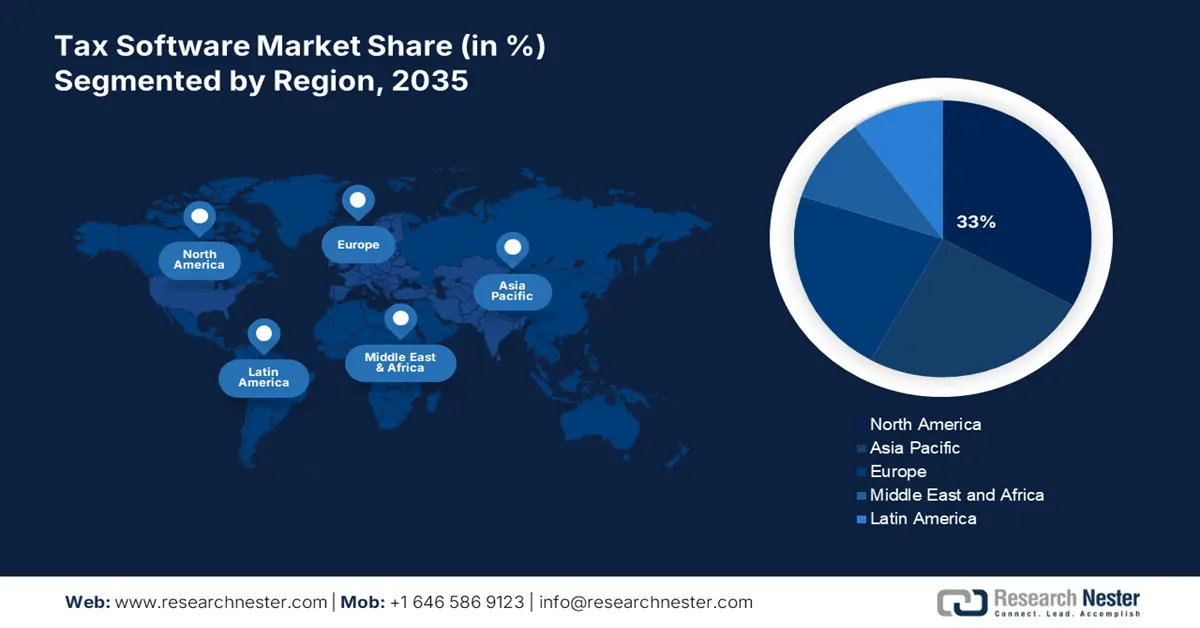

Tax Software Market Regional Analysis:

North American Market Insights

The North America tax software market is poised to dominate 33% revenue share by 2035. The growth of the market in this region can be attributed growing penetration of smartphones, and surge in number of internet user. There were about 414 million internet users in North America. In 2026, this number is anticipated to reach approximately 445 million internet users. Owing to rise in the internet user the demand for tax software is expected to grow as using internet provide them to avail benefit of advanced technology. However, the market in Asia Pacific region is estimated to grow with a highest CAGR of 11.9% over the forecast period.

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In the year 2026, the industry size of tax software is evaluated at USD 26.39 billion.

The global tax software market size exceeded USD 23.97 billion in 2025 and is set to register a CAGR of around 11.2%, exceeding USD 69.3 billion revenue by 2035.

North America tax software market is predicted to capture 33% share by 2035, driven by smartphone penetration and internet usage growth.

Key players in the market include SAP SE, Drake Software, Avalara Inc., Wolters Kluwer N.V., Intuit Inc., ADP, Inc., Thomson Reuters, Vertex, Inc., Sovos Compliance LLC, HRB Digital LLC.