Telecom Cloud Market Outlook:

Telecom Cloud Market size was valued at USD 28.5 billion in 2025 and is set to exceed USD 182.44 billion by 2035, registering over 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of telecom cloud is evaluated at USD 33.73 billion.

The rise in demand for 5G is anticipated to drive the market growth. For instance, currently, there are 296 commercial 5G networks around the world, and it is expected that this number will increase to 438 in 2025. The demand for cloud services is expected to increase as 5G's assured low latency and increased speed become available. It is expected that service providers and end users will benefit from these opportunities. For instance, with the announcement of a new 5G private network partnership between Orange Spain and Ericsson ERIC, marking a historic milestone in the country's digital transformation, Spain's B2B sector is set to receive a boost.

Furthermore, cloud-based customer relationship management (CRM) and customer experience platforms empower telcos to personalize services, anticipate customer needs, and deliver a superior user experience. The telecommunications industry benefits from the use of cloud-based analytical and artificial intelligence capabilities, allowing it to obtain valuable data on customer behavior that can enable it to make strategic decisions to enhance its service offerings.

Key Telecom Cloud Market Insights Summary:

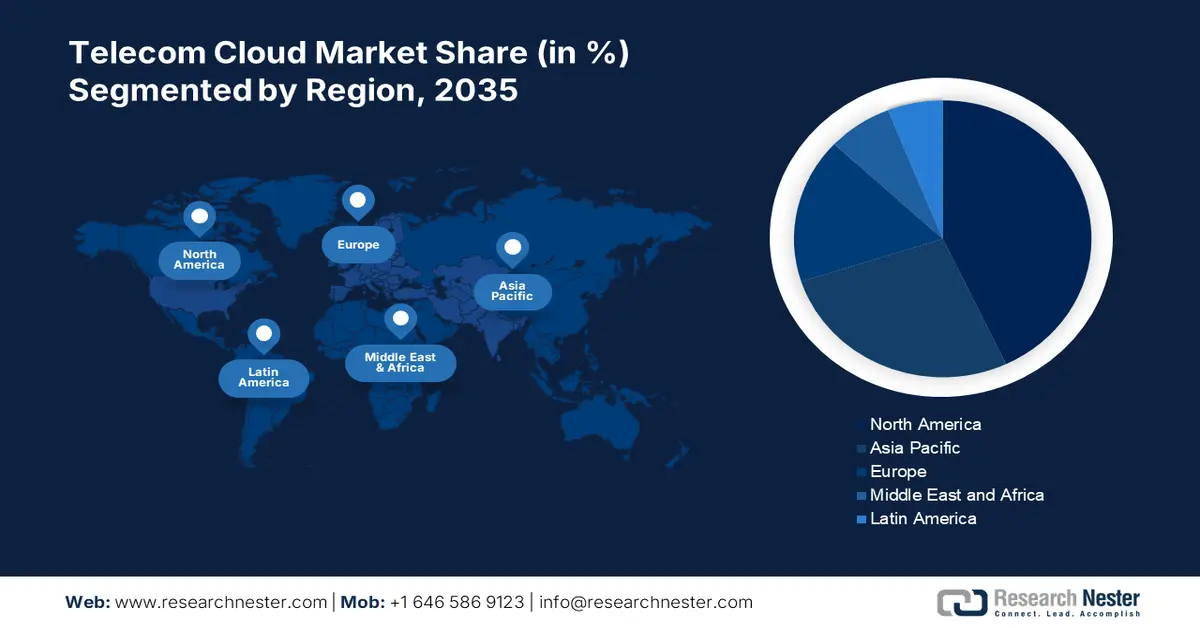

Regional Highlights:

- North America telecom cloud market will dominate over 35% share by 2035, driven by the rapid adoption of 5G and digital infrastructure expansion.

- Asia Pacific market will secure 28% share by 2035, driven by adoption of IoT, AI, and rising healthcare digitalization.

Segment Insights:

- The small & medium enterprises segment in the telecom cloud market is forecasted to hold a 57% share by 2035, driven by the adoption of scalable, cost-efficient cloud models by SMEs.

- The public cloud segment in the telecom cloud market is expected to capture a 48% share by 2035, driven by growing adoption of cost-effective operations.

Key Growth Trends:

- Growing Demand for Cloud-native Solutions

- Increasing Demand from Business Operations

Major Challenges:

- Growing Demand for Cloud-native Solutions

- Increasing Demand from Business Operations

Key Players: Dell Technologies, Google Cloud, VMware, Inc., IBM Corporation, Cisco Systems, Inc., Amazon Web Series, Inc., Oracle Corporation, Microsoft Corporation, Huawei Technologies Co., Ltd., HCL Technologies.

Global Telecom Cloud Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.5 billion

- 2026 Market Size: USD 33.73 billion

- Projected Market Size: USD 182.44 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Telecom Cloud Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Cloud-native Solutions - Demand for cloud-native network functions is expected to be fueled by rapid growth in industries and other technologies. Its effectiveness is influenced by the reduced automation and flexibility of cloud computing through traditional virtual networking functions. As the use of technologies such as Network Function Virtualization and Software Defined Networks (SDN) has increased globally, the technologies have been made simpler by replacing traditional hardware with software solutions. In addition, the SDN solutions directly detached data planes from control planes and thus enabled networks and programmable software to be driven by them. Therefore, this factor is expected to accelerate the growth of the market.

