Smart Glasses for Industrial Applications Market Outlook:

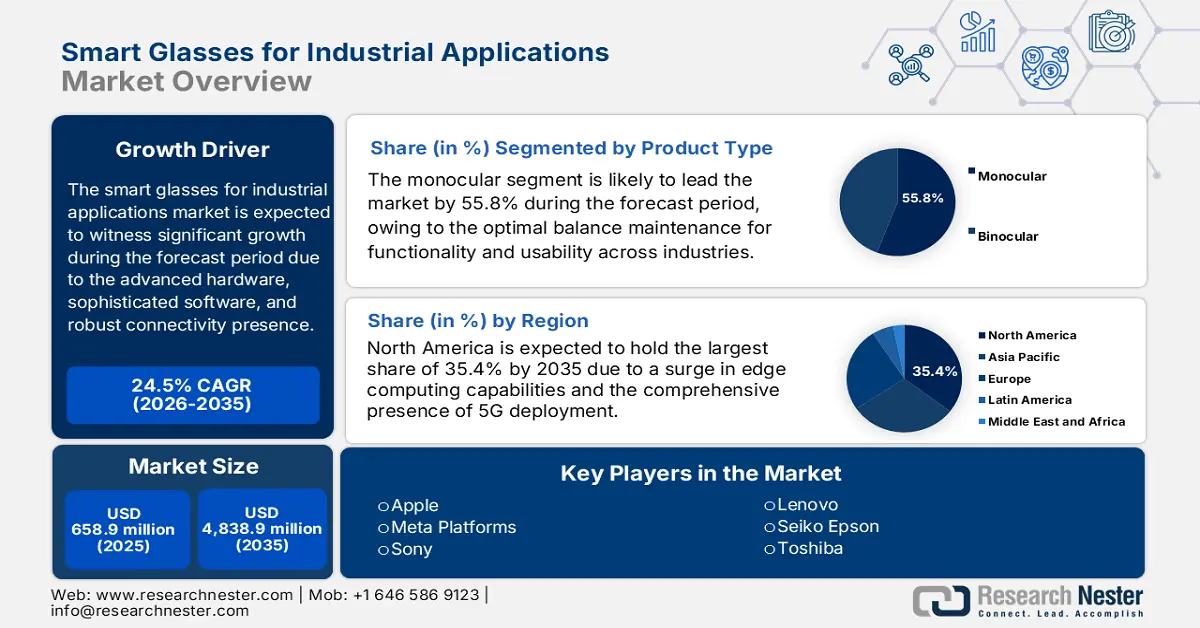

Smart Glasses for Industrial Applications Market size was over USD 658.9 million in 2025 and is estimated to reach USD 4,838.9 million by the end of 2035, expanding at a CAGR of 24.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart glasses for industrial applications is assessed at USD 822.3 million.

The market is currently undergoing a transformative shift and rapidly evolving from a notable proof-of-concept to the ultimate component of the industrial digitalized infrastructure. The market’s upliftment is extremely propelled by converging strong connectivity, sophisticated software, and advanced hardware, all of which aim to solve severe enterprise-based challenges in workforce, efficiency, and productivity management. According to a data report published by the UNDP Organization in July 2023, digitalization has led to the digital public infrastructure (DPI) globally, and low- and middle-income countries (LMICs) can enhance their economic development by almost 33%. Additionally, these nations can enhance their gross domestic product (GDP) from USD 200 billion to USD 280 billion by the end of 2030, thereby making it suitable for the market’s development.

Furthermore, an increase in all-in-one enterprise platforms, artificial intelligence-based functionality, extensive focus on services and software, standard design for durability and usability, ecosystem development, and tactical partnerships are also driving the market globally. As per an article published by NLM in February 2023, 65% of organizations utilize enterprise resource planning (ERP) systems, which are AI-driven and data-centric. The purpose is to manage and execute different business processes, which eventually generate increased data volumes. Besides, few organizations utilize only 12% of the gathered data, and leave 88% of the data to be wasted. Meanwhile, Accenture noted that over 67% of well-known organizations have readily integrated ERP systems, of which 35% are presently using on-premise versions, while the remaining 12% are hybrid, thus immensely bolstering the market’s exposure.

