3D Printing Construction Market Outlook:

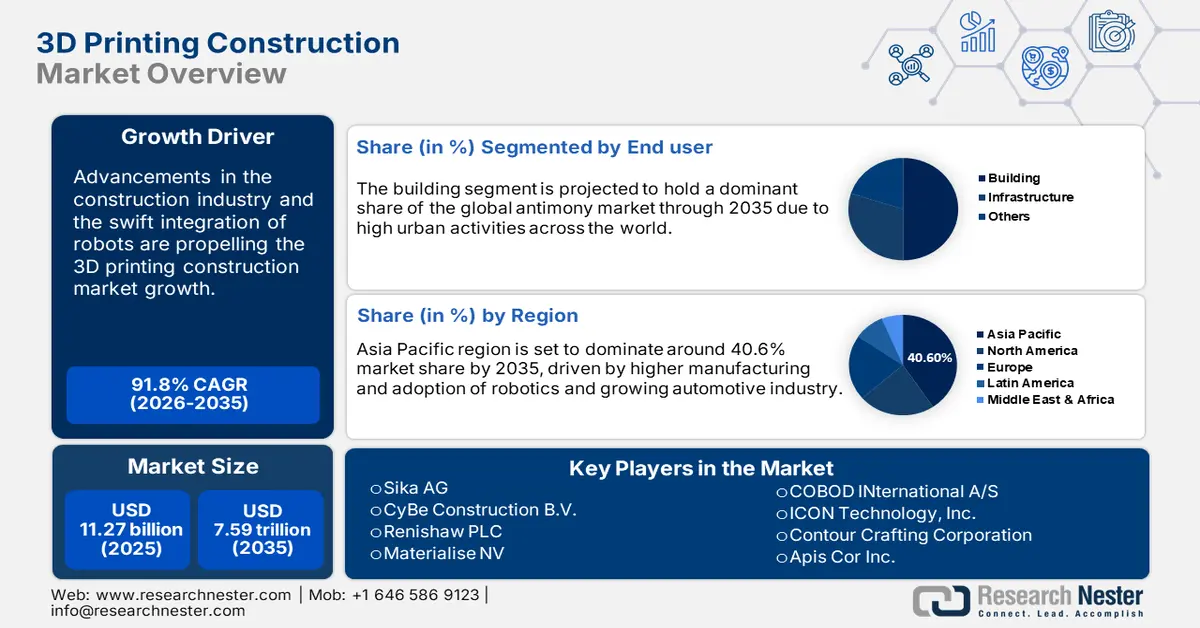

3D Printing Construction Market size was valued at USD 11.27 billion in 2025 and is likely to cross USD 7.59 trillion by 2035, registering more than 91.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D printing construction is assessed at USD 20.58 billion.

The growth of the market can primarily be attributed to the higher demand in the aerospace industry owing to the rising aerospace export/import volume. As of 2021, the total export volume of aerospace in the United States reached nearly USD 90 billion while in Canada, it was estimated to hit approximately USD 10 billion.

Global 3D printing construction market trends such as, growing demand for robotics and respective technological advancement are projected to influence the growth of the market positively over the forecast period. For instance, around 2.5 million industrial robots were noticed to be functioning in factories. Moreover, the growing manufacturing of automobiles, such as commercial and passenger vehicles, is further expected to increase the growth of the market over the forecast period. It was observed that in 2022, approximately 200 million vehicles including three & two-wheelers, commercial, passenger, and others were sold out across the globe. Hence, all these factors are expected to hike the growth of the market during the forecast period.

Key 3D Printing Construction Market Insights Summary:

Regional Highlights:

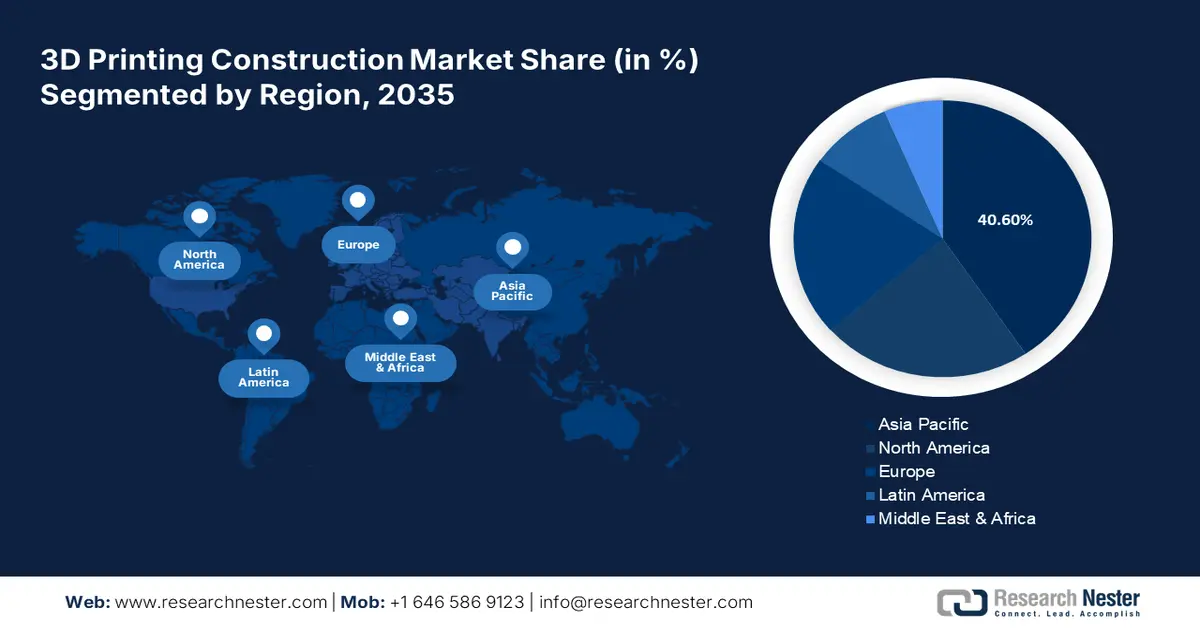

- Asia Pacific 3d printing construction market will hold over 40.6% share by 2035, driven by higher manufacturing and adoption of robotics and growing automotive industry.

Segment Insights:

- The building segment in the 3d printing construction market is forecasted to achieve noteworthy growth during 2026-2035, driven by escalating spending on residential and non-residential building construction.

Key Growth Trends:

- Rapidly Developing Construction Industry to Boost the Market Growth

- Growing Utilization in the Development of Robots

Major Challenges:

- Presence of Alternatives in the Market

- Requirement for Higher Initial Investment

Key Players: 3D Systems Corporation, COBOD INTERNATIONAL A/S, ICON Technology, Inc., Yingchuang Building Technique, (Shanghai)Co. Ltd., Contour Crafting Corporation, Apis Cor Inc., Sika AG, CyBe Construction B.V., Renishaw PLC, Materialise NV.

Global 3D Printing Construction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.27 billion

- 2026 Market Size: USD 20.58 billion

- Projected Market Size: USD 7.59 trillion by 2035

- Growth Forecasts: 91.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

3D Printing Construction Market Growth Drivers and Challenges:

Growth Drivers

-

Rapidly Developing Construction Industry to Boost the Market Growth: In the construction industry, 3D printing is essential since it can create a physical model of a digital image. In 3D printing, specialized 3D printers are used that can manufacture a real-time 3D model by using materials such as, concrete, metal, polymer, and others. 3D printing assists designers and architects to build any complex design and it also avoids labor expensive and is intensive. Hence, such a higher demand is anticipated to drive the growth of the market over the forecast period.

-

Growing Utilization in the Development of Robots: It was observed that about 375,000 new robots are launched in the market annually while approximately 85% of the companies are noticed to be adding robotics in their working infrastructure.

-

Higher Demand in Automotive Industry: As of 2021, automobile sale across the globe was anticipated to be around 65 million units.

-

Increasing Demand for 3D Printing in Jewelry Designing: For instance, in 2022, the global jewelry segment was estimated to reach approximately USD 250 billion.

Challenges

-

Presence of Alternatives in the Market

-

Requirement for Higher Initial Investment

-

Constant Need for the Maintenance of 3D Printers

3D Printing Construction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

91.8% |

|

Base Year Market Size (2025) |

USD 11.27 billion |

|

Forecast Year Market Size (2035) |

USD 7.59 trillion |

|

Regional Scope |

|

3D Printing Construction Market Segmentation:

The global 3D printing construction market is segmented and analyzed for demand and supply by end-user into building, infrastructure, and others, out of which, the building segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the escalating spending on the construction of buildings. For instance, in 2022, residential and nonresidential construction received total spending of around USD 900 billion and USD 500 billion respectively in the United States.

Our in-depth analysis of the Global Market Includes the following segments:

|

By Material |

|

|

By Construction Method |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Printing Construction Market Regional Analysis:

North American Market Insights

Regionally, the global 3D printing construction market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, Asia Pacific region is set to dominate around 40.6% market share by 2035, driven by higher manufacturing and adoption of robotics and growing automotive industry. For instance, in 2021, approximately 70% of the newly developed robots were installed in Asia Pacific. Therefore, such factors are expected to propel the growth of the market over the forecast period.

3D Printing Construction Market Players:

- 3D Systems Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- COBOD INTERNATIONAL A/S

- ICON Technology, Inc.

- Yingchuang Building Technique (Shanghai) Co. Ltd.

- Contour Crafting Corporation

- Apis Cor Inc.

- Sika AG

- CyBe Construction B.V.

- Renishaw PLC

- Materialise NV,

Recent Developments

-

COBOD INTERNATIONAL A/S to contribute to the largest 3D printing building projects in the United States. The building projects are developed and designed by CIVE and Peri. COBOD INTERNATIONAL A/S has provided a BOD2 3D construction printer for the respective projects.

-

ICON Technology, Inc. to introduce House Zero, 3D printed home based in Austin, Texas. The company has designated House Zero as the new home genre created by 3D printing. Additionally, ICON Technology, Inc. has collaborated with Lake Flato Architects for the development of the company’s Exploration Series.

- Report ID: 4593

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Printing Construction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.