Hyperloop Technology Market Outlook:

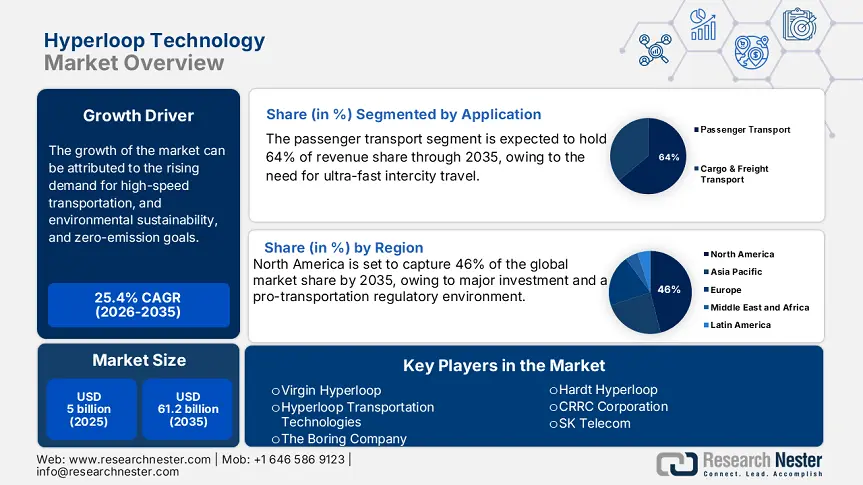

Hyperloop Technology Market size was valued at USD 5 billion in 2025 and is projected to reach USD 61.2 billion by the end of 2035, rising at a CAGR of 25.4% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of hyperloop technology is assessed at USD 11.2 billion.

The hyperloop technology industry has experienced considerable advances in the past decade, both in the way of technological advances and in greater public and private investment. The continued evolution of propulsion systems has made hyperloop technology more energy efficient. Additionally, advancements in propulsion technology are important to the entire hyperloop technology industry. Moreover, these innovations will allow for the removal of previous limitations in speed, energy consumption, and maintenance costs. A second major trend is the increase in support from government-backed projects and public-private partnerships. Various countries in varying stages of development and supporting environmental projects and providing support to the development and integration of a hyperloop system into their transportation options. These types of projects support completely transformative trends that continue to support the new regulatory approach, which shows ongoing social and regulatory support.

Moreover, private-sector investment is expanding as a result of venture capital and strategic chats in fueling Hyperloop's technical advancement. These financial investments are advancing research and testing as well as accelerating the opportunity for "commercial" full-size systems. Finally, regional collaborations are leading to varied solutions to be introduced to the market. The utilization of global expertise, local insights, and infrastructure development allows hyperloop systems to adapt to different geographical and regulatory instances. This phenomenon indicates that the market is becoming more regionally connected.

Key Hyperloop Technology Market Insights Summary:

Regional Highlights:

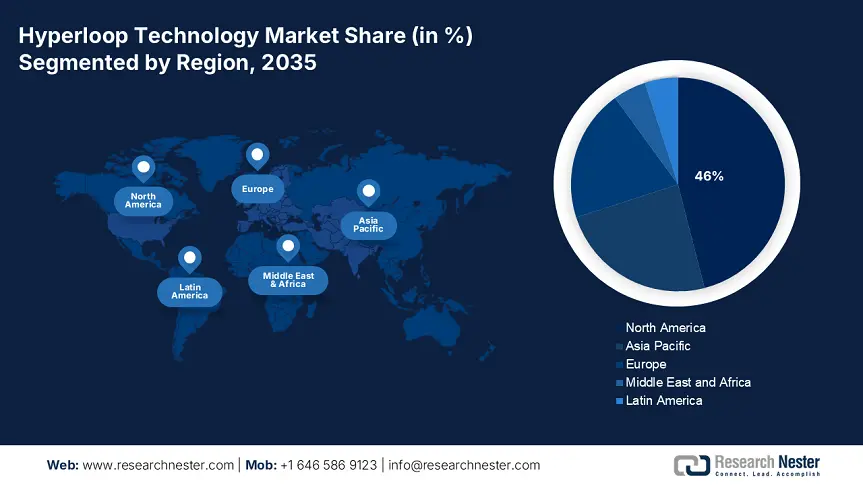

- By 2035, North America is anticipated to secure a 46% share of the hyperloop technology market, underpinned by substantial investment and a favorable regulatory environment for transport.

- Asia Pacific is projected to expand strongly through 2026–2035, capturing a notable CAGR as a result of rapid urbanization, government backing, technological advancement, and rising demand for efficient and sustainable mobility solutions.

Segment Insights:

- The passenger transport segment is set to command a 64% share by 2035 in the hyperloop technology market, bolstered by the need for ultra-fast intercity travel.

- The transportation and logistics segment is positioned to attain a 51% share by 2035, sustained by the growing necessity to optimize supply chains and increased usage driven by rising e-commerce demand.

Key Growth Trends:

- Rising demand for high-speed transportation

- Environmental sustainability and zero-emission goals

Major Challenges:

- High infrastructure & capital costs

- Pricing pressures & public procurement constraints

Key Players: Virgin Hyperloop (USA), Hyperloop Transportation Technologies (USA), TransPod (Canada), The Boring Company (USA), Hardt Hyperloop (Netherlands), Zeleros (Spain), CRRC Corporation (China), MHI Group (Mitsubishi Heavy Industries) (Japan), HTT (Hyperloop Transportation Technologies) (USA), Lilium (Germany), Arrivo (USA), SK Telecom (South Korea), Bechtel Corporation (USA), AeroVironment (USA), Vinci Construction (France).

Global Hyperloop Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5 billion

- 2026 Market Size: USD 11.2 billion

- Projected Market Size: USD 61.2 billion by 2035

- Growth Forecasts: 25.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, United Arab Emirates, Singapore, Canada

Last updated on : 26 June, 2025

Hyperloop Technology Market - Growth Drivers and Challenges

Growth Drivers

-

Rising demand for high-speed transportation: As mega-cities grow, the demand for faster, long-distance travel is becoming critical. According to the European Commission, in 2023, the EU's rail passenger transport performance nearly quadrupled from 2020 and grew by 11.2% from 2022. Hyperloop can reach speeds of over 1000 km/h and has the potential to become a viable competitor with both air and high-speed rail. Commuters and logistics companies know there is a demand for faster and more productive travel times over congested metropolitan areas.

-

Environmental sustainability and zero-emission goals: Hyperloop's small environmental footprint contributes to progress toward global decarbonization targets. Since Hyperloop operates in sealed, low-resistance tubes, it is designed to operate using renewable, zero-emission energy sources. Governments and corporations face increasing pressure to reduce carbon emissions. As per the estimates published by the International Energy Agency, 2024 saw a 0.8% increase in total energy-related CO2 emissions, reaching a record high of 37.8 Gt CO21. Hyperloop provides another sustainable alternative to air and road travel and is therefore compatible with the systems and policies. Countries with net-zero targets by 2050 identify Hyperloop as the next generation of mobility.

-

Technological advancements in magnetic levitation (Maglev) and IoT integration: Sustained improvements in Maglev, vacuum technologies, and IoT convergence are increasing Hyperloop's commercial viability. Smart sensors, predictive maintenance solutions, and AI-based automation of traffic will enhance safety, energy efficiency, and operations control. The convergence of Hyperloop with AI, robotics, and IoT will open up more avenues for governments and technology companies to invest R&D towards Hyperloop development.

Challenges

-

High infrastructure & capital costs: Developing Hyperloop systems requires vast amounts of upfront money, which is one of the major challenges facing the market today. Many governmental authorities favour lower-priced, low-risk infrastructure projects instead. Hyperloop's large capital requirement means that it can consume a large part of national or regional transportation budgets and limit critical investments in public transit, road repair, or broadband access.

-

Pricing pressures & public procurement constraints: Pricing concerns and public procurement limitations are two significant barriers to the supply chain for hyperloop technology. Hyperloop is still in such early development phases that it is unable to fulfil procurement requirements needed for large-scale government tenders. It is extremely difficult for governments to justify investing in a costly, untested transport system.

