Swellable Packers Market Outlook:

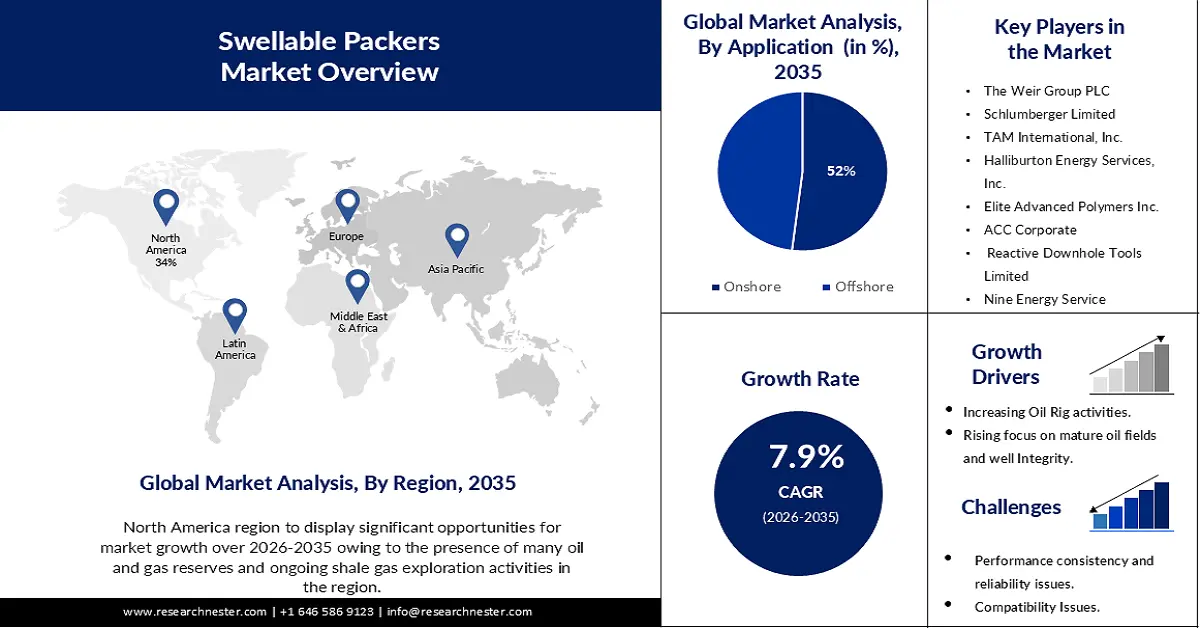

Swellable Packers Market size was over USD 629.42 million in 2025 and is anticipated to cross USD 1.35 billion by 2035, growing at more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of swellable packers is assessed at USD 674.17 million.

The Market for swellable packers has been experiencing significant growth in recent years owing to several factors. The increased demand for oil and natural gas, which has resulted in higher drilling rig activity as well as an urgent need to develop efficient horizontal isolation tools, is one of the key factors behind this growth. Swellable packers offer a reliable and cost-effective solution in this direction since they do not require any mechanical packing or simplify the installation process. In addition, swellable packers allow operators to isolate and produce from multiple zones within a single wellbore, thereby increasing flexibility and flexibility. This increases production potential and decreases overall operating costs regarding well completion and workover activities.

Key Swellable Packers Market Insights Summary:

Regional Highlights:

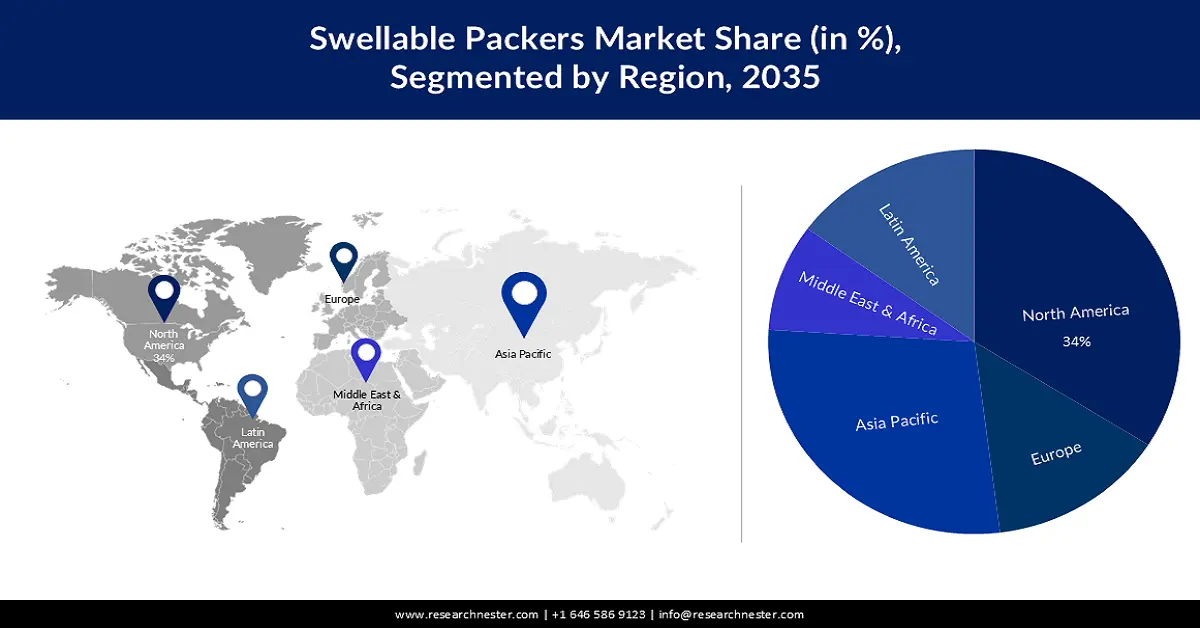

- By 2035, the North America swellable packers market is set to command a 34% share, underpinned by expanding shale gas output and advanced drilling practices.

- Asia Pacific market is projected to witness substantial growth through 2035, bolstered by rising E&P activities across China, India, Australia, and Indonesia.

Segment Insights:

- The onshore segment in the swellable packers market is projected to secure a 52% share by 2035, propelled by its extensive deployment in well and zonal isolation operations.

- The retrievable packers segment is anticipated to remain the leading product category through 2026-2035, sustained by widespread installations and ease of replacement.

Key Growth Trends:

- Technological Advancements

- Rising Focus on Mature Oilfields and Well Integrity

Major Challenges:

- Performance Consistency and Reliability

Key Players: Weatherford, The Weir Group PLC, Schlumberger Limited, TAM International, Inc., Halliburton Energy Services, Inc., Elite Advanced Polymers Inc., ACC Corporate, Reactive Downhole Tools Limited, Nine Energy Service, Baker Hughes Company.

Global Swellable Packers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 629.42 million

- 2026 Market Size: USD 674.17 million

- Projected Market Size: USD 1.35 billion by 2035

- Growth Forecasts: 7.9%

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, Saudi Arabia, United Arab Emirates

- Emerging Countries: India, Brazil, Australia, Indonesia, Malaysia

Last updated on : 26 November, 2025

Swellable Packers Market - Growth Drivers and Challenges

Growth Drivers

- Technological Advancements- Advances in the swellable packer technology are driving swellable packers market growth. To improve the performance and reliability of this equipment, market players have been investing in R&D. For instance, self-healing swellable packers that can automatically repair any damage caused during manufacture or installation have been developed. These developments have led to a significant increase in operators' confidence that swellable packing can be applied, resulting in wider adoption.

- Rising Focus on Mature Oilfields and Well Integrity- With a significant number of mature oil and gas wells globally, there’s a growing emphasis on well integrity and production optimization. Swellable packers offer an effective solution for wellbore isolation, and helping in revitalizing production from mature wells and extending their productive lifespan. As per estimates, there were 16,900 oil and gas wells drilled in the United States in 2017, which is expected to increase to 22,600 by 2022.

- Cost and Operational Efficiency- Swellable packers are preferred for their simplicity and cost efficiency compared to traditional mechanical packers. They require less equipment and maintenance, reducing operational costs. Their ability to swell and seal annular spaces in the wellbore without the need for intervention contributes to increased operational efficiency.

- Environmental and Safety Benefits- Swellable packers contribute to enhanced environmental and safety measures in the oil and gas industry. Their reliable zonal isolation properties minimize the risk of fluid leaks and environmental contamination, ensuring safer and more sustainable operations.

Challenges

- Performance Consistency and Reliability- One of the key challenges faced by swellable packers is ensuring consistent and reliable performance. Factors such as variations in downhole conditions, including temperature, pressure, and chemical composition of fluids, can impact the swelling characteristics of the packers. Achieving uniform performance across diverse well environments poses a challenge for manufacturers and operators, as inconsistencies might affect zonal isolation and overall well integrity.

