Surface Mount Technology Market Outlook:

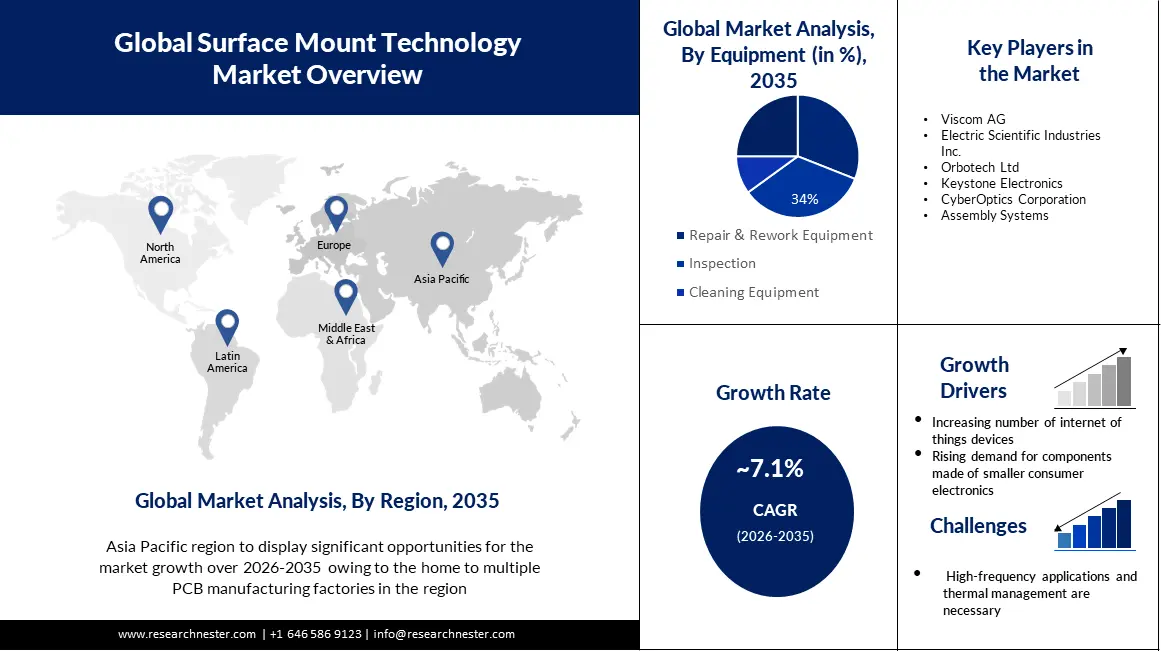

Surface Mount Technology Market size was over USD 6.45 billion in 2025 and is projected to reach USD 12.81 billion by 2035, witnessing around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surface mount technology is evaluated at USD 6.86 billion.

Industries are moving away from through-hole technology in favor of surface mount technology due to its many benefits, including its lower component count, higher component density, superior mechanical performance, and simpler, quicker automated assembly. Thus, it is anticipated that surface mount technology will become more popular.

Additionally, it is projected that most electronics will become more compact and smaller, and there is an increase in demand for these tiny components, which is made possible by SMT. New devices have a substantially higher component density and more connections per component, although they are smaller than older ones. This suggests that electronic devices with the smallest possible form factors, such as smartphones, wearables, and IoT, can be more advanced and efficient than before. Between 2019 and 2022, the number of wearable gadgets globally expanded dramatically. From 929 million the year before to approximately 1.1 billion in 2022, this number grew worldwide.

