Global Snowboard Equipment Market Overview

Snowboard Equipment Market is expected to rise again during the forecast period 2016-2023. There has been a significant decline in the global market of snowboard equipment during 2008-2013 due to heavy snowfall in southern ranges make the conditions unsuitable for snowboarders.

Market size and forecast

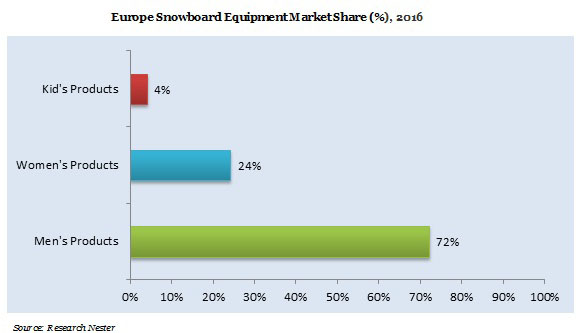

The global snowboard equipment market is expected to reach USD 352.01 Billion by 2023 due to increasing initiatives to encourage for snowboarding events and participation across the globe. Europe is expected to showcase a lucrative growth in snowboard equipment market in the forecast period 2016-2023 and snowboard equipment market registered USD 399.09 Million sales by 2013 and USD 167.5 Million from rental and repair services of snowboard equipment. Due to presence of heavy snowfall in the European region, it is expected to be the biggest market for snowboard equipment over the forecast period 2016-2023.

Growing Infrastructure in snowboarding and promotion of snowboarding equipment through different channels by manufacturer is expected to spur the market of snowboard equipment across the globe. Advancement in snowboard equipment helps the providers to launch newly designed cost effective snowboard equipment which will further expected to grow exponentially across the globe. Further, rising awareness towards safety due to rise in severe injuries at the time of snowboarding is expected to upsurge the market of snowboard equipment.

Get more information on this report: Download Sample PDF

Rise in global warming makes the weather conditions unpredictable which leads snowboarders to have severe injuries and it is a major burden for the future of snowboard equipment market globally.

By Region

The study further analysis the Y-O-Y Growth, demand & supply and forecast future opportunity in North America (United States, Canada), Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa).

Growth Drivers and challenges

Increasing initiatives to encourage participation in snowboarding across the globe is expected to spur the demand for snowboard equipment over the forecast period 2016-2023. Introduction of newly designed cost-effective snowboard equipment by different providers will make the consumer to choose according to the requirement which will further expected to fuel the growth of snowboard equipment market globally.

On the other hand, availability of hybrid snowboards in the global market of snowboard equipment is expected to attract more consumers towards snowboarding which will further anticipated the market of snowboard equipment during the forecast period 2016-2023. Organizing of various snowboarding events by government authorities and snowboard manufacturers are growing awareness towards snowboarding which will further expected to expand the demand for snowboard equipment across the globe.

Furthermore, high injury rate and rental equipment will make fewer consumers to adopt snowboard equipment which will expected to hinder the growth of snowboard equipment market over the forecast period 2016-2023. Growing young population in most of the nations across the globe and desire of adventure of youth is expected to have more beginners which will further boost the market for snowboard equipment over the forecast period 2016-2023.

However, high cost of snowboard equipment in the global market and less life of equipment needs to change periodically which would be a major burden on the consumers which will further expected to decrease the demand for snowboard equipment. Inconsistence weather conditions across the globe due to global warming and increasing pollution is expected to hinder the growth of snowboard equipment market across the globe over the forecast period 2016-2023. Lack of infrastructure and medical assistance for snowboarders offered a great challenge to the market of snowboard equipment globally.

Top Featured Companies Dominating the Market

The key developers of Snowboard Equipment across the globe as follows:

- Zionor

- Company Overview

- Key Product Offerings

- Business Strategy

- SWOT Analysis

- Financials

- Lucky Bums

- Arctix

- Burton

- Emsco Group

- Report ID: 235

- Published Date: Jan 30, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Snowboard Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert