Super Absorbent Polymers Market Outlook:

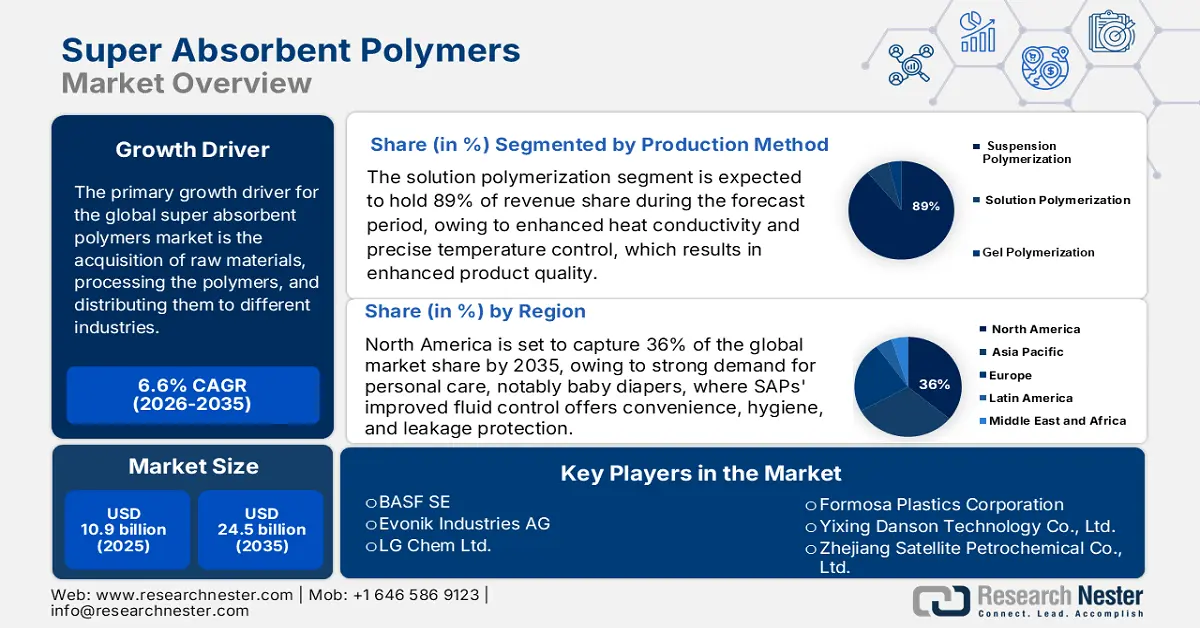

Super Absorbent Polymers Market size was valued at USD 10.9 billion in 2025, and is projected to reach around USD 24.5 billion by the end of 2035, rising at a CAGR of about 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of super absorbent polymers is estimated at USD 11.8 billion.

The global super absorbent polymer market’s supply chain is complicated since it involves the acquisition of raw materials, processing the polymers, and distributing them to different industries such as hygiene products and medical devices. As shown by a report from NLM in February 2024, the swelling rate of the superabsorbent composites is the highest at a sodium bentonite content of 2 wt% and gradually decreases as the content of sodium bentonite increases to 8 wt%, which proves that small amounts of sodium bentonite can enhance absorbency. These methods use some key materials such as sodium polyacrylate, polyacrylamide copolymers, and starch grafted copolymers. Such materials are procured from domestic and foreign vendors, with major manufacturing plants in locations such as North America, Europe, and Asia, thereby suitable for enhancing the market.

Moreover, superabsorbent polymers are organic three-dimensional materials with moderately crosslinked networks that swell in water solutions. According to a report published by MDPI in December 2024, superabsorbent polymers are capable of absorbing more than 1000 times their dry weight of liquids, and are expected not to release liquid absorbed under pressure. Additionally, the availability of SAPs relies on raw material supply, manufacturing, and trading policies. Tariffs and trade agreements may influence the price and supply of raw materials, thereby affecting the overall cost of production of SAPs. For example, variations in the prices of acrylic acid, which is a principal raw material, can determine the cost of production of sodium polyacrylate-based SAPs. Also, supply chain interruption, for example, due to geopolitical conflict or natural disasters, may cause delays in production and delivery, affecting the availability of SAPs in the market.

