Smart Food Bin Market - Regional Analysis

North America Market Insights

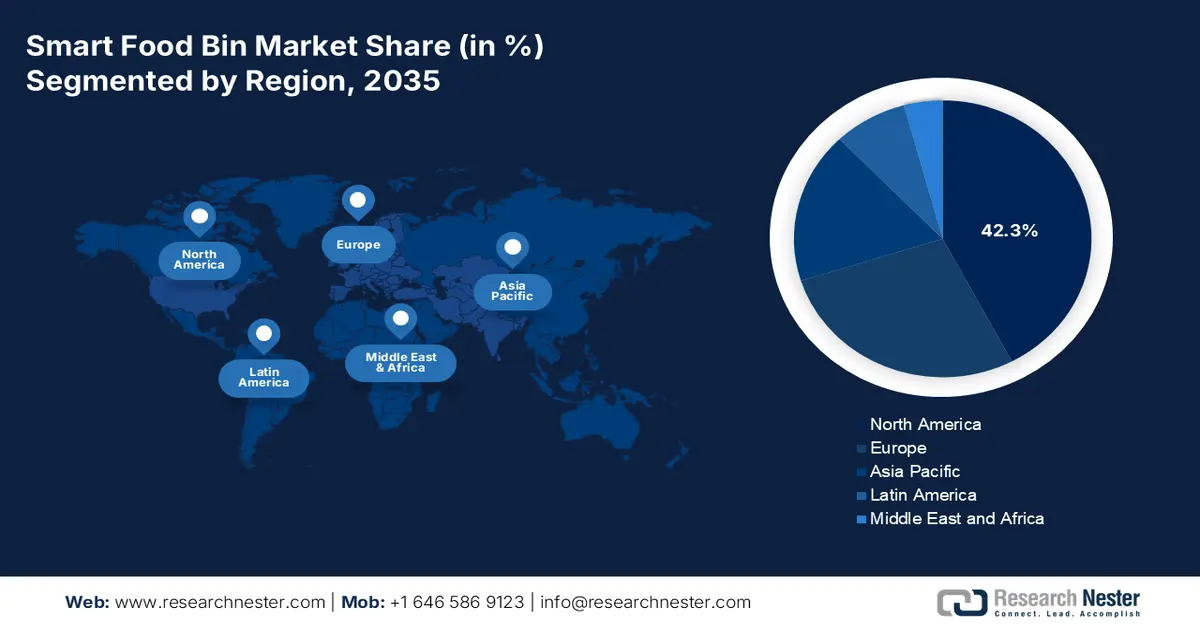

North America is dominating the smart food bin market and is projected to maintain the largest revenue share of 42.3% by 2035. The market is driven by the robust regulatory mandates and high consumer tech adoption. In the U.S., the state-level organic waste bans, notably California’s SB 1383, push the residential and commercial waste diversion, creating a compliance-driven demand for the smart tracking and separation solutions. Further, the substantial federal investment via the EPA grants under the Bipartisan Infrastructure Law funds the modern recycling infrastructure, enabling municipal smart bin pilot programs. Canada’s market is propelled by the national Food Waste Reduction Challenge and provincial policies such as Ontario’s Food and Organic Waste Framework that mandates circular economy targets. A key trend is the evolution from the standalone consumer products to integrated B2B and B2G solutions where big data feeds corporate ESG reporting and municipal waste logistics.

The smart food bin market in the U.S. is defined by a regulatory patchwork that drives asymmetric growth, with the early adopter states creating a blueprint for the national expansion. The primary trend is the shift from voluntary to mandatory organic waste diversion for both businesses and residents. The EPA report in February 2025 reported that the 59.84% of the wasted food is landfilled, while 4.99% are composted. These data continue to be used as the national baseline for policy and funding decisions. The federal initiatives are investing heavily to support the source-level measurements and organic waste diversion infrastructure. For the institutional food generators, including the hospitals, universities, government facilities, and large food service operators, smart food bins enable auditable tracking, improved sorting, and compliance with EPA-aligned food recovery pathways. As landfill diversion and methane reduction remain federal priorities, the demand is increasingly policy-driven rather than discretionary.