Key Smart Glasses for Industrial Applications Market Insights Summary:

Regional Highlights:

- By 2035, North America in the smart glasses for industrial applications market is anticipated to command a 35.4% share, owing to strong ICT infrastructure including edge computing capabilities and extensive 5G deployment.

- Europe is projected to emerge as the fastest-growing region by 2035, stemming from its robust manufacturing base and strategic industrial digitalization initiatives such as Industry 5.0.

Segment Insights:

- By 2035, the monocular product type segment in the smart glasses for industrial applications market is projected to secure a 55.8% share, supported by its ability to maintain an optimal balance of usability and functionality for industrial settings.

- By 2035, the mid-range price range segment is expected to capture the second-highest share, spurred by its effectiveness in addressing the severe limitations of both premium and entry-level tiers.

Key Growth Trends:

- Pursuit of operational efficiency

- Maturation in enabling ICT facilities

Major Challenges:

- Unclear ROI and increased total cost of ownership (TCO)

- Privacy, network integrity, and data security concerns

Key Players: Microsoft (U.S.), Google (A.S.), RealWear (U.S.), Apple (U.S.), Meta Platforms (U.S.), Sony (Japan), Epson (Japan), EON Reality (U.S.), Lenovo (China), Seiko Epson (Japan), Toshiba (Japan), Samsung (South Korea), LG Electronics (South Korea), Huawei (China), Bosch (Germany), Zeiss (Germany), Magic Leap (U.S.).

Global Smart Glasses for Industrial Applications Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 658.9 million

- 2026 Market Size: USD 822.3 million

- Projected Market Size: USD 4838.9 million by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, United Arab Emirates, Indonesia

Last updated on : 19 November, 2025

Smart Glasses for Industrial Applications Market - Growth Drivers and Challenges

Growth Drivers

- Pursuit of operational efficiency: At present, industries are significantly leveraging smart glasses to diminish machine downtime, speed up logistics operations, and minimize errors in complicated assembly. This is directly impacting the overall equipment effectiveness in the market globally. According to an article published by NLM in July 2025, smart glasses utilization resulted in a 9%-point optimization in accuracy and diminished assessment duration by more than 50%. In addition, these increased the success rate of interns from 71.7% to 89.8%, with over 23%-point reduction in complication rates. However, to maintain such efficiencies, continuous glass and glassware are required to be supplied from and to different nations, thus a he opportunity for the market.

Glass and Glassware 2023 Export and Import Boosting the Smart Glasses for Industrial Applications Market

|

Countries/Components |

Export |

Import |

|

China |

USD 21.3 billion |

USD 6.9 billion |

|

Germany |

USD 7.7 billion |

USD 6.0 billion |

|

U.S. |

USD 6.4 billion |

USD 9.1 billion |

|

Global Trade Valuation |

USD 86.5 billion |

|

|

Global Trade Share |

0.3% |

|

|

Product Complexity |

0.5 |

|

Source: OEC

- Maturation in enabling ICT facilities: The comprehensive rollout of Wi-Fi 6E and 5G offers low-latency and high-bandwidth connectivity, which is crucial for real-time AR. Meanwhile, the aspect of edge computing permits complicated data processing closer to the point of use, which is positively impacting the market internationally. As stated in the September 2024 AKGEC article, with the latest advancements, Wi-Fi readily operating in the 6-GHz frequency band is regarded as Wi-Fi 6E. Based on this, the BharatNet Project has successfully made advancements in rural connectivity and established more than 104,675 Wi-Fi hotspots to effectively bridge the gap for internet accessibility. Therefore, with the availability of such innovations, there is a huge growth opportunity for the overall market.

