Smart Food Bin Market Outlook:

Smart Food Bin Market size was valued at USD 211.8 million in 2025 and is projected to reach USD 607.1 million by the end of 2035, rising at a CAGR of 11.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart food bin is estimated at USD 235.3 million.

The smart food bin market is being shaped primarily by regulatory pressure and quantified food waste reduction targets set by governments and intergovernmental bodies. As per the Food and Agriculture Organization report in September 2022, nearly 17% of the food is wasted by retailers and consumers, mainly in households. This efficiency carries an estimated annual economic cost, with the substantial environmental impacts linked to the methane emissions and unnecessary resource use. Further, the governments are increasingly mandating food waste measurement and reporting across commercial kitchens, institutional facilities, hospitality chains, and public sector food services. For example, the European Union's Waste Framework Directive demands that the member states quantify food waste at each level of the supply chain and promotes the digital monitoring tools as part of compliance reporting, hence directly encouraging business adoption of smart food bin systems in B2B environments.

The growth of the smart food bin market is further supported by the increasing investment in the circular economy infrastructure and waste characterization research. The public funding for organic recycling and waste prevention technologies is becoming more accessible via state grants and federal programs. For instance, the EPA’s Sustainable Materials Management program funds initiatives aimed at advancing waste reduction and diversion strategies. The need for accurate data is key for municipalities and waste haulers to design efficient collection systems and meet the diversion mandates. Organizations such as the World Resources Institute emphasize that what gets measured gets managed, highlighting the value of data acquisition in the food waste value chain. Smart bins, by providing granular household-level data on the food waste types and quantities, offer a potential source of this critical information for the waste management authorities and policymakers seeking to optimize systems and measure progress against the statutory targets, thereby creating a B2B and B2G value proposition beyond the direct-to-consumer channel.

Key Smart Food Bin Market Insights Summary:

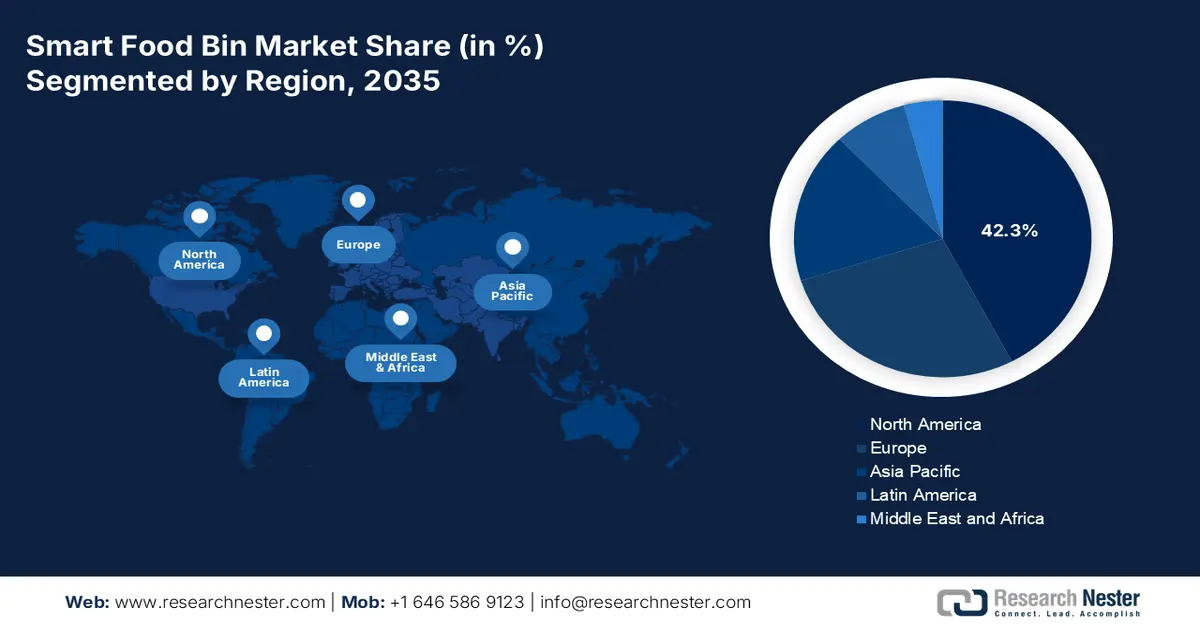

Regional Insights:

- North America is anticipated to account for a leading 42.3% share by 2035 in the smart food bin market, underpinned by stringent organic waste regulations and high consumer adoption of connected home technologies fostering compliance-led demand.

- Asia Pacific is expected to expand at the fastest pace through 2026–2035, recording a CAGR of 16.5% as rapid urbanization and government-backed smart city investments accelerate the deployment of AI-enabled waste solutions.

Segment Insights:

- Residential end users are projected to secure a dominant 67.4% share by 2035 in the smart food bin market, supported by rising household environmental awareness and growing integration of connected bins within smart home ecosystems to curb food waste.

- Online sales channels are set to command the largest revenue share by 2035, bolstered by direct-to-consumer models and the convenience of e-commerce platforms enhancing product discovery among sustainability-focused buyers.

Key Growth Trends:

- Expansion of municipal organic waste bans

- Corporate sustainability commitments and ESG Reporting

Major Challenges:

- High consumer price sensitivity and perceived value

- Technical complexity and reliability in the hostile environments

Key Players: Simplehuman (U.S.), ROVSUN (U.S.), OWSOO (U.S.), Kalea (U.S.), SEQUOIA (Netherlands), Brød & Taylor (UK), Luqel (Germany), Airtender (Spain), Sage Appliances (UK), Siroca (Japan), Iris Ohyama (Japan), Luvele (Australia), Brabantia (Netherlands), Cuchen (South Korea), Winia (South Korea), KENT (India), Lifelong Online (India), Pensonic Holdings (Malaysia), Xiaomi (China).

Global Smart Food Bin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 211.8 million

- 2026 Market Size: USD 235.3 million

- Projected Market Size: USD 607.1 million by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, South Korea, United Kingdom, France, Australia

Last updated on : 19 December, 2025

Smart Food Bin Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of municipal organic waste bans: The government mandates are a primary demand driver in the smart food bin market. Jurisdictions worldwide are enacting laws requiring households and businesses to separate food waste from landfill trash. For instance, the report from the State of California in 2025 has indicated that California is expected to reduce the organic waste disposal by 75% by 2025, affecting various local governments. Compliance creates an immediate need for efficiency at source separation. Smart bins that assist with the sorting and provide user feedback can reduce the contamination, a major cost for the municipal composting programs. This regulatory pressure transforms smart bins from a consumer luxury into a compliance tool, opening B2B and B2G channels for manufacturers targeting municipalities or property managers.

- Corporate sustainability commitments and ESG Reporting: Stringent ESG reporting requirements and corporate net-zero pledges are pushing the hospitality and food service sectors to quantify and reduce waste. Tools that provide auditable granular data on the food waste composition are vital for accurate reporting. A smart bin that automatically logs waste data helps companies comply with frameworks such as the World Resources Institute’s Food Loss and Waste Standard. This creates a strong B2B sales channel for the manufacturers that can integrate data outputs into the corporate sustainability dashboards. This demand is evidenced by initiatives like the U.S. Food Loss and Waste 2030 Champions, where major brands commit to a 50% reduction goal, reported in the USDA March 2021 report. This data creates a direct smart food bin market for measurement solutions.

