Steam Turbine Market Outlook:

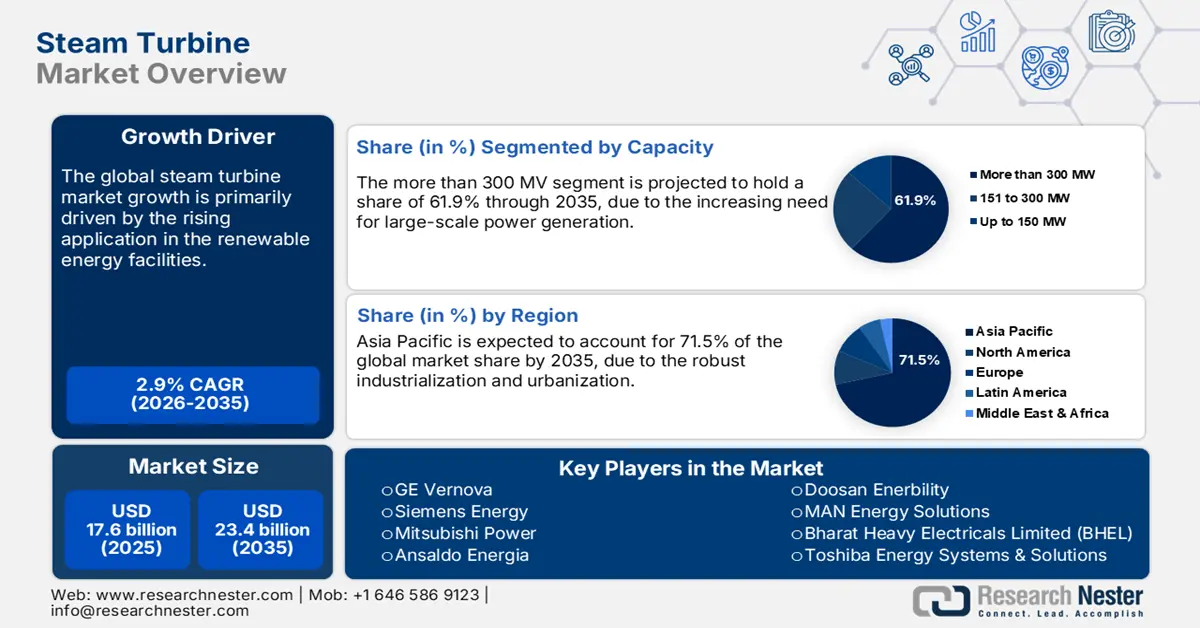

Steam Turbine Market size was USD 17.6 billion in 2025 and is estimated to reach USD 23.4 billion by the end of 2035, expanding at a CAGR of 2.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of steam turbines is evaluated at USD 18.1 billion.

The shift toward renewable-integrated turbines is expected to reshape the steam turbine market. The hybrid systems are gaining traction in wind and solar facilities, owing to their efficiency and effectiveness. The concentrated solar power (CSP) plants are driving a high demand for steam turbines. According to the Solar Power Europe report in 2024, the world added nearly 600 gigawatts of solar power, a 33% increase from the previous year, breaking another record. Solar made up 81% of all new renewable energy capacity installed globally. Thus, the clean energy mandates are set to double the revenues of hybrid steam turbine manufacturers.

|

Region |

2024 Capacity (GW) |

Annual Growth Rate |

Global Market Share (%) |

Notes |

|

Asia-Pacific (APAC) |

– |

37% |

70% |

Remains the undisputed leader in additions |

|

Americas |

– |

40% |

14% |

Strong growth driven by the U.S. and LATAM |

|

Europe |

82.1 |

15% |

14% |

Moderate expansion, focus on renewables |

|

Middle East & Africa |

14.5 |

-2% |

2.4% |

Only region with YoY decline in 2024 |

Source: Solar Power Europ

Key Steam Turbine Market Insights Summary:

Regional Highlights:

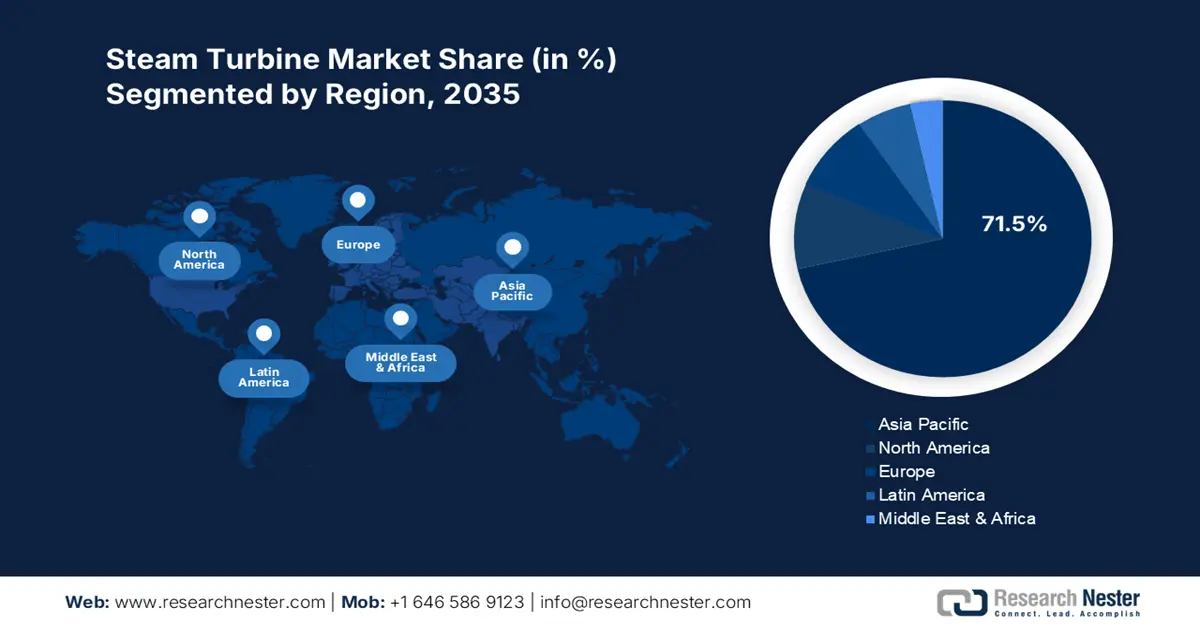

- The Asia Pacific steam turbine market is projected to secure a dominant 71.5% revenue share by 2035, owing to rapid urbanization, industrialization, and rising electricity demand.

- North America is expected to hold the second-largest share by 2035, impelled by nuclear power expansion and growing investments in carbon capture and storage (CCS) projects.

Segment Insights:

- The more than 300 MW capacity segment is estimated to command 61.9% of the Steam Turbine Market share by 2035, propelled by large-scale power generation demand and expanding nuclear energy investments.

- The power and utility segment is forecast to capture 86.1% of the global share through 2035, driven by surging electricity generation requirements and grid stabilization amid renewable energy integration.

Key Growth Trends:

- Rising global electricity demand

- Government investments in nuclear power

Major Challenges:

- High capital costs

- Supply chain pressures

Key Players: GE Vernova (General Electric), Siemens Energy, Mitsubishi Power / Mitsubishi Heavy Industries (MHPS), Ansaldo Energia, Doosan Enerbility, MAN Energy Solutions, Bharat Heavy Electricals Limited (BHEL), Toshiba Energy Systems & Solutions, Hitachi (Power Systems / Hitachi Energy), IHI Corporation, Kawasaki Heavy Industries, Alstom (legacy steam business), Hyundai Heavy Industries (HHI), Power Machines / OMZ, Babcock & Wilcox, Thermax, Voith, Australian Regional OEMs / Engineering Firms, Malaysian Regional OEMs / Engineering Firms, Ansaldo / GE Servicing Partnerships.

Global Steam Turbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.6 billion

- 2026 Market Size: USD 18.1 billion

- Projected Market Size: USD 23.4 billion by 2035

- Growth Forecasts: 2.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (71.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, India, Japan, United States, France

- Emerging Countries: South Korea, United Kingdom, Germany, Indonesia, Brazil

Last updated on : 3 October, 2025

Steam Turbine Market - Growth Drivers and Challenges

Growth Drivers

- Rising global electricity demand: The expanding electricity demand globally, due to rapid urbanization and industrialization, is projected to propel the application of steam turbines in the years ahead. The large-scale electricity projects that don’t fluctuate with weather conditions are prime end users of steam turbines. According to the EMBER report, the global electricity demand grew by 4%, or 1,172 terawatt-hours, in 2024. This was the third biggest yearly increase in electricity use ever recorded. The developing economies are poised to lead the power consumption and fuel the sales of steam turbines.

