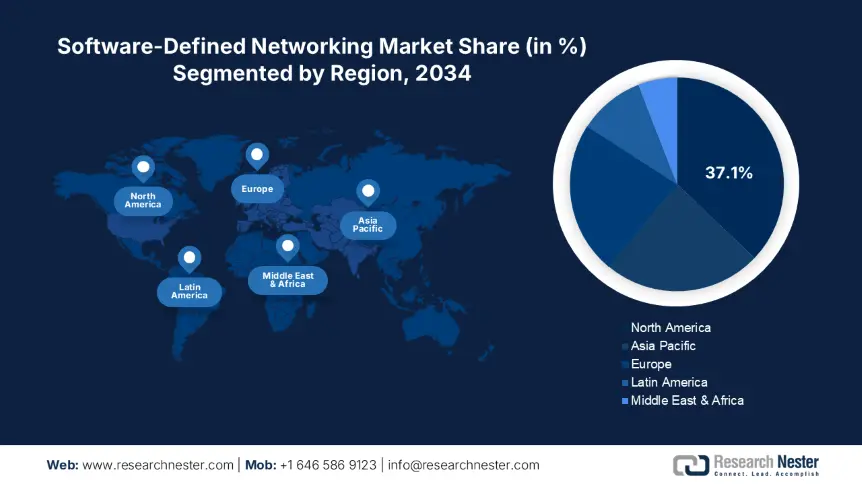

Software-Defined Networking Market - Regional Analysis

North America Market Insights

The North America SDN market is anticipated to hold 37.1% of the global revenue share through 2034. The rising federal infrastructure investments and telecom digitization are propelling the sales of software-defined networking solutions. The widespread enterprise cloud adoption in both public and private infrastructure is boosting the sales of software-defined networking technologies. The U.S. government allocated more than USD 90.5 billion between 2023 and 2024 to broadband infrastructure and digital transformation programs. In addition, the hefty public spending initiatives are set to double the revenues of key players in the coming years.

The software-defined networking adoption in the U.S. is expected to be fueled by rising demand for secure, programmable networks across the public sector and telecom domains. Cloud-native architectures driven by Amazon Web Services and Microsoft Azure have integrated SDN for real-time orchestration and segmentation. Moreover, the supportive government policies and funding are poised to encourage market players to expand their operations. The government’s Zero Trust Architecture push is expected to accelerate SDN adoption in defense and public agency networks.

Europe Market Insights

The Europe software-defined networking market is poised to capture 21.5% of the global revenue share throughout the study period. The EU-funded innovation initiatives and increasing demand for cloud-native infrastructure are expected to propel the deployment of SDN solutions. The European Commission’s Digital Europe Programme has reserved €7.6 billion in funding through 2027, with nearly €1.7 billion allocated to advanced digital infrastructure, including SDN. Moreover, the strategic public-private investment partnership is further set to drive the sales of software-defined networking technologies in the coming years.

The sales of software-defined networking systems in Germany are estimated to be driven by high public sector investments and robust enterprise digitalization programs. The strong industrial demand for programmable networks is creating lucrative earning opportunities for key players. The BMDV’s Digital Strategy allocated more than €6.5 billion to critical IT infrastructure from 2021 to 2025, with SDN positioned as a core technology for building flexible, secure, and scalable networks. In addition to this, the expansion of 5G infrastructure and cloud data centers is set to accelerate the trade of SDN solutions in the coming years.

Country-Specific Insights

|

Country |

Government/Program |

Investment Amount (2021-2024) |

Purpose / Focus Area |

|

United Kingdom |

Digital Infrastructure Investment Fund (DSIT) |

£375.5 million |

SDN-enabling infrastructure for cloud and telecom networks |

|

France |

France Numérique / ARCEP / Numeum |

€1.5 billion |

Telecom orchestration, enterprise networks, smart cities |

|

Italy |

National Recovery and Resilience Plan (PNRR) – ICT allocation |

€920.2 million |

5G/SDN deployment in public services and SMEs |

|

Spain |

Plan de Digitalización de las Administraciones Públicas |

€642.6 million |

Public cloud-SDN integration, smart city backbone networks |

|

Sweden |

Post- och telestyrelsen (PTS) Innovation Support |

SEK 4.4 billion (~€370.4 million) |

SDN trials in rural connectivity and green data centers |

|

Netherlands |

Digital Economy Strategy (EZK Ministry) |

€580.6 million |

SDN in enterprise WANs, broadband virtualization |

|

Finland |

National Cyber Security Centre – SDN for public infra |

€340.1 million |

Secure SDN backbone for critical services |

|

Denmark |

Ministry of Climate and Digitalization Initiatives |

€210.8 million |

Sustainable SDN infrastructure in municipal networks |

APAC Market Insights

The Asia Pacific software-defined networking market is foreseen to increase at a CAGR of 13.5% between 2025 and 2034, owing to aggressive digital transformation programs and public sector investment in programmable networks. The telecom, cloud infrastructure, and healthcare IT sectors are boosting the demand for advanced SDN solutions. China, Japan, India, and South Korea are high-earning marketplaces for SDN manufacturers. India’s MeitY confirmed a 19.9% CAGR in SDN investment from 2015 to 2023, with 2.9 million SMEs integrating SDN in cloud connectivity.

China is projected to lead the sales of SDN solutions owing to the massive government spending and industrial integration of programmable networks. The Ministry of Industry and Information Technology (MIIT) reveals that the public-sector investment in SDN-centric digital infrastructure crossed ¥48.5 billion between 2020 and 2024. This investment supported SDN expansion in 5G backhaul, edge computing, and smart manufacturing hubs. The China Academy of Information and Communications Technology (CAICT) further reveals that more than 3.2 million enterprises have deployed SDN in 2023, with financial services, energy, and logistics as leading sectors. The country’s 14th Five-Year Plan for Digital Economy is also contributing to the increasing trade of software-defined networking solutions.

Country-Specific Insights

|

Country |

2023-2024 SDN Funding |

Notable Stats |

|

Japan |

¥205B (~$1.7B) |

2024 budget up 23.9% from 2022 |

|

Malaysia |

RM2.4B (~$510M) |

SDN adoption doubled (2013–2023), 78.4% funding increase |

|

South Korea |

₩1.86T (~$1.5B) |

70.1% of public cloud systems on SDN by 2023 |

|

Indonesia |

IDR 7.2T (~$485M) |

Focus on SDN for digital health and cloud infrastructure |

|

Australia |

AUD 831M |

Used in federal data exchange & eHealth |