Smart Firewall Market Outlook:

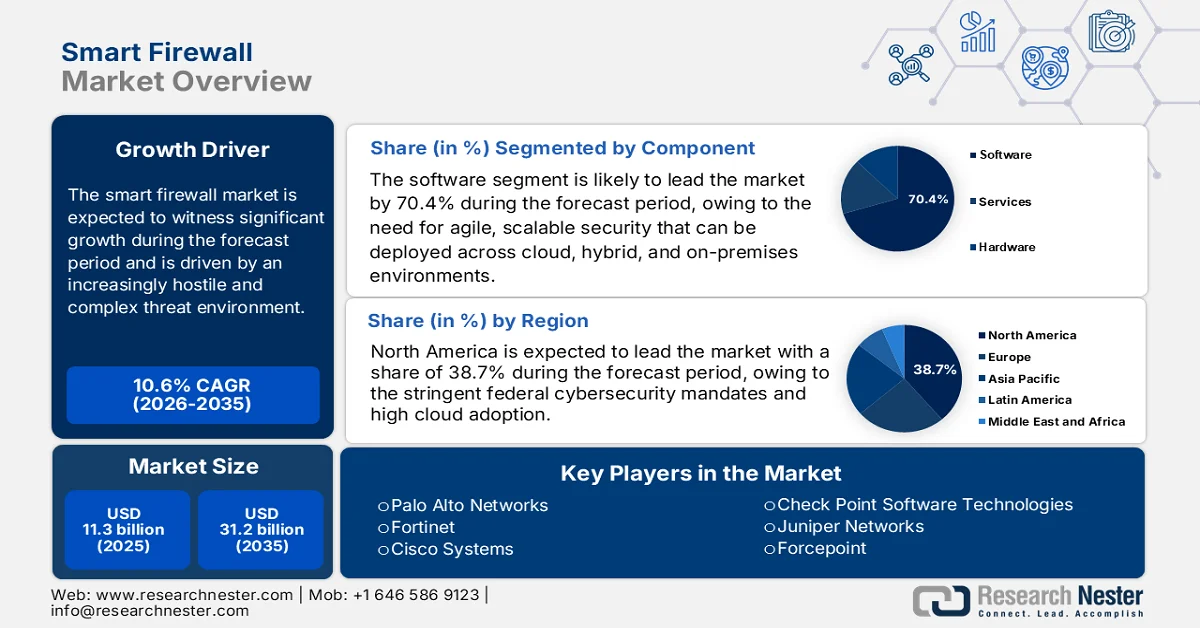

Smart Firewall Market size was valued at USD 11.3 billion in 2025 and is projected to reach USD 31.2 billion by the end of 2035, rising at a CAGR of 10.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart firewall is estimated at USD 12.6 billion.

The global smart firewall market for advanced network security solutions is expanding in response to an increasingly hostile and complex threat environment. The public sector cybersecurity priorities are materially shaping the enterprise firewall demand, mainly for adaptive and policy-driven network security controls deployed across hybrid IT environments. According to the Internet Crime Complaint Center 2023 report, nearly 880,418 cyber complaints were registered, with losses over USD 12.5 billion and the business email compromise ransomware, and network intrusion among the most costly attack vectors affecting enterprises and public infrastructure operators. Moreover, the modern threat models are driving the adoption of more context-aware traffic inspecting firewall architectures across various critical infrastructure sectors.

Besides, the U.S. Government Accountability Office's January 2025 report depicts that nearly 32,211 federal information security incidents were reported in 2023, with the 38% attributed to improper usage, which is directly relevant to the market as it exposes a persistent control and enforcement gap across government and government-aligned enterprise networks. Moreover, the improper usage incidents, such as unauthorized access policy violations and misuse of network privileges, indicate the limitations of legacy perimeter control and strengthen the demand for a firewall platform capable of enforcing granular identity and application-aware traffic policies across the hybrid environment. Moreover, the ransomware quantity in 2021 reached 3,729, underscoring the growing exposure of federal and enterprise networks to lateral movement and encrypted traffic abuse, which is accelerating B2B investment in firewall platforms with advanced traffic inspection and internal network segmentation capabilities.