- Increasing Demand from Business Operations - Significant changes in company operations worldwide have been brought about by the improvement of communications and information technology. A wide range of government and public sector organizations use key information infrastructure services. For instance, Amazon Web Services (AWS) is launching a new cloud service called the AWS European Sovereign Cloud. This cloud service is designed specifically to help public sector customers and those in highly regulated industries meet the most stringent regulatory data residency and operational requirements in Europe. In addition, enterprises are becoming more and more interested in outsourcing services to meet the growing demand for their activities. In response to increasing demand for over-the-top cloud services, increased enterprise awareness of telecom cloud, and a reduction in administration and operating costs, the global telecom cloud market is expected to develop.

- Increased Data Consumption - In particular due to increased data demand, the market for telecommunications cloud services is rapidly developing. For instance, the number of internet users around the world has reached 5.3 billion by 2023, meaning that about two-thirds of the population has access to the Internet. Due to the widespread adoption of Digital Technologies, including cloud computing and the Internet of Things, there has been a significant increase in data traffic leading to an increasing number of telecommunications services that use Cloud Services. The market is undergoing a paradigm shift to cloud solutions as businesses and individuals look for more agile, flexible, safe & cost-effective ways of storing data.

Challenges

- Growing Concerns Regarding Data Security - The risk of cybersecurity could increase as the telecommunications sector expands its cloud services. For suppliers and operators, this increases the complexity. This technology contains strong data that could be damaged by a single error in the safety system. Therefore, the industries need to put in place comprehensive solutions and monitor all alerts with care. Global risks are increasing, such as internal threats, Third Party Risks, and so on. For instance, in the first half of 2022, there has been a 48% increase in phish attacks, with 11,395 cases costing businesses over USD 13.4 million. Therefore, the increase in threats may hinder the growth of the market.

- Increased Risk of Information Loss may Hamper the Growth of the Market

- Deployment Location and Interoperability Issues may Impede the Market Growth

Telecom Cloud Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 28.5 billion |

|

Forecast Year Market Size (2035) |

USD 182.44 billion |

|

Regional Scope |

|

Telecom Cloud Market Segmentation:

Deployment Model Segment Analysis

Public cloud segment in the telecom cloud market is expected to hold a share of 48% during the forecast period. The public cloud deployment model offers various benefits to enterprises. For instance, the average spending on public cloud is expected to reach USD 196.75 in 2024. The way companies manage their IT budgets is changing due to public cloud services.

Traditionally, significant investments have been made in purchasing and operating hardware, but the approach to operational expenditure in the cloud is changing the financial landscape. Therefore, the growing adoption of public cloud services is propelling the growth of the segment. For instance, the investment by NORD Holding will initiate a corporate merger to form a platform that is 100% focused on public cloud solutions and offers transformation and management services for public clouds. The majority of the shares in Cloudwrdig, Innovations On, and DION Solutions are acquired by NORD Holding.

Enterprise Segment Analysis

Small & Medium Enterprises segment in the telecom cloud market is anticipated to dominate largest share of 57% by 2035. Small and medium-sized enterprises, which employ less than 5,000 workers, are not subsidiaries. The SME segment is the fastest-growing segment, as it has adopted the pay-as-you-go model strategy, empowering businesses to scale up and grow more quickly. Better productivity, more efficient designs, improved product quality, reduced costs of introducing new products, better insights into critical Processes, improvements in reporting & analysis, better standards & regulatory compliance, improvements to the design review & approval process, better communication with each other as well as increased resource utilization are the key reasons for SMEs' adoption of cloud solutions and services are the following. SMEs now demand an instinctive graphical interface to facilitate complete user adoption and highly configurable functionality in applications.

Our in-depth analysis of the global market includes the following segments:

|

Deployment Model |

|

|

Enterprise |

|

|

Function Type |

|

|

Service Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Telecom Cloud Market Regional Analysis:

North American Market Insights

North American telecom cloud market is expected to hold a share of 35% during the forecast period. The region is embracing cloud computing services which is propelling the market growth. Also, the expansion can be attributed to the growing adoption of 5G technology in the region. In addition, the presence of the key telecom industries and major market players will boost the market revenue. For instance, between 2010 and 2020, telecommunications companies around the world invested about USD 1.8 trillion in infrastructure. Furthermore, in the US, the growing and swiftly changing digital data is accelerating the market growth in the region.

APAC Market Insights

Telecom cloud market in Asia Pacific is poised to hold a significant share of 28% by the end of 2035. The adoption of new and advanced technologies is driving the market for telecommunications cloud services in Asia Pacific. Innovative technologies such as the Internet of Things, cloud computing, and AI have been introduced by market players. Increasing healthcare expenditure, the expansion of healthcare sectors, and increasing government initiatives are also factors driving the market growth.

Telecom Cloud Market Players:

- Dell Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google Cloud

- VMware, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- Amazon Web Series, Inc.

- Oracle Corporation

- Microsoft Corporation

- Huawei Technologies Co., Ltd.

- HCL Technologies

Recent Developments

- February 2024 - To achieve better economics and flexibility while maintaining network reliability, Dell Technologies has announced new solutions to help CSPs facilitate the transition of their networks into cloud computing and operating systems. To make it easier for communications service providers to deploy, operate, and simplify support and lifecycle management of disaggregated network cloud infrastructure, Dell is using its decades of experience in digital transformation and deep industry partnerships to develop telecommunications solutions that reduce risk.

- February 2023 - Google Cloud announced three new telecommunications products to help communications service providers digitally transform their networks, using hybrid MWCcloud principles and unlock new revenue opportunities at the Telecoms Industry's biggest event of the year in 2023. The new telecommunications products, Telecom Network Automation, Telecom Data Fabric, and Telecom Subscriber Insight, will provide CSPs with a unified cloud solution enabling them to build, deploy, and operate hybrid cloud-native networks; collect and manage network data; and improve customer experience through artificial intelligence and Analytics.

- Report ID: 2562

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telecom Cloud Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.