Sphincterotomes Market Outlook:

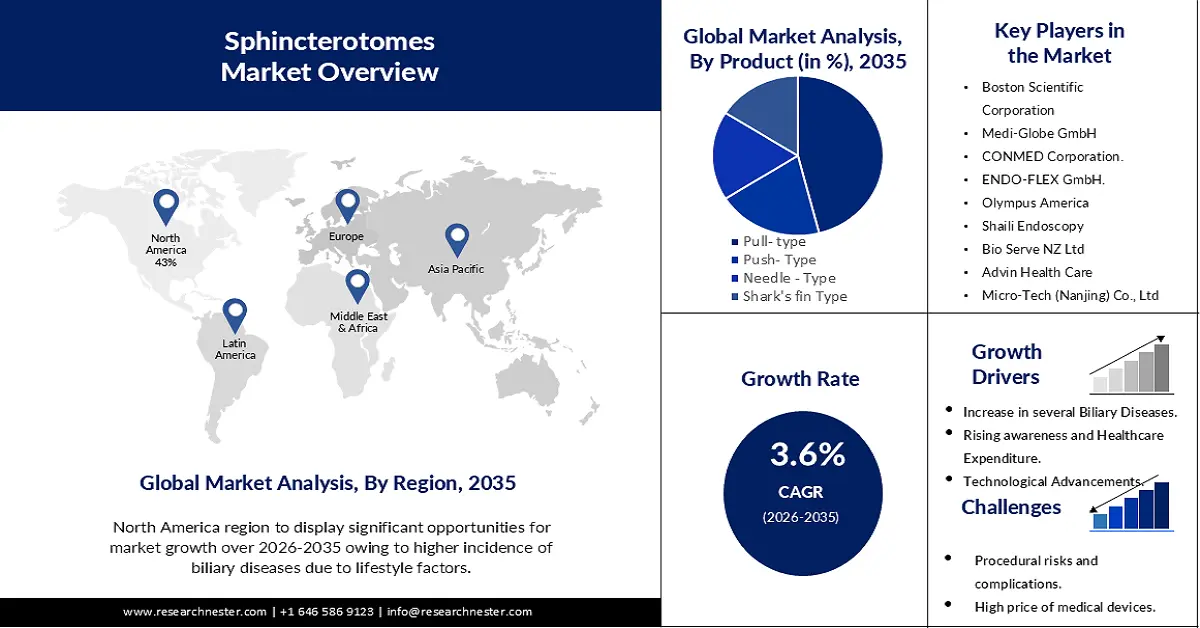

Sphincterotomes Market size was over USD 3.01 billion in 2025 and is anticipated to cross USD 4.29 billion by 2035, growing at more than 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sphincterotomes is estimated at USD 3.11 billion.

The market for sphincterotomes, a procedure used to treat conditions such as gallstones and bile duct disorders, is expected to grow due to the increasing incidence of these conditions. Gallbladder disease is a common condition in the United States, with an estimated 20.5 million cases and 14.2 million of them occurring in women. The most common reason for cholecystectomies, a surgical procedure to remove the gallbladder, is symptomatic gallstone disease. More than 600,000 cholecystectomies are performed each year in the United States due to the prevalence of this condition.

Further, the shift towards minimally invasive procedures fuels the demand for tools like sphincterotomes, as they are integral in endoscopic retrograde cholangiopancreatography (ERCP) procedures, which are increasingly preferred due to reduced invasiveness and quicker recovery times.

Key Sphincterotomes Market Insights Summary:

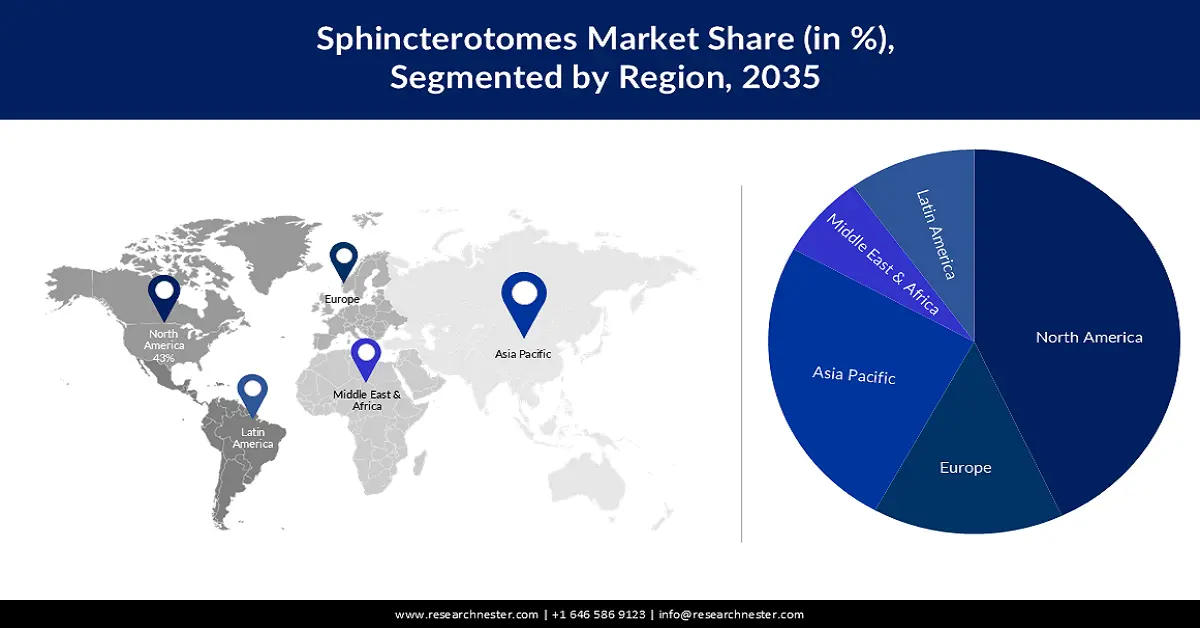

Regional Highlights:

- North America is projected to command a 38% share by 2035 in the sphincterotomes market, supported by rising biliary disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies owing to strengthened R&D and technology adoption.

- Asia Pacific is anticipated to register the highest CAGR through 2026-2035 as chronic disease incidence rises and healthcare expenditure accelerates, propelled by rapid economic development and heightened regional competitiveness.

Segment Insights:

- The pull-type sphincterotomes segment is expected to secure a 46% share by 2035 in the sphincterotomes market, underpinned by favorable regulatory initiatives enhancing medical tourism confidence and encouraging broader adoption.

- The hospital segment is forecast to dominate revenues by 2035 as global procedure volumes rise, impelled by growing awareness of the clinical advantages of sphincterotome-assisted surgeries.

Key Growth Trends:

- Increase in geriatric population

- Technological Advancements

Major Challenges:

- Procedural Risks and Complications

- Limited Access in Developing Regions

Key Players: Boston Scientific Corporation, Medi-Globe GmbH, CONMED Corporation., ENDO-FLEX GmbH., Olympus America, Shaili Endoscopy, Bio Serve NZ Ltd, Advin Health Care, Micro-Tech (Nanjing) Co., Ltd, HOYA Corporation.

Global Sphincterotomes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.01 billion

- 2026 Market Size: USD 3.11 billion

- Projected Market Size: USD 4.29 billion by 2035

- Growth Forecasts: 3.6%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 19 November, 2025

Sphincterotomes Market - Growth Drivers and Challenges

Growth Drivers

- Increase in geriatric population - As the global population ages, there’s a higher prevalence of diseases requiring biliary interventions, augmenting the need for sphincterotomies and associated devices. As per our analysis, the number of individuals in the world who are 60 years of age or older is expected to double (to 2.1 billion) by 2050. It is anticipated that between 2020 and 2050, the number of people 80 years of age or older will triple, reaching 426 million.

- Technological Advancements- Innovations in endoscopic procedures and device technology, such as improvements in endoscope design or the development of advanced sphincterotomes. For instance, some sphincterotome's design permits the use of numerous guidewires throughout surgery and can support guidewire sizes ranging from 018 to 035".