- Compatibility issues with various wellbore fluids, including drilling fluids, completion fluids, and production fluids, can affect the performance of swellable packers.

- Striking a balance between performance, reliability, and cost-effectiveness remains a challenge.

Swellable Packers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 629.42 million |

|

Forecast Year Market Size (2035) |

USD 1.35 billion |

|

Regional Scope |

|

Swellable Packers Market Segmentation:

Application Segment Analysis

Onshore segment is poised to largest revenue share, accounting for 52% of the global swellable packers market. The segment’s growth is primarily due to its extensive use in well isolation, zonal isolation, and hydraulic fracturing operations. As per the US Energy Information Administration, the production of 6.44 million barrels of crude oil per day, or 59% of the total production in the United States, was attributed to hydraulic fracturing from tight oil reservoirs in 2018, this provided for prospective opportunities for the market’s growth. The onshore oil and gas industry widely uses swellable packers for annular sealing, and increasing oil production and consumption is likely to drive the segment’s demand in the upcoming years. Additionally, Increasing government and public investment in new drilling contracts will also drive the demand for onshore swellable packers.

Product Type Segment Analysis

The retrievable packers segment is estimated to dominate the global swellable packers market during the forecast period, due to the low cost and simple installation process, retrieval packers are used widely. It may be changed several times by the use of milling equipment in the drilling process. In view of the large number of installations, this has led to a high market penetration and is expected to remain the dominant product segment. As a result of numerous installations in the well lifecycle, recoverable packers are likely to increase rapidly over the next few years.

Our in-depth analysis of the global swellable packers market includes the following segments:

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Swellable Packers Market - Regional Analysis

North American Market Insights

North America industry is poised to hold largest revenue share of 34% by 2035. There is a high level of oil and gas reserves as well as continuing shale gas exploration activities in the region, which has led to market growth. It is analyzed by Research Nester analysts that, the United States has increased shale gas and tight oil production to approximately 25 TCF in 2021, up from 1.77 TCF in 2000. In 2050, almost 34 trillion cu m is expected to be produced. The United States' natural gas reserves stood at 12.6 trillion cubic meters as of 2020. The continual advancements in drilling techniques, including horizontal drilling and hydraulic fracturing further augment the adoption of swellable packers, as these technologies enable access to complex reservoirs that demand precise zonal isolation capabilities. Moreover, North America’s strict adherence to safety standards and environmental regulations accentuates the preference for swellable packers, as they contribute to minimizing environmental impact and ensuring wellbore integrity. Collaborations between industry stakeholders and ongoing innovation efforts sustain the momentum of the swellable packers’ market across North America’s dynamic oil and gas landscape.

APAC Market Insights

Asia Pacific swellable packers market is experiencing substantial growth due to several key factors. The region’s burgeoning oil and gas exploration and production activities, particularly in countries like China, India, Australia, and Indonesia, drive the demand for efficient well-completion solutions. Swellable packers, offering cost-effective zonal isolation capabilities, cater to the increasing need for reservoir management in complex geological formations. Additionally, advancements in drilling technologies allowing access to deeper and more challenging reserves further fuel the adoption of these packers. The region’s focus on environmental regulations and safety standards also favors the utilization of swellable packers, as they enhance wellbore integrity and reduce the risk of fluid migration between reservoir zones. Collaborations between industry players, ongoing R&D initiatives, and the pursuit of cost-effective yet reliable solutions contribute significantly to the growth of the swellable packers market across the diverse oil and gas landscapes in the Asia Pacific region.

Swellable Packers Market Players:

- Weatherford

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Weir Group PLC

- Schlumberger Limited

- TAM International, Inc.

- Halliburton Energy Services, Inc.

- Elite Advanced Polymers Inc.

- ACC Corporate

- Reactive Downhole Tools Limited

- Nine Energy Service

- Baker Hughes Company

Recent Developments

- June 2022- Nine Energy Services has completed the installation of production casing for a monitor well on one of New Mexico's largest operators, which is using Swell Tech 150, an additive that makes its cement more flexible. To provide rapid diffusion when mixed with water and improve the mixability of slurry cement, this additive is a naturally occurring mineral composed of surfactants.

- November 2023- Halliburton Company and Oil States Industries, Inc. announced a strategic partnership that would enable them to provide customers with cutting-edge deepwater managed pressure drilling (MPD) solutions by combining two award-winning technology sets.

- Report ID: 5513

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Swellable Packers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.