- Digital twin systems and IIoT integration: The market is emerging to be an essential human interface for the industrial internet of things (IIoT). This has readily permitted workers to interact with digital twins and visualize real-time sensor data for stimulation and maintenance of equipment. As stated in the October 2023 OECD article, 31% of enterprises in the manufacturing industry, particularly in Europe, followed by 22% in Canada, have integrated this technology. In addition, 76% of these enterprises in these locations utilize the technology to ensure security, 42% to monitor production logistics and processes, and 37% to improve energy consumption. Therefore, the IIoT technology has gained immense importance, which is significantly driving the market internationally.

Challenges

- Unclear ROI and increased total cost of ownership (TCO): While the long-lasting return on investment (ROI) can be significant, the usual financial gap still exists and remains a substantial roadblock for many enterprises, especially SMEs, in the market. Besides, the TCO has extended beyond the hardware purchase price, which is also negatively impacting the market’s growth. It comprises investments in enterprise-based software licenses and system integration services to successfully connect smart glasses with current CMMS and ERP platforms, content creation, and continuous maintenance for digitalized work instructions. Besides, for a few organizations, this can display a generous investment before deploying the first unit.

- Privacy, network integrity, and data security concerns: The market has unveiled the latest frontier of data privacy and cybersecurity challenges in the present industrial environment. These devices are usually internet-based cameras and always-on sensors that can effectively capture highly sensitive proprietary processes, personally recognized worker information, and intellectual property. This has created certain risks, such as unauthorized surveillance, data breaches, and industrial espionage. Moreover, incorporating this newest data stream into the corporate network has extended the attack surface for cyber threats. Therefore, organizations need to ensure strong end-to-end encryption, adopt stringent data governance policies, and secure device management to determine accessibility, storage, and recording.

Smart Glasses for Industrial Applications Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 658.9 million |

|

Forecast Year Market Size (2035) |

USD 4,838.9 million |

|

Regional Scope |

|

Smart Glasses for Industrial Applications Market Segmentation:

Product Type Segment Analysis

The monocular product type segment is anticipated to garner the highest share of 55.8% by the end of 2035. The segment’s upliftment is highly attributed to its ability to maintain an optimal balance of usability and functionality for industrial settings. Unlike binocular models that provide complete immersive AR, the monocular design represents suitable information within a single line of insight, permitting customers to maintain overall situational awareness of the physical environment. Besides, this is an essential efficiency and safety feature for workers performing complicated manual activities, operating machinery, and navigating busy factory floors. Furthermore, these particular devices are usually affordable to produce and purchase, thus boosting the segment’s exposure.

Price Range Segment Analysis

The mid-range segment, which is categorized under price range, is projected to hold the second-highest share during the forecast duration. The segment’s growth is effectively fueled by the aspect of addressing the severe limitations of both premium and entry-level tiers. Besides, unlike budget devices, the smart glasses segment provides enterprise-based software features, such as standard cameras for computer vision, along with durable build quality and strong processing power. Conversely, this segment avoids the prohibitive expense and frequently excessive feature-set of premium devices, which can be challenging to justify for a wide-ranging rollout. Meanwhile, for the majority of organizations, mid-range devices deliver a standard balance of performance, overall expense of ownership, and durability, thus enabling a calculable and clear ROI for applications, such as logistics, remote assistance, and assembly guidance.

