Smart Highway Construction Market Outlook:

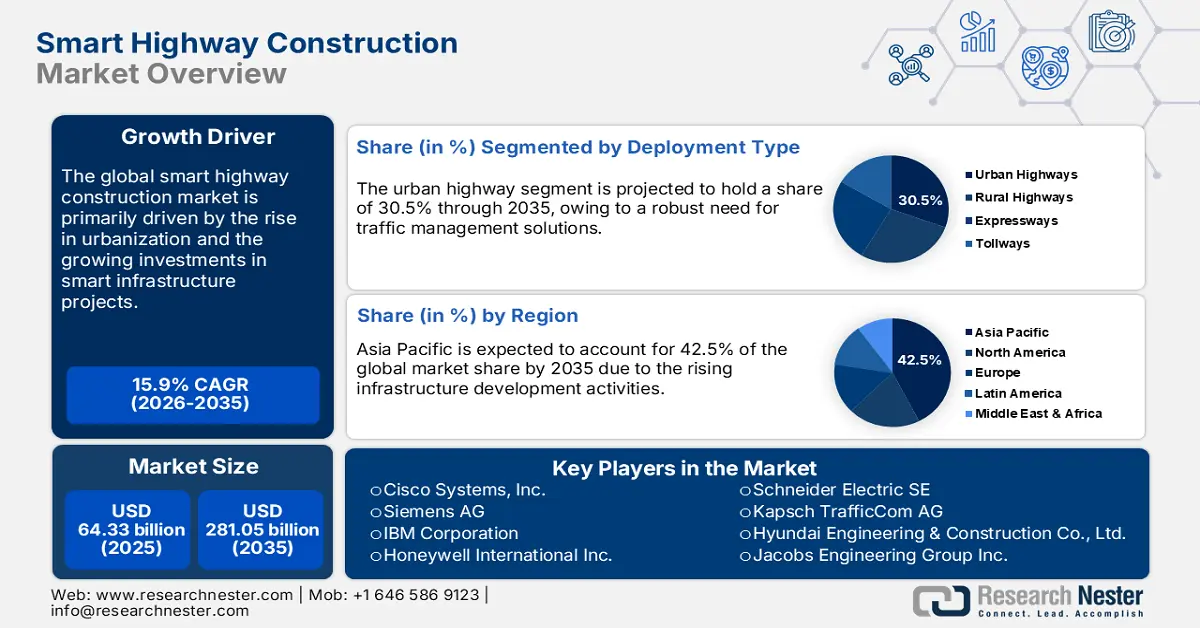

Smart Highway Construction Market size was USD 64.33 billion in 2025 and is estimated to reach USD 281.05 billion by the end of 2035, expanding at a CAGR of 15.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart highway construction is evaluated at USD 74.55 billion.

The production of smart highway construction technologies depends on the stable supply chain of raw materials and components such as concrete, bitumen, steel, sensors, and radar systems. The U.S., Germany, China, and Japan are leading the import and export of specialized electronic control units and semiconductor components. The U.S. exports of cross-border services outpaced imports in 2021, creating a $247.0 billion trade surplus. The majority of significant services industries showed U.S. cross-border trade surpluses, with professional, financial, and digital and electronic services showing the biggest surpluses. This reflects high trade in smart highway construction components.

On the other hand, the U.S. Bureau of Labor Statistics projects that the producer price index for construction inputs relevant to highway systems, particularly fabricated structural metal and electrical equipment. Between March 2024 and March 2025, the CPI for all transportation-related goods and services decreased by 0.9%. According to the CPI, transportation contributed 5.7% to the 2.4% increase in the cost of all goods and services. The largest contributor to inflation was motor vehicle insurance, which increased 7.5% annually and accounted for 8.9% of the yearly change in the cost of all goods and services. The rising public sector procurement budgets are expected to drive the sales of smart highway construction technologies in the years ahead.

