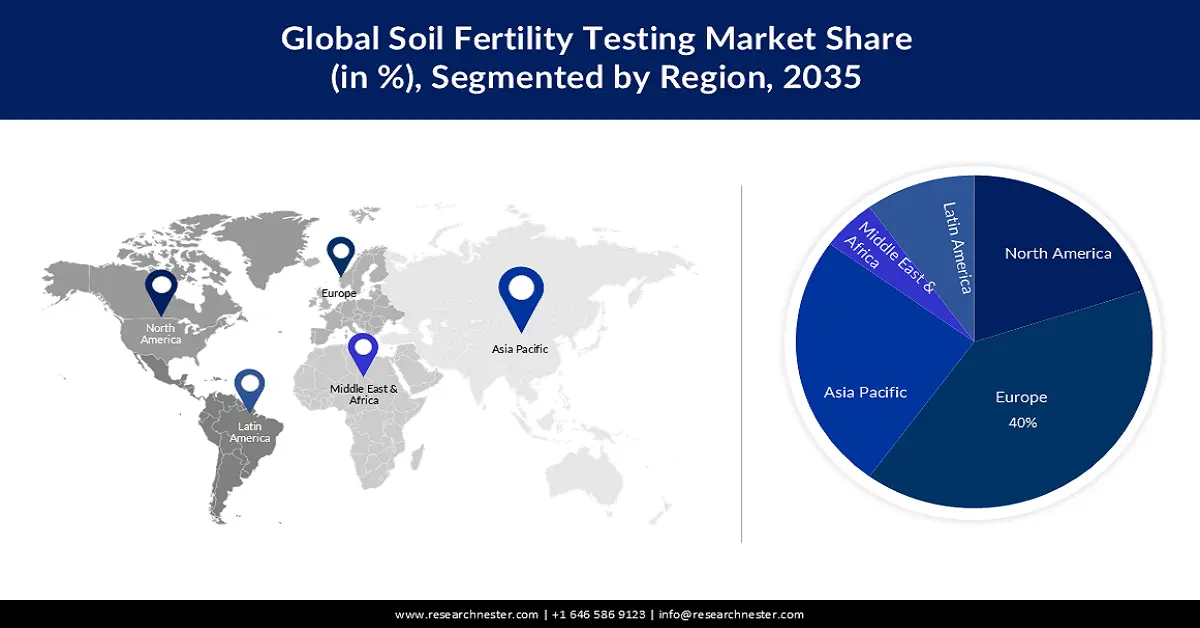

Soil Fertility Testing Market Regional Analysis:

European Market Insights

The soil fertility testing market in Europe is set to gather a share of about 40% over the projected period. This growth of the market in this region could be owing to rising agriculture regulations. For instance, the EU has launched rules for organic production and labelling of these organic products which was expected to be implemented in 2022. For Organic farming, according to this EU legislation, the farmer should maintain the natural fertility of the soil and enhance its life. Hence, with this the need for soil fertility testing is growing.

APAC Market Insights

The Asia Pacific soil fertility testing market is also expected to grow over the coming years. The demand for food is growing in this region, and on the other hand, the availability of land for production is not enough to satisfy this demand. As a consequence, the adoption of soil fertility testing is growing further giving scope for the treatment of soil which is found infertile.