Surgical Monitors Market Outlook:

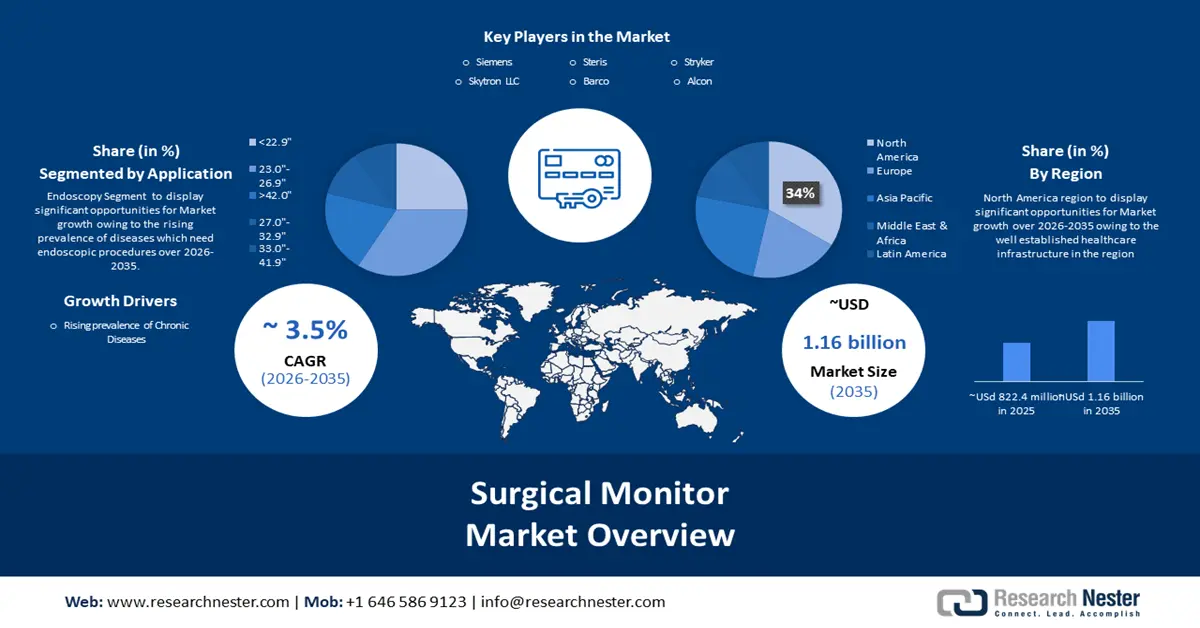

Surgical Monitors Market size was over USD 822.4 million in 2025 and is projected to reach USD 1.16 billion by 2035, witnessing around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surgical monitors is evaluated at USD 848.31 million.

The market is in reality significantly driven by the increasing incidence of chronic illnesses. Surgical operations are frequently necessary for the treatment or management of chronic conditions, including neurological disorders, cancer, and cardiovascular diseases. For instance; as per the data provided by the UN, by 2050, chronic illnesses like cancer, diabetes, respiratory disorders, and cardiovascular diseases will be responsible for 86% of the 90 million fatalities that occur annually. This represents a startling 90% increase in absolute numbers since 2019.

In addition, all medical display monitors experienced a shift in trend as a result of the widespread use and conversion to LCD displays, which are growing at a never-before-seen rate due to declining LCD unit pricing. The need for diagnostic displays is driving growth in the market across all application platforms.

Key Surgical Monitors Market Insights Summary:

Regional Highlights:

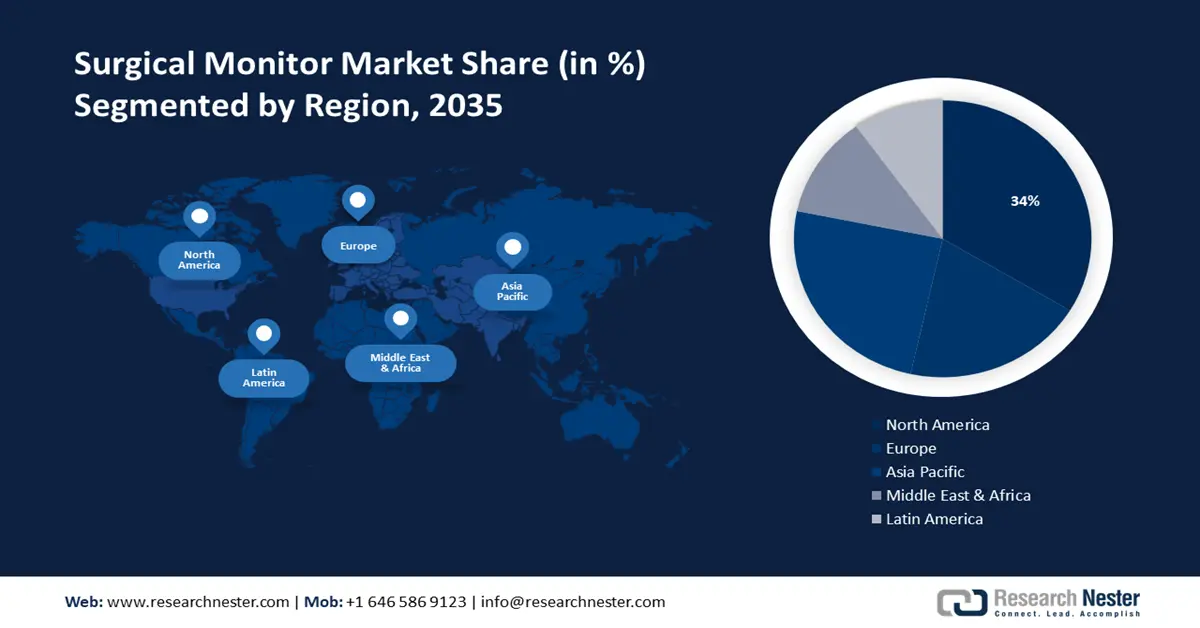

- North America surgical monitors market will secure over 34% share, fueled by technological improvements in the region, forecast period 2026–2035.

- Asia Pacific market will capture a 25% share, driven by demand for modern healthcare facilities in developing nations, forecast period 2026–2035.

Segment Insights:

- The endoscopy segment in the surgical monitors market is projected to achieve a 53% share by 2035, driven by increased endoscopic procedures due to rising chronic diseases.

- The 23.0”-26.9” segment in the surgical monitors market is expected to achieve a 34% share by 2035, driven by advancements in display technology offering improved image quality and resolutions.

Key Growth Trends:

- Rising Number of Surgeries

- Growing Aged Population

Major Challenges:

- Dearth of Trained Professionals

- High Prices of Surgical Monitors may Hinder Market Growth.

Key Players: Barco NV, Sony Corporation, Steris plc, Eizo Corporation, Olympus Corporation, NDS Surgical Imaging (Novanta Inc.), FSN Medical Technologies, Advantech Co., Ltd., LG Electronics Inc., Ampronix, Inc.

Global Surgical Monitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 822.4 million

- 2026 Market Size: USD 848.31 million

- Projected Market Size: USD 1.16 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Surgical Monitors Market Growth Drivers and Challenges:

Growth Drivers

- Rising Number of Surgeries: Millions of individuals throughout the world receive surgery each year, and surgical procedures are thought to be responsible for 13% of all disability-adjusted life years (DALYs) worldwide. An estimated 1.19 million persons lost their lives in traffic-related incidents each year. For kids and young adults aged 5 to 29, automobile accidents are the main cause of death. Despite having over 60% of the world's vehicles, low- and middle-income countries account for 92% of all road fatalities worldwide. An additional 20 to 50 million people sustain non-fatal injuries; many of them become disabled. A significant proportion of people injured in such accidents, raise the need for surgeries. Thus, with the rising number of road accidents the number of surgeries conducted is also increasing further providing growth prospects to the market.

- Growing Aged Population: The percentage of the population that is 60 years of age or older is rising. There were one billion individuals sixty years of age or older in the world in 2019. By 2030, there will be 1.4 billion, and by 2050, there will be 2.1 billion. This increase is happening at an unprecedented pace, and it will continue to grow in speed in the upcoming decades, especially in developing nations. Eighty percent of the elderly will reside in low- and middle-income nations in 2050. Chronic obstructive pulmonary disease, depression, diabetes, dementia, back and neck discomfort, cataracts, hearing loss, refractive errors, and osteoarthritis are common illnesses in older adults. People are more prone to having multiple ailments at once as they get older. Owing to this, the demand for surgeries among old age people would rise. In light of this, the market is anticipated to witness growth during the projection period.

