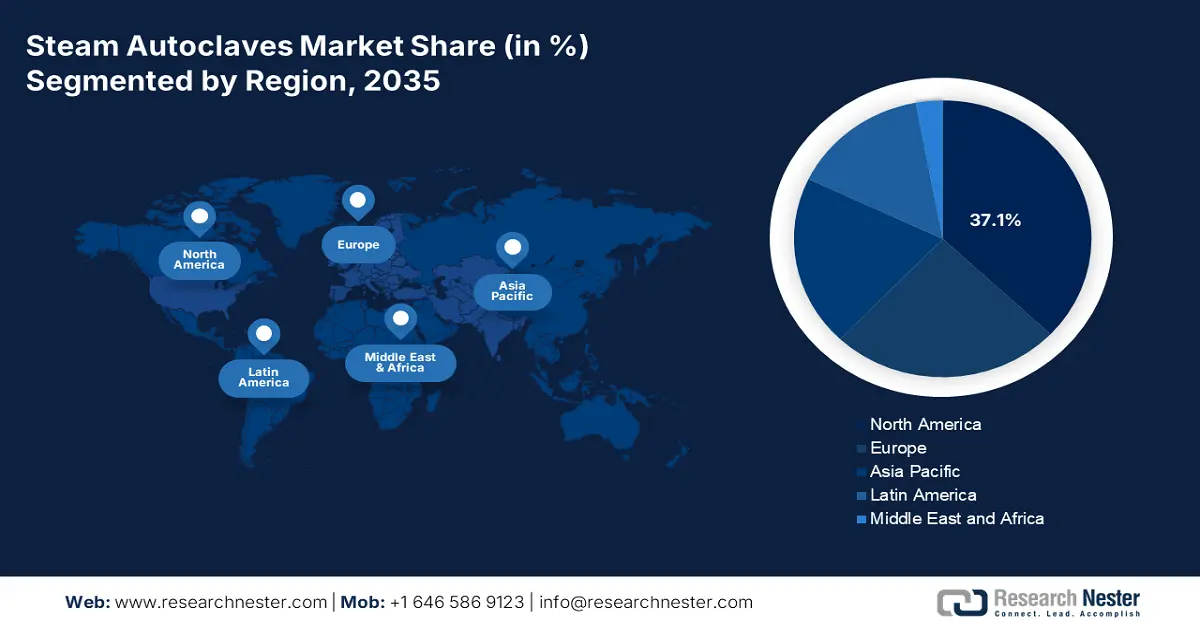

Steam Autoclaves Market - Regional Analysis

North America Market Insights

North America is estimated to maintain dominance over the steam autoclaves market by capturing the largest share of 37.1% during the analyzed tenure. High utilization rate of these devices to align with world-class infection control practices and healthcare quality is the primary factor consolidating the region’s forefront position in this sector. Besides, efforts from both public and private organizations to cultivate a greater supply chain of resources to support this cohort are also contributing to the sector’s expansion in North America. As evidence, in May 2024, Crothall Healthcare allied with Ascendco Health to bring a new era for instrument tracking and overall sterile processing quality within healthcare facilities across the U.S. marketplace.

According to a report from the OEC, the U.S. ranked among the top global traders of medical, surgical or laboratory sterilizers in 2023, accounting for USD 145 million and USD 155 million export and import values. This portrays the well-balanced and potentially profitable commercial dynamics of the country in the market, attracting more investors to engage their resources. On the other hand, the U.S. is home to several pioneers in this category, which reflects the presence of a pre-established business atmosphere for new entrants and innovators capitalizing on this field.

The robust infrastructural upgrades in hospitals across Canada are fostering a scope of continuous revenue generation for the steam autoclaves market. Besides, intra-region and cross-border collaboration around medical device certification through Health Canada is also supporting growth and reducing lead time for these tools. This is further allowing manufacturers to deploy systems in a majority of medical settings at a faster pace. The country is also seeing increased public-private investments that are aimed to build centralized sterilization services (CSS), especially in underserved rural areas, expanding the territory of the merchandise in Canada.

