Tax Software Market Outlook:

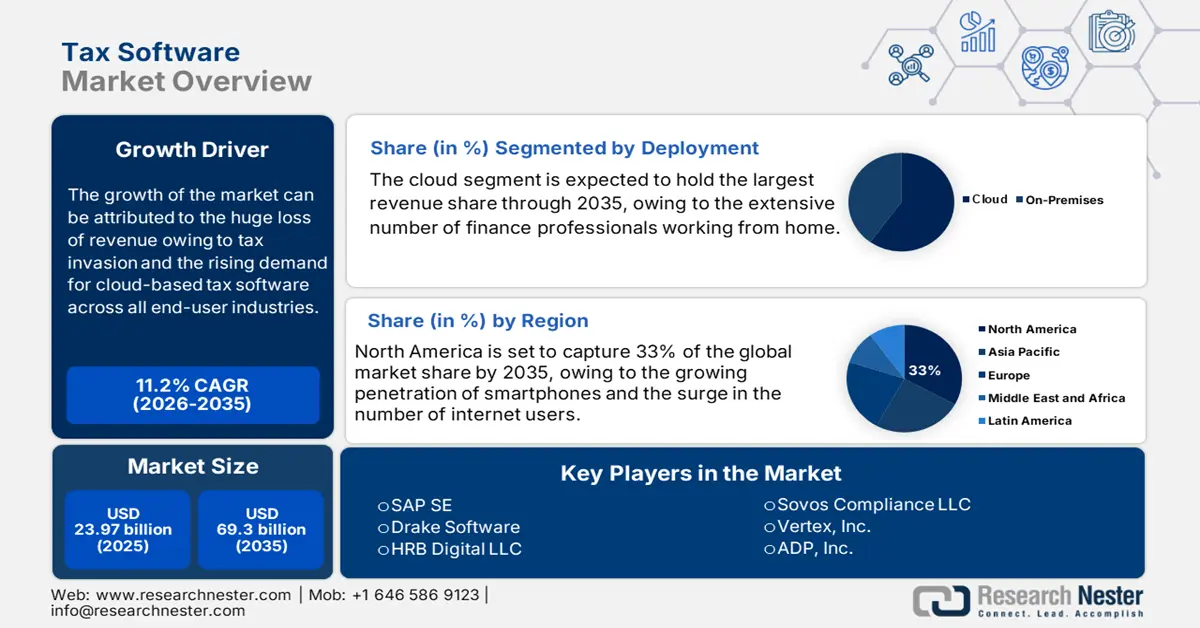

Tax Software Market size was valued at USD 23.97 billion in 2025 and is expected to reach USD 69.3 billion by 2035, registering around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tax software is evaluated at USD 26.39 billion.

The growth of the market can be attributed to huge loss of revenue owing to tax invasion. In United States every year lose about USD 180 Billion in tax evasion. Further China and Japan lose approximately USD 60 Billion and close to 50 Billion respectively owing to the same reason. Hence installation of tax software is expected to reduce the tax fraud taking placing all around globe which is further boosting the demand for the same. Additionally, the governments have recognized the benefits of digitization and began implementing information technology and e-services to increase productivity and enhance government functions including tax collection and auditing. They are extensively employing tax software or integrated websites in order to offer dependable and quick operations, further assisting both clients and accountants in quickly accessing accounting information.

In addition, demand for cloud-based tax software is rising across all end user industries. The use of cloud accounting has changed how frequently accountants operate and interact with their clients. These cloud-based solutions support businesses in decentralizing data storage and computation and provide high levels of flexibility, scalability, cost savings, and data security. Further, there has been surge in small and medium scale businesses which is also estimated to boost the growth of the market. For instance, India has about 62 million micro businesses, 0.33 million small businesses, and roughly about 4000 medium-sized businesses. These small and medium-sized companies are also adoption cloud-based tax management solution extensively. This is since they benefit from the incorporation of cloud-based tax management solutions into their organisational frameworks, as it facilitates them in lessening the economic burden related to subscription, software programme license acquisition, and maintenance.