Therapeutic Plasma Exchange Market Outlook:

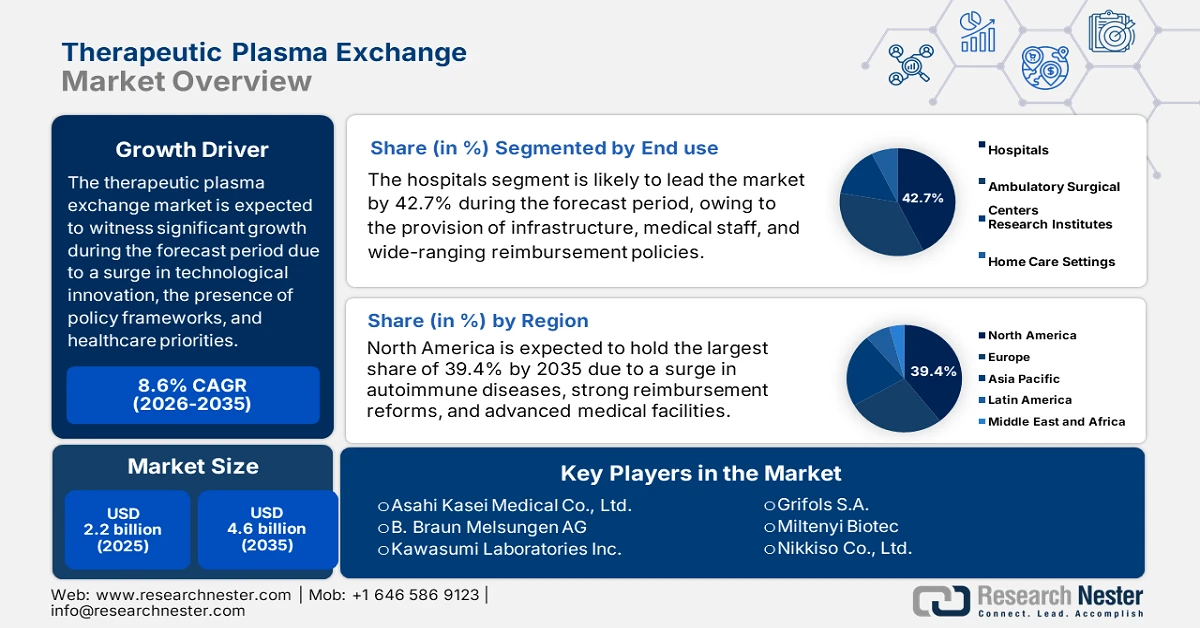

Therapeutic Plasma Exchange Market size was over USD 2.2 billion in 2025 and is estimated to reach USD 4.6 billion by the end of 2035, expanding at a CAGR of 8.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of therapeutic plasma exchange is estimated at USD 2.3 billion.

The international therapeutic plasma exchange market is rapidly evolving, shaped by technological advancement, a shift in healthcare priorities, and the existence of the latest policy frameworks. The market is also positively influenced by wide-ranging systemic modifications in health delivery, sustainability, and digitalized integration. According to official statistics published by NLM in October 2025, rare disorders collectively affect more than 400 million people globally, which is an estimated 8 times the international number of cancer patients. Recently, there are over 10,000 different types of chronic disorders, and 5% of these have approved treatments. Based on this, data monitoring and collection is one of the most suitable digital health technologies, with 31.3% relevancy rate that is utilized to treat diseases. Besides, the yearly number of interventional trials utilizing digital health technologies for selected chronic conditions is proliferating the therapeutic plasma exchange market globally.