Key Surface Mount Technology Market Insights Summary:

Regional Highlights:

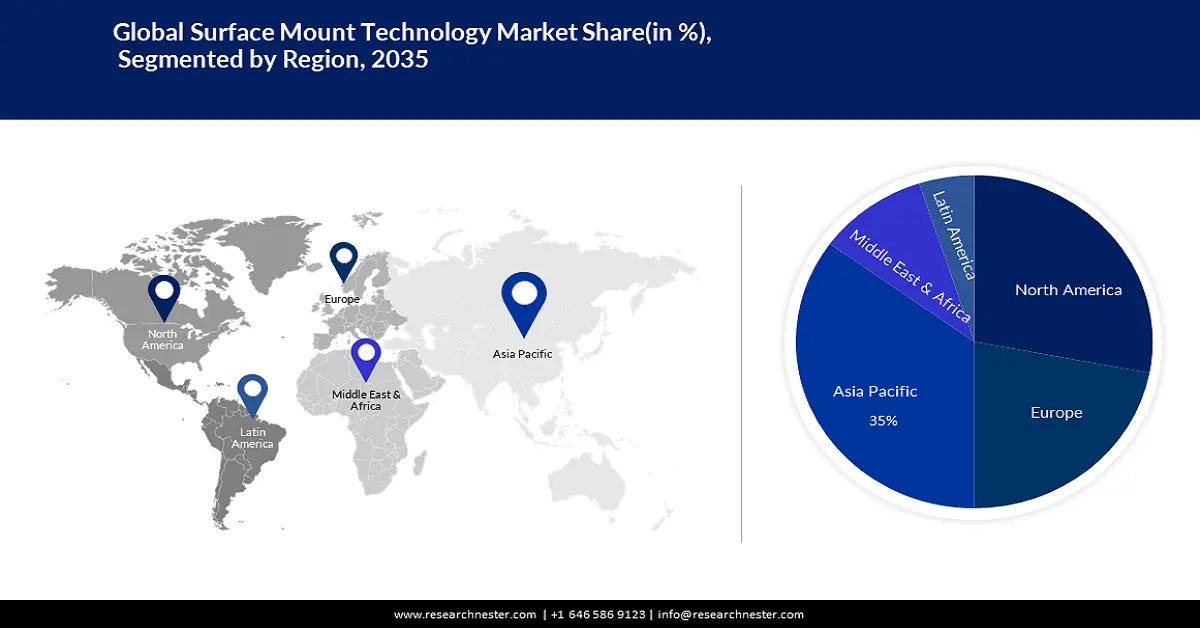

- The Asia Pacific surface mount technology (SMT) market is projected to achieve a 35% share by 2035, driven by the presence of multiple PCB manufacturing facilities in the region.

- The North America market is expected to capture a 28% share by 2035, attributed to rising demand for consumer electronics and miniaturized devices.

Segment Insights:

- The inspection segment in the surface mount technology market is anticipated to hold a 34% share by 2035, driven by demand in telecommunication, automotive, and electronics industries.

- Telecommunication segment in the surface mount technology market is forecasted to experience 25% growth by the forecast year 2035, attributed to increasing wireless network demand for high-performance computing.

Key Growth Trends:

- Increase in the Number of Internet of Things (IoT) Devices

- Rising Demand for Components Made of Smaller Consumer Electronics

Major Challenges:

- High-Frequency Applications and Thermal Management Are Necessary

-

Systems for Surface Mounting Equipment are Expensive.

Key Players: Keystone Electronics, Orbotech Ltd, Cicor Group, Linx Technologies, CyberOptics Corporation, Nordson Corporation, Assembly Systems, Electro Scientific Industries Inc., Viscom AG.

Global Surface Mount Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.45 billion

- 2026 Market Size: USD 6.86 billion

- Projected Market Size: USD 12.81 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, Singapore

Last updated on : 11 September, 2025

Surface Mount Technology Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in the Number of Internet of Things (IoT) Devices- The development of wearable technology and IoT devices is increasing demand for SMT in a number of ways. To enhance the user experience, IoT technologies and devices that are portable and small can be easily incorporated into a number of products. There are well over 13 billion linked IoT devices across the globe. IoT devices are projected to reach 25.4 billion by 2030.

-

Rising Demand for Components Made of Smaller Consumer Electronics- In the consumer electronics industry, new technologies and innovators are always developing, providing consumers with access to cutting-edge features like fingerprint sensors in smartphones and smart televisions. Around the globe now, 6.8 billion people use smartphones. This equates to a smartphone penetration rate of more than 80% given that there are 8 billion people on the earth. In response to the rising demand for smaller, more compact devices, electronic components have been made smaller and more compact.