- Rising Healthcare Expenditure: The analysis, which was released in advance of Universal Health Coverage (UHC) Day, shows that, in 2021, health spending worldwide hit a record high of US$ 9.8 trillion, or 10.3% of the world's gross domestic product (GDP). Health spending across all income categories was mostly concentrated in hospitals, ambulatory care providers, and pharmacies (65%–84%). During the epidemic, capital investments rose in all income brackets: 40–50% in low- and lower-middle-income nations, and 8–9% in upper-middle- and high-income nations. This rise in spending on the healthcare sector also offers growth prospects to the surgical monitors market.

Challenges

- Dearth of Trained Professionals: Surgical Monitors are intricate instruments that require proficient personnel to ensure that no mistakes are made throughout the monitorsing process. Lack of understanding and knowledge is posing several obstacles to market expansion due to a shortage of trained personnel to operate this sophisticated equipment. Most healthcare facilities, particularly those in rural areas, are unable to benefit from monitors. Additionally, many small & medium-sized hospitals find it difficult to afford the large capital expenditure needed to purchase such equipment which will have an impact on their adoption of Surgical Monitors and perhaps impede market growth.

- High Prices of Surgical Monitors may Hinder Market Growth.

- Regulatory Compliances Associated with the Surgical Monitors may hamper the Market Growth.

Surgical Monitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 822.4 million |

|

Forecast Year Market Size (2035) |

USD 1.16 billion |

|

Regional Scope |

|

Surgical Monitors Market Segmentation:

Screen Size

Surgical monitors market from the 23.0”-26.9” segment is anticipated to hold the largest share of 34% during the forecast period. The market increase in the 23.0” to 26.9” inch screen size points to a trend toward the usage of more sophisticated displays in surgical settings. The size range becomes more attractive for surgical applications because of advancements in display technology such as improved image quality and greater resolutions. Demand for monitors in this size range may rise as a result of the surgeon’s preference for larger screens that serve them with ease and comfort during the complex procedures.

Application

Endoscopy segment in the surgical monitors market is expected to hold a share of 53% by the end of 2035. Endoscopy is visualizing inside organs and structures for surgical or diagnostic purposes utilizing specialized equipment equipped with cameras. Surgical can carry out procedures more efficiently when these endoscopic images are monitorsed. Endoscopic procedures have increased as a result of the rising incidence of chronic diseases like cardiovascular disease, cancer, and gastrointestinal disorders. Advanced Surgical Monitors are therefore becoming more and more necessary to support the surgeries and enhance patient outcomes.

Our in-depth analysis of the global market includes the following segments:

|

Screen Size |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Monitors Market Regional Analysis:

North American Market Insights

North America industry is predicted to dominate majority revenue share of 34% by 2035. Over the forecast period, the market is anticipated to be dominated by technological improvements in the region. A rise in sports injuries, developing healthcare infrastructure that allows the adoption of surgical imaging technology, and supportive government policies that promote the purchase and reimbursement of advanced Surgical Monitors devices are some of the factors supporting the growth of the market in the region. Furthermore, in 2019, in the United States, passenger cars accounted for more than half of the 12.15 million vehicles involved in crashes. This high number of accidents further raises the need for surgeries and is thus predicted to influence the market in North America positively.

APAC Market Insights

APAC Surgical Monitors market is anticipated to hold the second-largest share of 25% during the forecast period. The population growth in developing nations like China, India, and Japan is driving up demand for modern healthcare facilities that offer cutting-edge medical treatments like surgery and diagnostic imaging. The need for screening and interventional procedures using imaging technologies is being strengthened by the country's aging population, which is more prone to chronic diseases. It is expected to present possible avenues for the Asia Pacific market to flourish. Additionally, the region's adoption of surgical and screening procedures is driven by rising knowledge and the availability of patient-friendly health insurance, which is driving the market for Surgical Monitors.

Surgical Monitors Market Players:

- Skytron LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens

- Steris

- Stryker

- Alcon

- Barco

- Koninklijke Philips N.V

- Ambu A/S

Recent Developments

- Stryker was the market leader in the world for PACS monitors and surgical displays in 2023. Stryker and Barco work together to provide a selection of surgical displays in HD and 4K resolutions that are appropriate for use in a variety of medical environments, such as interventional suites, hybrid operating rooms, and endoscopy rooms.

- Jan 2021- ADLINK Technology, Inc released ASM (ADLINK Surgical Monitors) series, a series of medical-grade Surgical Monitors. The launch intended to facilitate visualizing videos and still images from various clinical imaging systems in ICUs, ORs, and emergency & examination rooms.

- Report ID: 5826

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Monitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.