Yearly Clinical Trials Analysis for Different Chronic Conditions (2014-2024)

|

Year |

Cystic Fibrosis |

Amyotrophic Lateral Sclerosis |

Pulmonary Hypertension |

Frontotemporal Dementia |

Pulmonary Fibrosis |

Duchenne Muscular Dystrophy |

|

2014 |

2 |

- |

- |

1 |

- |

- |

|

2015 |

2 |

1 |

- |

- |

1 |

1 |

|

2016 |

4 |

1 |

1 |

1 |

- |

1 |

|

2017 |

7 |

6 |

2 |

1 |

4 |

1 |

|

2018 |

9 |

1 |

1 |

1 |

3 |

- |

|

2019 |

7 |

- |

3 |

1 |

- |

1 |

|

2020 |

12 |

4 |

3 |

2 |

1 |

2 |

|

2021 |

15 |

6 |

3 |

4 |

2 |

6 |

|

2022 |

14 |

7 |

3 |

3 |

4 |

- |

|

2023 |

3 |

3 |

6 |

5 |

3 |

1 |

|

2024 |

19 |

11 |

4 |

1 |

1 |

3 |

Source: NLM

Furthermore, remote monitoring, digitalized integration, green healthcare and sustainability practices, decentralization of plasma exchange services, and cross-border plasma supply chains are drivers boosting the therapeutic plasma exchange market globally. As per an article published by NLM in November 2023, in terms of remote health monitoring systems, a metasurface antenna design can be utilized in optical sensing, accounting for an original wavelength, ranging between 10.0 μm and 11.9 μm with a quarter-wave plate. Besides, the utilization of phase-changing 𝐺𝑒2𝑆𝑏2𝑇𝑒5 (GST) material with a metasurface wavelength ranging from 10.3 μm to 10.9 μm with a half-wave plate also represents the benefit of implementing digitalized health technologies for aiding rare diseases. Therefore, with the availability of such monitoring strategies, there is a huge growth opportunity for the therapeutic plasma exchange market internationally.

Key Therapeutic Plasma Exchange Market Insights Summary:

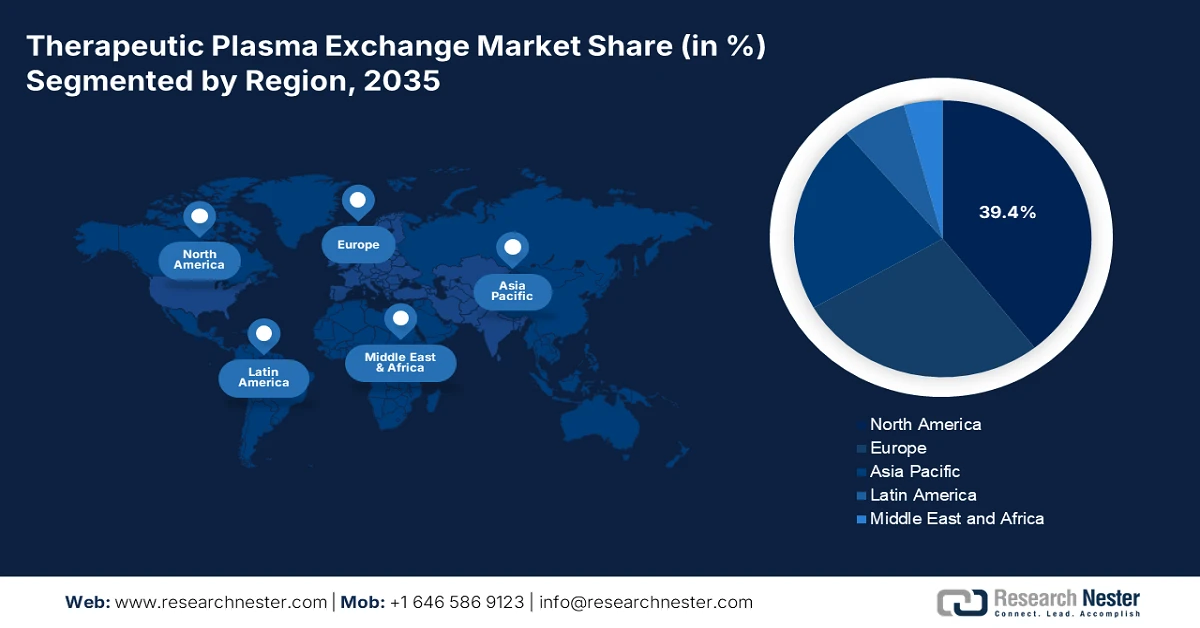

Regional Highlights:

- North America in the therapeutic plasma exchange market is projected to command a 39.4% share by 2035, underpinned by the high prevalence of neurological and autoimmune disorders alongside robust reimbursement policies.

