals and AIIMS.

Country-wise Thrombophilia Treatment Market Analysis & Government Spending

|

Country |

Govt. Spending (Latest Year) |

Patient Coverage |

Spending Growth (Last 10 Years) |

Major Initiatives |

|

Japan |

USD 3.2 billion (2024) |

~1.3 million patients |

↑12% since 2022 |

National Screening Initiative |

|

Malaysia |

USD 300 million (2023) |

>650,000 patients (public sector) |

↑20% since 2013 |

Public formulary expansion, subsidized diagnostics in MoH-run hospitals |

|

South Korea |

USD 360 million (2023) |

~900,000 patients (NHI-covered) |

↑16% since 2014 |

Inclusion in National Health Insurance (NHI), Cancer-associated thrombosis program |

|

Australia |

USD 410 million (2023) |

~720,000 patients (across public/private) |

↑15% since 2015 |

PBS (Pharmaceutical Benefits Scheme) reimbursement of DOACs, VTE care guidelines |

Europe Market Insights

The thrombophilia treatment market in Europe is projected to witness remarkable growth driven by a rising aging population and increased awareness of genetic clotting disorders. There has been regulatory harmonization by the European Medicines Agency (EMA), which has enhanced access to direct oral anticoagulants (DOACs). Also, USD 2.6 billion was allocated under the Horizon Europe program to upgrade the research and development in coagulation disorders. Various initiatives are enhancing the real-time monitoring and upgrading the early diagnosis. These factors are propelling the thrombophilia treatment market growth during the forecasted period.

In 2023, government in UK has allocated 8.1% of the national healthcare budget for upgrading the treatment of thrombophilia. The increase in budget reflects a constant surge of patient volume and rising usage of long-term anticoagulants. Additionally, there are almost 450,100 patients are receiving adequate treatment annually. The adoption of e-health records and the huge inclusion of precision medicine are projected to propel the demand for the treatment. Additionally, in Germany, there has been a surge in public investment in the latest biologics to lower the exorbitant costs of the medicines for the thrombophilia treatment.