Systemic Inflammatory Response Syndrome Treatment Market Outlook:

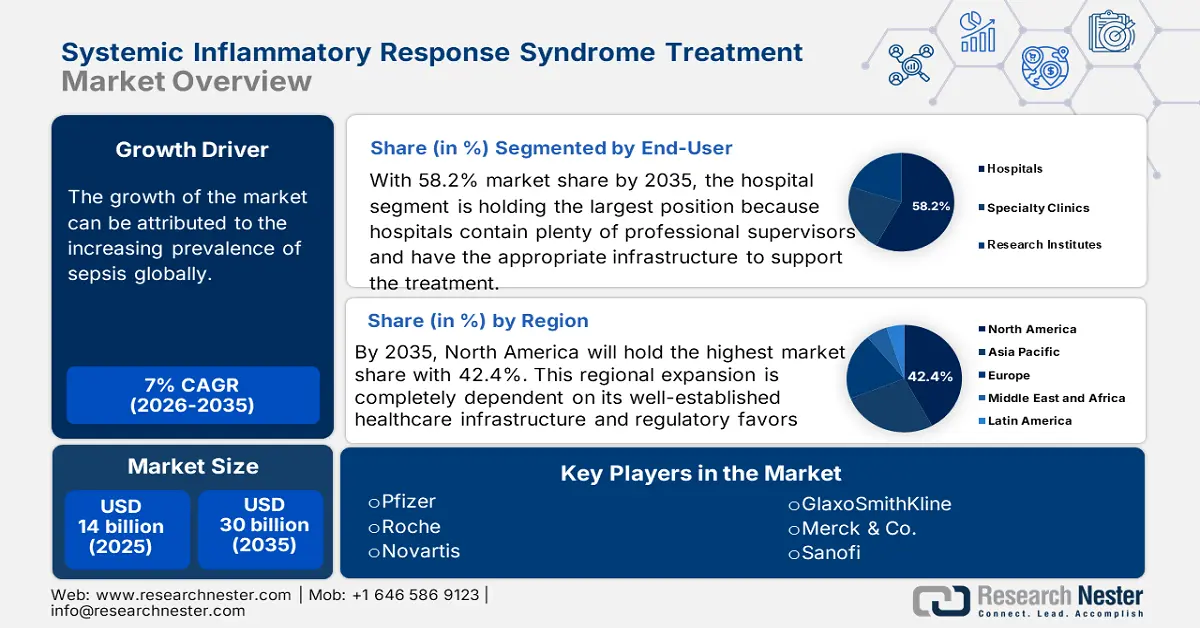

Systemic Inflammatory Response Syndrome Treatment Market size was valued at approximately USD 14 billion in 2025 and is projected to reach around USD 30 billion by the end of 2035, rising at a CAGR of approximately 7% during the forecast period from, 2026–2035. In 2026, the industry size of systemic inflammatory response syndrome treatment is estimated at USD 15 billion.

One of the major drivers behind the exponential growth in the market is the increasing incidence of sepsis across the globe. According to data published by the World Sepsis Alliance, 47-50 million sepsis cases occur per year. This is magnifying the surge for urgent and effective clinical and pharmaceutical solutions in dedicated medical settings. Researchers suggest that the early-stage use of therapeutics for systemic inflammatory response syndrome (SIRS) reduced the need for hospitalization. These factors are augmenting the market growth during the forecasted period.

Factors such as the burgeoning cost of active pharmaceutical ingredients (APIs) and supplementary expenditure on the stringent regulatory approval process are causing economic discrepancies in the market. The supply chain faces the risk of raw material shortages and cold chain failures, compelling the companies to utilize digital tracking and dual sourcing to ensure compliance as well as continuity. Also, the value chain of the market depends upon regulatory bodies for pharmacovigilance for the approval of the product. Market players are also integrating robotics and automation to streamline operations.

