- Market Definition and Research Methodology

- Market Definition

- Research Objective

- Research Methodology

- Executive Summary

- Market Dynamics

- Drivers

- Restraint

- Trends

- Opportunities

- Regulatory & Standards Landscape

- Industry Value Chain Analysis

- Impact of COVID-19 on the Global Tax Software Market

- Competitive Landscape

- Market Share Analysis, 2021

- Competitive Benchmarking

- SAP SE

- Detailed Overview

- Assessment of Key Offering

- Analysis of Growth Strategies

- Exhaustive Analysis on Key Financial Indicators

- Recent Developments

- Drake Software

- Avalara, Inc

- Wolters Kluwer N.V.

- Intuit Inc

- ADP, Inc

- Thomson Reuters

- Vertex, Inc

- Sovos Compliance, LLC

- HRB Digital LLC

- Other major players

- Global Tax Software Market Outlook

- Market Overview

- By Value (USD million)

- Global Tax Software Segmentation Analysis (2023-2036)

- By Component

- Software, 2023-2036F (USD million)

- Services, 2023-2036F (USD million)

- By Deployment

- Cloud, 2023-2036F (USD million)

- On-premises, 2023-2036F (USD million)

- By Tax Type

- Direct Tax, 2023-2036F (USD million)

- Indirect Tax, 2023-2036F (USD million)

- By End User

- Individuals, 2023-2036F (USD million)

- Commercial Enterprises, 2023-2036F (USD million)

- By Industry Vertical

- Banking, Financial Services & Insurance, 2023-2036F (USD million)

- Telecom & IT, 2023-2036F (USD million)

- Manufacturing, 2023-2036F (USD million)

- Retail, 2023-2036F (USD million)

- Others, 2023-2036F (USD million)

- By Region

- North America, 2023-2036F (USD million)

- Europe, 2023-2036F (USD million)

- Asia Pacific, 2023-2036F (USD million)

- Latin America, 2023-2036F (USD million)

- Middle East and Africa, 2023-2036F (USD million)

- By Component

- North America Tax Software Market Outlook

- Market Overview

- By Value (USD million)

- North America Tax Software Segmentation Analysis (2023-2036)

- By Component

- Software, 2023-2036F (USD million)

- Services, 2023-2036F (USD million)

- By Deployment

- Cloud, 2023-2036F (USD million)

- On-premises, 2023-2036F (USD million)

- By Tax Type

- Direct Tax, 2023-2036F (USD million)

- Indirect Tax, 2023-2036F (USD million)

- By End User

- Individuals, 2023-2036F (USD million)

- Commercial Enterprises, 2023-2036F (USD million)

- By Industry Vertical

- Banking, Financial Services & Insurance, 2023-2036F (USD million)

- Telecom & IT, 2023-2036F (USD million)

- Manufacturing, 2023-2036F (USD million)

- Retail, 2023-2036F (USD million)

- Others, 2023-2036F (USD million)

- By Country

- US, 2023-2036F (USD million)

- Canada, 2023-2036F (USD million)

- By Component

- Europe Tax Software Market Outlook

- Market Overview

- By value (USD million)

- Europe Tax Software Segmentation Analysis (2023-2036)

- By Component

- By Deployment

- By Tax Type

- By End User

- By Industry Vertical

- By Country

- UK, 2023-2036F (USD million)

- Germany, 2023-2036F (USD million)

- France, 2023-2036F (USD million)

- Italy, 2023-2036F (USD million)

- Rest of Europe, 2023-2036F (USD million)

- Asia Pacific Tax Software Market Outlook

- Market Overview

- By Value (USD million)

- Asia Pacific Tax Software Segmentation Analysis (2023-2036)

- By Component

- By Deployment

- By Tax Type

- By End User

- By Industry Vertical

- By Country

- China, 2023-2036F (USD million)

- India, 2023-2036F (USD million)

- Japan, 2023-2036F (USD million)

- South Korea, 2023-2036F (USD million)

- Australia, 2023-2036F (USD million)

- Rest of Asia Pacific, 2023-2036F (USD million)

- Latin America Tax Software Market Outlook

- Market Overview

- By value (USD million)

- Latin America Tax Software Segmentation Analysis (2023-2036)

- By Component

- By Deployment

- By Tax Type

- By End User

- By Industry Vertical

- By Country

- Brazil, 2023-2036F (USD million)

- Mexico, 2023-2036F (USD million)

- Argentina, 2023-2036F (USD million)

- Rest of Latin America, 2023-2036F (USD million)

- Middle East and Africa Tax Software Market Outlook

- Market Overview

- By value (USD million)

- Middle East and Africa Tax Software Segmentation Analysis (2023-2036)