Information Security Incidents (2023)

|

Factors |

Percentage |

|

Web |

11 |

|

Loss or Theft of the Equipment |

10 |

|

Improper Usage |

38 |

|

Email/ Phishing |

19 |

|

Spoofing, Multiple Attack Vendors, External/ Removable Media |

Less than 1 |

|

Attrition |

4 |

|

Other/ Unknown |

18 |

Source: GAO January 2025

Key Smart Firewall Market Insights Summary:

Regional Highlights:

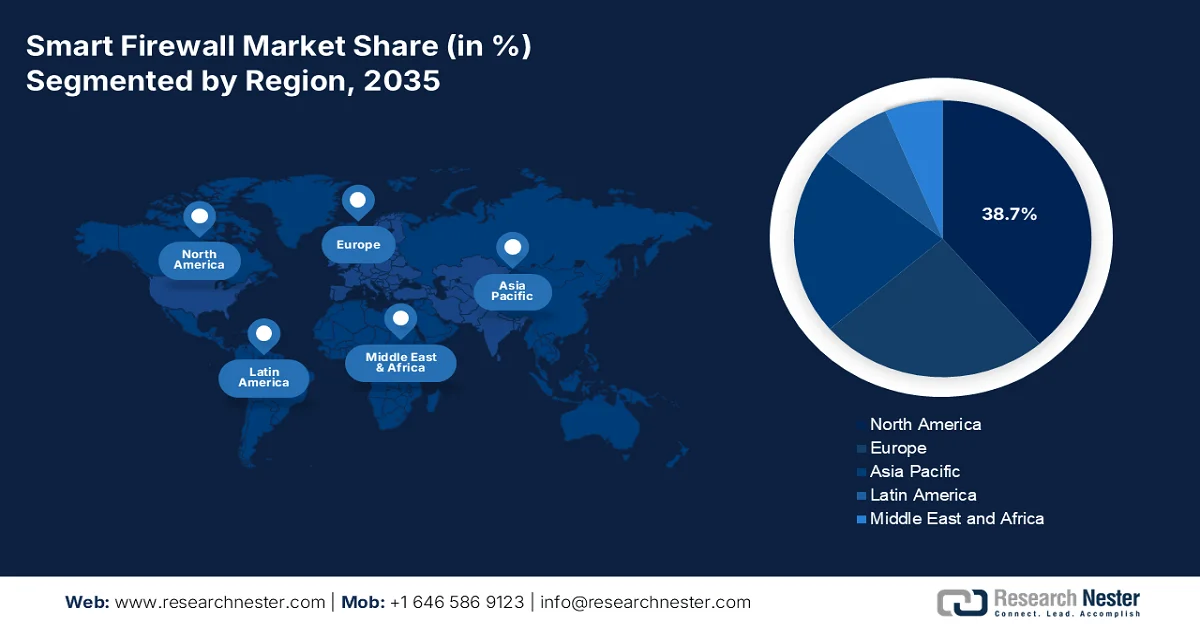

- The north america smart firewall market is projected to command a 38.7% revenue share by 2035, propelled by stringent federal cybersecurity mandates and high cloud adoption.

- Asia Pacific is anticipated to expand at a CAGR of 13.2% during 2026–2035, fueled by rapid digitalization, stringent data sovereignty regulations, and government-led cybersecurity investments.

Segment Insights:

- In the smart firewall market, the software segment is forecast to capture 70.4% share by 2035, driven by the transition toward subscription-based software models and the need for agile, scalable security across cloud and hybrid environments.

- The large enterprises segment is expected to account for the dominant revenue share by 2035, impelled by complex multi-site IT infrastructures and heightened cybersecurity investment to counter major threat exposure.

Key Growth Trends:

- Growth in government cloud and hybrid infrastructure spending

- Expansion of critical infrastructure protection budgets

Major Challenges:

- High R&D and innovation costs

- Integration and compatibility complexities

Key Players: Palo Alto Networks (U.S.), Fortinet (U.S.), Cisco Systems (U.S.), Check Point Software Technologies (Israel), Juniper Networks (U.S.), Forcepoint (U.S.), Barracuda Networks (U.S.), Zscaler (U.S.), Sophos (UK), Stormshield (France), WatchGuard (U.S.), SonicWall (U.S.), Hillstone Networks (U.S.), Huawei (China), Sangfor Technologies (China), CyberOam (India), LG Uplus (South Korea), Trend Micro (Japan), Telstra (Australia), SecMatrix (Malaysia).

Global Smart Firewall Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.3 billion

- 2026 Market Size: USD 12.6 billion

- Projected Market Size: USD 31.2 billion by 2035

- Growth Forecasts: 10.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Canada, United Kingdom, France, Australia

Last updated on : 17 February, 2026

Smart Firewall Market - Growth Drivers and Challenges

Growth Drivers

- Growth in government cloud and hybrid infrastructure spending: Government migration to the cloud and hybrid IT environments is directly driving the demand for the smart firewall market. According to the National Center for Science and Engineering Statistics, August 2022 data, nearly 54% of majority firms in the U.S. have adopted cloud infrastructure, significantly increasing the east-west traffic and internal attack surfaces. Moreover, the report highlights that the hybrid deployments require centralized and policy-driven network enforcement to maintain compliance with federal security baselines. Moreover, the Agency for Digital Government (2021–2027) data shows that the Digital Europe Programme is allocating over EUR 7.5 billion to digital infrastructure and cybersecurity. These investments necessitate firewall platforms that can operate consistently across on-premise cloud and multi-cloud environments, making smart firewalls a foundational control layer.

- Expansion of critical infrastructure protection budgets: Critical infrastructure protection programs are a sustained driver of smart firewall market adoption. According to the National Governors Association, August 2022 data, nearly USD 1 billion is funded to state and local cyber security grant programs to address the risk related to cybersecurity and cybersecurity threats to their information systems. These sectors require firewall platforms capable of enforcing policy across operational technology (OT) and IT convergence environments. Moreover, the International Telecommunication Union reports that national governments globally increased critical infrastructure cybersecurity spending. These investments prioritize network-level enforcement and visibility, directly supporting smart firewall demand in regulated industrial environments.

- Rising cybersecurity threats: Cyber attacks are growing faster and demanding that companies invest in smart firewalls. The frequency, cost, and complexity of cyberattacks provide a continuous push towards security investment. Moreover, the sustained increase in ransomware and state-sponsored intrusions is targeting both private and public entities. As per the Astra Security September 2025 data, the ransomware attacks are increasing by 13% annually, and companies are incorporating AI-based threat detection into their platforms. This evidence of a pervasive security gap makes the case for AI/ML-enhanced firewalls that can detect novel threats and automate response, moving beyond signature-based defenses.

Challenges

- High R&D and innovation costs: Developing a competitive AI/ML-driven smart firewall market requires immense continuous investment in R&D for threat intelligence, behavioral analysis, and cloud integration. New players struggle to match the R&D budgets of top players. Many leading players invest billions in R&D to fuel their AI-powered platforms. This creates a high barrier to achieving feature parity and forces startups to seek niche specializations or rely on external threat feeds to remain viable, stretching limited capital thin from the outset.

- Integration and compatibility complexities: Modern enterprises operate hybrid multi-vendor environments. A new smart firewall must integrate with the existing SIEMs, SOAR platforms, cloud providers, and legacy hardware. Failure to offer broad API compatibility is a deal breaker. This is addressed by the leading players in the smart firewall market via offering pre-built integrations with hundreds of third-party technologies. New entrants lack such an ecosystem and face barriers during sales.

Smart Firewall Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 11.3 billion |

|

Forecast Year Market Size (2035) |

USD 31.2 billion |

|

Regional Scope |

|

Smart Firewall Market Segmentation:

Component Segment Analysis

The software is the leading sub-segment and are poised to hold the share value of 70.4% by 2035 in the smart firewall market. This reflects the pivotal industry shift from hardware-centric appliances to subscription-based software licenses, virtual images, and managed security services. The demand is driven by the need for agile, scalable security that can be deployed across cloud, hybrid, and on-premises environments without physical constraints. Software enables rapid feature updates and AI integration, and on the other hand, the professional and managed services address the critical cybersecurity skill gap. The key indicator of this digital transformation is the spending on IT modernization. According to the U.S. Government Accountability Office, March 2025 data, the federal government has spent more than USD 100 billion to manage its IT systems, highlighting the shift from capital expenditure on hardware to operational funding for software and solutions.

