Tetrahydrofuran Market Outlook:

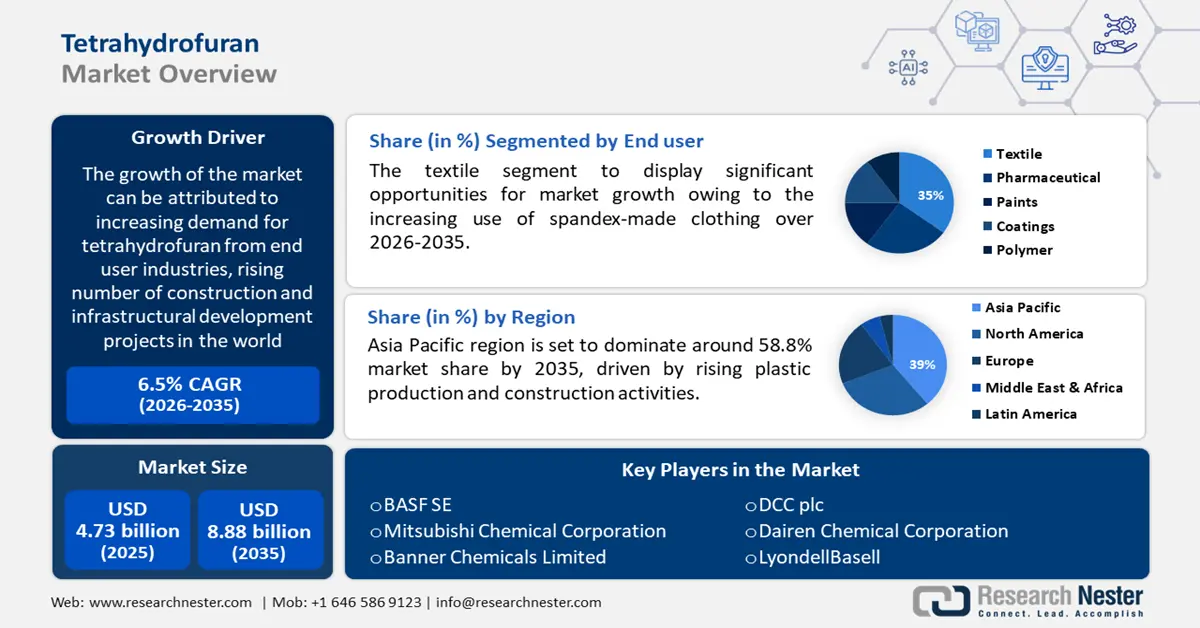

Tetrahydrofuran Market size was over USD 4.73 billion in 2025 and is poised to exceed USD 8.88 billion by 2035, witnessing over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tetrahydrofuran is evaluated at USD 5.01 billion.

The market growth is driven by increasing demand for tetrahydrofuran (THF) from end user industries, rising number of construction and infrastructural development projects in the world. In 2020, the revenue of the construction industry in the United States alone reached to USD 1.3 billion. The value was almost USD 1 billion in 2018.

In addition, the market revenue is propelled by growing requirement for spandex from textile industry. Tetrahydrofuran is highly used for the manufacturing of the chemical that are used for manufacture swimsuits, sportswear and casual wear. Moreover, rise in usage of THF as adhesive, coating agent and reaction medium is expected to boost the market growth. Furthermore, high demand for polyvinyl chloride (PVC) and polyurethane manufacturing is projected to offer lucrative opportunities to the market.