- Asia Pacific is expected to register the fastest growth through 2035, stimulated by government-led plasma therapy initiatives, expanding healthcare infrastructure, and rising public health expenditure.

Segment Insights:

- The hospitals sub-segment within the therapeutic plasma exchange market is anticipated to secure a 42.7% share by 2035, supported by advanced medical infrastructure, specialized clinical expertise, and comprehensive reimbursement coverage.

- The autoimmune diseases application segment is projected to represent the second-largest share by 2035, reinforced by the critical reliance on plasma exchange for managing severe and refractory autoimmune conditions.

Key Growth Trends:

- Rise in the demand for personalized medicines

- Expansion in clinical trials

Major Challenges:

- Shortage of plasma and donor availability

- Regulatory complexity and compliance burden

Key Players: Fresenius Medical Care (Germany), Terumo BCT (Japan), Haemonetics Corporation (U.S.), Baxter International Inc. (U.S.), Asahi Kasei Medical Co., Ltd. (Japan), B. Braun Melsungen AG (Germany), Kawasumi Laboratories Inc. (Japan), Kaneka Corporation (Japan), Grifols S.A. (Spain), Miltenyi Biotec (Germany), Nikkiso Co., Ltd. (Japan), JMS Co., Ltd. (Japan), Medica S.p.A. (Italy), Macopharma (France), Otsuka Pharmaceutical Co., Ltd. (Japan), Jafron Biomedical Co., Ltd. (China), Hemonetics Malaysia Sdn. Bhd. (Malaysia), Medion Healthcare Pvt. Ltd. (India), Gambro AB (Sweden), CSL Limited (Australia).

Global Therapeutic Plasma Exchange Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.4% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Saudi Arabia, Australia

Last updated on : 29 January, 2026

Therapeutic Plasma Exchange Market - Growth Drivers and Challenges

Growth Drivers

- Rise in the demand for personalized medicines: The therapeutic plasma exchange market is continuously adopting precision medicine strategies, wherein treatments are tailored to individual patient profiles. According to official statistics published by the Open Access Government Organization in August 2024, utilizing precision medicine in drug development is expected to reach 17%, proactively saving the overall industry a generous sum of USD 26 billion globally. Besides, the consumption of such medicines has the ability to lead to a 10% reduction in chronic diseases for more than 50 years, and translates to an economic valuation, ranging from USD 33 billion to USD 114 billion. Besides, the industrial size for personalized medicine was USD 35.7 billion as of 2022, which is predicted to increase by 270% by the end of 2027, thus making it suitable for uplifting the therapeutic plasma exchange market.

- Expansion in clinical trials: The aspect of continuous clinical trials are readily validating the latest therapeutic applications of plasma exchange, such as metabolic and rare neurological diseases. As per an article published by NLM in February 2023, 6,763 clinical trials are suitable for epilepsy, and 503 trial-indication pairs are identified for utilizing DHTs through a search algorithm. Besides, after manual verification, 441 trial pairs, which are associated with 430 unique clinical trials, have been determined to be included and relevant during sample analysis. Moreover, sample trials count varied across different diseases, including 198 for Parkinson’s Disease, 119 for multiple sclerosis, 87 for Alzheimer’s Disease, and 37 for epilepsy, thereby denoting an optimistic outlook for the therapeutic plasma exchange market.