Key Systemic Inflammatory Response Syndrome (SIRS) Treatment Market Insights Summary:

Regional Insights:

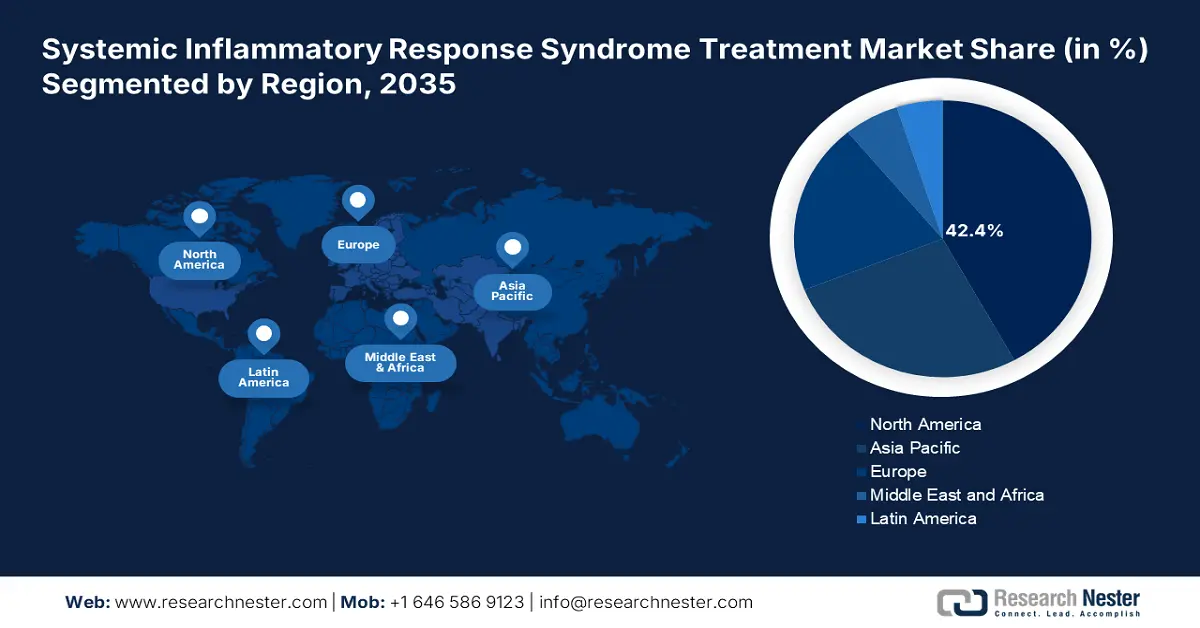

- North America is projected to hold a 42.4% share of the Systemic Inflammatory Response Syndrome Treatment Market by 2035, owing to well-established healthcare infrastructure.

- Asia Pacific is anticipated to expand at the fastest pace by 2035, propelled by rapid infrastructural development.

Segment Insights:

- By 2035, the immunomodulators segment in the Systemic Inflammatory Response Syndrome Treatment Market is projected to secure a 32.4% share, bolstered by escalating R&D investments.

- The hospitals segment is anticipated to command a 58.2% share by 2035, strengthened by the availability of robust infrastructure and skilled supervision.

Key Growth Trends:

- Investments and efforts in innovation

- Technological integration in treatment and monitoring

Major Challenges:

- Disparities in affordability and availability

Key Players: Pfizer,Roche,Novartis,GlaxoSmithKline,Merck & Co.,Sanofi,Johnson & Johnson,AstraZeneca,Eli Lilly,Takeda Pharmaceutical,Daiichi Sankyo,CSL Limited,Sun Pharma,Lupin,Samsung Bioepis,Celltrion,Hikma Pharmaceuticals,Biocon,Pharmaniaga

Global Systemic Inflammatory Response Syndrome (SIRS) Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14 billion

- 2026 Market Size: USD 15 billion

- Projected Market Size: USD 30 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, Japan, United Kingdom

- Emerging Countries: – India, Brazil, South Korea, Australia, Italy

Last updated on : 2 September, 2025

Systemic Inflammatory Response Syndrome Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Investments and efforts in innovation: The clinically proven enhancement in product efficacy due to extended R&D conducted is inspiring companies to invest more in exploration. According to data published by the UNESCO Institute for Statistics (UIS), global spending on research and development has reached USD 1.7 trillion. Furthermore, the integration of advanced technologies in both development and manufacturing is leveraging the capacities of the market in both therapeutic excellence and product accessibility. Together, these factors are propelling the SIRS market growth to render innovative and efficient solutions that can enhance the survival rates of the patient while ensuring faster availability of the treatment across the regions.