Key Tetrahydrofuran Market Insights Summary:

Regional Highlights:

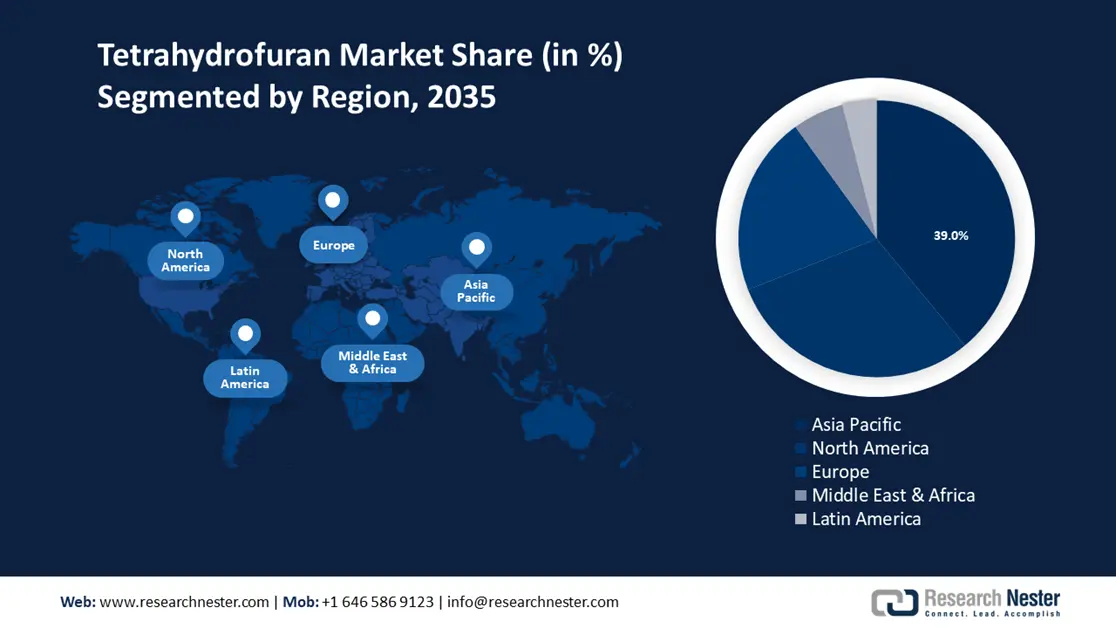

- Asia Pacific tetrahydrofuran market will hold around 58.8% share by 2035, driven by rising plastic production and construction activities.

- North America market projects a substantial CAGR during 2026-2035, driven by rising consumption of medicines.

Segment Insights:

- The polytetramethylene ether glycol (ptmeg) segment in the tetrahydrofuran market is projected to hold a significant share by 2035, fueled by its role in enhancing the tensile strength of elastane.

- The textile segment in the tetrahydrofuran market is expected to maintain a dominant share by 2035, fueled by higher spandex usage and increased textile exports.

Key Growth Trends:

- Growing Building and Construction Sector

- Rising Demand of Polyurethane

Major Challenges:

- Health-related disorder caused by tetrahydrofuran

- Tetrahydrofuran is highly inflammable

Key Players: Mitsubishi Chemical Corporation, Banner Chemicals Limited, Ashland Global Holdings Inc., DCC plc, Dairen Chemical Corporation, LyondellBasell Industries Holdings B.V., Koch Industries, Inc., Nova Molecular Technologies, Inc., PENNAKEM, LLC.

Global Tetrahydrofuran Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.73 billion

- 2026 Market Size: USD 5.01 billion

- Projected Market Size: USD 8.88 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Tetrahydrofuran Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Building and Construction Sector – Tetrahydrofuran is used in polyurethane coating and paints. The demands for paints and coatings is expected to increase with rising construction. In 2021, France had more residential buildings than any other nation in Europe, with over 471,000 homes being built. Germany came in second with 310,000 homes being built.

-

Rising Demand of Polyurethane – THF is a major component of polyurethane fibers and urethane elastomers. An estimated of around 18 million tonnes of polyurethanes were consumed globally in 2019, and nearly 23 million tonnes are anticipated to be consumed by 2024.

-

Increasing Consumption of Prescribed Drugs – Tetrahydrofuran are the chemical intermediate that is used in the manufacturing of various drugs. Over 26% of adults in the UK use prescription drugs. Moreover, 35% of Australians use prescription drugs daily.