- By Component

- By Deployment

- By Tax Type

- By End User

- By Industry Vertical

- By Country

- GCC, 2023-2036F (USD million)

- Israel, 2023-2036F (USD million)

- South Africa, 2023-2036F (USD million)

- Rest of Middle East and Africa, 2023-2036F (USD million)

Tax Software Market Outlook:

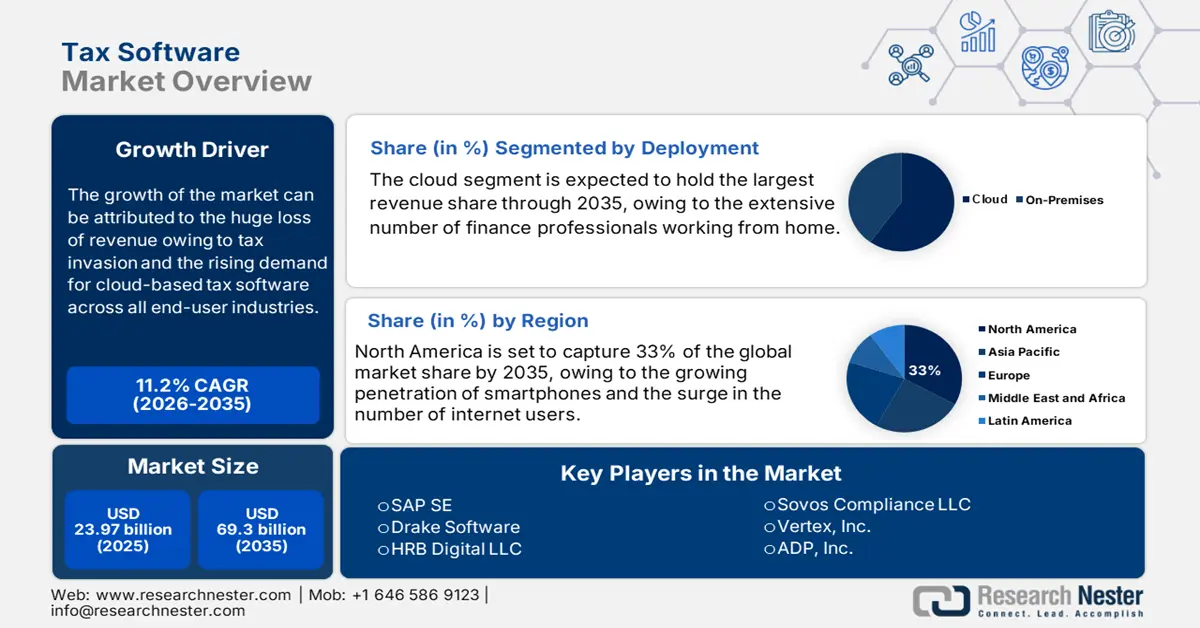

Tax Software Market size was valued at USD 23.97 billion in 2025 and is expected to reach USD 69.3 billion by 2035, registering around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tax software is evaluated at USD 26.39 billion.

The growth of the market can be attributed to huge loss of revenue owing to tax invasion. In United States every year lose about USD 180 Billion in tax evasion. Further China and Japan lose approximately USD 60 Billion and close to 50 Billion respectively owing to the same reason. Hence installation of tax software is expected to reduce the tax fraud taking placing all around globe which is further boosting the demand for the same. Additionally, the governments have recognized the benefits of digitization and began implementing information technology and e-services to increase productivity and enhance government functions including tax collection and auditing. They are extensively employing tax software or integrated websites in order to offer dependable and quick operations, further assisting both clients and accountants in quickly accessing accounting information.

In addition, demand for cloud-based tax software is rising across all end user industries. The use of cloud accounting has changed how frequently accountants operate and interact with their clients. These cloud-based solutions support businesses in decentralizing data storage and computation and provide high levels of flexibility, scalability, cost savings, and data security. Further, there has been surge in small and medium scale businesses which is also estimated to boost the growth of the market. For instance, India has about 62 million micro businesses, 0.33 million small businesses, and roughly about 4000 medium-sized businesses. These small and medium-sized companies are also adoption cloud-based tax management solution extensively. This is since they benefit from the incorporation of cloud-based tax management solutions into their organisational frameworks, as it facilitates them in lessening the economic burden related to subscription, software programme license acquisition, and maintenance.