Technology Segment Analysis

By the end of 2035, the enterprise software and platforms segment, which is part of the technology, is predicted to cater to the third-highest share. The segment’s development is highly fueled by its provision of a crucial framework for effective device management, real-time collaboration, and seamless data flow. These are essential for converting raw material into a strong and integrated solution that can significantly bolster productivity, safety, and efficacy. According to an article published by the UK Government in September 2025, the country is readily supporting 17 businesses to adopt cost-effective innovations for lightweight smart glasses. Besides, technology will be developed over the upcoming 1.5 years by following £3.6 million of support from Innovate UK’s Mindset extended reality, thereby suitable for the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Price Range |

|

|

Technology |

|

|

Connectivity |

|

|

Application |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Glasses for Industrial Applications Market - Regional Analysis

North America Market Insights

North America market is anticipated to account for the largest share of 35.4% by the end of 2035. The market’s upliftment in the region is highly attributed to the presence of strong ICT facilities, which include edge computing capabilities and wide-ranging 5G deployment, which are crucial for high-performance industrial AR. In addition, the early integration by manufacturing, aerospace, and automotive organizations, readily supported by an effective system integrator and a technology vendors ecosystem, is equally fueling the market demand in the region. According to an article published by the Federal Communications Commission in October 2025, the commission established the 5G Fund for Rural America and generated USD 9 billion in the form of the Universal Service Fund to deploy innovative 5G mobile wireless-based services in rural locations. In addition, this comprised USD 650 million for deployment across tribal locations.

The U.S. smart glasses for industrial applications market is significantly growing, owing to an increase in the smart glasses integration in advanced manufacturing and defense ecosystems. In addition, the U.S. Department of Defense is considered one of the crucial drivers, with its generous investments in the Visual Augmentation System (IVAS) program for demonstrating a suitable pathway for enterprise incorporation. Moreover, the aspect of funding for smart manufacturing projects by the National Institute of Standards and Technology (NIST) has underscored the federal push towards digitizing factories. As per an article published by Morris County Economic Development Corporation in July 2024, the NIST has readily anticipated funding of almost USD 70 million for more than 5 years, depending on federal funding availability. The purpose is to establish and conduct industrial activities with AI to ensure innovative, fast, and smart applications, along with maximizing benefits and combating risks.

The Canada-based smart glasses for industrial applications market is also growing due to its strategy to associate with optimized productivity within its core manufacturing and natural resource sectors. Additionally, the smart glasses utilization for remote expert applications in forestry, energy, and mining, wherein massive disparities make on-site specialist travel inefficient and expensive. Besides, as stated in the March 2022 Government of Canada article, the Canada Digital Adoption Program (CDAP) has been successfully established, with a USD 4.0 billion valuation. The purpose is to assist small and medium-sized enterprises (SMEs) in realizing their complete potential by incorporating digitalized technologies. Moreover, the program is considered a USD 1.4 billion investment in grants, along with advisory services to SMEs in the country. This also included an additional USD 2.6 billion in funding from the country’s government to cover expenses for the newest digital technologies implementation.

Europe Market Insights

Europe in the smart glasses for industrial applications market is expected to emerge as the fastest-growing region during the projected period. The market’s development is highly fueled by the region’s robust and progressive manufacturing base, especially in machinery, aerospace, and automotive. Additionally, the region’s tactical push for industrial competitiveness and digitalized sovereignty through strategies, such as Industry 5.0, has emphasized sustainable, resilient, and human-based production. As per a report published by the UN Trade and Development (UNCTAD) in 2025, different organizations in the region have ensured R&D, and over 80% funding was carried out in 2022 by 2,500 firms. This resulted in an investment of €1.2 trillion, of which 40% was initiated by 100 organizations to ensure innovation and digitalization. Besides, the presence of different technological areas in the region with supply chain management is also driving the market growth.