- Technological integration in treatment and monitoring: The introduction of technological innovations is playing a prominent role in monitoring and diagnosing. The advanced diagnostic tools are capable of detecting markers swiftly and enabling the doctors to begin the timely intervention. According to data published by the University of Minnesota School of Public Health in January 2025, almost 65% of the U.S. hospitals are utilizing AI-enabled predictive models. Moreover, the inclusion of the digital health solution assists swift remote patient monitoring, mainly in post-treatment progress, augmenting clinical results and lowering the hospital readmission rates.

- Aging population and chronic disease burden: A data published by the Centers for Disease Control and Prevention in October 2024, 6 in 10 U.S. residents have at least 1 type of chronic disease. These chronic diseases, such as cardiovascular diseases, diabetes, etc., are creating a large patient pool susceptible to SIRS. Other than this, the rising geriatric population is also contributing to the growth of the SIRS treatment market. Hospitals are catering to critical care services, and the demand for immunomodulators, is continues to thrive, further boosting the market growth.

Challenges

- Disparities in affordability and availability: Despite the gradual growth in developed landscapes, the systemic inflammatory response syndrome treatment market still lacks resources in underserved regions. The slow and limited penetration of advanced solutions in price-sensitive countries, such as China and India, often becomes a major hurdle for pioneers in globalizing their portfolios. Besides, the product’s expensiveness and the absence of adequate reimbursement policies also hinder wide adoption in these marketplaces. However, the introduction of generics is helping companies mitigate these issues.

Systemic Inflammatory Response Syndrome Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 14 billion |

|

Forecast Year Market Size (2035) |

USD 30 billion |

|

Regional Scope |

|

Systematic Inflammatory Response Syndrome Treatment Market Segmentation:

Treatment Type Segment Analysis

Based on treatment type, the immunomodulators segment is expected to hold the largest share of 32.4% in the systemic inflammatory response syndrome treatment market by 2035. Its high efficacy in reducing mortality makes this segment a priority for both drug developers and consumers. Moreover, the specificity in targeting affected or inflated cells has introduced a revolutionary asset for global leaders in this field. The increasing R&D investments are fueling its dominance over other subtypes. In 2023, the CDC initiated the Hospital Sepsis Program to implement a standard process to screen for sepsis, and it confirmed that early administration of the treatment of sepsis is lifesaving. These factors are also augmenting the segment’s growth during the forecasted period.

End-user Segment Analysis

In terms of end user, the hospitals segment is predicted to dominate the systemic inflammatory response syndrome treatment market with a share of 58.2% over the assessed timeline. The presence of adequate infrastructure and supervision professionals makes these medical settings the most preferred point of care for patients. Additionally, the availability of better financial support and a standardized approach helps this segment create greater scope for garnering lucrative revenues. Bulk procurement in these organizations made ICU SIRS treatment less expensive than in clinics.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Systemic Inflammatory Response Syndrome Treatment Market - Regional Analysis

North America Market Analysis

North America is poised to capture the highest share of 42.4% of the global market throughout the discussed timeframe. The region’s dominance is pledged to its well-established healthcare infrastructure and regulatory favors. These factors are cumulatively influencing both domestic and international pioneers to introduce innovative SIRS solutions for afflicted individuals. The enlarging population of sepsis patients in developed countries, such as the U.S. and Canada, is also fueling demand in this landscape. Also, North America is pioneering in medical research, mainly in biomarker development, which is further propelling the market growth during the forecasted period.

Considering the widespread associated ailments, several public authorities in the U.S. are heavily investing in developments in the market. Additionally, market players are focusing on cultivating local sources and supply channels to make related therapeutics and other essentials more accessible for citizens, fueling adoption in this sector. Furthermore, the continuously increasing reimbursement coverage is acting as a financial cushion for patients. According to the CDC in August 2025, every year, more than 1.7 million adults in the country develop sepsis. These factors are further augmenting the market share in the country.