- Federal recycling infrastructure funding: The U.S. Solid Waste Infrastructure for Recycling grant program is a direct growth driver for the smart food bin market by reducing the capital and implementation barriers for the public sector and institutional buyers. The report from the EPA in December 2025 has depicted that the Save Our Seas 2.0 Act, funded via the Infrastructure Investment and Jobs Act, provides USD 275 million from 2022 to 2026. This multi-year guaranteed funding structure enables state agencies, municipalities, public hospitals, universities, and government contractors to invest in waste measurement and tracking infrastructure with budget certainty. The smart food bins align directly with the eligible use cases under the program, mainly source-level waste tracking, organics diversion, and data-backed reporting. As the funding remains available until expended, procurement timelines are extended, supporting the phased deployments and system scaling. The presence of recurring federal allocations through 2026 sustains predictable demand from B2B buyers operating under federal or state waste management mandates, positioning smart food bins as grant-aligned infrastructure rather than discretionary sustainability investments.

U.S. Solid Waste Infrastructure for Recycling (SWIFR) Grant Program

|

Fiscal Year |

Authorizing Legislation |

Base Annual Allocation (USD million) |

Additional EPA Implementation Funding (USD million) |

Total Funding Available for Year (USD million) |

|

FY 2022 |

Save Our Seas 2.0 Act; Infrastructure Investment and Jobs Act |

55.0 |

2.5 |

57.5 |

|

FY 2023 |

Save Our Seas 2.0 Act; Infrastructure Investment and Jobs Act |

55.0 |

6.5 |

61.5 |

|

FY 2024 |

Save Our Seas 2.0 Act; Infrastructure Investment and Jobs Act |

55.0 |

5.0 |

60.0 |

|

FY 2025 |

Save Our Seas 2.0 Act; Infrastructure Investment and Jobs Act |

55.0 |

— |

55.0 |

|

FY 2026 |

Save Our Seas 2.0 Act; Infrastructure Investment and Jobs Act |

55.0 |

— |

55.0 |

Source: EPA December 2025

Challenges

- High consumer price sensitivity and perceived value: The primary challenge in the smart food bin market is convincing consumers to pay a significant premium for a waste bin. Overcoming the perception of it as a luxury gadget rather than an essential tool for cost/waste savings is difficult. Top companies are shifting the value proposition from the hardware to a service, bundling their bin with a paid monthly subscription for the food waste collection and reprocessing, thereby justifying the upfront cost with the long-term utility and environmental impact. This model reframes the purchase from a one-time expense to an investment in a waste management system.

- Technical complexity and reliability in the hostile environments: Smart bins must operate flawlessly in the harsh variable conditions of a kitchen, exposure to moisture, food residue, odors, and frequent impacts. Integration of reliable sensors, compacting mechanisms, and robust connectivity adds cost and engineering complexity to the smart food bin market. A failure in core functions, such as the lid or odor control, destroys the user's trust. Competitive players initiate this by focusing on perfected mechanical automation and robust sensor technology, first ensuring their core smart feature, reliable hands-free opening, is nearly faultless, before adding more complex connectivity layers.

Smart Food Bin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 211.8 million |

|

Forecast Year Market Size (2035) |

USD 607.1 million |

|

Regional Scope |

|

Smart Food Bin Market Segmentation:

End user Segment Analysis

Under the end user segment, the residential segment is a dominant end user segment in the smart food bin market and is poised to hold the share value of 67.4% by 2035. The segment is driven by the rising consumer environmental consciousness and the pursuit of cost savings via reduced household and food waste. This demand is amplified by the integration of smart bins into the broader smart home ecosystem. A key catalyst is the scale of the problem at the household level that necessitates intervention. As per the U.S. Environmental Protection Agency report in March 2025, more than 58% of the methane emissions from the landfilled food waste result from residential generation, highlighting the critical role of in-home solutions. Further, consumers ' concerns about food waste, which fuels the adoption of tools that help to track and reduce the waste directly in the kitchen.

Sales Channel Segment Analysis

Online subsegment is leading the sales channels segment, which commands the largest revenue share in the smart food bin market, and the trend is stimulated by the direct-to-consumer strategies of pioneering startups and the convenience of home delivery for bulky items. This channel is a vital platform for detailed product education, consumer reviews, and targeted digital marketing to an environmentally conscious demographic. Further, the transition is indicated by the robust e-commerce growth across consumer electronics. The report from the Nationwide Group in May 2025 has depicted that e-commerce has surged at 11.6% YoY, continuing a strong trend. This continued increase in online electronics buying creates a favorable and fast-paced environment for the discovery and purchase of smart household goods such as connected food bins.