Key Super Absorbent Polymers Market Insights Summary:

Regional Insights:

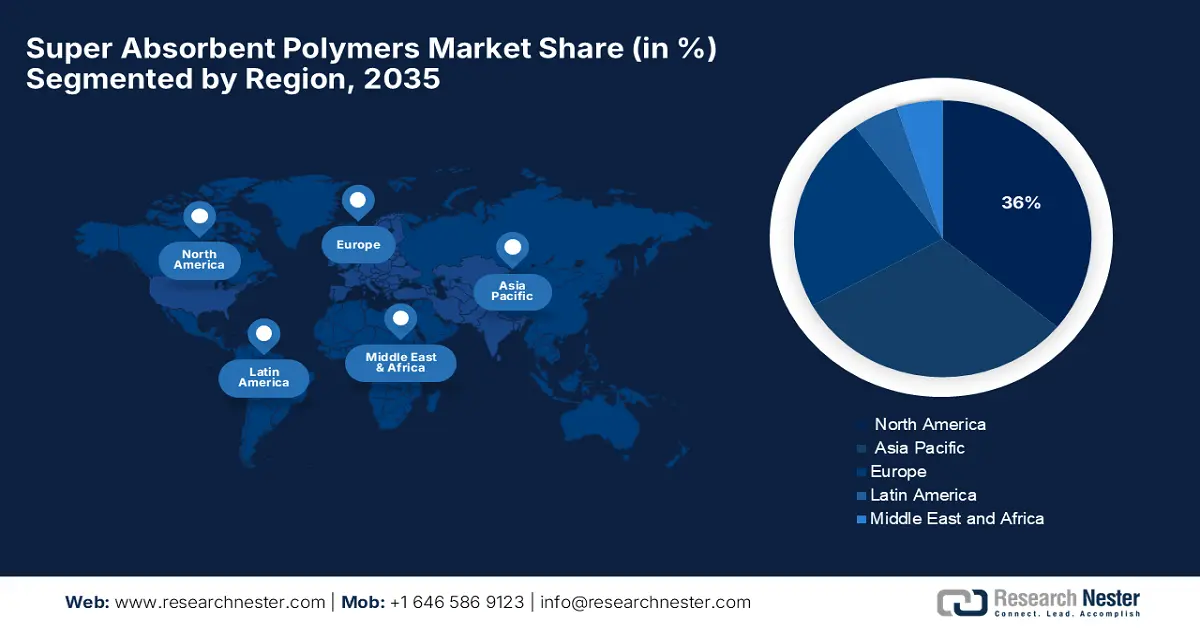

- North America’s Super Absorbent Polymers Market is projected to hold a 36% share by 2035, supported by the rising demand for personal care products such as baby diapers offering superior fluid control and hygiene protection.

- Europe is expected to emerge as the fastest-growing regional market through 2035, fueled by increasing utilization of SAP-based products across hospitals and healthcare facilities.

Segment Insights:

- The solution polymerization sub-segment of the production method in the Super Absorbent Polymers Market is projected to command an 89% share by 2035, propelled by enhanced heat conductivity and precise temperature control that elevate product quality.

- The standard sub-segment within the super absorbent polymer grade category is anticipated to maintain dominance through 2035, owing to its balanced combination of absorbency, cost-efficiency, and versatility.

Key Growth Trends:

- Thermal Control in Manufacturing

- Advancements in wound care driving innovation

Major Challenges:

- High Raw Material Costs Limiting Market Expansion

- Environmental Concerns and Regulatory Restrictions

Key Players: BASF SE,Evonik Industries AG,LG Chem Ltd.,Formosa Plastics Corporation,Yixing Danson Technology Co., Ltd.,Zhejiang Satellite Petrochemical Co., Ltd.,Archer Daniels Midland Company,Chemtex Speciality Limited,San-Dia Polymers, Ltd.,Shandong Nuoer Biological Technology Co., Ltd.,Quanzhou Banglida Technology Industry Co., Ltd.,Nippon Polytech Co., Ltd.,BASF India Ltd.,Sumika Polymer Compounds Co., Ltd.,Polytrap Inc.

Global Super Absorbent Polymers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 10.9 billion

- 2026 Market Size: USD 11.8 billion

- Projected Market Size: USD 24.5 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, China, Japan, India

- Emerging Countries: Brazil, South Korea, Mexico, Indonesia, Italy

Last updated on : 8 September, 2025

Super Absorbent Polymers Market - Growth Drivers and Challenges

Growth Drivers

- Thermal Control in Manufacturing: Heat control during production is required to maximize superabsorbent polymer (SAP) efficiency. The report by MDPI published in February 2024 found that with increasing crosslinking temperature, centrifuge retention capacity (CRC) slowly diminished, and absorption under load (AUL) increased, leveling before falling at 160 degrees Celsius due to carboxylic acid group dehydrations. Such capacity of SAP properties to be manipulated with temperature adjustment hampers the market from growing with better product efficiency and an increased application range, such as in health care, thereby boosting the market.