Organization Size Segment Analysis

The large enterprises represent the leading sub-segment by organization size, generating the majority of smart firewall market revenue. Their dominance is attributed to complex multi-site IT infrastructure, substantial data assets, and stringent regulatory networked security controls. Moreover, the large organizations are the early adopters of integrated platforms such as SASE and Zero Trust, which rely on smart firewall technology as a core layer. They possess the capital and dedicated IT Security teams necessary to manage and deploy these advanced systems. further it is stated that the major cyber incidents are reported in large-scale enterprises, underscoring both their high threat profile and corresponding security expenditure. Additionally, compliance audits and global operations further amplify continuous firewall investment needs.

Technology Segment Analysis

Within the technology segment, AI & machine learning are the leading sub-segments in the smart firewall market, driving the market’s evolution from static signature-based defenses to proactive behavioral threat prevention. These systems analyze network traffic, user behavior, and application patterns in real time to identify anomalies, zero-day exploits, and advanced multi-stage attacks that bypass the traditional rules. This capacity is critical for defending against ransomware and advanced persistent threats. Adopting these advanced defenses helps in risk management, and adversarial machine learning attacks against AI-powered security systems have become a documented and growing threat vector, confirming both the expansion of this technology and the advanced nature of the threats it is designed to counter.

Our in-depth analysis of the global smart firewall market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Type |

|

|

Deployment |

|

|

Organization Size |

|

|

Vertical |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Firewall Market - Regional Analysis

North America Market Insights

The North America smart firewall market is the largest and dominating one and is expected to hold the regional revenue share of 38.7% by 2035. The market is driven by the stringent federal cybersecurity mandates and high cloud adoption. The primary demand stems from the binding of zero trust strategy, pushing all federal agencies to deploy advanced security architectures where smart firewalls are fundamental for micro segmentation and application-layer security. further this directive creates a substantial multi-year procurement cycle. Moreover, the rising threats to critical infrastructure and the rapid shift to cloud and hybrid work models fuel the private sector investment in next-gen firewall and firewall as a service solutions. A mature regulatory environment and major incident response needs ensure sustained, high-value demand, though market growth will gradually face saturation, yielding share to high-growth APAC regions.

Rising cybercrime losses and structurally supported federal procurement programs are driving the smart firewall market in U.S. According to the Federal Bureau of Investigation data in April 2025, it is reported that nearly USD 16 billion losses was registered in 2024, representing a 33% increase over 2023 with phishing, spoofing, extortion, and data breaches as the most frequent attack vectors all of which rely heavily on network-level exploitation and misuse of trusted access paths. These loss patterns are accelerating demand for strong firewall platforms capable of inspecting application traffic, controlling user access, and monitoring encrypted sessions across enterprise and government networks. Together, rising cybercrime exposure and multi-year, cost-optimized federal purchasing vehicles are converting firewall demand into sustained compliance-driven growth across the U.S. public sector and government-aligned enterprises.

Targeted federal funding aimed at improving network-level defenses across public and private sectors, and the rising cybercrime losses are accelerating the smart firewall market in Canada. According to the Government of Canada's August 2025 report under the Cyber Security Cooperation Program, the Government of Canada allocated USD 10.3 million over five years to support cybersecurity innovation and capacity building as part of the National Cyber Security Strategy, directly boosting the adoption of advanced network security controls by institutions and critical infrastructure operators. Further, the Government of Canada in October 2024 has depicted that there is a surge in the fraud losses in Canada increased with phishing, which is identified as the most common cybercrime affecting organizations. Moreover, ransomware risk is surging, with the average ransom paid in Canada reaching USD 1.13 million in 2023, indicating the demand for firewall platforms capable of monitoring lateral movement and enforcing access controls. Overall, Canada shows a positive growth in the market.