- Growing investment across emerging economies: Countries, such as Malaysia, Brazil, and India, are significantly making investments in healthcare facilities, creating an increasing demand for the therapeutic plasma exchange market internationally. As per an article published by the ITA in August 2025, the Ministry of Health in Brazil declared an investment of USD 84 million in digital and informatics solutions pertaining to healthcare as of 2024. Besides, the country is considered the largest healthcare industry in Latin America, spending 9.7% of GDP and displaying USD 135 billion in valuation. Likewise, as per the August 2025 IBEF Organization article, in India, the healthcare industry is witnessing unprecedented evolution, with a surge in private equity investment of Rs. 4,900 crore (USD 572 million) across 33 deals as of 2025, thus denoting a positive impact for the market’s upliftment.

Challenges

- Shortage of plasma and donor availability: The therapeutic plasma exchange market is heavily dependent on the availability of plasma, and a shortage of donors remains a critical bottleneck. Plasma collection is a complex process requiring strict safety standards, and donor participation rates vary significantly across regions. In Europe and North America, donor programs are relatively well-established, but demand often outpaces supply, particularly during public health crises. In the Asia Pacific and Latin America, cultural barriers, lack of awareness, and limited infrastructure further restrict plasma donation. This shortage directly impacts the availability of plasma-derived therapies and increases costs. Moreover, global supply chains are vulnerable to disruptions, as seen during the COVID-19 pandemic, when plasma collection centers faced closures and reduced donor turnout.

- Regulatory complexity and compliance burden: The therapeutic plasma exchange market faces significant challenges due to regulatory complexity and compliance requirements across different regions. Plasma exchange involves handling human biological materials, which necessitates stringent safety, quality, and ethical standards. Regulatory agencies such as the FDA (U.S.), EMA (Europe), and NMPA (China) impose rigorous approval processes for devices, consumables, and plasma-derived therapies. While these regulations ensure patient safety, they also create delays in product launches and increase compliance costs for manufacturers. Small-scale companies often struggle to meet these requirements, limiting innovation and therapeutic plasma exchange market entry.

Therapeutic Plasma Exchange Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Therapeutic Plasma Exchange Market Segmentation:

End use Segment Analysis

The hospitals sub-segment, which is part of the end use segment, is anticipated to garner the largest share of 42.7% in the therapeutic plasma exchange market by the end of 2035. The sub-segment’s upliftment is highly attributed to the availability of advanced infrastructure, specialized medical staff, and comprehensive reimbursement frameworks that make hospitals the primary setting for plasma exchange procedures. Hospitals are uniquely positioned to handle complex cases such as autoimmune and neurological disorders, which require intensive monitoring and specialized equipment. The integration of automated apheresis systems within hospital networks ensures higher efficiency, patient safety, and adherence to international treatment guidelines. Moreover, hospitals benefit from government funding and insurance coverage, particularly in North America and Europe, where Medicare, Medicaid, and national health systems reimburse plasma therapies.

Application Segment Analysis

By the end of the forecast period, the autoimmune diseases segment as an application is projected to hold the second-largest share in the therapeutic plasma exchange market. The segment’s growth is highly driven by the importance of plasma exchange for providing life-saving treatment services for refractory autoimmune disorders, such as autoimmune encephalitis, SLE, myasthenia gravis, and Guillain-Barré syndrome. According to official statistics published by NLM in January 2026, there are more than 100 distinct autoimmune diseases, with rheumatoid arthritis, inflammatory bowel disease, and type 1 diabetes being the most common types. Besides, it has been predicted that these particular diseases affect an estimated 8% to 10% of the population globally. Moreover, owing to increased risk of complications, disabilities, and infection, these diseases have a huge impact on the mental and physical health of patients, thus bolstering the market’s demand.