Europe’s Competitiveness in Different Technology Areas

|

Technology Type |

Regional Proximity |

Supply Chain Risk |

|

Additive Manufacturing |

69% |

Moderate |

|

Advanced Connectivity |

71% |

Low to moderate |

|

Advanced Semiconductors |

45% |

High |

|

Artificial Intelligence |

53% |

Moderate to high |

|

Energy Technologies |

61% |

Moderate to high |

|

Health Biotechnologies |

57% |

Moderate |

|

Quantum Computing |

575 |

Moderate |

|

Space Technologies |

69% |

Moderate to high |

Source: Digital Europe

The Germany smart glasses for industrial applications market is gaining increased traction, owing to the existence of industrial machinery sectors, which have strongly adopted Industry 5.0 principles. Besides, the actual growth driver caters to the incorporation of smart glasses into digitalized twin environments for quality control, maintenance, and complicated assembly. Meanwhile, as per a data report published by the UNESCO Organization in 2025, the country’s Recovery and Resilience Plan (DARP) has allocated an estimated EUR 1.3 billion to effectively strengthen digital education. This has been possible by developing a digitalized educational program with EUR 630 million investment. Furthermore, funding disbursements in the country are connected with target and milestone completion, with 60% of investment projects and 68% of reforms, which is also uplifting the market.

The UK smart glasses for industrial applications market is also developing due to the existence of the national Made Smarter program, which provides direct advisory and funding services for SMEs to integrate industrial digital technologies, such as smart glasses and AR. In addition, an increase in the focus on levelling up by significantly deploying this particular technology in domestic industrial clusters, including the North England and Midlands, is also bolstering the market in the country. According to a report published by the UK Research and Innovation Organization in May 2025, the Made Smarter Innovation (MSI) Industrial Strategy Challenge Fund (ISCF) readily allocated £147 million, of which £138 million caters to workstreams and £9 million for opex, for more than 5 years through the comprehensive £2.6 billion ISCF. Therefore, with such funding provision, there is a huge growth opportunity for the market in the country.

APAC Market Insights

Asia Pacific in the smart glasses for industrial applications market is predicted to grow steadily by the end of the forecast duration. The market’s growth in the region is highly driven by the manufacturing dominance, especially in semiconductors, automotive, and electronics. Besides, South Korea’s Manufacturing Innovation 3.0, India’s Make in India, and China’s Made in China 2025 are also boosting the market’s exposure in the region. As per an article published by the Institute for Studies in Industrial Development Organization in February 2024, advancement in industrialization has resulted in lifting 71 million people from poverty with offering 56 million employment opportunities. This denotes continuous development in the overall market across different countries in the region. In addition, huge investments in 5G facilities are offering low-latency and high-speed connectivity, which is also fueling the market’s growth.

The China smart glasses for industrial applications market is gaining increased exposure, owing to the aspect of increased governmental expenditure on industrial digitalization, with the intention of launching different 5G and industrial internet pilot programs. For instance, as per a report published by Huawei in 2024, the general-purpose computing domination will successfully reach 3.3 ZFLOPS, denoting a 10-fold increase. Additionally, AI-based computing power will also reach 864 ZFLOPS, demonstrating a 4,000-fold increase in the upcoming years. Moreover, there will be the provision of 200 billion connections, and 1 YB of data will be generated yearly, constituting a 23-fold upliftment. Therefore, with all these futuristic projections, there is a huge growth opportunity for readily advancing in the overall market.

The South Korea smart glasses for industrial applications market is continuously growing due to the presence of the Manufacturing Innovation 3.0 strategy. Besides, the country’s Ministry of SMEs and Startups significantly operates the K-Cloud and smart factory voucher programs, with a generous budget to support AR and smart glasses integration into SMEs for production and logistics management. As stated in the December 2023 ITA data report, manufacturing is considered the mainstay of the country’s economy, which accounts for 25.5% of the GDP, and is effectively responsible for 90% of domestic exports. In addition, over 80% of R&D is readily focused on manufacturing fields, which is responsible for boosting the overall market. Besides, as per industrial experts, the additional manufacturing sector valuation is projected to increase from USD 437 billion to USD 678 billion by 2030, thus suitable for the market’s growth.

Key Smart Glasses for Industrial Applications Market Players:

- Microsoft (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google (A.S.)

- RealWear (U.S.)

- Apple (U.S.)

- Meta Platforms (U.S.)