Key Smart Highway Construction Market Insights Summary:

Regional Highlights:

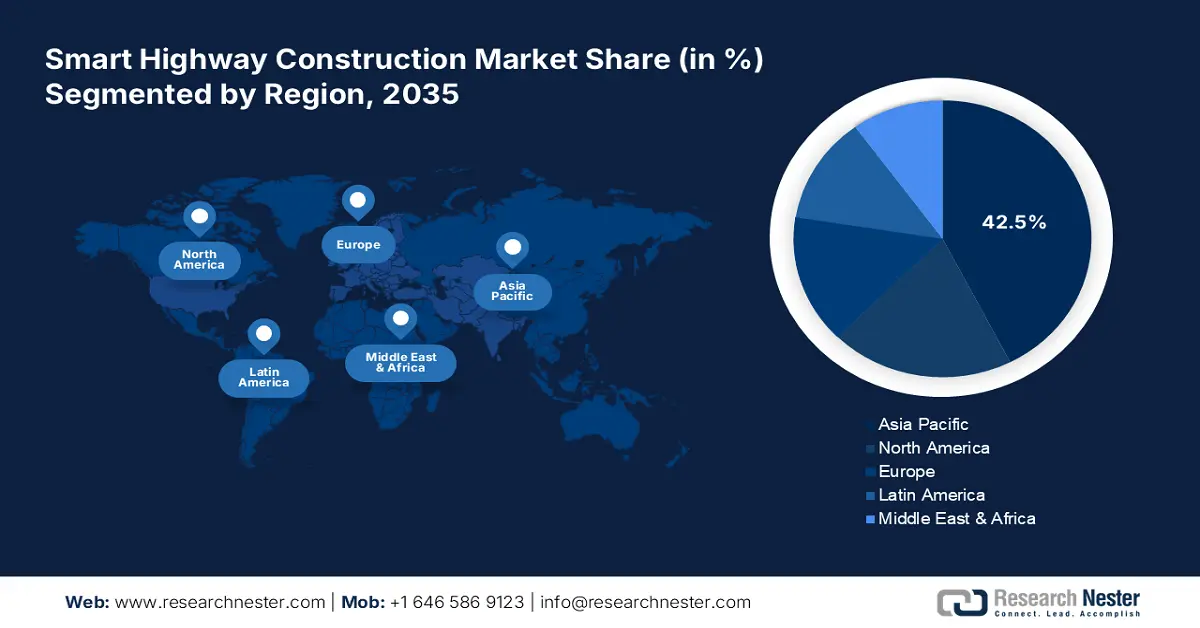

- Asia Pacific is projected to hold 42.5% share by 2035, owing to rising infrastructure development and government investments in smart highway projects.

- North America is anticipated to capture 20% share by 2035, driven by massive spending on ICT and road technology expansion.

Segment Insights:

- Intelligent transportation systems (ITS) segment is projected to account for 28.9% share by 2035, driven by the integration of adaptive traffic control systems and connected vehicle technologies.

- Urban highway segment is anticipated to hold 30.5% share by 2035, impelled by the expansion of smart city initiatives and urban congestion management needs.

Key Growth Trends:

- Rapid urbanization and rise in vehicle density

- Government investment in smart infrastructure

Major Challenges:

- Infrastructure readiness gaps

- Limited access to government incentives

Key Players: Cisco Systems, Inc., Siemens AG, IBM Corporation, Honeywell International Inc., Schneider Electric SE, Kapsch TrafficCom AG, Hyundai Engineering & Construction Co., Ltd., Jacobs Engineering Group Inc., L&T Construction, Downer Group, Gamuda Berhad, Alstom SA, Thales Group, SK Telecom Co., Ltd., Larsen & Toubro Limited (L&T), LG CNS Co., Ltd., Cubic Transportation Systems, SWARCO

Global Smart Highway Construction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 64.33 billion

- 2026 Market Size: USD 74.55 billion

- Projected Market Size: USD 281.05 billion by 2035

- Growth Forecasts: 15.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Canada, France, Brazil, Australia

Last updated on : 10 September, 2025

Smart Highway Construction Market - Growth Drivers and Challenges

Growth Drivers

- Rapid urbanization and rise in vehicle density: The swift rise in urbanization activities reflects high growth in vehicle density worldwide. The increasing vehicle registrations and urban congestion are fueling robust investments in advanced traffic management systems. The public and private entities are entering into strategic collaborations to drive innovations in highway construction and traffic optimization systems. China, India, Nigeria, and Indonesia, where road demand outpaces conventional infrastructure capacity, are set to fuel the sales of smart highway construction technologies in the years ahead.

- Government investment in smart infrastructure: The rise in public funding for infrastructure development is expected to emerge as a catalyst for innovation and adoption of smart highway construction technologies. Governments are heavily investing in smart infrastructure projects worldwide. The U.S. Infrastructure Investment and Jobs Act (IIJA) has invested more than USD 90 billion in transit programs for urban and rural regions. This reflects that the public funding initiatives are likely to offer high-earning opportunities for smart highway construction companies.