Type Segment Analysis

The plasma exchange devices sub-segment is expected to account for the third-largest share in the therapeutic plasma exchange market by the end of the stipulated duration. The sub-segment’s development is highly fueled by performing plasma separation and replacement, enabling safe and efficient treatment of autoimmune, neurological, and hematological disorders. The segment’s growth is fueled by continuous technological innovation, including automation, AI-driven monitoring, and improved membrane filtration systems. Modern devices are designed to reduce treatment time, enhance patient safety, and minimize complications, making them indispensable in hospitals and ambulatory care centers. Manufacturers such as Fresenius, Terumo BCT, and Asahi Kasei are investing heavily in research and development to develop next-generation devices that integrate digital platforms and sustainability features.

Our in-depth analysis of the therapeutic plasma exchange market includes the following segments:

|

Segment |

Subsegments |

|

End use |

|

|

Application |

|

|

Type |

|

|

Technology |

|

|

Disease Indication |

|

|

Procedure Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Therapeutic Plasma Exchange Market - Regional Analysis

North America Market Insights

The North America therapeutic plasma exchange market is anticipated to garner the highest share of 39.4% by the end of 2035. The market’s upliftment in the region is highly driven by an increase in the prevalence of neurological and autoimmune diseases, robust reimbursement policies, and the presence of innovative healthcare facilities. According to official statistics published by the IHME Organization in November 2025, 1 in 2 people in the U.S., which is more than half of the population, is readily impacted by a neurological disease. There are 36 medical conditions, and more than 180 million people, or 54% of the population, comprise at least 1 of these conditions. In addition, tension-type headache is one of the most prevalent conditions affecting 122 million people in the overall region. This is followed by migraine affecting 58 million people and diabetic neuropathy affecting 17 million people, thus bolstering the market’s exposure.

The therapeutic plasma exchange market in the U.S. is growing significantly due to a surge in the incidence of myasthenia gravis and lupus, along with an increase in federal expenditure. Based on government estimates published by the CMS Government in January 2026, the national health expenditure (NHE) increased to 7.2%, amounting to USD 5.3 trillion as of 2024, which is USD 15,474 per person, and further accounted for 18.0% of the country’s gross domestic product (GDP). Likewise, Medicare expenditure surged 7.8% to USD 1,118.0 billion, accounting for 21% of the NHE, while Medicaid expenditure rose 6.6% to USD 931.7 billion, accounting for 18% of the NHE in the same year. Besides, private health insurance spending increased by 8.8% to USD 1,644.6 billion in the same year, accounting for 31% of the NHE, thereby making the therapeutic plasma exchange market suitable for expansion in the country.

National Health Expenditure Analysis in the U.S. (2024)

|

Components |

Growth |

|

Out-of-Pocket Expense |

5.9% to USD 556.6 billion (11% of NHE) |

|

Other Third-Party Payers and Programs and Public Health Activity |

7.9% to USD 590.5 billion (11% of NHE) |

|

Hospital |

8.9% to USD 1,634.7 billion |

|

Physician and Clinical Services |

8.1% to USD 1,109.7 billion |

|

Prescription Drug |

7.9% to USD 467.0 billion |

|

Sponsored by the Federal Government |

31% |

Source: CMS Government

The aspect of federal healthcare budget, provincial and federal collaboration, universal healthcare partnerships, expansion in donor plasma, an upsurge in provincial reimbursement, and the adoption of innovative apheresis devices are drivers that are uplifting the therapeutic plasma exchange market in Canada. As per an article published by the Commonwealth Fund Organization in 2026, the overall health spending in the country is estimated to have reached 11.5% of the domestic GDP. Additionally, the private and public sectors account for approximately 30% and 70% of the overall health spending, respectively. Besides, provincial and territorial government revenue is considered the ultimate funding source, and based on this, almost 24%, which is an estimated CAD 37 billion (USD 29.4 billion), is significantly offered by the Canada Health Transfer, thus boosting the market’s expansion.

APAC Market Insights

The Asia Pacific therapeutic plasma exchange market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly attributed to government-based plasma therapy programs, an expansion in healthcare infrastructure, and the existence of robust government expenditure. Based on government estimates published by the NLM in November 2025, South Asia is considered home to more than 2 billion people, with the facility of achieving universal healthcare coverage. Besides, the health expenditure per capita for Bhutan amounted to USD 154.4, followed by USD 145.5 in Sri Lanka, and USD 61.0 in Bangladesh. Likewise, the governmental health spending amounted to USD 75.6 in Bhutan, USD 58.6 in Sri Lanka, and USD 3.9 in Bangladesh. Besides, the primary healthcare spending in India amounts to USD 28.9 per capita, which is also boosting the market’s exposure in the overall region.

The therapeutic plasma exchange market in China is gaining increased traction due to the aspect of a massive patient population, the provision of government investment in plasma infrastructure, regulatory support, and urban healthcare expansion. As stated in an article published by NLM in December 2025, as of 2023, the country’s population aged more than 60 years effectively reached 280 million, representing over 19% of the total population. Simultaneously, chronic diseases are continuing to increase in prevalence, accounting for over 80% of the domestic disease burden. In addition, the floating population has exceeded 240 million, experiencing acute health risks, while an estimated 85 million citizens with disabilities urgently demand enhanced health services. Therefore, with an increase in health challenges and a rise in diseases, there is a huge growth opportunity for the market in the country.

The presence of public health accessibility programs, an increase in government healthcare expenditure, a high burden of autoimmune diseases, and growth in medical tourism are factors that are propelling the therapeutic plasma exchange market in India. Based on government estimates published by the PIB Government in July 2024, there has been an increase in social welfare expenditure by 12.8% as of 2024, with a surge in health expenditure also increasing by 15.8%. Besides, the spending on social services has also increased to 7.8% of GDP, along with an upsurge in the domestic health spending by 1.9% of GDP in the same year. This growth in social services and healthcare has been underpinned by the effective and transformational implementation of governmental programs, which is creating an optimistic outlook for the market’s growth.

Europe Market Insights

Europe therapeutic plasma exchange market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by the presence of robust reimbursement frameworks, regional investment in plasma-based therapies, and a rise in chronic disorders. According to official statistics published by the Europe Commission in March 2025, under the EU4Health, the HaDEA significantly manages 68 projects for supporting the integration of the Europe Health Data Space (EHDS) Regulation, amounting to an overall funding of €105,206,061. This caters to 3 notable projects for preparing the EHDS adoption groundwork, including the Xt-HER for securing the Electronic Health Records (EHR) system, the TEHDAS2 for accessing health data in a secure manner, and the EHDS2 Pilot for sharing health information with the futuristic EHDS.

The therapeutic plasma exchange market in Germany is gaining increased traction due to regional plasma strategies, innovative hospital infrastructure, and an increase in government expenditure. As per a data report published by GTAI in 2022, the pharmaceutical industry's revenue accounted for EUR 46.4 billion, along with 12.5% of revenue in revenue and development. In addition, the yearly revenue growth constituted for 5.1% in the country’s pharmaceutical industry for more than a 5-year duration. Moreover, EUR 83.2 billion has been allocated for exports of pharmaceuticals, which is the world’s largest exporter of medicinal products. Meanwhile, EUR 7.4 billion has been allocated for research and development by pharmaceutical organizations in the country, and 83 million significantly drives the domestic demand for healthcare products and services, which is also bolstering the market’s growth.

The presence of safety legislation, EHDS funding provision, along with innovative apheresis technologies are significantly responsible for uplifting the therapeutic plasma exchange market in the UK. As stated in an article published by the NIHR in May 2023, 19 autoimmune diseases affect almost 10% of the population in the country, constituting 13% of women and 7% of men. Besides, a clinical study was published by NCBI in June 2023, wherein 22,009,375 individuals were evaluated. Based on the evaluation, 978,872 comprised the newest diagnosis of at least 1 autoimmune disease. Additionally, 625,879 diagnosed patients were female, which is 63.9%, and 352,993 were male, which is 36.1%. Besides, during the clinical study, there has been a huge increase in coeliac disease, with an incidence ranging between 2.0 and 2.3, followed by Sjogren’s syndrome, accounting for between 1.8 and 2.3, and Graves’ disease, ranging between 1.9 and 2.2. Therefore, with the increased prevalence, there is a huge growth opportunity for the market in the country.