Loss Due to Cyber Crime in Canada in CAD

|

Year |

Amount |

|

2021 |

USD 383 million |

|

2022 |

USD 530 million |

|

2023 |

USD 567 million |

Source: Government of Canada, October 2024

APAC Market Insights

The Asia Pacific smart firewall market is growing rapidly and is poised to grow at a CAGR of 13.2% during the forecast period 2026 to 2035. The market is driven by rapid digitalization, stringent new data sovereignty laws, and government-led cybersecurity investment. The key drivers include cybersecurity law and multi level protection scheme in China, which mandates specific technical controls for network operators, and India’s national cybersecurity policy and revised CERT In directives compelling enhanced perimeter security. A vital trend is the substantial state funding for national cyber capabilities. Further, the rise in domestic cloud providers and smart city projects is creating massive demand for integrated, scalable security.

The smart firewall market in India is driven by the rapidly rising cybercrime exposure, accelerated digitization of public services, and increasing government investment in the national cyber resilience. According to the PIB October 2025 data, the cybersecurity incidents in India rose from 10.29 lakh in 2022 to 22.68 lakh in 2024, with phishing, unauthorized access, and malware attacks among the most frequently reported vectors targeting enterprise and government networks. Moreover, the Risk Management Association of India data in July 2025 reported that the cyber fraud losses increased by 206%, largely driven by online fraud, identity misuse, and network-based scams. Together, high incident volumes, measurable financial losses, and sustained government digitization spending are surging the smart firewall adoption in India as a foundational control for both public-sector systems and regulated enterprises.

The smart firewall market in Japan is dominated by cyber risk exposure, government-led digital transformation, and sustained national investment in cybersecurity for public and regulated sectors. Recently, the cyberattacks targeting organizations in Japan have increased steadily, with government networks and critical infrastructure experiencing persistent intrusion attempts, particularly through phishing and malware-based access vectors. Moreover, Observer Research Foundation March 2024 data depicts that 25.6 billion yen is allocated towards cyber security, prioritizing network monitoring, access control, and protection of interconnected IT and operational systems. These data show that the market is significantly growing in the overall country.

Europe Market Insights

The smart firewall market in Europe is growing significantly due to stringent regulatory enforcement and significant cross-border investment in critical infrastructure defense. The primary demand driver is the NIS2 Directive, which mandates enhanced cybersecurity measures for essential entities across sectors, directly compelling the investment in advanced network security controls such as smart firewalls for threat prevention and supply chain security. This is complemented by the Cyber Resilience Act, which sets mandatory security requirements for hardware and software products. further the key trend is the surge in public funding for cybersecurity, driven by the various specific initiatives that integrate the cyber safeguards. The market is further stimulated by the need to secure the expanding cloud and IoT ecosystems against advanced state-sponsored threats, particularly in light of geopolitical tensions.

The rapidly growing security economy and rising cyber threat exposure is drivig the smart firewall market in Germany. As per the GTAI March 2026 data, Germany’s domestic security market reached EUR 31 billion in 2023, supported by 9.7% growth, indicating strong enterprise and public-sector prioritization of network protection controls. Moreover, the threat perception is shifting into strong investment as 65% of Germany companies reported their business existence was threatened by cyberattacks in 2024, up from 52% in 2023, underscoring rising operational risk across industrial and digital infrastructure. Further, the financial impact reinforces this trend with cyberattack-related losses reaching EUR 178.6 billion in 2024, accounting for 67% of total damage according to industry-backed national assessments. These data highlight an active market growth in Germany.

The strong business exposure and government investment in the network security modernization are surging the demand for the smart firewall market in UK. According to the UK Government's June 2025 report, Cyber Security Breaches Survey 2024, 43% of UK businesses and 30% of charities experienced a cybersecurity breach or attack in the past 12 months, with phishing identified as the most common attack vector. Moreover, the financial pressure is intensifying demand as ransomware and data extortion remain among the most disruptive threats to UK organizations, particularly across healthcare, local government, and critical services. Further, the UK Government's 2022 data depicts that the UK government committed EUR 2.6 billion under the National Cyber Strategy (2022–2030) to strengthen cyber resilience across public-sector and critical infrastructure systems. These government-backed indicators position smart firewalls for sustained growth in the UK market.

Key Smart Firewall Market Players:

- Palo Alto Networks (U.S.)

- Fortinet (U.S.)

- Cisco Systems (U.S.)