- Government investments in nuclear power: The increasing expansion of nuclear power projects is likely to accelerate the production and commercialization of steam turbines. The International Energy Agency (IEA) estimates that right now, about USD 65 billion is invested in nuclear power each year. By 2030, this is expected to grow to USD 70 billion if current policies remain the same. Following the trend, this is also projected to help boost global nuclear power capacity by 50%, reaching nearly 650 gigawatts by 2050. Furthermore, the supportive government funding and policies are poised to expand nuclear expansion at a robust pace. In a scenario where all energy and climate goals are fully met on time, investments are likely to hit USD 120 billion by 2030, doubling nuclear capacity by 2050. Thus, nuclear power is a high earning space for steam turbine companies.

- Integration with carbon capture: The integration of steam turbines with carbon capture and storage (CCS) technologies is expected to emerge as a revenue-boosting factor for leading companies. This integration of technologies is expected to be vital to keep coal- and gas-based power plants viable under strict emissions regulations. Technological advancements and increasing power demand are poised to increase the application of these advanced technologies in emerging markets. The governments in Europe, North America, and some areas of Asia are investing heavily in CCS demonstration projects, creating a profitable environment for steam turbine manufacturers.

Challenges

- High capital costs: The manufacturing of steam turbines is a cost-intensive process, which creates a challenging environment for small and new companies. The production infrastructure integrates advanced and complex technologies and a skilled workforce. This adds up the production cost, making steam turbine more costly. Thus, small companies are expected to witness high capex challenges in the price-sensitive markets.

- Supply chain pressures: The supply chain pressures are key challenging factors hampering the sales of steam turbines. The production of steam turbines is based on specialized components and materials. The fluctuation in their sales due to geopolitical, logistical, or environmental factors directly hinders the production of steam turbines, leading to low profit margins.

Steam Turbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

2.9% |

|

Base Year Market Size (2025) |

USD 17.6 billion |

|

Forecast Year Market Size (2035) |

USD 23.4 billion |

|

Regional Scope |

|

Steam Turbine Market Segmentation:

Capacity Segment Analysis

The more than 300 MW capacity segment is estimated to hold 61.9% of the market share by 2035. The need for large-scale power generation is directly accelerating the adoption of over 300 MW capacity steam turbines. Utilities and independent power producers are prime end users of more than 300 MW capacity steam turbines. The countries investing heavily in nuclear power, such as India, China, and France, are poised to be key growth drivers of more than 300 MW capacity steam turbines. The national electrification strategies, modernization, and retrofits of existing plants are also contributing to the segmental growth.

End use Segment Analysis

The power and utility segment is projected to account for 86.1% of the global market share through 2035, owing to massive electricity generation. Utilities favor steam turbines for their ability to provide consistent, high-capacity output. The steam turbines are also widely used to stabilize grids as renewable penetration rises. The rising investments in government in renewables and nuclear power are poised to boost the demand for advanced steam turbines in the years ahead. Furthermore, rapid industrialization and urbanization continue to push utilities toward large-scale turbine projects to meet surging demand.

Design Segment Analysis

The impulse design segment is expected to capture the largest revenue share throughout the study period. The prime factors fueling the sales of impulse-designed steam turbines are their simpler construction and durability. The ability to operate effectively under varying steam conditions is also increasing the popularity of impulse steam turbines. Impulse turbines also handle high-pressure and high-temperature steam efficiently, making them well-suited for large-capacity power plants above 300 MW.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Capacity |

|

|

End use |

|

|

Design |

|

|

Exhaust |

|

|

Fuel |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Turbine Market - Regional Analysis

APAC Market Insights

The Asia Pacific steam turbine market is estimated to capture 71.5% of the revenue share through 2035. The rapid urbanization and industrialization activities are pushing the trade of steam turbines. The soaring electricity demand is also contributing to the high sales of steam turbine systems. The strong presence of coal and gas power plants is further creating a lucrative environment for steam turbine companies. The rise in nuclear expansion in the region, particularly in China, India, Japan, and South Korea, is poised to fuel the application of steam turbines.

China leads the APAC market owing to the largest fleet of coal-fired power plants. The fastest-growing nuclear program is also contributing to the high application of steam turbines. Strong investments in renewables and coal power plants are accelerating the production and commercialization of steam turbine systems. The government’s dual goals of energy security are likely to propel the entry of international companies in the years ahead.

Steam Turbine Market in India is projected to increase at a high pace between 2026 and 2035, due to the strong electricity demand. The increasing industrial activities and government-led infrastructure expansion are encouraging key companies to invest in India. The data from NITI Aayog on the electricity generation in mid-September 2025 from coal, nuclear, and hydro was totaled at around 3500.13 MU, 131.57 MU, and 775.99 MU, respectively. This reflects that the power plants are investing heavily in large-capacity turbines, attracting several international players.