Key Therapeutic Plasma Exchange Market Players:

- Fresenius Medical Care (Germany)

- Terumo BCT (Japan)

- Haemonetics Corporation (U.S.)

- Baxter International Inc. (U.S.)

- Asahi Kasei Medical Co., Ltd. (Japan)

- B. Braun Melsungen AG (Germany)

- Kawasumi Laboratories Inc. (Japan)

- Kaneka Corporation (Japan)

- Grifols S.A. (Spain)

- Miltenyi Biotec (Germany)

- Nikkiso Co., Ltd. (Japan)

- JMS Co., Ltd. (Japan)

- Medica S.p.A. (Italy)

- Macopharma (France)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Jafron Biomedical Co., Ltd. (China)

- Hemonetics Malaysia Sdn. Bhd. (Malaysia)

- Medion Healthcare Pvt. Ltd. (India)

- Gambro AB (Sweden)

- CSL Limited (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Fresenius Medical Care is a global leader in dialysis and apheresis technologies, with strong expertise in plasma exchange systems. Its advanced devices and consumables are widely adopted in hospitals across Europe and North America, giving it a dominant market position.

- Terumo BCT specializes in blood and plasma technologies, offering innovative apheresis systems that are central to therapeutic plasma exchange. The company’s strong research and development focus and global distribution network make it a key player in the Asia Pacific and beyond.

- Haemonetics Corporation is a major U.S.-based provider of blood management solutions, including plasma collection and exchange technologies. Its emphasis on automation and efficiency has strengthened its role in hospital-based plasma therapies worldwide.

- Baxter International Inc. provides a wide range of medical devices and therapies, with plasma exchange systems integrated into its portfolio. Its global reach and partnerships with healthcare providers ensure strong adoption in both developed and emerging markets.

- Asahi Kasei Medical Co., Ltd. is renowned for its advanced membrane filtration technologies used in therapeutic plasma exchange. Its innovations in bioprocessing and apheresis devices have positioned it as a leader in Japan and a growing force internationally.

Here is a list of key players operating in the global therapeutic plasma exchange market:

The international therapeutic plasma exchange market is highly competitive, with leading players such as Fresenius, Terumo BCT, Baxter, and Grifols dominating through advanced apheresis technologies and strong hospital partnerships. Europe-based firms such as B. Braun and Macopharma leverage innovation in consumables, while Asia-specific companies, including Asahi Kasei and Kaneka, expand regional presence. Strategic initiatives include mergers, acquisitions, and collaborations with healthcare providers to strengthen distribution networks. U.S. companies focus on research and development and automation, while APAC manufacturers emphasize affordability and accessibility. Besides, in September 2025, Terumo Blood and Cell Technologies declared that its very own Spectra Optia Apheresis System has achieved regulatory acceptances for the latest therapeutic indications across 14 countries in Latin America, denoting a huge growth opportunity for the therapeutic plasma exchange industry globally.

Corporate Landscape of the Therapeutic Plasma Exchange Market:

Recent Developments

- In January 2026, Kaplan Center has significantly offered outpatient therapeutic plasma exchange to effectively aid chronic illness, aging, and cognitive health, with the ultimate objective to lower Alzheimer’s progression.

- In January 2026, BioCryst Pharmaceutical, Inc. notified that it has declared that it has successfully acquired Astria Therapeutics, Inc. to strengthen its position as one of the notable leaders in hereditary angioedema and enhance its long-lasting growth trajectory.

- In July 2025, KalVista Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) has accepted EKTERLY, which is a suitable plasma kallikrein inhibitor for aiding acute attacks of hereditary angioedema among pediatric and adult patients.

- Report ID: 8371

- Published Date: Jan 29, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Therapeutic Plasma Exchange Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.