- Advancements in wound care driving innovation: Chronic wounds such as diabetic ulcers and pressure sores have been common among the elderly, and healthcare providers are now turning to SAP-based dressings to improve patient outcomes and reduce treatment time. As per a study by MDPI in February 2025, the pH of healthy skin is 5 to 6, acute wounds around 7.4, while chronic wounds have an alkaline pH of 7.3 to 10 due to bacterial growth. pH-sensitive SAP dressings can be specially designed to release antimicrobial agents when the pH rises, helping to control infection and speed up wound healing, thus suitable for the market.

- Rising demand in hygiene and medical applications: A key growth driver for market includes the global demand for personal care items, especially disposable baby diapers and adult incontinence. Growing personal hygiene care, as well as the higher populations in developing economies and growing disposable incomes, drive demand. The growing application of SAPs in agriculture as a water retainer and in medical applications also drives the market by increasing product functionality and sustainability.

Comparative Properties of Superabsorbent Polymers Reflecting Emerging Trends in Performance, Sustainability, and Application Diversification (2024)

|

Material |

Molecular Weight (Monomer) |

Physical Property |

Water Absorbency (g/g) |

Water Holding Rate (%) |

Application |

|

Polyacrylic acid |

72 |

Colorless/light yellow liquid |

59 |

>90% |

Horticulture, agriculture, and drug delivery |

|

Polyacrylonitrile |

53 |

White opaque powder |

95 |

85% |

Drug delivery, construction work, oil and water separation |

|

Polyvinyl alcohol |

44 |

Flocculent, granular, powdery white solid |

74 |

93% |

Cement, adsorption of alkali metals, cardiac tissue engineering |

|

Cellulose |

162 |

Macromolecular polysaccharide |

119 |

61% |

Soil water retention conditioning |

|

Chitosan |

161 |

White/off-white, semi-transparent, flaky, or powdery solid |

670 |

56% |

Soil water retention, isolated lysozyme, wound dressings |

|

Starch |

162 |

White powdery solid |

343 |

80% |

Soil water retention, flexible batteries, controlled-release fertilizers |

|

Protein |

75-240 |

A macromolecule consisting of n peptide chains |

860 |

30% |

Hygiene products, hemostatic agents |

|

Amino acid |

75-240 |

White crystals |

590 |

55% |

Viral diagnostic monitoring, wound dressing, and drug delivery |

|

Alginate |

176 |

White or light yellow powder |

1700 |

70% |

Dye adsorption, water-absorbent fabrics, and concrete anti-cracking |

Source: NLM February 2024

Challenges

- High Raw Material Costs Limiting Market Expansion: Variations in the prices and scarcity of raw materials such as acrylic acid and sodium hydroxide increase the production cost of market. Such costs are passed on to the prices of the raw materials, which reduces their adoption in an already tough pricing market. The manufacturer is under margin pressure, thereby slowing market growth, preventing any new entries into the market. Additionally, long-term supply chain instability and dependency on petrochemical-derived inputs further exacerbate these cost challenges, making strategic sourcing and pricing even more difficult.

- Environmental Concerns and Regulatory Restrictions: Strict regulations and growing environmental awareness create severe problems in the market. All these superabsorbent polymers are not easily biodegradable and hence find themselves at the center of scrutiny and restrictions concerning their use and disposal. The costs incurred in compliance with these laws impeded innovation and delayed the expansion of the markets, especially in those areas where environmental policies are taken very seriously. These have been draining the demand, coupled with investment in the industry.

Super Absorbent Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 10.9 billion |

|

Forecast Year Market Size (2035) |

USD 24.5 billion |

|

Regional Scope |

|

Super Absorbent Polymers Market Segmentation:

Production Method Segment Analysis

The solution polymerization sub-segment of the production method segment is expected to hold the highest market share of 89% of the market due to enhanced heat conductivity and precise temperature control, which results in enhanced product quality. However, its lower concentration of monomers limits product yield, affecting cost-effectiveness. As per the report published by MDPI in February 2025, even though solution polymerization SAPs are more expensive than other non-polymer adsorbents, such as activated carbon, they offer much better performance, with the ability to absorb up to 247.2 mg of lead (Pb²⁺) per gram. Their high efficiency and strong performance are driving strong market demand despite the higher cost.

