Steam Turbine MRO Market Outlook:

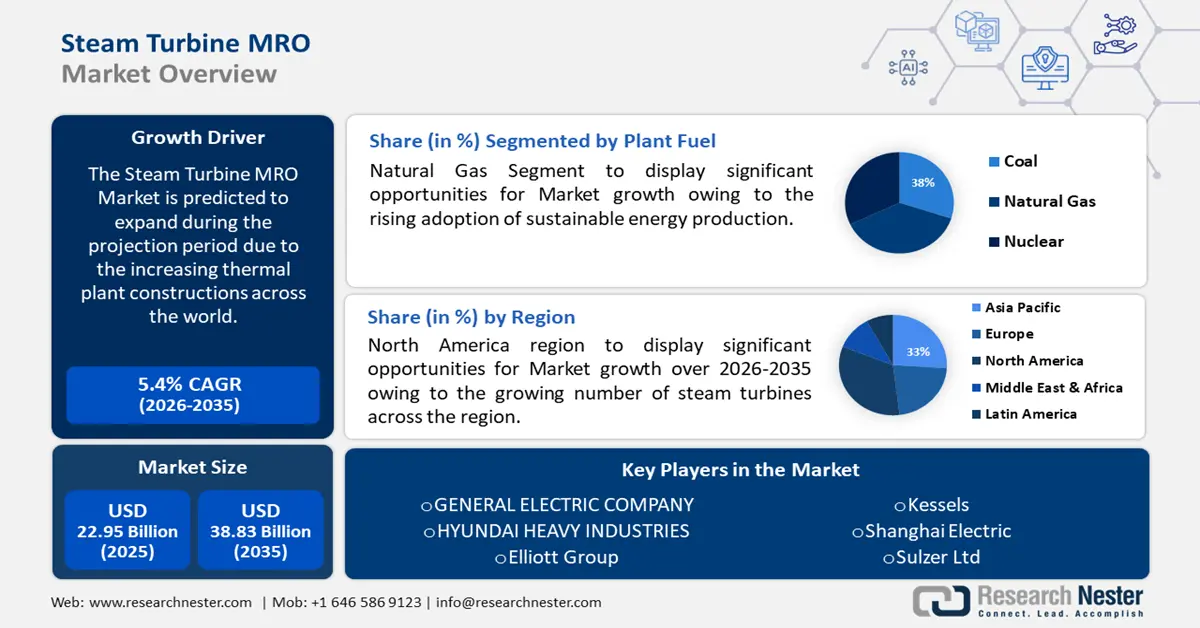

Steam Turbine MRO Market size was valued at USD 22.95 billion in 2025 and is likely to cross USD 38.83 billion by 2035, registering more than 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam turbine MRO is estimated at USD 24.07 billion.

Steam and gas-fired turbomachinery technologies have gained major traction owing to their ability to withstand harsh environmental conditions. Steam and gas-fired turbines are established energy technologies that constitute 80% of the total U.S. electricity production today, of which combined-cycle gas turbines (CCGT) contribute 34%. Combined or cogeneration heat and power (CHP) plants also have a pivotal role to play in heat generation for heavy-duty industries. Typically, CHP systems have energy efficiencies of 60-80%. Presently, R&D efforts are being undertaken to develop components that can withstand environmental stressors such as high temperatures, dust, acidic and corrosive chemicals, irradiation, hydrogen exposure, mechanical stresses, and particulate-laden fluids.

The steam turbine MRO market supply chain comprises primary raw materials including steel alloys, steel, and nickel alloys. The global trade dynamics of these materials shape the steam turbine MRO industry landscape. The world trade value of powder, alloy steel was USD 840 million in 2022, with Japan (USD 185 million) being the top exporter and China (USD 129 million) the top importer. ASEAN steel imports remained elevated in 2023 and stood at 50 MMT. Looking at the country-wise breakdown, Thailand’s imports were 14.7 MMT, Vietnam's was 12.3 MMT, and Indonesia's was 13.3 MMT respectively. Japan’s steel exports were stable in 2023 and registered a modest rise in imports despite weak demand. Furthermore, a strong decline in flat products exports to China was observed (-32% annual vs 2022) and this was compensated by a significant spike in exports to Korea (+30.7%), and Türkiye (+5.5%).

The United States was the second-largest importer of steel in the world in 2023, according to the International Trade Administration (ITA). The United States imported 25.6 MMT of steel in 2023, a decline of 8.7% from 2022's 28.0 million metric tons. In 2023, the country imported steel from 79 nations and territories. The comparative yearly analysis of the U.S. production, imports, and the leading five producers are mentioned below.

U.S. Overall Production and Import Penetration

|

|

2020 |

2021 |

2022 |

2023 |

|

Production Volume |

72.7M |

85.8M |

80.5M |

81.4M |

|

Apparent Consumption |

86.6M |

106.8M |

100.9M |

98.8M |

|

Import Volume |

20.0M |

28.6M |

28.0M |

25.6M |

|

Import Penetration |

23.10% |

26.74% |

27.76% |

25.90% |

Source: ITA

U.S. Top Producers in 2023

|

Rank |

Company |

Production (MMT) |

Key Products |

|

1 |

Nucor |

17.40 |

Bars, sheets, beams, plate |

|

2 |

Cleveland Cliffs |

13.30 |

Hot-rolled, cold-rolled, stainless, electrical, plate, tinplate, long, and tubul |

|

3 |

US Steel Corp. |

12.40 |

Hot-rolled, cold-rolled, coated sheets, tubular products |

|

4 |

Steel Dynamics |

9.60 |

Flat-rolled, structural, bars, rails |

|

5 |

Commercial Metals Company |

4.10 |

Rebar, bars, sections, billets |

Source: ITA

Steam turbines thermodynamically reach an isentropic efficiency of 20-70%, which equates to low electricity generation costs. Moreover, backpressure turbines offer electricity production at often lower than USD 0.04/kWh. Apart from electricity savings, criteria pollutant reduction and ancillary benefits from onsite electricity recover the initial capital outlay. Back-pressure turbogenerator’s capital expenditure complete with electrical switchgear ranges from USD 900 kW for a small system to less than USD 200/kW for a larger system with capacity over 2,000 kW. Despite the recoup of capex, MRO holds potential opportunities as a result of rapid expansion of industrial processes and the adoption of steam turbines.

A steam turbine has several moving components, such as rotors, discs, blades, pins, and shrouds; stationary components, such as blades, nozzles, and vanes; and additional components, such as seals, pedestals, casings, and hoods. They are made from a variety of metals. These consist of titanium alloys, cobalt alloys, nickel superalloys, carbon steels, stainless steels, and alloy steels. Over time, fatigue breakdowns result from the spinning parts' exposure to strong centrifugal forces, cyclical loads, and temperature variations. Additional significant issues with steam turbines include pitting, flow-accelerated corrosion, corrosion fatigue of blades, and stress corrosion cracking of rotors and discs.

Design considerations and corrosion control techniques can reduce (but not completely eliminate) the many corrosion mechanisms that are active in steam turbines. These processes include leaching, galvanic, fretting, intergranular assault, erosion, and crevices. Steam impurity levels, pH control, flow, and velocity management are significant elements that contribute to the environment's corrosiveness. According to EPRI, steam turbine corrosion costs the US economy more than USD 1 billion a year, thereby fueling the steam turbine MRO market.