- Integration of electric vehicle (EV) charging infrastructure: The increasing adoption of electric vehicles has significantly influenced and driven the development of smart highways with wireless and solar charging lanes. Governments and private companies are exploring dynamic charging to allow EVs to charge while driving. It is expected that e-two wheelers will reach a market of 5 million by 2025, and e-three wheelers will make up 30% of sales. Growing at a compound annual growth rate of 49% from 2021 onward, the government anticipates the EV segment will exceed 17 million units annually by 2030. Focused mainly on electrified public and shared transportation, it is planned to subsidize 7262 e-buses, 160,000 e-3 wheelers, 30461 e-4 wheeler passenger cars, and 1.5 million e-2 wheelers. Overall, electric vehicle penetration in India is projected to increase eightfold by 2030, up from the current 5%. There is a strong focus on developing smart highways equipped for EV charging as a key part of future road projects.

Innovations in the Smart Highway Construction Market

Shuttering in smart highway construction provides temporary forms for concrete, ensuring it is properly placed, aligned, and maintains structural integrity in pavements, bridges, and sections with embedded smart sensors. Shuttering offers durability in new asphalt supported by technology in EV charging lanes, IoT-supported roadways, and drainage systems, promising quality, safety, and performance across all advanced highways.

Top Global Exporters of Shuttering for Concrete Construction Work

|

Country / Region |

Export Value (USD thousand) |

Quantity (kg) |

|

European Union |

189,149.72 |

116,084,000 |

|

Austria |

150,726.31 |

94,653,100 |

|

Czech Republic |

58,138.21 |

44,129,300 |

|

Germany |

49,220.80 |

29,536,100 |

|

Spain |

28,506.07 |

15,558,000 |

|

Slovak Republic |

26,247.53 |

18,321,400 |

|

Italy |

16,157.57 |

7,122,290 |

|

Poland |

12,611.58 |

7,319,640 |

|

Netherlands |

11,764.56 |

2,973,460 |

|

Bosnia and Herzegovina |

5,664.24 |

4,653,470 |

|

Denmark |

4,238.30 |

1,894,260 |

|

Turkey |

3,205.84 |

2,702,520 |

|

Ukraine |

3,074.68 |

2,606,790 |

Source: WITS

Challenges

- Infrastructure readiness gaps: The unavailability of basic infrastructure required for smart highway systems is challenging the revenue growth of key players in underdeveloped markets. Reliable electricity, 5G networks, and high-capacity fiber optic cables are not easily accessible in the price-sensitive markets. This slows down the production and commercialization of smart highway construction technologies in poor regions.

- Limited access to government incentives: The lack of fiscal incentives or tax benefits for producers of smart highway construction technologies in low and middle-income countries is hindering the overall market growth. According to the Organization for Economic Cooperation and Development (OECD), several low and middle-income regions have smart transport incentives. Such financial and budget uncertainty deters companies from investing in these markets, which affects the trade of smart highway construction technologies.

Smart Highway Construction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.9% |

|

Base Year Market Size (2025) |

USD 64.33 billion |

|

Forecast Year Market Size (2035) |

USD 281.05 billion |

|

Regional Scope |

|

Smart Highway Construction Market Segmentation:

Technology Segment Analysis

The intelligent transportation systems (ITS) segment is projected to capture 28.9% of the smart highway construction market share by 2035. The rising integration of adaptive traffic control systems and connected vehicle technologies is expected to drive the sales of innovative intelligent transportation solutions. The introduction of V2X (vehicle-to-everything) technology is also set to enhance the overall efficiency of the ITS. The U.S. Department of Transportation states that the ITS solutions are vital in reducing road congestion and improving safety metrics. By 2050, global transportation CO2 emissions are expected to increase by 60% under the current ambition scenario, which calls for the implementation of current and announced mitigation strategies.

Deployment Type Segment Analysis

The urban highway segment is poised to account for 30.5% of the smart highway construction market share by 2035. The increasing smart city initiatives and urban congestion management needs are propelling segment growth. The metro cities are driving high demand for AI-based monitoring and toll management systems. A resolution titled "Improving Global Road Safety" was voted on by the UN General Assembly in September 2020, announcing the Decade of Action for Road Safety 2021–2030, in which the goal is to prevent at least 50% of traffic-related fatalities and injuries by that year. Such suggestions are creating a lucrative environment for urban highway safety producers.

Service Model Segment Analysis

The construction services segment is projected to capture 28.9% of the smart highway construction market share by 2035. They encompass the large-scale development of physical infrastructure, the integration of IoT systems and sensors into highways, traffic management solutions, and renewables. Design & engineering, and O&M are also important services. However, construction accounts for most of the investment, and contracts, as construction services are mainly driven by large infrastructure projects with support mainly from governments, and participation by the private sector in developing and constructing next-generation highways.