Hyperloop Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.4% |

|

Base Year Market Size (2025) |

USD 5 billion |

|

Forecast Year Market Size (2035) |

USD 61.2 billion |

|

Regional Scope |

|

Hyperloop Technology Market Segmentation:

Application Segment Analysis

The passenger transport segment is estimated to account for the largest share of 64% in the market over the discussed timeframe. The need for ultra-fast intercity travel is driving the passenger transport segment. Cities, states, and nations are seeking to reduce the time in traveling between metropolitan regions. Regardless of the source of funding, some initiatives have mobilized resources. Moreover, hyperloop systems in the passenger transport segment are by far the market-leading application segment based on revenue share.

End User Segment Analysis

The transportation and logistics segment is poised to dominate the market with a share of 51% during the analyzed period. The transportation and logistics industry utilizes hyperloop as a mode of transportation for cargo and other commodities due to its speed and efficiency. The increased necessity to optimize supply chains and the increased usage phase through growing e-commerce demand have improved the investment landscape for Hyperloop-related logistics solutions. For instance, Canada's Innovation, Science, and Economic Development offers support for tech-driven freight solutions, indicating support for this end-user segment to preserve revenue domination.

Technology Segment Analysis

Maglev technology is still the underlying propulsion mechanism with the most significant share of technology segments. The Maglev technology component can be expected to take over the market for its basic value in enabling super high-speed, frictionless travel. Maglev supports pod speeds virtually unlimited, except a little over 1,000 km/h with respect to passengers' comfort. In addition, Maglev systems have decades of development and reasonably successful pilot programs around the world. This milestone of maturity presents investments in the technology as it is now familiar and has reduced technical uncertainties for Hyperloop tech developers.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Application |

|

|

End User |

|

|

Technology |

|

|

Infrastructure |

|

|

Service Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyperloop Technology Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 46% in the global hyperloop technology market by the end of 2035. Growth is supported by substantial investment and a favorable regulatory environment for transport. The United States Government is committed to creating sustainable transportation, thus spurring momentum for future hyperloop systems. The U.S. Department of Transportation declared almost USD 830 million in grants in April 2024 to U.S. territories, Tribal Nations, and state and local governments. These grants build on the USD 7.3 billion in formula funding that states receive to assist their transportation system resilience to climate effects such as flooding, sea level rise, wildfires, and high heat. The demand for quicker and cleaner transportation options in cities will also lead to increased demand.

The U.S. market has gained substantial traction from government support, private investment, tech development, and the growing interest in sustainable transportation solutions. The U.S. continues to focus on sustainable transportation solutions and smart-city planning, which indicates that hyperloop solutions would interact with these sustainability and infrastructure needs. There is significant public-private partnership, regulatory support, and funding for hyperloop, meaning that the U.S. is very well positioned to take lead in the global market in the near future.

The hyperloop technology market in Canada is expanding due to the constant support of government technology advancements and investment in sustainable infrastructure. As a nation, Canada continues to invest in private equity in green technology, which aims to eliminate carbon emissions from fossil fuel applications. According to the International Energy Agency, Canada has set a lofty goal to achieve net-zero emissions by 2050 and reduce greenhouse gas emissions by 40-45% from 2005 levels by 2030. The government of Canada is focusing on investments in 5G networks. These components will enable hyperloop systems to operate efficiently. Moreover, the government’s focus on clean energy and sustainable transportation relates to enhances the market's development.

APAC Market Insights

Asia Pacific is poised to exhibit a notable CAGR in the global hyperloop technology market throughout the discussed period. Several key forces, including rapid urbanization, government backing, technological advancement, and increased demand for efficient and sustainable mobility solutions, are influencing the development of hyperloop technology. With the rapid urbanization and resulting population growth in major cities, there is an increasing demand for faster and more efficient transportation systems. As per the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), by 2050, sustainable transportation can save USD 70 trillion when all transportation costs, including fuel, charges, and congestion costs, are considered. In addition, Government backing has also been a significant force in this region.