Connectivity Segment Analysis

The Wi-Fi-enabled smart bins represent the leading connectivity sub-segment as continuous cloud-based data syncing is essential for the core functions, such as the waste analytics expiry notifications and the integration with the grocery or municipal services. The Wi-Fi connectivity enables real-time data transmission and remote access via smartphone apps, creating a seamless user experience and enabling over-the-air updates. The proliferation of this technology in households is a fundamental driver. As per the National Telecommunications and Information Administration data, the number of households used broadband internet at home is high and is the foundational statistic for connected device adoption. This high and stable penetration rate has created a reliable infrastructure, ensuring that the majority of the target consumers have the necessary home network to fully utilize a Wi-Fi-dependent smart bin’s advanced features.

Our in-depth analysis of the smart food bin market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Capacity |

|

|

Connectivity |

|

|

Sales Channel |

|

|

Function |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Food Bin Market - Regional Analysis

North America Market Insights

North America is dominating the smart food bin market and is projected to maintain the largest revenue share of 42.3% by 2035. The market is driven by the robust regulatory mandates and high consumer tech adoption. In the U.S., the state-level organic waste bans, notably California’s SB 1383, push the residential and commercial waste diversion, creating a compliance-driven demand for the smart tracking and separation solutions. Further, the substantial federal investment via the EPA grants under the Bipartisan Infrastructure Law funds the modern recycling infrastructure, enabling municipal smart bin pilot programs. Canada’s market is propelled by the national Food Waste Reduction Challenge and provincial policies such as Ontario’s Food and Organic Waste Framework that mandates circular economy targets. A key trend is the evolution from the standalone consumer products to integrated B2B and B2G solutions where big data feeds corporate ESG reporting and municipal waste logistics.

The smart food bin market in the U.S. is defined by a regulatory patchwork that drives asymmetric growth, with the early adopter states creating a blueprint for the national expansion. The primary trend is the shift from voluntary to mandatory organic waste diversion for both businesses and residents. The EPA report in February 2025 reported that the 59.84% of the wasted food is landfilled, while 4.99% are composted. These data continue to be used as the national baseline for policy and funding decisions. The federal initiatives are investing heavily to support the source-level measurements and organic waste diversion infrastructure. For the institutional food generators, including the hospitals, universities, government facilities, and large food service operators, smart food bins enable auditable tracking, improved sorting, and compliance with EPA-aligned food recovery pathways. As landfill diversion and methane reduction remain federal priorities, the demand is increasingly policy-driven rather than discretionary.

Wasted Food Management Estimates

|

MANAGEMENT PATHWAY |

QUANTITY MANAGED (TONS) |

PERCENTAGE MANAGED |

|

Donation |

5,135,293 |

7.76% |

|

Animal Feed |

1,516,771 |

2.29% |

|

Bio-based Materials/Biochemical Processing |

2,335,988 |

3.53% |

|

Anaerobic Digestion |

538,539 |

0.81% |

|

Composting |

3,304,764 |

4.99% |

|

Land Application |

141,371 |

0.21% |

|

Controlled Combustion |

9,646,263 |

14.57% |

|

Landfill |

39,621,902 |

59.84% |

|

Sewer/Wastewater Treatment |

3,975,352 |

6.00% |

|

Total |

66,216,242 |

100.00% |

Source: EPA February 2025

In Canada, the smart food bin market is driven by a coordinated national-provincial strategy aimed at building a circular economy with food waste as a primary target. The key trend is the alignment of federal innovation funding with the provincial regulatory action to commercialize and deploy smart waste technologies. The report from the Government of Canada in February 2025 stated that in Canada, nearly 50% of the foods are wasted every year. Further, the Agriculture and Agri-Food Canada has launched the USD 20 million food waste reduction challenge under the Food Policy for Canada. This directly funds and scales novel solutions, including smart bin technologies, to divert food waste from landfills. Moreover, the policies such as Ontario’s Food and Organic Waste Policy and British Columbia’s organic waste landfill ban mandate diversion, compelling municipalities and businesses to seek efficient data-driven solutions.