North America Market Insights

The North America market is expected to capture the second-largest market share throughout the forecast period. The nuclear power expansion and infrastructure modernization efforts are boosting the sales of steam turbine systems. The high energy consumption is also representing robust demand for steam turbines. The increasing investments in carbon capture and storage (CCS) projects are set to accelerate the production and commercialization of steam turbines.

The U.S. steam turbine market is estimated to be driven by the extensive fleet of fossil fuel and nuclear power plants. The federal support for small modular reactors (SMRs) and life-extension programs for the existing fleets is also pushing the application of steam turbines. The projects aimed at exploring carbon capture retrofits at coal and gas plants are further creating high-earning opportunities for key players.

The sales of steam turbines in Canada are fueled by the country’s energy transition movement and hefty investment in clean energy. The expansion of nuclear projects is likely to propel the demand for advanced steam turbines. The country’s large industrial base, including pulp and paper, mining, and chemicals is also increasing the application of steam turbines. The CCS initiatives and industrial cogeneration growth are other factors accelerating the trade of steam turbines.

Europe Market Insights

The Europe steam turbine market is forecast to expand at the fastest CAGR from 2026 to 2035. The decarbonization trend, with the need for reliable baseload generation, is projected to increase the application of advanced steam turbines. The gas-fired plants, nuclear reactors, and biomass facilities are key users of steam turbine systems in the EU. France, the U.K., and Eastern European countries are investing heavily in new nuclear projects, creating a lucrative environment for key players. Furthermore, continuous technological advancements are anticipated to double the revenues of leading companies in the years ahead.

The Germany market is projected to be driven by the increasing expansion of modern natural gas plants and biomass-based CHP systems. The strong chemical, steel, and paper industries are also contributing to high sales of steam turbine systems. The International Energy Agency (IEA) states that Germany has been a pioneer in offshore wind and solar power. New laws are set to make it easier to plan and build renewable energy projects, aiming for 100-110 gigawatts of onshore wind, 30 gigawatts of offshore wind, 200 gigawatts of solar, and 10 gigawatts of hydrogen by 2030. Further, the government’s push for hydrogen and renewable integration is poised to drive hefty investments in steam turbine innovation.

France’s heavy reliance on nuclear power is propelling the application of steam turbine technologies. In January 2023, the U.S. Energy Information Administration (EIA) disclosed that France has 56 working nuclear reactors with a total capacity of 61 gigawatts, which makes it the second-largest nuclear power fleet in the world, behind the United States’ 95 gigawatts. This indicates that steam turbines are the backbone of the country’s power system.

Key Steam Turbine Market Players:

- GE Vernova (General Electric)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Energy

- Mitsubishi Power / Mitsubishi Heavy Industries (MHPS)

- Ansaldo Energia

- Doosan Enerbility

- MAN Energy Solutions

- Bharat Heavy Electricals Limited (BHEL)

- Toshiba Energy Systems & Solutions

- Hitachi (Power Systems / Hitachi Energy)

- IHI Corporation

- Kawasaki Heavy Industries

- Alstom* (legacy steam business)

- Hyundai Heavy Industries (HHI)

- Power Machines / OMZ

- Babcock & Wilcox

- Thermax

- Voith

- Australian Regional OEMs / Engineering Firms

- Malaysian Regional OEMs / Engineering Firms

- ANSALDO / GE servicing partnerships

The key players in the market are employing both organic and inorganic marketing strategies to earn lucrative shares. They are investing heavily in research and development activities to introduce next-gen solutions and attract a wider customer base. Some of the leading companies are entering into partnerships and collaborations with other players to expand their product offerings. Industry giants are also expanding their operations in the emerging markets to earn lucrative gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Mitsubishi Power unveiled that it received an order to supply an M701F gas turbine and a steam turbine for a 500-megawatt gas turbine combined cycle (GTCC) power plant in Sarawak, Malaysia. They signed the equipment supply deal with Sinohydro Corporation Limited, the company handling the engineering, procurement, construction, and commissioning for the project.

- In April 2025, GE Vernova introduced the AGP XPAND upgrade, an improved version of its Advanced Gas Path (AGP) technology, first used over ten years ago on their 9E.03 gas turbines to increase power output. The first AGP XPAND will be installed at the 1,250-megawatt Bazyan Power Plant, run by Taurus Energy, a company owned by Onex Group.

- Report ID: 8167

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Turbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.