Our in-depth analysis of the smart highway construction market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Deployment Type |

|

|

Service Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Highway Construction Market - Regional Analysis

APAC Market Insights

The Asia Pacific smart highway construction market is anticipated to hold 42.5% of the global revenue share through 2035. The significant rise in construction and infrastructure development activities is poised to accelerate the sales of smart highway construction solutions. Governments are investing massively in these projects, which are opening lucrative earning opportunities for smart highway construction technology producers. China and India are investment-worthy markets for key players. Japan and South Korea are estimated to lead the sales of smart highway construction solutions in the coming years.

The swift rise in technological innovations and leadership in semiconductor and sensor manufacturing is expected to aid China in propelling the sales of smart highway construction solutions. According to a report from China's Ministry of Industry and Information Technology, the 5G network in the nation continues to expand, existing in all cities, towns, and more than 90% of villages supported by 3.84 million 5G base stations, over 60% of the global total. This digital infrastructure helps support smart highway projects, which incorporate real-time traffic management and monitoring, and autonomous vehicles. Through 5G access, China's evolving highway network is set to advance next-generation transportation safety, efficiency, and connectivity.

North America Market Insights

The North America smart highway construction market is anticipated to hold 20% of the global revenue share through 2035. The massive spending on ICT and road technology expansion is set to drive innovations in the smart highway construction technologies. The presence of early adopters and key manufacturers is also contributing to the overall market growth. The easy availability of high-tech solutions and the government's aim to remain technologically ahead are set to fuel the overall market growth in the coming years.

The positive federal initiatives aimed at enhancing the infrastructure are expected to fuel the sales of smart highway construction technologies in the U.S. The Federal Communications Commission (FCC) recently approved a deal, T-Mobile pledged to provide 5G connectivity to 99% of Americans within six years on both low-band and mid-band spectrum, including 90% of rural Americans in the same time period. This is increasing the adoption of real-time traffic management V2X communication systems in the country. Overall, the U.S. is the most lucrative market for smart highway construction technology producers.

Europe Market Insights

The European smart highway construction market is anticipated to hold 15% of the global revenue share through 2035. The market is fueled by sustainability targets set out by the EU, a move to integrate digital infrastructure, and more focus on reducing congestion and emissions. Many of the EU governments are introducing intelligent transport systems, renewable-powered roadways, and even monitoring pavements using IoT devices. There is a strong emphasis on public-private partnerships and funding through the European Green Deal to develop smart mobility corridors that can be used for real-time traffic management, enhanced safety, and connectivity across different border sectors for freight and passenger transportation networks.

Poland made development in highway and road infrastructure a major priority by investing in transport. From 2014-2023, and projected through 2025, the government invested approximately USD 36.6 billion in road infrastructure, as well as USD 17.5 billion for rail infrastructure. These investments support intelligent solutions like the e-TOLL satellite-based toll system and National Traffic Management System, which was launched in May 2020 with co-financing by the EU valued at more than USD 52 million.

Key Smart Highway Construction Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- IBM Corporation

- Honeywell International Inc.

- Schneider Electric SE

- Kapsch TrafficCom AG

- Hyundai Engineering & Construction Co., Ltd.

- Jacobs Engineering Group Inc.

- L&T Construction

- Downer Group

- Gamuda Berhad

- Alstom SA

- Thales Group

- SK Telecom Co., Ltd.

- Larsen & Toubro Limited (L&T)

- LG CNS Co., Ltd.

- Cubic Transportation Systems

- SWARCO

The smart highway construction market is characterized by the presence of gigantic companies and the increasing emergence of start-ups. Industry giants are employing strategies such as technological innovations, new product launches, partnerships and collaborations, mergers and acquisitions, and regional expansion to boost their revenue shares. Leading companies are collaborating with other players to enhance their product offerings and increase market reach. Organic marketing strategies are expected to double the revenues of smart highway construction market players in the years ahead.

Recent Developments

- In June 2024, Siemens AG announced the upgrade of its flagship smart traffic management software, Sitraffic Concert. This solution, integrated with AI-driven predictive algorithms, manages highway traffic effectively.

- In March 2024, Cisco Systems launched the SmartRoad IoT Management Platform, an integrated software suite designed to optimize smart highway infrastructure. This product led to a 12.4% rise in its Infrastructure Solutions revenue segment in the first quarter of 2024.

- Report ID: 7742

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Highway Construction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.