- Sony (Japan)

- Epson (Japan)

- EON Reality (U.S.)

- Lenovo (China)

- Seiko Epson (Japan)

- Toshiba (Japan)

- Samsung (South Korea)

- LG Electronics (South Korea)

- Huawei (China)

- Bosch (Germany)

- Zeiss (Germany)

- Magic Leap (U.S.)

- Eargo (U.S.)

- Nuheara (Australia)

- Microsoft is one of the market leaders with its HoloLens 2, which is a mixed reality device designed for complicated industrial activities, such as remote assistance and digital prototyping. The organization has leveraged its AI and Azure cloud services to offer a wide-ranging enterprise platform for securing spatial computing and device management applications. Besides, as per its 2024 annual report, the organization has delivered more than USD 245 billion in yearly revenue, denoting a 16% year-over-year increase, and over USD 109 billion in operational revenue, demonstrating a 24% rise.

- Google has catalyzed the enterprise segment with its Google Glass Enterprise Edition, which is a monocular device that has focused on hands-free workflow assistance in manufacturing and logistics. Its approach focuses on deep integration, task-based functionality, and lightweight adoption with cloud ecosystems and Google Workspace.

- RealWear readily specializes in voice-controlled and rugged tablets that offer hands-free accessibility to remote expert solutions and digital work instructions for frontline workers in challenging settings, such as gas and oil. The firm’s focus on safety, durability, along with a form factor that works with personal protective equipment (PPE) has made it a leader in heavy industrial sectors.

- Apple is considered a highly anticipated entrant with its Vision Pro, which has brought a revolutionary level of display fidelity and processing power to the spatial computing domain. While presently positioned as one of the most premium consumer devices, its entry is projected to significantly uplift market awareness, train applications, and target high-value industrial design. Based on these, its 2025 annual report indicated the quarterly revenue valuation of USD 102.5 billion, denoting an 8% YoY increase, as well as USD 1.8 as diluted earnings per share, revealing a 13% YoY on adjusted basis.

- Meta Platforms, which is usually regarded for its customer-centric Quest line, is proactively pursuing the industrial market through its Meta Quest for business platform, offering enterprise-based support and software. The organization has aimed to leverage its competitive hardware pricing and robust ecosystem developer to gain market share in virtual collaboration and industrial training.

Here is a list of key players operating in the global market:

The competitive landscape for the smart glasses for industrial applications market is extremely dynamic and readily characterized by a mix of vibrant software ecosystems, specialized hardware OEMs, and technological titans. Dominating players such as Google and Microsoft have leveraged their expanded AI and cloud infrastructure to provide end-to-end enterprise solutions. Strategic approaches are paramount, with organizations focusing on developing tactical partnerships with industrial software and system integrator firms to ensure effortless deployment. Besides, in May 2025, Vuzix Corporation’s smart glasses have readily power enterprise deployments in logistics and warehouses for major multinational. These glasses are effectively supporting maintenance and reliability engineering teams by ensuring the see what I see functionality, which is creating a positive impact on the smart glasses for industrial applications market globally.

Corporate Landscape of the Smart Glasses for Industrial Applications Market:

Recent Developments

- In March 2025, Hitachi Construction Machinery Co., Ltd., Holo-Light GmbH, and HMS Co., Ltd., collectively developed the latest XR smart glasses. These are extremely dustproof, watertight, durable, and their advanced accessory permits technicians to receive support from their service desks.

- In September 2024, EssilorLuxottica declared that it has expanded its partnership with Meta Platforms by entering into the newest long-lasting deal, under which both organizations collaborated to create multi-generational smart eyewear products.

- In January 2023, TCL notified the introduction of TCL RayNeo X2 augment reality smart glasses, which can harness pioneering binocular Micro-LED optical wavelength for creating unparalleled AR experiences for consumers.

- Report ID: 8249

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Glasses for Industrial Applications Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.