Grade Segment Analysis

The super absorbent polymer grade segment in the market is dominated by the standard sub-segment, due to a balanced combination of absorbency, cost, and versatility. This grade is applied widely in markets for hygienic products and agriculture due to its consistency in performance and competitiveness. Its market leadership is a pointer to high demand for low-cost, multi-purpose SAPs, so that standard is the highest revenue-generating and most adopted sub-segment among the SAP grade category.

Material Segment Analysis

Synthetic (petroleum-derived) is the highest subsegment in the material segment of the super absorbent polymers market. The synthetic material is easily affordable, while having a better performance in absorbency, and this segment owns an established supply chain. Despite growing interest in bio-based alternatives, synthetic SAPs remain the go-to choice for hygiene applications due to optimal quality consistency and scalability. Moreover, ongoing innovations in synthetic SAP formulations continue to enhance their functionality, further solidifying their dominance in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Grade |

|

|

Production Method |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Super Absorbent Polymers Market - Regional Analysis

North America Market Insights

North America's super absorbent polymers (SAPs) market is expected to occupy the largest share in the market with 36% market share because of strong demand for personal care, notably baby diapers, where SAPs' improved fluid control offers convenience, hygiene, and leakage protection. Secure access to hygiene products facilitates secure growth in the SAPs market, notably in the personal care and healthcare industries. As per a study submitted by ISPOR in 2025, with over 50% of the U.S. population covered by employer-sponsored insurance, SAP-based personal products' frequent use is being encouraged through institutional and consumer markets.

The U.S. super absorbent polymers market is expanding on the heels of extensive use in adult incontinence wear for an aging population, robust demand in the healthcare industry, and government assistance toward healthcare development. According to the American Hospital Association 2025 report, the U.S. super absorbent polymers (SAPs) market is well backed by its huge healthcare infrastructure, which includes more than 6,000 hospitals and almost 913,000 staffed beds in the country. Out of these, 5,112 are community hospitals, and they receive more than 32 million admissions per year. This reflects the huge SAP-based medical product demand for wound dressings, surgical pads, and incontinence care material.

The super absorbent polymers market in Canada is expanding as a result of a high population and the availability of universal health care, increasing demand for incontinence and medical hygiene products, and government health care and aged care spending. According to a Hexavision 2025 report, the USD 300 federal payment in Canada shows that the government is taking more action to support low- and middle-income families as living costs rise. This trend also increases the demand for affordable hygiene products. With increased economic demands, there is a corresponding demand for more affordable, high-absorbency items like SAP-based incontinence care products and diapers by families and the elderly.

Europe Market Insights

The super absorbent polymers market in Europe is expected to hold the highest growing market share within the forecast period. In Europe, the dominance of public hospital provision of care impacts the super absorbent polymers (SAP) market, notably in healthcare and hygiene segments. According to the NLM January 2024 report, Hospital care costs share while measuring against total current health expenditures have varying percentages across Europe, from 28.8% in Germany to over 48.0% in Romania, with 25 countries in Europe reporting that hospital costs are above 35%, hence majorly contributing toward hospital care in total healthcare expenditure in the region. There exists a solid and consistent demand for SAP-based items, such as incontinence products for adults, surgical dressings, and hygiene products.

The super absorbent polymers market in the UK is expanding steadily as a result of rising demand in personal care products and healthcare uses. As per the report by The Commonwealth Fund, published in January 2023, the UK spent 4,725 USD on health care, which makes healthcare innovations favorably supported, and, therefore, there is high demand for superior absorbent material for medical and wound care products. Moreover, with a prevalence of voluntary health insurance, there is a growing market for high-end and specialty healthcare products, which tend to take up SAP technology.

Germany's market is developing due to demand. As per the report by The Commonwealth Fund, January 2023, the country has almost a health insurance coverage of 6,524 USD per year, which is a relatively high voluntary insurance percentage underpinning a robust health care system with a focus on innovation. The country's advanced health infrastructure generates huge demand for SAP in medical applications such as dressing wounds and sanitary products. Besides, Germany's emphasis on sustainability and environmental protection is broadening SAP applications.

