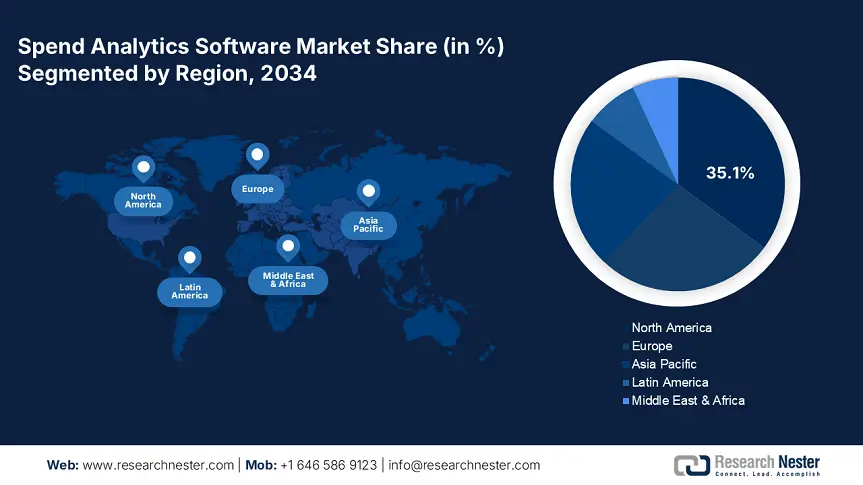

Spend Analytics Software Market - Regional Analysis

North America Market Insights

The North America spend analytics software market is expected to hold 35.1% of the global revenue share through 2034, owing to structured regulatory frameworks. The strong government digitalization strategies and high cloud adoption rates are boosting the sales of spend analytics software platforms. Canada’s ISED under the Universal Broadband Fund has allocated around CAD 3.3 billion, which reinforces analytics tool adoption in underserved areas. The education and healthcare sectors are likely to lead the sales of spend analytics software solutions. The hefty spending on digital infrastructure is also contributing to the trade of spend analytics software solutions.

The demand for spend analytics software market in the U.S. is driven by hefty federal spending on ICT and digital infrastructure. The procurement automation and cybersecurity modernization are also supporting the increasing sales of spend analytics software solutions. The public investments in IT crossed USD 78.5 billion in 2024. The substantial portion of this funding was allocated for procurement systems under the Federal IT Dashboard program. The FCC’s Affordable Connectivity Program and USAC’s E-Rate Program are accelerating the application of spend analytics software solutions in the education sector.

Europe Market Insights

The Europe spend analytics software market is poised to account for 27.2% of the global revenue share throughout the study period. The widespread digital transformation mandates and sustainability-linked procurement regulations are promoting the sales of spend analytics software solutions. The cross-border interoperability initiatives are also propelling the adoption of spend analytics software technologies. The Digital Europe Programme allocated €250.5 million between 2021 and 2027, especially for AI and analytics innovation, which has significantly advanced public sector procurement systems.

The digitalization trend and hefty ICT investments are expected to boost the spend analytics software market growth in Germany. The digital market was totaled at €44.7 billion in 2024, and around €5.0 billion of it was allocated for the enhancement of spend analytics solutions. Also, the Federal Ministry for Digital and Transport (BMDV) prioritized AI-integrated procurement platforms, supported by its €3.1 billion public sector digital transformation agenda. The supportive government policies and funding initiatives are projected to propel the sales of spend analytics software technologies. The manufacturing, energy, and smart city sectors are also fueling the adoption of spend analytics software solutions.

Country-Specific Insights

|

Country |

2023 Allocation to Spend Analytics |

2024 Spend on Analytics Tools |

Growth Trend (2021-2024) |

|

United Kingdom |

10.3% of the digital budget |

£1.63 billion |

+18.7% |

|

Germany |

11.3% of the ICT budget |

€5.0 billion |

+21.5% |

|

France |

9.6% of the ICT budget |

€3.3 billion |

+18.0% |

APAC Market Insights

The Asia Pacific spend analytics software market is expected to increase at a CAGR of 15.1% from 2025 to 2034, owing to the aggressive digitization programs and public procurement reforms. China, India, Japan, South Korea, and Malaysia are some of the most opportunistic marketplaces for key players. The expanding ICT investments in these countries are attracting numerous international players. The public healthcare and smart city sectors are poised to propel the adoption of spend analytics software technologies in the years ahead.

China spend analytics software market leads the sales of spend analytics software solutions, owing to its massive digital governance reforms and booming enterprise cloud adoption. The public investments for spend analytics software solutions grew by 43.3% between 2019 and 2024. In 2023, more than 3.3 million enterprises adopted analytics solutions, particularly across public procurement, manufacturing, and telecom sectors. Also, the 14th Five-Year Plan, which emphasizes digital infrastructure and mandates the integration of data-driven procurement tools in the public sector, is boosting the growth of the spend analytics software market. Continuous technological advancements are likely to propel the adoption of spend analytics software technologies in the transportation, energy, and healthcare sectors.

Country-Specific Insights

|

Country |

Govt ICT Allocation to Spend Analytics |

2023-2024 Key Statistics |

|

Japan |

7.7% (2024) |

+$1.7B vs. 2022 |

|

India |

+52.4% (2015-2023) |

$2.5B spent; 5.5M businesses use analytics |

|

Malaysia |

+64.5% funding growth |

3× firm-level adoption (2013-2023) |

|

South Korea |

$3.2B smart ICT AI budget (2023) |

Enhanced analytics in 74.3% of public tenders |