APAC Market Insights

Asia Pacific is the fastest-growing smart food bin market and is poised for the highest growth rate globally, projected at a CAGR of 16.5% during the forecast period 2026 to 2035. The smart food bin market is driven by rapid urbanization, severe waste management challenges, and substantial government smart city investments. The key growth driver is the vital need to reduce the massive volume of municipal solid waste, leading to overflowing landfills and methane emissions. The national policies are creating a top-down momentum through various initiatives in countries such as China, Japan, and India. The trend is the integration of the AI-enabled smart bins into the broader smart city ecosystem, funded by the national digitalization budgets, positioning them not as standalone appliances but as critical data nodes for optimizing municipal collection and processing infrastructure.

The smart food bin market in China is driven by the aggressive top-down waste sorting regulations rolled out in the major cities that mandate household compliance and create immediate demand for the waste segregation aids. The policy’s expansion beyond pilot cities provides a clear roadmap for the nationwide market growth. A key supporting initiative is the National Development and Reform Commission and the Ministry of Housing and Urban Rural Development’s focus on constructing a waste-free city framework. The report from the WTERT in December 2022 has indicated that nearly 1.9 billion tonnes of municipal solid waste are generated, of which 30% of it are uncollected. On the other hand, the municipal governments are investing heavily in supporting infrastructure to enforce the sorting policy and improve the data collection. This extensive physical rollout, coupled with the public education campaigns, is stimulating the integration of smart bins as essential tools for both compliance and efficient municipal waste management.

Japan’s smart food bin market is defined by the robust food recycling law that mandates commercial sector reduction and recycling, and a cultural emphasis on precision and efficiency. This creates a premium segment for high accuracy, IoT-integrated bins that provide auditable data for corporate compliance. A major driver is the government’s commitment to a circular economy. The report from the Ministry of Environment in March 2025 has depicted that the total expenses of the waste disposal in 2023 were nearly 2,291.2 billion yen. Strict municipal enforcement and detailed reporting obligations require large food service operators, retailers, and manufacturers to document waste volumes and recycling outcomes at the facility level. The public-private collaboration programs promoted by the Ministry of the Environment encourage digital monitoring tools to improve food loss visibility across supply chains.

Europe Market Insights

The smart food bin market in Europe is positioned for significant growth, primarily driven by the robust regulatory framework aimed at achieving a circular economy. The European Union’s Waste Framework Directive mandates that by 2025, the member states must separately collect the biowaste or recycle it at source. This top-down legislative pressure is a powerful catalyst compelling municipalities and households to seek technological solutions for efficient waste segregation and data tracking. The EU’s Green Deal and associated funding mechanisms, such as the Circular Economy Action Plan, are unlocking substantial public and private investment in smart waste management infrastructure. The key trend is the integration of the smart bins into the Internet of Things fabric of smart cities, where they function not just as containers but as data nodes.

The UK is shaped by the national waste reduction targets and the increasing local authority costs for waste disposal. The Resources and Waste Strategy for England sets a legally binding target to minimize the avoidable waste by 2050, with a specific focus on cutting food waste. This policy framework pushes businesses and local councils to find more efficient solutions in creating a fertile environment for smart technology that provides data on waste generation. A concrete example of government action is the significant budget allocated for grants to local authorities under the consistency in household and business recycling initiative aimed at improving food waste collection infrastructure. This funding supports the rollout of separate food waste collections for all the households in England by early 2025, a system where smart bins can add significant value via user engagement and contamination reduction.