-

Advent of Self-Monitoring, Analysis, and Reporting Technology (SMART)- Self-monitoring, analysis, and reporting technology (SMART) has revolutionized the technological landscape. SMART is rapidly becoming more and more widely used, from smart devices like smartwatches, and laptops to even more extensive uses in smart homes and factories. The necessity to quickly and properly install and inspect each component has fuelled the need for SMT equipment. 216.43 million people used smartwatches in 2022, and an estimated USD 43.39 billion in revenue was generated.

Challenges

-

High-Frequency Applications and Thermal Management Are Necessary- The process of creating an electrical device is difficult because many factors, particularly in SMT, must be considered. When designing the device, factors including high-frequency applications, thermal control, and stress on the PCB from an improper coefficient of thermal expansion (CTE) must be considered. Understanding how a change in temperature will impact an object's size is made simpler by the CTE. When designing for high-frequency applications, such as telephony and consumer electronics, additional factors such as the impedance of the package signal lines, cross-talk noise between these lines, and inductance interconnects on the PCB must be considered.

-

Systems for Surface Mounting Equipment are Expensive.

-

Surface Mount Technology Should not be Used to Mount Power Circuits Or Other Components.

Surface Mount Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 6.45 billion |

|

Forecast Year Market Size (2035) |

USD 12.81 billion |

|

Regional Scope |

|

Surface Mount Technology Market Segmentation:

Equipment Segment Analysis

The inspection segment in the surface mount technology market is expected to grow with the highest revenue share of 34% during the forecast period. Its demand is likely to be driven by the increasing demand for inspection equipment in the telecommunication, automotive, consumer electronics, computing, and storage industries during the course of the projected period. Around 9.2 million US cars will be produced in 2021, a 4.5% increase from the year before.

End-User Industry Segment Analysis

Surface mount technology market from the telecommunication segment is expected to have a significant share of about 25% during the forecast period. The need for surface mount technology is being driven by the increasing demand for wireless networks in high-performance computing and telecommunications applications, which is essential for networks to operate quickly and accurately. By the end of 2021, there will be 5.3 billion subscribers to mobile services or 67% of the global population. Between now and 2025, there will be an increase of more than 400 million new mobile subscribers.

Our in-depth analysis of the global surface mount technology market includes the following segments:

|

Equipment |

|

|

Component |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surface Mount Technology Market Regional Analysis:

APAC Market Insights

The surface mount technology market is expanding significantly in the Asia-Pacific region with about 35% revenue share mainly because the area is home to multiple PCB manufacturing factories. China has a large number of PCB production facilities such as Shanghai is home to AT&S's largest production facility, which specializes in multi-layer PCBs. This is a result of the company focusing on the sizable mobile communications industry in China. In 2022, China produced over 324 billion integrated circuits, a 10% decrease from the previous year.

North America Market Insights

The North America is anticipated to hold 28% share of the global surface mount technology market during the forecast period. Owing to the production of consumer electronics with high quality and competitive pricing in North America, SMT assembly solutions are used. Also, due to the growing need for mobile, internet-connected devices, consumer electronics, automotive, and telecommunications as well as the need for increased precision, product miniaturization, and quicker processing times, the surface mount technology market for placement equipment is growing.

Surface Mount Technology Market Players:

- Mycronic AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Keystone Electronics

- Orbotech Ltd

- Cicor Group

- Linx Technologies

- CyberOptics Corporation

- Nordson Corporation

- Assembly Systems

- Electro Scientific Industries Inc.

- Viscom AG

Recent Developments

- Mycronic AB received an order for a Prexision 800 Evo mask writer for display applications from an existing customer in Asia. Delivery of the system is planned for the second quarter of 2024.

- Keystone Electronics expanded its product portfolio of ultra-flat surface mount thread inserts with the launch of metric and inch-threaded versions. The surface mount inserts are now available in metric thread (M2.5, M3, M4) or inch thread (2-56, 4-40, 6-32). The special packaging and design makes it quick and easy to add tin-coated steel thread inserts to printed circuit boards.

- Report ID: 5253

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surface Mount Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.