Wasted Food Management Estimates

|

MANAGEMENT PATHWAY |

QUANTITY MANAGED (TONS) |

PERCENTAGE MANAGED |

|

Donation |

5,135,293 |

7.76% |

|

Animal Feed |

1,516,771 |

2.29% |

|

Bio-based Materials/Biochemical Processing |

2,335,988 |

3.53% |

|

Anaerobic Digestion |

538,539 |

0.81% |

|

Composting |

3,304,764 |

4.99% |

|

Land Application |

141,371 |

0.21% |

|

Controlled Combustion |

9,646,263 |

14.57% |

|

Landfill |

39,621,902 |

59.84% |

|

Sewer/Wastewater Treatment |

3,975,352 |

6.00% |

|

Total |

66,216,242 |

100.00% |

Source: EPA February 2025

In Canada, the smart food bin market is driven by a coordinated national-provincial strategy aimed at building a circular economy with food waste as a primary target. The key trend is the alignment of federal innovation funding with the provincial regulatory action to commercialize and deploy smart waste technologies. The report from the Government of Canada in February 2025 stated that in Canada, nearly 50% of the foods are wasted every year. Further, the Agriculture and Agri-Food Canada has launched the USD 20 million food waste reduction challenge under the Food Policy for Canada. This directly funds and scales novel solutions, including smart bin technologies, to divert food waste from landfills. Moreover, the policies such as Ontario’s Food and Organic Waste Policy and British Columbia’s organic waste landfill ban mandate diversion, compelling municipalities and businesses to seek efficient data-driven solutions.

APAC Market Insights

Asia Pacific is the fastest-growing smart food bin market and is poised for the highest growth rate globally, projected at a CAGR of 16.5% during the forecast period 2026 to 2035. The smart food bin market is driven by rapid urbanization, severe waste management challenges, and substantial government smart city investments. The key growth driver is the vital need to reduce the massive volume of municipal solid waste, leading to overflowing landfills and methane emissions. The national policies are creating a top-down momentum through various initiatives in countries such as China, Japan, and India. The trend is the integration of the AI-enabled smart bins into the broader smart city ecosystem, funded by the national digitalization budgets, positioning them not as standalone appliances but as critical data nodes for optimizing municipal collection and processing infrastructure.

The smart food bin market in China is driven by the aggressive top-down waste sorting regulations rolled out in the major cities that mandate household compliance and create immediate demand for the waste segregation aids. The policy’s expansion beyond pilot cities provides a clear roadmap for the nationwide market growth. A key supporting initiative is the National Development and Reform Commission and the Ministry of Housing and Urban Rural Development’s focus on constructing a waste-free city framework. The report from the WTERT in December 2022 has indicated that nearly 1.9 billion tonnes of municipal solid waste are generated, of which 30% of it are uncollected. On the other hand, the municipal governments are investing heavily in supporting infrastructure to enforce the sorting policy and improve the data collection. This extensive physical rollout, coupled with the public education campaigns, is stimulating the integration of smart bins as essential tools for both compliance and efficient municipal waste management.

Japan’s smart food bin market is defined by the robust food recycling law that mandates commercial sector reduction and recycling, and a cultural emphasis on precision and efficiency. This creates a premium segment for high accuracy, IoT-integrated bins that provide auditable data for corporate compliance. A major driver is the government’s commitment to a circular economy. The report from the Ministry of Environment in March 2025 has depicted that the total expenses of the waste disposal in 2023 were nearly 2,291.2 billion yen. Strict municipal enforcement and detailed reporting obligations require large food service operators, retailers, and manufacturers to document waste volumes and recycling outcomes at the facility level. The public-private collaboration programs promoted by the Ministry of the Environment encourage digital monitoring tools to improve food loss visibility across supply chains.

Europe Market Insights

The smart food bin market in Europe is positioned for significant growth, primarily driven by the robust regulatory framework aimed at achieving a circular economy. The European Union’s Waste Framework Directive mandates that by 2025, the member states must separately collect the biowaste or recycle it at source. This top-down legislative pressure is a powerful catalyst compelling municipalities and households to seek technological solutions for efficient waste segregation and data tracking. The EU’s Green Deal and associated funding mechanisms, such as the Circular Economy Action Plan, are unlocking substantial public and private investment in smart waste management infrastructure. The key trend is the integration of the smart bins into the Internet of Things fabric of smart cities, where they function not just as containers but as data nodes.

The UK is shaped by the national waste reduction targets and the increasing local authority costs for waste disposal. The Resources and Waste Strategy for England sets a legally binding target to minimize the avoidable waste by 2050, with a specific focus on cutting food waste. This policy framework pushes businesses and local councils to find more efficient solutions in creating a fertile environment for smart technology that provides data on waste generation. A concrete example of government action is the significant budget allocated for grants to local authorities under the consistency in household and business recycling initiative aimed at improving food waste collection infrastructure. This funding supports the rollout of separate food waste collections for all the households in England by early 2025, a system where smart bins can add significant value via user engagement and contamination reduction.

The smart food bin market in Germany is defined by the world’s most stringent packaging and waste management laws, creating a strong compliance-driven demand for precise waste sorting. The circular economy act and the packaging act manage high recycling quotas and place financial responsibilities on producers. This makes accurate household sorting critical as contamination leads to higher system costs. The federal government actively funds circular economy innovation, for instance, the Deutsche Bundesstiftung Umwelt report in 2025 has reported that the federal foundation awarded 2.08 billion euros for projects related to environmental protection aimed at developing AI-based systems to enhance the purity of recyclable materials. This direct investment in the R&D for smart sorting technology demonstrates the official push for the digitalization of waste management that directly underpins the market for intelligent food waste solutions in Germany.