The smart food bin market in Germany is defined by the world’s most stringent packaging and waste management laws, creating a strong compliance-driven demand for precise waste sorting. The circular economy act and the packaging act manage high recycling quotas and place financial responsibilities on producers. This makes accurate household sorting critical as contamination leads to higher system costs. The federal government actively funds circular economy innovation, for instance, the Deutsche Bundesstiftung Umwelt report in 2025 has reported that the federal foundation awarded 2.08 billion euros for projects related to environmental protection aimed at developing AI-based systems to enhance the purity of recyclable materials. This direct investment in the R&D for smart sorting technology demonstrates the official push for the digitalization of waste management that directly underpins the market for intelligent food waste solutions in Germany.

Key Smart Food Bin Market Players:

- Mill (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Simplehuman (U.S.)

- ROVSUN (U.S.)

- OWSOO (U.S.)

- Kalea (U.S.)

- SEQUOIA (Netherlands)

- Brød & Taylor (UK)

- Luqel (Germany)

- Airtender (Spain)

- Sage Appliances (UK)

- Siroca (Japan)

- Iris Ohyama (Japan)

- Luvele (Australia)

- Brabantia (Netherlands)

- Cuchen (South Korea)

- Winia (South Korea)

- KENT (India)

- Lifelong Online (India)

- Pensonic Holdings (Malaysia)

- Xiaomi (China)

- Mill is a pioneer in transforming household food waste and has significantly advanced the smart food bin market by integrating a proprietary drying and grinding system. The advancement ensures waste is securely processed at home into a sterile odorless Food Grounds material that the company then collects for conversion into animal feed creating a first of its kind closed loop system.

- Simplehuman is a leader in intelligent home organization and has made notable advancements in the smart food bin market with its sensor-driven voice-activated bins. This advancement ensures a completely hands-free user experience via precise motion sensing and integration with platforms such as Alexa, optimizing kitchen hygiene and convenience for the modern household.

- Rovsun is a prominent manufacturer of commercial and home appliances and has entered the smart food bin market by offering compact, efficient models with the odor sealing lids and touchless operation. This advancement ensures reliable and hygienic waste containment for the smaller kitchens and offices, making smart bin technology accessible at a competitive price point.

- OWSOO is an emerging brand in the smart home solutions and has contributed to the smart food bin market by focusing on automated stainless steel bins with infrared sensors. This advancement ensures durable hands-free operation that blends seamlessly with the modern kitchen aesthetics, emphasizing practical automation and ease of use for everyday consumers.

- Kalea is an innovator in sustainable kitchen technology and has carved a niche in the smart food bin market by specializing in smart compost caddies. This advancement ensures an optimized countertop composting experience with features such as carbon filters for odor control and reminders directly supporting the households in reducing the landfill waste via easier segregation.

Here is a list of key players operating in the global smart food bin market:

The smart food bin market is highly fragmented and features appliance giants, niche innovators, and sustainability-focused startups. The competition focuses on technology integration, such as AI cameras, weight sensors, expiry tracking, as well as material science and subscription models for biodegradable liners or linked services. Key strategic initiatives such as forming partnerships with the municipal waste programs, developing closed-loop recycling ecosystems, and integrating with the broader smart kitchen platform to improve the data utility. For example, in November 2025, Denali announced the expansion of the food waste recycling network in the Carolinas with the acquisition of Smart Recycling. This acquisition has strengthened Denali’s regional food collection and composting services infrastructure. The drive is toward minimizing the household food waste via predictive analytics and seamless user experiences, blending hardware with the services-based revenue streams.

Corporate Landscape of the Smart Food Bin Market:

Recent Developments

- In April 2025, Mill, a startup company that is tackling food waste via a smart recycling bin, has launched a bin for offices, which is designed to help companies manage food waste at scale.

- In February 2025, DPW has announced the launch of the food waste smart bin program to expand composting access citywide. These smart bins provide residents with convenient, 24/7 drop-off locations for food scraps.

- Report ID: 2277

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Food Bin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.