- Increasing Awareness and Healthcare Expenditure- Heightened awareness of the advantages linked to early medical intervention, coupled with augmented healthcare investments worldwide, facilitates broader accessibility to sophisticated procedures such as sphincterotomes. This increased accessibility fuels the adoption of advanced medical techniques, contributing significantly to market expansion. As individuals become more informed about the benefits of timely medical interventions and as healthcare spending continues to rise globally, the demand for and utilization of sphincterotomes as a crucial medical solution is projected to increase significantly.

Challenges

- Procedural Risks and Complications- Sphincterotomy procedures carry inherent risks like bleeding or perforation, necessitating skilled professionals and stringent safety protocols. Perceived risks can also impact patient acceptance and procedure adoption rates.

- High costs associated with advanced medical devices and procedures pose barriers to adoption, especially in regions with limited budgets.

- Limited Access in Developing Regions.

Sphincterotomes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 3.01 billion |

|

Forecast Year Market Size (2035) |

USD 4.29 billion |

|

Regional Scope |

|

Sphincterotomes Market Segmentation:

Product Segment Analysis

The pull-type sphincterotomes market are anticipated to grab the largest share by 2035 amounting to 46% on account of higher positive results owing to the increasing focus and initiatives of regulatory bodies across the globe. These regulatory bodies are working towards ensuring that medical tourism is conducted safely and ethically, thereby boosting the trust and confidence of medical tourists. This, in turn, is expected to attract more medical tourists, leading to the growth of the segment. Additionally, the rise in healthcare costs in developed countries and the availability of affordable medical treatments in emerging economies are also expected to contribute to the growth of the medical tourism segment in the coming years. Further, Pull-type sphincterotomes can be used to accomplish endoscopic sphincterotomy, which is technically possible in 50–86% of patients.

End- User Segment Analysis

The hospital segment in the sphincterotomes market is anticipated to be the largest revenue-generating segment due to the vast number of sphincterotome-related treatments that are carried out annually throughout the world, including anorectal surgeries such as Crohn's disease repair procedures and surgeries to correct hypopadias. Over the course of the projection period, this market segment is expected to be the top revenue generator in the industry due to the anticipated increase in demand for sphincterotome devices brought about by increased knowledge of the benefits of their use in operations.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End- User |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sphincterotomes Market - Regional Analysis

North American Market Insights

North America industry is estimated to hold largest revenue share of 38% by 2035. In North America, the market is primarily driven by factors such as a higher incidence of biliary diseases due to lifestyle factors, an aging population contributing to increased cases of biliary disorders, and robust healthcare infrastructure encouraging the adoption of advanced medical procedures. Additionally, technological advancements and a strong focus on R&D foster innovation in sphincterotome devices. The region’s healthcare expenditure and favorable reimbursement policies further support market growth.

APAC Market Insights

Asia Pacific sphincterotomes market is estimated to grow at the highest CAGR during the forecast period. Chronic illnesses like diabetes, cancer, heart disease, neurological problems, and others are becoming more common. According to statistical; data analysed by research analysts, 55% of deaths in the Asia Pacific region occur due to chronic diseases. The main market participants in the area are expected to become more competitive, which will further propel the industry's expansion. Rapid economic development in countries like China and India leads to increased healthcare expenditure, thereby boosting the market for sphincterotomes.

Sphincterotomes Market Players:

- TeleMed Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Medi-Globe GmbH

- CONMED Corporation.

- ENDO-FLEX GmbH.

- Olympus America

- Shaili Endoscopy

- Bio Serve NZ Ltd

- Advin Health Care

- Micro-Tech (Nanjing) Co., Ltd

Recent Developments

- Due to the vast number of sphincterotome-related treatments that are carried out annually throughout the world, including anorectal surgeries such as Crohn's disease repair procedures and surgeries to correct hypopadias. Over the course of the projection period, this market segment is expected to be the top revenue generator in the industry due to the anticipated increase in demand for sphincterotome devices brought about by increased knowledge of the benefits of their use in operations.

- In tandem with other core businesses, Olympus is a global leader in technology design and delivery. The company announced the launch of its StoneMasterV and VorticCatchV EndoTherapy devices, which increase the efficiency of bile duct stone management and retrieval for endoscopic retrograde cholangiopancreatography (ERCP).

- Report ID: 3140

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sphincterotomes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.