The hyperloop technology market in India is growing rapidly as a result of the country’s expanding urbanization, congestion, and demand for high-speed transportation. The International Energy Agency states that with its aggressive sustainable development goals, India has set a lofty goal to achieve net-zero carbon emissions by 2070. The government is actively committed to developing sustainable transport solutions, which will move forward with feasibility studies and pilot projects. The development of smart cities and infrastructure investment that is being made by the government can provide a major opportunity for the implementation of hyperloop technology. For instance, in February 2025, India declared plans to build the longest hyperloop test facility in the world, to reach 1,100 kmph. Indian Railways is supporting the project, which comes after a 422-meter test track was finished.

China's hyperloop technology market is developing quickly, propelled by infrastructure goals, urbanization, and innovation. China has made enormous investments to develop high-speed rail networks. As a continuation of the government's public push for smart cities and technological leadership, hyperloop technology is being considered for the long-term plans for urban mobility and environmental sustainability.

Europe Market Insights

The hyperloop technology market in Europe is exhibiting substantial growth due to the region's emphasis on sustainable transportation, continuous development in transportation infrastructure, and government measures to incentivize high-speed traveling systems. As per a report by Europe Diplomatic Magazine, sustainable transportation has emerged as a major priority as the European Union strives to achieve carbon neutrality by 2050. With its promise of emission-free travel, the hyperloop is a natural fit for this goal. Europe is leading the global charge against climate change and has set lofty goals to decrease carbon emissions. Consequently, public-private partnerships are helping to generate the infrastructure systems to support Hyperloop technology.

The hyperloop technology market in France is developing rapidly as a reaction to the country's goals for sustainable transport and innovations in high-speed rail. France already has the fastest commercial trains in the world. France's efforts to limit the amount of carbon it emits fit well with Hyperloop's zero emissions model as one more option to achieve France's goals for mobility that is green. Additionally, given France's existing transport infrastructure, there is scope to shorten the approach to developing a Hyperloop system. As demand grows for faster and more efficient intercity travel, Hyperloop is well-positioned to fill a void within France's transport sector.

Germany is witnessing a growth in the hyperloop technology market. The emphasis on technologies and innovations of the current transport challenges facilitates a match with Germany's traditional strengths in engineering across the automotive engineering and high-speed rail systems. As Germany moves towards determining the future components of its transportation infrastructure, hyperloop will be an increasingly important component of technology. Moreover, Germany's environmental policies have been developed around carbon reduction and green energy solutions that closely match Hyperloop's values of sustainability. Germany's focus on innovation has also created a niche market for hyperloop, where there is the potential for connectivity to major European cities.

Key Hyperloop Technology Market Players:

- Virgin Hyperloop (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hyperloop Transportation Technologies (USA)

- TransPod (Canada)

- The Boring Company (USA)

- Hardt Hyperloop (Netherlands)

- Zeleros (Spain)

- CRRC Corporation (China)

- MHI Group (Mitsubishi Heavy Industries) (Japan)

- HTT (Hyperloop Transportation Technologies) (USA)

- Lilium (Germany)

- Arrivo (USA)

- SK Telecom (South Korea)

- Bechtel Corporation (USA)

- AeroVironment (USA)

- Vinci Construction (France)

The hyperloop technology embodies a fiercely competitive environment. Competitors are heavily investing in horizontal or vertical R&D and strategic partnerships to enhance their technology offerings. Market leaders are devoting sizable market shares towards developing initial test routes, selecting routes, securing sponsors, as well as searching for government and private support. On the other hand, competitors in Europe are making their presence felt through cross-border collaboration projects and partnerships. This competitive and fragmented market is exemplified by a continuous level of innovation of all the components, regulatory advancements, and strategically aligned relationships in the industry. All company efforts are relevant and are attaining progress towards enhancing sustainability to deliver to market and link to global climate goals.

Recent Developments

- In May 2025, BEML plans to start producing India's first bullet train prototype, with a December 2026 launch date in mind. An important turning point in India's aspirations for high-speed rail will be reached when the 280 kmph trainset is tested on the Mumbai-Ahmedabad circuit and is constructed domestically at a reduced cost.

- In April 2025, California agrees to reimburse the investors, a long-delayed project that promises nonstop rail service between San Francisco and Los Angeles. The project has already cost over USD 100 billion, more than three times what was originally projected. The majority of its funding has come from the state's cap-and-trade program and the voter-approved bond.

- Report ID: 7820

- Published Date: Jun 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyperloop Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.