Key Tax Software Market Insights Summary:

Regional Highlights:

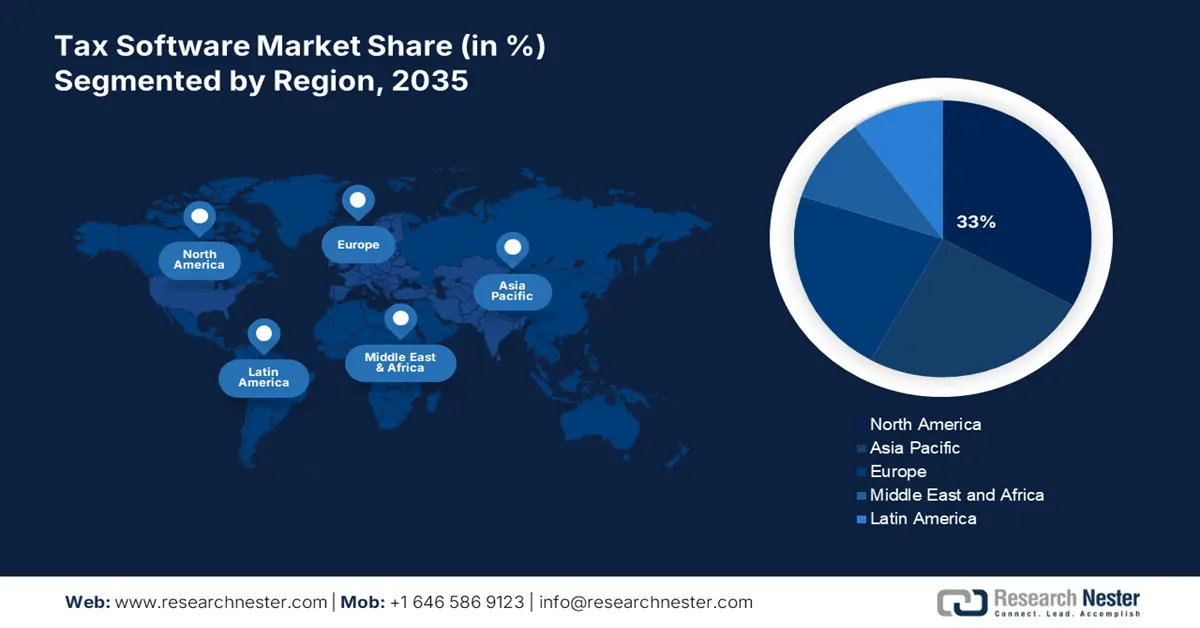

- North America tax software market is predicted to capture 33% share by 2035, driven by smartphone penetration and internet usage growth.

- Asia Pacific market will achieve significant growth during the forecast timeline, driven by increased internet adoption and access to tax tech.

Segment Insights:

- The cloud deployment segment in the tax software market is expected to capture a significant share by 2035, driven by the rising number of finance professionals working remotely.

- The commercial enterprises segment in the tax software market is forecasted to achieve significant growth during 2026-2035, driven by increasing use of tax software for integrated financial systems.

Key Growth Trends:

- Growing Penetration of Smartphones

- Significant Penetration of Internet

Major Challenges:

- Rapid Regulatory Changes

- Lack of Skilled Employees for Accounting and Handling Tax Software

Key Players: SAP SE, Drake Software, Avalara Inc., Wolters Kluwer N.V., Intuit Inc., ADP, Inc., Thomson Reuters, Vertex, Inc., Sovos Compliance LLC, HRB Digital LLC.

Global Tax Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.97 billion

- 2026 Market Size: USD 26.39 billion

- Projected Market Size: USD 69.3 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Australia

- Emerging Countries: China, India, Singapore, South Korea, Mexico

Last updated on : 10 September, 2025

Tax Software Market Growth Drivers and Challenges:

Growth Drivers

- Growing Penetration of Smartphones-According to a projection, there are already about 7 billion smartphone users worldwide, which translates to an ownership rate of approximately 82%. Various applications are available on smartphones which prove to be beneficial in calculating tax. These ingenious tools make it easier to organize finances and make contingency plans. Also, not large number of people have access to computers and laptops. However, the penetration of smartphones is greater all around the globe. For instance, by the end of 2020, a projected 5 billion smartphones were expected to be in use worldwide, more than three times the number of PCs. Hence growing penetration of smartphones is estimated to boost the tax software market growth.

- Significant Penetration of Internet- There were estimated to be about 3 billion active internet users worldwide in 2022. That represents about 60% of the entire world's population. Most of the tax software completely reply on internet for its functionality. Internet access is essential to install program updates and utilize PPR software. High speed internet connection further improves the user experience. Hence rise in penetration of internet is expected to boost the market in future.

- Growing Adoption of Digital Tools- A digital property tax tool was introduced in the United States in March 2022 by CentralSquare Technologies, a Florida-based public sector software supplier. The outdated systems are intended to be replaced by this cloud-based tax software. Property tax software is included in this product launch as local and state governments increasingly adopt digital tools.