APAC Market Insights

The steam autoclave market in the Asia Pacific region is poised to boom at the fastest rate by the end of 2035. The pace of growth in the region is attributed to the amplifying surgical volumes, the unmet needs of infection prevention and control practices, and the rapid modernization of medical infrastructures. Besides, assigned medical services for the aging population that prioritize safety regulations over cost also prompt the deployment of more of this sterilization equipment. Moreover, continuous government spending on steam autoclaves to enable maximum patient safety in hospitals is contributing to market expansion in Asia Pacific.

The increasing volume of patients requiring sterilization-based forms of treatment is making China a prominent consumer base for the steam autoclaves market. Meanwhile, the governing authorities in the country are concentrating their focus on building smart hospitals and the integration of data-driven clinical practices, which is streamlining the inclusion of automatic sterilization systems. On the other hand, the country’s strong emphasis on medical device production and supply also supports greater outcomes from business operations in this category. This can be testified by the 2023 OEC report, positioning China as the 2nd leading exporter of medical, surgical or laboratory sterilizers in the world with a USD 155 million value.

India is emerging as one of the fastest‑growing landscapes in the APAC market, which is backed by the heightened incidences and mortality rates of HAIs. This is pushing hospitals, clinics, and diagnostic labs across the country to adopt such advanced sterilization tools that can deliver workflow efficiency while lowering carbon footprints. Vertical autoclaves are currently the most used subtype in India, while compact table‑top models are witnessing a steady increase in deployment, especially in smaller clinics and outpatient settings.

Country-wise Trading Data for Medical, Surgical, or Laboratory Sterilizers (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Australia |

34.1 million |

26.5 million |

|

Japan |

21.9 million |

49.3 million |

|

Korea Rep. |

21.3 million |

16.5 million |

|

India |

7.8 million |

31.1 million |

|

Thailand |

1.0 million |

13.2 million |

|

Indonesia |

38.8 thousand |

18.2 million |

|

Philippines |

25.5 thousand |

5.4 million |

Source: WITS

Europe Market Insights

Europe is expected to hold a notable share in the steam autoclaves market over the timeline between 2026 and 2035. The well-established healthcare infrastructure, strict regulatory standards, and strong manufacturing capabilities are the major growth factors behind the region’s persistent performance in this field. This can be evidenced by the 2023 OEC report, which positioned Italy as a leader in worldwide exports of medical, surgical or laboratory sterilizers, with USD 193 million worth of shipments. On the demand side, Germany and Russia were the top importers, with imports of USD 52.3 million and USD 48.7 million, respectively.

The UK features a growing emphasis on infection control, particularly in hospitals and research labs, which continues to fuel demand in the market. Besides, ongoing technological innovation and sustainable equipment development are further reinforcing the country's position as both a major consumer and innovator in this field. In this regard, a 2023 government-led survey revealed that the occurrence of HAIs was 15.9% among patients admitted in intensive care units (ICUs). However, only 1% increase in overall figures was detected across the UK since 2016.

Germany is one of the leading landscapes in the Europe steam autoclaves market, which is accomplished through massive support from its robust national medical system and Medtech industry. The government is also contributing to the massive surge in this sector from hospitals and research laboratories, with a greater focus on infection control. On the other hand, Germany is a global hub of precision manufacturing for both medical devices and pharmaceutical products, solidifying its role as a key supplier and consumer base for sterilization equipment within Europe.

Country-wise Trading Data for Medical, Surgical, or Laboratory Sterilizers (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Poland |

59.0 million |

14.1 million |

|

Sweden |

54.0 million |

6.1 million |

|

Spain |

47.1 million |

18.4 million |

|

Switzerland |

34.6 million |

22.2 million |

|

Finland |

31.1 million |

5.0 million |

|

Netherlands |

30.8 million |

28.0 million |

|

Turkey |

24.0 million |

14.9 million |

|

Denmark |

20.2 million |

6.4 million |

|

France |

18.0 million |

48.9 million |

Source: WITS