APAC Market Analysis

The Asia Pacific systemic inflammatory response syndrome treatment market is anticipated to register the fastest pace of growth by the end of 2035. The region’s propagation is fueled by rapid infrastructural development and ongoing government initiatives in the healthcare industry. This is fostering a lucrative business environment for both domestic and global leaders in this field. Additionally, the increasing adoption of AI-based diagnostic and disease management tools is procuring consumers’ faith, stimulating regionwide acceptability of advanced solutions. Moreover, the continuous expansion of the sepsis patient pool is also attracting pharma producers to participate in this market.

The market in China is highly influenced by proactive government participation and contribution to domestic SIRS production. The frequent occurrence of this medical condition is pushing them to reform the nationwide healthcare infrastructure and medicine supply chain to accommodate the required solutions for every individual. China is also paying attention to strengthening the administration of biosimilars as a cost-efficient alternative to exorbitant, obsolete treatment options, helping lower the cost crisis for patients. The National Institutes of Health 2022 stated that Sepsis is prevalent in 25% of ICU patients in China.

Europe Market Analysis

The market in Europe is set to offer lucrative opportunities and is experiencing significant growth. The growth is driven by rising cases of sepsis, which has become a major concern in the healthcare system across the region. Moreover, the advancements in healthcare infrastructure have upgraded the ability to assess and treat SIRS with utmost efficiency. Furthermore, the advent of novel therapeutics has introduced a myriad of treatment options, rendering increased patient outcomes. Also, the market in Europe is benefiting from the increased awareness among the population.

The market in Germany is experiencing astounding growth, bolstered by a plethora of prominent factors that showcase the country’s state-of-the-art healthcare infrastructure. In September 2024, according to the Global Sepsis Alliance, sepsis is considered to be 3rd most frequent cause of death in the country. Also, it is considered to claim more than 85,100 lives a year. Additionally, the country’s aging population is contributing to the higher incidence of chronic diseases, making people susceptible to these diseases. Also, collaborative efforts between academic institutions in the country are driving innovations in the treatment for SIRS.

Key Systemic Inflammatory Response Syndrome Treatment Market Players:

- Pfizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche

- Novartis

- GlaxoSmithKline

- Merck & Co.

- Sanofi

- Johnson & Johnson

- AstraZeneca

- Eli Lilly

- Takeda Pharmaceutical

- Daiichi Sankyo

- CSL Limited

- Sun Pharma

- Lupin

- Samsung Bioepis

- Celltrion

- Hikma Pharmaceuticals

- Biocon

- Pharmaniaga

- Mesoblast

The current scenario of the market represents a healthy competition among key players. They are increasingly investing in R&D cohorts to explore the extensive potential of their existing pipelines. Additionally, their heavy investments in drug discovery, coupled with strategic commercial and public-private alliances, are benefiting them with greater revenue generation while fostering new business opportunities in various disciplines. For instance, in 2023, Pfizer invested USD 2.2 billion in the commencement of a clinical trial on its IL-6 inhibitor. Simultaneously, in the same year, Roche formed a consortium of AI-powered diagnostics with more than 92 hospitals in Europe. Such events replicate the ongoing global expansion of this sector.

Below are the areas covered for each company under the top 20 global manufacturers:

Recent Developments

- In March 2025, Roche received approval for its supplemental Biologics License Application (sBLA) for Gazyva/Gazyvaro (obinutuzumab) from the U.S. FDA, following the positive outcomes of the Phase III REGENCY study. The study demonstrated a significant improvement in complete renal response among patients with lupus nephritis, highlighting the therapy’s potential to address critical unmet needs in this patient population.

- In March 2024, Pfizer announced its Q2 financial results following the launch of CytokineX, an IL-6 inhibitor for the treatment of refractory SIRS in sepsis patients. The new therapy generated USD 320.4 million in revenue, contributing to a 12.3% increase in output from Pfizer’s immunomodulator portfolio, reflecting strong market uptake and reinforcing the company’s leadership in targeted inflammatory therapies.

- Report ID: 3013

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Systemic Inflammatory Response Syndrome (SIRS) Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.