Potential SAP Healthcare Market (2022):

|

Country |

Healthcare Expenditure (€ million) |

€ per Inhabitant |

% of GDP |

Relevance to the SAP Market |

|

Germany |

488,677 |

5,832 |

12.6% |

Very High - Largest spender; aging population boosts demand for SAP-based wound care. |

|

France |

313,574 |

4,607 |

11.9% |

High - Strong healthcare infrastructure, high chronic wound prevalence. |

|

Netherlands |

96,820 |

5,470 |

10.1% |

High - Advanced wound care market, emphasis on medical innovation. |

|

Sweden |

59,110 |

5,637 |

10.7% |

High - Universal healthcare, strong demand for high-tech medical dressings. |

|

Austria |

49,897 |

5,518 |

11.2% |

Moderate-High - High per capita spending with a focus on chronic care. |

|

Italy |

175,719 |

2,978 |

9.0% |

Moderate - Large aging population, growing chronic wound needs. |

|

Spain |

131,114 |

2,745 |

9.7% |

Moderate - Increasing investment in healthcare, rising elderly population. |

Source: Eurostat, November 2024

Asia Pacific Market Insights

The super absorbent polymers market in the Asia Pacific is expected to hold a steadily growing market, with hygiene products driving demand. investment in R&D for new hygiene uses, M&A, capacity expansion, and new product development. According to a report by ResearchGate in September 2021, the Asia Pacific market for post-surgical care has a high demand for highly absorbent and elastic dressings that are the primary characteristics of superabsorbent polymer (SAP) products, since 77.3% of healthcare professionals are willing to pay extra for best-in-class dressing characteristics. Since 39.8% of them indicate that they deal with post-operative complications like infections, SAP dressings can potentially greatly improve outcomes.

The super absorbent polymers market in China is growing due to rapid growth in the usage of diapers because of a high number of infants, an aging population, and the unwinding of the one-child policy, with rising incomes boosting steady SAP demand. Based on a WHO 2024 report, the number of people in China is 1,422,584,933 as of 2023. China's rising population, with an aged population and increasing life expectancy at 77.6 years, is driving increased demand for innovative wound care solutions such as superabsorbent polymers (SAP) for the treatment of chronic wounds and post-surgery wounds. With over 90% of deaths being caused by noncommunicable diseases, some of which are complications involving good care of wounds, the SAP market is on an expansion course.

The super absorbent polymers market in India is growing due to higher demand for adult incontinence, sanitary pads, and tampons because of urbanization and high health standards, and sustainability & eco-friendly trends. As per a report by NHM August 2025, government interventions supporting menstrual hygiene in rural adolescent girls are pushing the demand for cheap and good-quality sanitary products containing superabsorbent polymer (SAP). Subsidized schemes such as distribution of Freedays napkins at Rs. 6 per pack promote access in 107 districts by way of decentralized procurement under the National Health Mission.

Key Super Absorbent Polymers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- LG Chem Ltd.

- Formosa Plastics Corporation

- Yixing Danson Technology Co., Ltd.

- Zhejiang Satellite Petrochemical Co., Ltd.

- Archer Daniels Midland Company

- Chemtex Speciality Limited

- San-Dia Polymers, Ltd.

- Shandong Nuoer Biological Technology Co., Ltd.

- Quanzhou Banglida Technology Industry Co., Ltd.

- Nippon Polytech Co., Ltd.

- BASF India Ltd.

- Sumika Polymer Compounds Co., Ltd.

- Polytrap Inc.

The global market is very competitive, with major companies focusing on sustainable activities, innovating, and focusing on growth. The companies invest heavily in R&D and are coming up with faster-performing products while attempting to meet strict environmental norms. Strategically, companies have reinforced their positions in the market and expanded their geographical footprint through mergers and acquisitions, partnerships, and collaborations. The development of biodegradable and sustainable SAP solutions is clearly in focus to keep up with the green consumer demand.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, BASF invested USD 19.2 million to upgrade its North American SAP facility located in Freeport, Texas, with an eye to greater efficiency and capacity, and with provisions for future growth in the hygiene market to keep pace with changing industry needs.

- In September 2022, Sanyo Chemical Industries, through the operations of its subsidiary SDP Global Co., commercialized an environmentally friendly superabsorbent polymer (SAP) with between 10% and 25% plant biomass content.

- Report ID: 4780

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Super Absorbent Polymers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.