- Check Point Software Technologies (Israel)

- Juniper Networks (U.S.)

- Forcepoint (U.S.)

- Barracuda Networks (U.S.)

- Zscaler (U.S.)

- Sophos (UK)

- Stormshield (France)

- WatchGuard (U.S.)

- SonicWall (U.S.)

- Hillstone Networks (U.S.)

- Huawei (China)

- Sangfor Technologies (China)

- CyberOam (India)

- LG Uplus (South Korea)

- Trend Micro (Japan)

- Telstra (Australia)

- SecMatrix (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palo Alto Networks has redefined the smart firewall market by pioneering a platform-based AI-driven approach. Its strategic initiative centers on integrating its next-gen firewalls with its Cortex XSIAM and XDR platforms, transforming the firewall from a perimeter appliance into a core sensor and enforcement point for a unified security strategy. This ensures real-time threat prevention and automated response across cloud network and endpoint environments, optimizing protection for hybrid enterprises.

- Fortinet dominates the smart firewall market via its security fabric architecture and custom ASIC technology. Its key strategic initiative is the deep integration of its FortiGate next-gen firewalls with a full suite of security and networking tools from SD WAN to zero-trust access. This advancement ensures real-time seamless security performance across distributed networks, optimizing protection and operational efficiency for organizations. In 2024, the company has made a total revenue of USD 5.96 billion.

- Cisco Systems leverages its unparalleled network installed base to advance in the smart firewall market. Its strategic initiative focuses on embedding its Firepower Threat Defense software across its ecosystem from Catalyst switches to SD WAN appliances. Integrated with Cisco Talos threat intelligence, this ensures real-time context-aware security enforcement deep within the network fabric, optimizing protection by aligning firewall policies directly with business and application intent. According to the 2025 annual report, the company has made a revenue of USD 56.7 billion in 2025.

- Check Point Software Technologies maintains a strong position in the smart firewall market via its consolidated Infinity architecture. Its primary strategic initiative is the prevention-first deployment of its Quantum next-generation firewalls unified under a single management and threat prevention cloud service. This advancement ensiles real time collaborative threat intelligence across the networks cloud, and mobile assets, optimizing the preemptive protection against the most advanced cyber-attacks.

- Juniper Networks competes in the smart firewall market by tightly integrating security with its AI-driven networking solutions. Its strategic imitative driven by its Mist AI and Marvis Virtual Network Assistant, is to embed its SRX series firewalls as intelligent enforcement points within a self-driving network. This ensures real-time automated threat response and policy optimization based on user and device behavior, simplifying security operations and improving the protection for the automated cloud-enabled enterprise.

Here is a list of key players operating in the global market:

The competitive landscape of the global smart firewall market is highly dynamic and is defined by the dominance of established cybersecurity giants and innovative specialists. The key players are aggressively adopting strategic initiatives such as mergers and acquisitions, deep integration of artificial intelligence and machine learning, and the development of cloud-native platforms. The shift towards unified threat management and security as a service models is pronounced. The strategic partnerships with the cloud providers and investments in zero-trust architectures are also critical differentiators as companies compete to protect increasingly complex hybrid network environments. For instance, in January 2024, HPE announced the acquisition of Juniper in an all-cash transaction for USD 40.00 per share, representing an equity value of approximately USD 14 billion.

Corporate Landscape of the Smart Firewall Market:

Recent Developments

- In August 2025, SonicWall introduced nine new firewalls as part of its Generation 8 portfolio, taking a pivotal step in delivering a cybersecurity platform purpose-built for Managed Service Providers (MSPs), Managed Security Service Providers (MSSPs), and the customers they serve.

- In August 2025, Palo Alto Networks announced two new security solutions to help organizations confidently navigate the evolving quantum landscape, and to keep pace with highly dynamic cloud and AI environments. These innovations provide enterprises with the visibility, agility and robust defenses needed to accelerate their quantum readiness and secure their workloads in a multicloud world.

- In September 2024, AlgoSec has launched its newest Security Management platform version, featuring advanced artificial intelligence (AI) technology that provides an application-centric security approach and a clearer picture of risks and their impact.

- Report ID: 3098

- Published Date: Feb 17, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Firewall Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.