- Growth in Digital Financial Transactions - Globally, two-thirds of adults have made or received a digital payment, with developing economies accounting for an increasing share from 35% in 2014 to 57% in 2021.

- Establishment of Various Taxation Strategies - In order to concentrate on data integration, processing, quality, warehousing, and management, the Income Tax Transaction Analysis Centre (INTRAC) was founded in India. For the purpose of assessing the risk associated with taxpayer profiles and carrying out audits, INTRAC would also use web-text mining and sophisticated data analytics, including artificial intelligence.Further, rising need and awareness for direct and indirect tax management is also expected to drive the tax software market growth.

Challenges

- Rising Concern for Incidence of Theft of Confidential Data - During the filing procedure of income tax returns, various documents are used that contain private information about the companies, including social security numbers, employer identification numbers, and other crucial details. Hackers take time-sensitive files from various tax filing platforms, steal secret data, and prevent the organization from submitting the files on time by freezing them. Hackers occasionally present the firm with incorrect tax return files in order to file a tax return. Owing to the replication of the social security number, the tax system does not permit the organization to resubmit the filing if it has already been submitted. Therefore, one of the reasons that is predicted to hinder the growth of the tax software market over the forecast period is the rising theft of sensitive information.

- Rapid Regulatory Changes

- Lack of Skilled Employees for Accounting and Handling Tax Software

Tax Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 23.97 billion |

|

Forecast Year Market Size (2035) |

USD 69.3 billion |

|

Regional Scope |

|

Tax Software Market Segmentation:

Deployment Segment Analysis

The cloud segment is expected to account for a significant revenue share by 2035. This growth of the segment is attributed to the large number of finance professional working from home. For instance, since the UK Coronavirus lockdown began in March, the vast majority (about 96%) of accountants and other finance professionals have worked from home. Hence tax software makes it easy for employees to work from anywhere as so long as they are connected to the internet. Additionally, authorized users of cloud-based tax software have the freedom to access the system from any location around the clock using a web browser, so they are not restricted to the confines of their office space. Moreover, growing efforts of various organization in order to offer their best services to general public is also estimated to boost the market growth. For instance, the leading Indian income tax e-filing service EZTax.in has added new capabilities that automatically select the appropriate tax regime to help customers save every last cent of the IT return.

End-user Segment Analysis

The commercial enterprises segment is expected to witness significant growth during the forecast period, backed by growing use of tax management software by commercial enterprises in order to integrates numerous applications including sales and billing software, purchasing software, accounting and employee payroll system, and other financial applications. This software is deployable across corporate networks on a variety of platforms and could be tailored for certain business needs. Additionally, the technicality of sales and use tax has increased significantly. To detect tax fraud and tighten up compliance, tax jurisdictions all over the world are aggressively utilizing technology. As a result, it has become necessary for small business to extensively deploy sales tax software to make their business grow. Further, as businesses expand, companies require business-oriented tax management that is created in accordance with particular business requirements that encodes corporate policies, regulations, and processes. Hence, the demand for tax software is estimated to increase.

Our in-depth analysis of the global tax software market includes the following segments:

|

By Deployment |

|

|

By Tax Type |

|

|

By End User |

|

|

By Component |

|

|

By Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tax Software Market Regional Analysis:

North American Market Insights

The North America tax software market is poised to dominate 33% revenue share by 2035. The growth of the market in this region can be attributed growing penetration of smartphones, and surge in number of internet user. There were about 414 million internet users in North America. In 2026, this number is anticipated to reach approximately 445 million internet users. Owing to rise in the internet user the demand for tax software is expected to grow as using internet provide them to avail benefit of advanced technology. However, the market in Asia Pacific region is estimated to grow with a highest CAGR of 11.9% over the forecast period.

Tax Software Market Players:

- SAP SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Drake Software

- Avalara Inc.

- Wolters Kluwer N.V.

- Intuit Inc.

- ADP, Inc.

- Thomson Reuters

- Vertex, Inc.

- Sovos Compliance LLC

- HRB Digital LLC

Recent Developments

-

Sovos Compliance, a leader in global tax software and industry authority, has just published a reference for insurers on Insurance Premium Tax (IPT). Both inexperienced IPT practitioners and seasoned tax professionals worried about cross-border compliance could find reliable advice in the booklet. Those who want to understand more about the evolving IPT regulatory environment around the world, notably in Europe and EU Member States, would find this insight to be of particular interest.

-

Intuit Inc. ProConnect has announced intentions to provide new third-party integrations to ProConnect Tax Online, Lacerte, and ProSeries in order to enhance their functionality. The growing partnership ecosystem would provide tax professionals access to additional resources to better serve clients, automate compliance tasks, and maintain using the software they already know and love while also improving workflow.

- Report ID: 4686

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tax Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.