-

Growing Use of Plastic-Made Products – Tetrahydrofuran acts as a solvent for manufacturing polyvinyl chloride (PVC), which in turn is used in producing automotive plastics, packaging plastics, and others. According to the UN Environment Program, by 2050, 1,100 million tonnes of primary plastic are expected to be produced worldwide. Furthermore, single-use plastic goods for food and beverage containers make up about 36% of all plastics produced for packaging.

-

Growing Global Chemical Industry – It is frequently used to dissolve and react with different compounds. Moreover, it serves as a precursor in the synthesis of a number of other chemical. The global chemical industry rose by nearly 4% in 2022

Challenges

- Health-related disorder caused by tetrahydrofuran - The increasing use of tetrahydrofuran imposes various risk to health, such as dryness, rashes and cracks on skin. Moreover, inhaling tetrahydrofuran can lead to breathing problems, coughing, wheezing and others. additionally, prolonged exposure can cause unconsciousness and even death.

- Tetrahydrofuran is highly inflammable

- They are carcinogenic in nature

Tetrahydrofuran Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 4.73 billion |

|

Forecast Year Market Size (2035) |

USD 8.88 billion |

|

Regional Scope |

|

Tetrahydrofuran Market Segmentation:

End-user

The textile segment is predicted to dominate the market share over the projected time frame. The segment growth can be attributed to increasing use of spandex made clothing followed by higher import and export of spandex material. Since people's need for comfortability has increased throughout the post-pandemic era, the added proportion of spandex in the textile and garment sectors has reportedly increased to around 10-25%. Furthermore, from January through November 2021, spandex exports increased by nearly 26% on a yearly basis to around 74 kt, with a monthly export of about 7,000 tonnes.

Application

The polytetramethylene ether glycol (PTMEG) segment is expected to garner significant share by 2035. Rising use of polytetramethylene ether glycol (PTMEG) is the major growth driver of the segment. Tetrahydrofuran is converted into polytetramethylene ether glycol (PTMEG/PTG) using an acid-catalyzed polymerization process (THF). Tetramethylene ether units are repeatedly present in this straight-chain diol. Moreover, the segment growth is propelled by rising use of polytetramethylene ether glycol (PTMEG) in increase the tensile strength of elastane. The PTMEG elastomer displayed around 67% retention of the initial tensile strength after 72 hours at 105°C and 100% RH.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Technology |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tetrahydrofuran Market Regional Analysis:

APAC Market Insights

Asia Pacific region is set to dominate around 58.8% market share by 2035. The market growth is impelled by rising production of plastic made products and higher constructional activities. China produces over 7 million metric tonnes of plastic goods each month. Since January 2020, December 2021 saw the highest monthly production of plastic items, which was over 8 million metric tonnes.

Furthermore, to establish the National Bank for Financing Infrastructure and Development (NaBFID), a $2.5 billion development finance institution, was approved by Parliament in March 2021 in order to finance infrastructure projects in India. Moreover, in India, where urbanization is predicted to increase from 33% to over 40% of the population by 2030, there will be a need for around 25 Million extra mid-range and inexpensive housing units.

North American Insights

The North American tetrahydrofuran market will register substantial growth through 2035. The market growth in the region is propelled by rising consumption of medicines by the people. Adults in the United States who use prescription medicines comprise about 66% of the population. Moreover, around 65% of Canadians between the ages of 40 and 79 use one or more prescription medicines.

Tetrahydrofuran Market Players:

-

BASF

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Chemical Corporation

- Banner Chemicals Limited

- Ashland Global Holdings Inc.

- DCC plc

- Dairen Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- Koch Industries, Inc.

- Nova Molecular Technologies, Inc.

- PENNAKEM, LLC

Recent Developments

-

BASF announced that it will increase the selling prices for butanediol and its derivatives, including tetrahydrofuran in the European Union. These products are widely used for producing solvents, polyurethanes and elastic spandex.

-

Ashland Global Holdings, Inc. releases the new prices of various chemical products, including 1,4 butanediol, tetrahydrofuran, gamma-butyrolactone, n-methyl-pyrrolidone, and others. the price of tetrahydrofuran increases by USD 0.15 per pound.

- Report ID: 3166

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tetrahydrofuran Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.